U.S. In Vitro Diagnostics Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

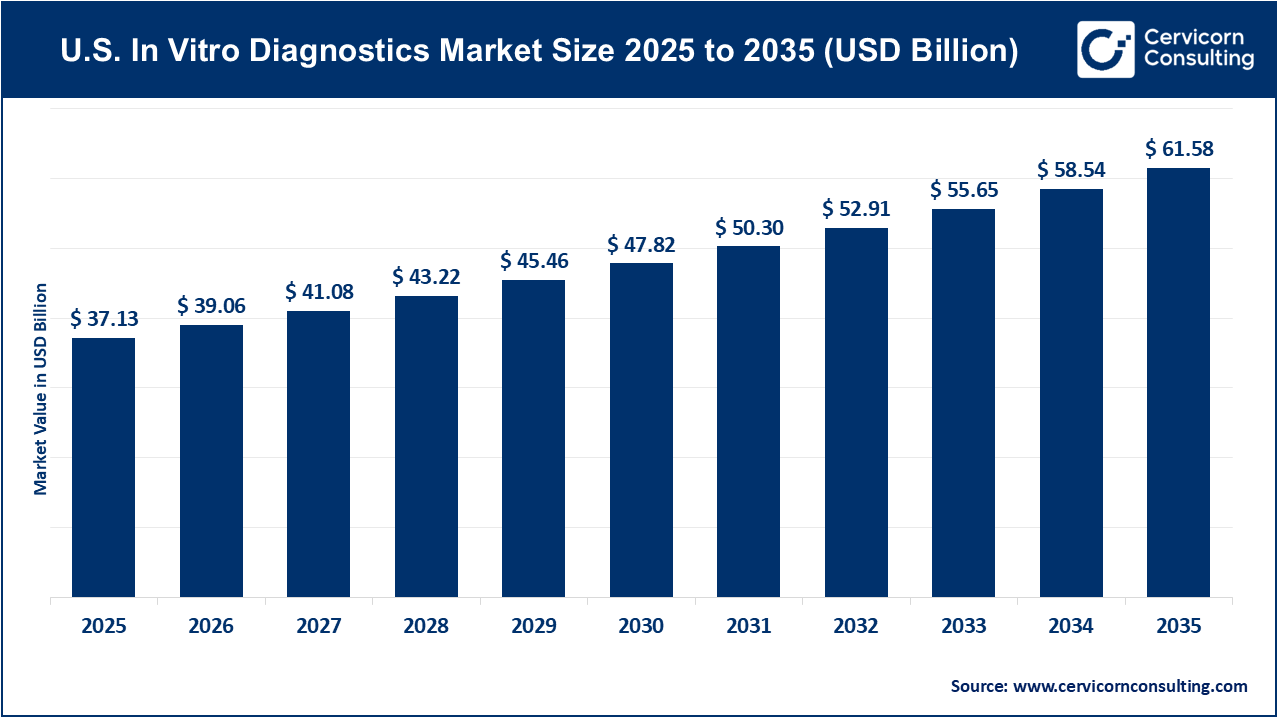

U.S. In Vitro Diagnostics Market Size

The U.S. in vitro diagnostics market size was worth USD 37.13 billion in 2025 and is anticipated to expand to around USD 61.58 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% from 2026 to 2035.

What Is the U.S. In Vitro Diagnostics Market?

The United States In Vitro Diagnostics (IVD) market encompasses the development, production, and commercialization of diagnostic tests, instruments, reagents, kits, and software used to analyze biological samples—such as blood, urine, tissue, and other bodily fluids—outside the human body. These tests support the detection, diagnosis, monitoring, and prevention of diseases and medical conditions across a wide range of clinical settings, including hospitals, independent laboratories, physician offices, pharmacies, and home-care environments.

The U.S. IVD market includes several major segments: clinical chemistry, immunoassays, hematology, molecular diagnostics, microbiology, coagulation testing, urinalysis, and point-of-care diagnostics. It also incorporates advanced technologies such as polymerase chain reaction (PCR), next-generation sequencing (NGS), biomarker-based assays, and AI-enabled diagnostic platforms.

As the largest and most technologically advanced diagnostics market globally, the U.S. plays a central role in shaping innovation, regulatory standards, and commercialization strategies for in vitro diagnostics worldwide.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2875

Why the U.S. In Vitro Diagnostics Market Is Important

The U.S. IVD market is foundational to the healthcare system, as diagnostic testing influences the majority of clinical decisions made by physicians. Accurate and timely diagnostics enable early disease detection, guide therapeutic selection, monitor treatment efficacy, and support preventive care initiatives. Without reliable diagnostic data, modern evidence-based medicine would not be possible.

