Advanced Air Mobility Market Trends, Companies, Government Initiatives, and Global Outlook by 2034

Advanced Air Mobility Market Size

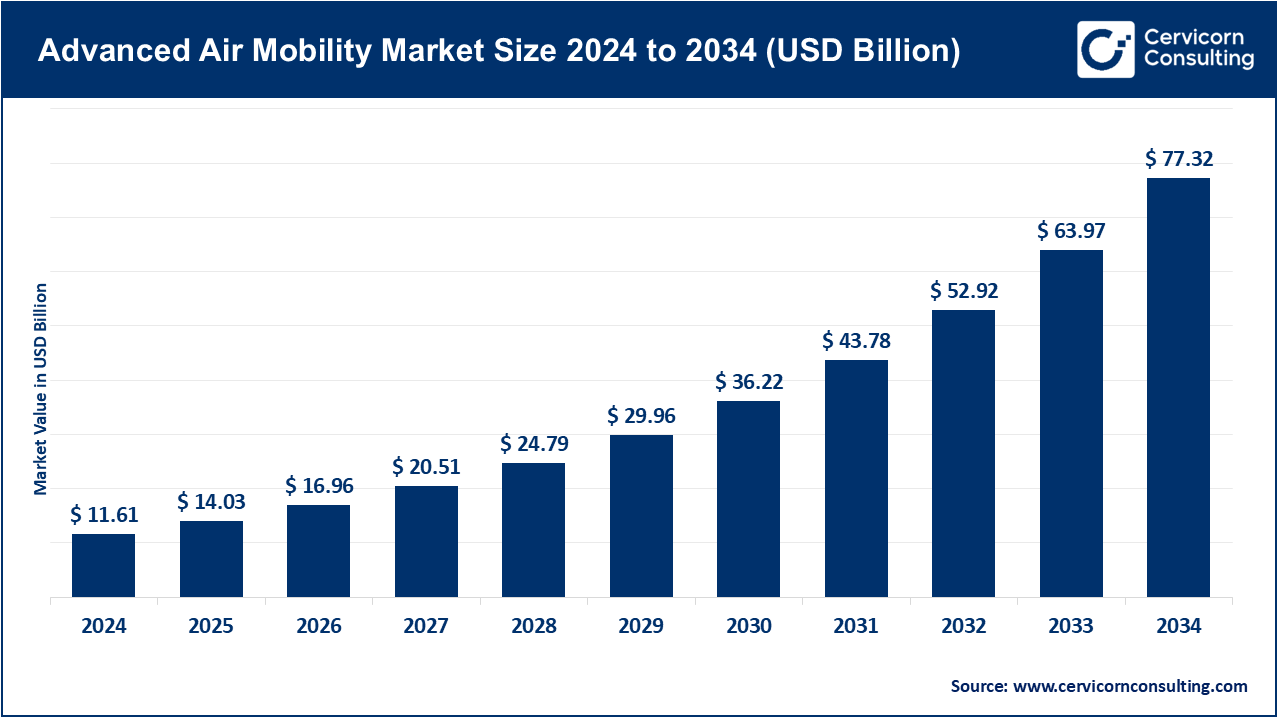

The global advanced air mobility market size was worth USD 11.61 billion in 2024 and is anticipated to expand to around USD 77.32 billion by 2034, registering a compound annual growth rate (CAGR) of 21.30% from 2025 to 2034.

Advanced Air Mobility Market Growth Factors

The Advanced Air Mobility (AAM) market is being propelled by a convergence of significant growth factors. Increasing urbanization and worsening traffic congestion are driving demand for aerial mobility solutions that can bypass traditional ground infrastructure. Simultaneously, rising environmental concerns are prompting a shift toward sustainable propulsion systems such as electric and hybrid-electric powertrains, which reduce emissions and noise pollution.

Technological advancements in electric propulsion, autonomous flight systems, and battery energy density are also enhancing the performance and feasibility of AAM vehicles. Furthermore, growing investments in supporting infrastructure—like vertiports, charging stations, and air traffic management systems—are accelerating adoption. Regulatory agencies such as the FAA, EASA, and others across Asia and the Middle East are actively working to integrate AAM into their national aviation frameworks. Finally, the pressing need for faster emergency response, medical delivery, and cargo transport solutions is widening AAM’s scope across industries beyond passenger mobility.

What is the Advanced Air Mobility Market?

Advanced Air Mobility (AAM) refers to the system of advanced aircraft and operations aimed at moving people and goods using new aviation technologies, particularly in urban, suburban, and regional settings. These include electric vertical take-off and landing (eVTOL) aircraft, autonomous drones, hybrid-electric systems, and other vertical mobility platforms. The core purpose of AAM is to enable faster, cleaner, and safer aerial transport for both commercial and public-sector applications. This market encompasses infrastructure, airspace integration technologies, aircraft development, and regulatory frameworks—all of which work together to redefine mobility in the air.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2674

Why It Is Important

AAM represents a critical evolution in the global mobility ecosystem. With the potential to drastically reduce ground traffic congestion and urban emissions, AAM addresses the environmental and logistical challenges of growing cities. The technology enhances emergency response capabilities by enabling faster delivery of medical supplies, organ transport, and on-demand access to disaster zones.

