India CNG Market 2024 Surges with Impressive Growth Insights

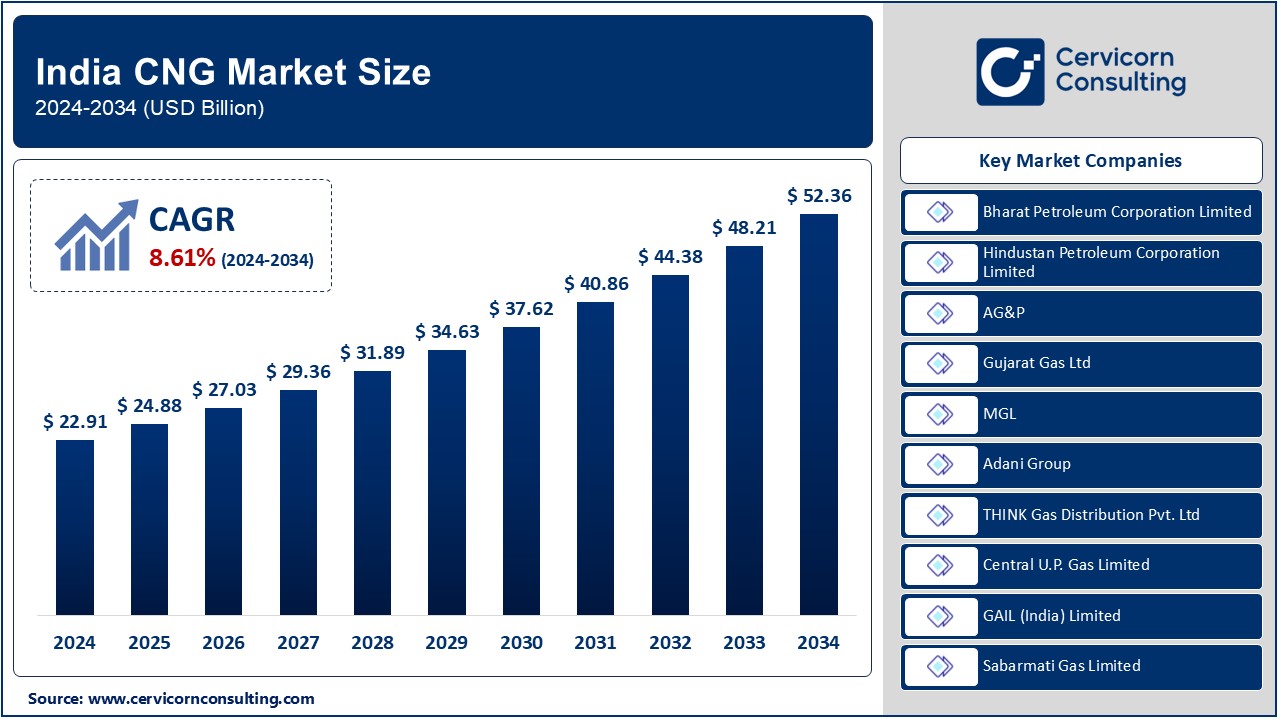

India CNG Market Size

The India CNG market was worth USD 22.91 billion in 2024 and is anticipated to expand to around USD 52.36 billion by 2034, registering a compound annual growth rate (CAGR) of 8.61% from 2025 to 2034.

India CNG Market Growth Factors

The India CNG (Compressed Natural Gas) market has witnessed robust growth, primarily driven by rising environmental concerns, increasing government support for cleaner fuels, the expansion of CNG infrastructure, and the cost-effectiveness of CNG compared to conventional fuels like petrol and diesel. Additionally, the adoption of stringent emission norms and efforts to reduce oil import dependence have further accelerated the market’s development.

What is India CNG Market?

The India CNG market encompasses the production, distribution, and utilization of compressed natural gas as a clean alternative to traditional fossil fuels. CNG, a form of natural gas stored under high pressure, is used primarily as a fuel for vehicles and in industrial applications. With its lower carbon emissions and affordability, CNG has become a pivotal component of India’s energy transition towards a greener and more sustainable future. The market includes infrastructure such as CNG stations, pipeline networks, and technology solutions for efficient gas storage and transportation.

Why is it Important?

The India CNG market is crucial for several reasons. First, it significantly reduces vehicular emissions, helping mitigate air pollution in urban areas. Second, it plays a vital role in diversifying India’s energy portfolio, reducing the country’s reliance on imported crude oil. Third, CNG’s affordability compared to petrol and diesel lowers transportation costs for consumers, thereby boosting economic activity. Lastly, the expansion of the CNG network creates employment opportunities and promotes regional development. As a sustainable energy source, CNG aligns with India’s commitment to reducing greenhouse gas emissions under global climate agreements.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2535

India CNG Market Top Companies

1. Bharat Petroleum Corporation Limited (BPCL)

- Specialization: BPCL specializes in oil and gas exploration, refining, and marketing, with a strong focus on natural gas distribution.

- Key Focus Areas: Expansion of CNG stations, development of pipeline infrastructure, and partnerships with city gas distribution (CGD) companies.

- Notable Features: BPCL’s CNG initiatives emphasize advanced fueling technologies and efficient supply chain management.

- 2024 Revenue (Approx.): $68 billion

- Market Share (Approx.): 15%

- Global Presence: Active in India and several international markets, particularly in Southeast Asia and the Middle East.

2. Hindustan Petroleum Corporation Limited (HPCL)

- Specialization: HPCL focuses on refining, marketing, and distribution of petroleum and natural gas products, including CNG.