The importance of the market is further amplified by the rising burden of chronic diseases such as cancer, diabetes, cardiovascular disorders, autoimmune conditions, and infectious diseases. Diagnostics play a critical role in managing these conditions over long periods, helping reduce hospitalizations, improve patient outcomes, and lower overall healthcare costs.

Beyond patient care, the U.S. IVD market is a major driver of biomedical innovation. It supports pharmaceutical research, clinical trials, public health surveillance, and personalized medicine. During global health emergencies, such as infectious disease outbreaks, U.S. diagnostic companies often lead the rapid development and scale-up of testing solutions, reinforcing the market’s strategic importance at both national and global levels.

U.S. In Vitro Diagnostics Market Growth Factors

The growth of the U.S. in vitro diagnostics market is driven by a combination of rising chronic and infectious disease prevalence, an aging population requiring frequent diagnostic monitoring, continuous technological advancements in molecular diagnostics and automation, expanding adoption of point-of-care and at-home testing solutions, increased focus on preventive healthcare and early disease detection, growing demand for personalized and precision medicine, integration of artificial intelligence and digital health tools into diagnostic workflows, favorable reimbursement for essential diagnostic tests, and sustained public and private investment in healthcare infrastructure, research, and innovation.

Key Companies Operating in the U.S. In Vitro Diagnostics Market

Abbott Laboratories

Company: Abbott Laboratories

Specialization: Diagnostics, medical devices, nutrition, and branded generic pharmaceuticals

Key Focus Areas: Core laboratory diagnostics, immunoassays, molecular diagnostics, rapid point-of-care testing, cardiometabolic and infectious disease testing

Notable Features: Abbott is recognized for its diversified diagnostics portfolio and scalable testing platforms. Its Alinity series supports high-throughput laboratory testing, while rapid diagnostic systems enable near-patient testing with fast turnaround times.

2024 Revenue: Approximately USD 41.9 billion (diagnostics segment contributing roughly USD 9+ billion)

Market Share: One of the top global IVD companies with a strong share across immunoassays, clinical chemistry, and rapid diagnostics

Global Presence: Extensive operations across North America, Europe, Asia-Pacific, Latin America, and emerging markets

Abbott continues to strengthen its diagnostics footprint through investments in cancer screening, molecular testing, and decentralized diagnostics, positioning itself for long-term growth in preventive and precision medicine.

Thermo Fisher Scientific

Company: Thermo Fisher Scientific

Specialization: Analytical instruments, laboratory reagents, consumables, and diagnostic solutions

Key Focus Areas: Molecular diagnostics, clinical chemistry, laboratory automation, reagents and consumables, life sciences research tools

Notable Features: Thermo Fisher offers end-to-end solutions that support diagnostic, research, and pharmaceutical workflows. Its strength lies in integrating instruments, reagents, and digital solutions into unified laboratory ecosystems.

2024 Revenue: Approximately USD 42.9 billion

Market Share: A major supplier across the diagnostics value chain, particularly strong in molecular and laboratory-based testing

Global Presence: Operations in more than 50 countries with a broad international customer base

Thermo Fisher’s scale, manufacturing capabilities, and continuous innovation make it a cornerstone of the U.S. diagnostics ecosystem, serving both clinical and research markets.

Danaher Corporation

Company: Danaher Corporation

Specialization: Diagnostics and life sciences instruments, consumables, and software

Key Focus Areas: Molecular diagnostics, oncology diagnostics, immunoassays, genetic testing, laboratory automation

Notable Features: Danaher’s diagnostics segment represents a significant portion of its business, supported by well-established brands and a strong emphasis on precision medicine and rapid molecular testing.

2024 Revenue: Diagnostics segment accounts for roughly 40% of total corporate revenue

Market Share: Consistently ranked among the leading global IVD companies

Global Presence: Strong presence across the U.S., Europe, Asia-Pacific, and other international markets

Danaher’s acquisition-driven growth strategy and focus on high-value diagnostics continue to expand its influence in clinical and molecular testing.

Quest Diagnostics

Company: Quest Diagnostics Incorporated

Specialization: Clinical laboratory testing services and diagnostic information services

Key Focus Areas: Routine and advanced laboratory testing, molecular diagnostics, oncology testing, infectious disease diagnostics, genetic testing

Notable Features: Quest operates one of the largest clinical laboratory networks in the United States, providing diagnostic services to hospitals, physicians, employers, and consumers.