From an economic standpoint, AAM fosters innovation across multiple industries, including aerospace, energy storage, telecommunications, and AI-driven navigation systems. It also opens new opportunities for job creation, infrastructure development, and public-private collaboration. Additionally, AAM is increasingly viewed as a solution for enhancing connectivity in remote, underserved, or geographically challenging regions—further reinforcing its strategic importance.

Advanced Air Mobility Market: Top Companies

1. Urban Aeronautics

- Specialization: Compact piloted VTOL aircraft with internal ducted fans

- Focus Areas: Urban emergency medical services and public safety

- Notable Features: Designed for tight urban environments with retractable fan systems to minimize noise

- Revenue (2024): Not publicly disclosed; focused on specialized applications

- Global Presence: Based in Israel; ongoing partnerships in Europe and North America

2. Volocopter

- Specialization: eVTOL multicopters for urban passenger transport

- Focus Areas: Air taxi services in congested urban areas

- Notable Features: VoloCity aircraft certified for crewed flights in Europe; scalable platform with multicopter architecture

- Revenue (2024): Privately held; major partnerships with public transit and infrastructure developers

- Global Presence: Operations in Singapore, Paris, Dubai, and pilot cities in Asia

3. The Boeing Company

- Specialization: Aerospace systems with integration into AAM operations

- Focus Areas: Infrastructure, system integration, and autonomous flight systems

- Notable Features: Strategic partnership with Wisk Aero for fully autonomous eVTOL aircraft

- Revenue (2024): ~$70 billion (company-wide); AAM-specific figures undisclosed

- Global Presence: Global operations; key initiatives in the U.S., Australia, and New Zealand

4. Archer Aviation

- Specialization: Piloted eVTOL air taxis

- Focus Areas: Airport-to-city aerial routes and pilot training

- Notable Features: Midnight eVTOL aircraft; FAA Part 135 Air Carrier Certificate

- Revenue (2024): Pre-commercial; revenue through strategic alliances and early pre-orders

- Global Presence: U.S.-based with initial routes planned for Newark–Manhattan and Chicago

5. Joby Aviation

- Specialization: Electric eVTOL aircraft optimized for urban and regional passenger flights

- Focus Areas: On-demand aerial ridesharing

- Notable Features: Aircraft capable of 200 mph with a range of 100 miles

- Revenue (2024): Pre-commercial phase; income from pilot projects and R&D grants

- Global Presence: Headquartered in the U.S.; testing in Dubai and partnerships with various municipalities

Leading Trends and Their Impact

- Electric Propulsion Systems: Adoption of electric and hybrid-electric propulsion is reducing operational costs, cutting carbon emissions, and enabling quieter urban flight. Solid-state battery innovations are improving range and payload.

- Autonomy and AI: Autonomous flight technology—including navigation, collision avoidance, and traffic management—is a major growth enabler, especially for cargo AAM.

- Infrastructure Development: Investments in vertiports, charging systems, and low-altitude traffic control are essential to AAM scalability.

- Public–Private Partnerships: Collaborations between AAM firms, aerospace giants, and local governments are driving early adoption and pilot programs.

- Diversification of Applications: From medical delivery and emergency services to military logistics and industrial inspections, AAM use cases continue to expand.

Successful AAM Examples Worldwide

- Dubai: A global testbed for autonomous eVTOLs, with commercial operations expected by 2025.

- Singapore & Paris: Volocopter-led demonstrations for air taxi services integrated with smart urban planning.

- Detroit, Michigan: Advanced Air Mobility Activation Fund supports cargo drones and emergency transport in rural zones.

- India: Rural drone delivery pilots for healthcare and agriculture supported by DGCA.

- China: EHang and AutoFlight are leading autonomous AAM certification efforts and intercity cargo delivery programs.

Global Regional Analysis & Government Initiatives

North America

- Leading in R&D, public–private collaboration, and FAA regulatory sandbox programs

- Innovation hubs: California, Texas, Florida, Michigan

Europe

- Strong focus on sustainability and multimodal urban air mobility

- EASA support for early certification pathways

- Key cities: Paris, Munich, Rotterdam

Asia-Pacific

- High investment from China, India, South Korea, and Japan

- Growing demand for smart urban mobility solutions

- Emphasis on drone corridors and rural connectivity

Middle East

- UAE pioneering full-scale AAM integration

- High investment in vertiport networks and airspace digitization

- Primary cities: Dubai, Abu Dhabi

Latin America & Africa

- Initial AAM efforts focused on medical drones and infrastructure mapping

- Opportunities in agricultural and remote logistics markets

- Limited regulatory support but rising interest

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Public Safety and Security Market Trends, Market Share & CAGR Insights by 2034