- Key Focus Areas: Enhancing the availability of CNG across urban and semi-urban areas, leveraging technology to optimize gas distribution.

- Notable Features: HPCL is recognized for its integrated approach to natural gas distribution and customer-centric service models.

- 2024 Revenue (Approx.): $50 billion

- Market Share (Approx.): 12%

- Global Presence: Operations concentrated in India with growing collaborations in South Asia.

3. AG&P (Atlantic Gulf & Pacific Company)

- Specialization: AG&P is a leading provider of infrastructure solutions for natural gas distribution, including small-scale LNG and CNG networks.

- Key Focus Areas: Development of CGD networks, establishment of CNG refueling stations, and innovation in gas logistics.

- Notable Features: AG&P stands out for its modular solutions and ability to quickly deploy CNG infrastructure in new markets.

- 2024 Revenue (Approx.): $2 billion

- Market Share (Approx.): 8%

- Global Presence: Extensive operations in India, the Philippines, and the Middle East.

4. Gujarat Gas Ltd.

- Specialization: Gujarat Gas Ltd. is India’s largest CGD company, specializing in the distribution of natural gas to residential, commercial, industrial, and vehicular consumers.

- Key Focus Areas: Expansion of pipeline networks, increased penetration in rural areas, and development of clean energy solutions.

- Notable Features: Gujarat Gas leads in customer base and operational efficiency, with one of the largest CNG station networks in India.

- 2024 Revenue (Approx.): $1.5 billion

- Market Share (Approx.): 22%

- Global Presence: Operations confined to India with strategic collaborations for technology adoption.

5. Mahanagar Gas Limited (MGL)

- Specialization: MGL focuses on the distribution of natural gas to Mumbai and adjoining areas.

- Key Focus Areas: Expansion of CNG stations, improvement of distribution networks, and investment in cleaner energy technologies.

- Notable Features: MGL’s strength lies in its urban market penetration and high customer satisfaction rates.

- 2024 Revenue (Approx.): $1.2 billion

- Market Share (Approx.): 14%

- Global Presence: Primarily operates in India with collaborations for technology upgrades.

Leading Trends and Their Impact

1. Expansion of CNG Infrastructure

India has been witnessing a rapid increase in the number of CNG stations and pipeline networks. The government’s aim to achieve a CGD coverage of 70% by 2030 has spurred private and public investments. This trend ensures greater accessibility of CNG, fostering its adoption among consumers and industries alike.

2. Increasing Adoption in Commercial and Public Transport

The adoption of CNG in buses, taxis, and commercial vehicles has gained momentum due to its cost efficiency and environmental benefits. This shift reduces urban air pollution and aligns with India’s green mobility goals.

3. Technology Integration

Advanced technologies like IoT-enabled gas meters, automated refueling systems, and real-time monitoring have significantly improved the efficiency of CNG distribution. This trend ensures reliability and enhances the user experience.

4. Government Incentives and Policy Support

Policies such as the National Gas Grid expansion and subsidies for CNG vehicle conversion kits have played a pivotal role in market growth. These initiatives lower entry barriers and attract investments in the sector.

5. Rising Awareness of Environmental Benefits

Consumers are increasingly recognizing the environmental advantages of using CNG, such as lower emissions and reduced carbon footprint. This awareness is driving demand across urban and semi-urban regions.

Successful Examples in India’s CNG Market

1. Delhi NCR Transformation

The Delhi NCR region has become a model for CNG adoption, with a significant portion of its public transport fleet running on CNG. This transformation was driven by stringent pollution control measures and the establishment of an extensive CNG refueling network.

2. Gujarat’s Leadership in CGD

Gujarat has emerged as a leader in CGD, with Gujarat Gas Ltd. spearheading the development of a robust natural gas network. The state’s proactive policies and focus on cleaner fuels have resulted in high CNG penetration.

3. Mumbai’s Transition to CNG

MGL’s efforts to expand CNG infrastructure in Mumbai have significantly reduced vehicular emissions in the city. The initiative’s success has set an example for other urban areas to follow.

4. AG&P’s Innovative Solutions

AG&P’s modular CNG infrastructure projects in Tier 2 and Tier 3 cities have showcased how innovative solutions can accelerate market penetration in underdeveloped regions.

Government Initiatives and Policies Shaping the Market

1. National Gas Grid Expansion

The Indian government’s ambitious plan to expand the National Gas Grid aims to connect more states and regions to the natural gas network. This initiative is expected to create a unified gas market, enhancing CNG accessibility.

2. CGD Licensing Rounds

The Petroleum and Natural Gas Regulatory Board (PNGRB) has conducted multiple CGD bidding rounds, encouraging private sector participation and accelerating the development of CNG infrastructure.

3. Subsidies and Incentives

Subsidies on CNG conversion kits for vehicles and tax benefits for companies investing in CGD infrastructure have made CNG a more attractive option for both consumers and businesses.

4. Promotion of Green Mobility

Programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) complement the CNG market by emphasizing cleaner transportation alternatives. The integration of CNG with hybrid technologies is gaining traction.

5. City-Specific Action Plans

Cities with high pollution levels, such as Delhi and Mumbai, have implemented action plans mandating the use of CNG in public transport and encouraging its adoption in private vehicles.

The India CNG market continues to thrive on the back of strong governmental support, innovative technologies, and growing consumer awareness. With top companies playing a pivotal role and trends driving future growth, the market is set to play a transformative role in India’s energy landscape.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Asia-Pacific Perovskite Solar Cell Market Growth Drivers, Key Players, and Emerging Trends in 2024