2024 Revenue: Multi-billion-dollar annual revenue from diagnostic testing services

Market Share: One of the dominant players in the U.S. clinical laboratory services market

Global Presence: Primarily U.S.-focused with select international operations and partnerships

Quest Diagnostics plays a vital role in translating diagnostic technologies into large-scale clinical practice, supporting population health and preventive care initiatives.

Becton, Dickinson and Company (BD)

Company: Becton, Dickinson and Company

Specialization: Medical devices, laboratory instruments, and diagnostic systems

Key Focus Areas: Microbiology diagnostics, laboratory automation, biosciences tools, diagnostic reagents

Notable Features: BD’s Life Sciences division delivers integrated diagnostic and laboratory solutions that improve efficiency, safety, and accuracy in clinical settings.

2024 Revenue: Over USD 20 billion across business segments

Market Share: Strong presence in microbiology and laboratory systems within the diagnostics market

Global Presence: Operations in more than 50 countries worldwide

BD continues to enhance its diagnostics capabilities through strategic restructuring and partnerships aimed at expanding its bioanalytical and diagnostic offerings.

Leading Trends in the U.S. In Vitro Diagnostics Market and Their Impact

Expansion of Point-of-Care and At-Home Testing

Point-of-care diagnostics are transforming how and where testing occurs. Rapid tests used in clinics, pharmacies, and homes reduce turnaround times and enable faster clinical decisions. This trend improves access to diagnostics, particularly in underserved or remote areas, while reducing the burden on centralized laboratories.

Growth of Molecular Diagnostics

Molecular diagnostics, including PCR and genetic testing, are among the fastest-growing segments of the IVD market. These technologies offer high sensitivity and specificity, enabling early detection of infectious diseases, cancer, and genetic disorders. Their adoption supports precision medicine and targeted therapies.

Laboratory Automation and Workflow Optimization

Automation is increasingly essential in high-volume laboratories. Automated sample handling, testing, and data management systems improve efficiency, reduce human error, and support scalability. This trend is especially important as test volumes rise due to preventive screening and chronic disease management.

Integration of Artificial Intelligence and Digital Health

AI-enabled diagnostics enhance image analysis, pattern recognition, and predictive analytics. Digital integration improves data interpretation, supports clinical decision-making, and enables remote diagnostics and monitoring. These capabilities are reshaping laboratory operations and patient care pathways.

Personalized and Precision Medicine

The shift toward personalized medicine drives demand for companion diagnostics, biomarker testing, and genomic assays. Diagnostics are increasingly used to identify patients most likely to benefit from specific therapies, improving outcomes and reducing unnecessary treatments.

Successful Examples of U.S. In Vitro Diagnostics Market Impact Worldwide

One of the most prominent examples of U.S. IVD influence globally was the rapid development and worldwide distribution of diagnostic tests during the COVID-19 pandemic. U.S. companies scaled molecular and rapid antigen testing at unprecedented speed, supporting global testing capacity and public health response.

U.S. leadership in molecular diagnostics has also shaped global standards in PCR and sequencing-based testing. Technologies developed and commercialized in the U.S. are now routinely used in clinical laboratories across Europe, Asia, Latin America, and the Middle East.

In oncology, U.S. diagnostics firms have driven the global adoption of companion diagnostics that guide targeted cancer therapies. These tests are now integral to treatment protocols in advanced healthcare systems worldwide.

Additionally, U.S. laboratory service providers have expanded international partnerships, sharing expertise in high-throughput testing, quality assurance, and laboratory management, thereby strengthening global diagnostic infrastructure.

Government Initiatives and Policies Shaping the U.S. In Vitro Diagnostics Market

Healthcare Reform and Preventive Care Policies

U.S. healthcare reforms emphasizing preventive services and early diagnosis have increased demand for routine screening and diagnostic testing. Coverage for preventive diagnostics encourages wider test adoption and supports early intervention strategies.

Regulatory Oversight and FDA Framework

The U.S. Food and Drug Administration plays a central role in regulating IVD products, ensuring safety, accuracy, and reliability. While stringent regulatory requirements can increase development timelines, they also build trust in diagnostic products and support long-term market stability.

Public Funding and Research Support

Government funding through national research programs supports innovation in diagnostics, particularly in genomics, infectious disease surveillance, and emerging technologies. These investments strengthen the U.S. diagnostics innovation ecosystem.

Reimbursement and Payment Policies

Reimbursement decisions significantly influence diagnostic adoption. Favorable coverage for essential and advanced diagnostic tests improves accessibility and encourages healthcare providers to integrate new diagnostic technologies into routine care.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Twin Market Growth Drivers, Trends, Key Players and Regional Insights by 2035