Electric Vehicle (EV) Charging Station Market Revenue, Global Presence, and Strategic Insights by 2035

Electric Vehicle (EV) Charging Station Market Size

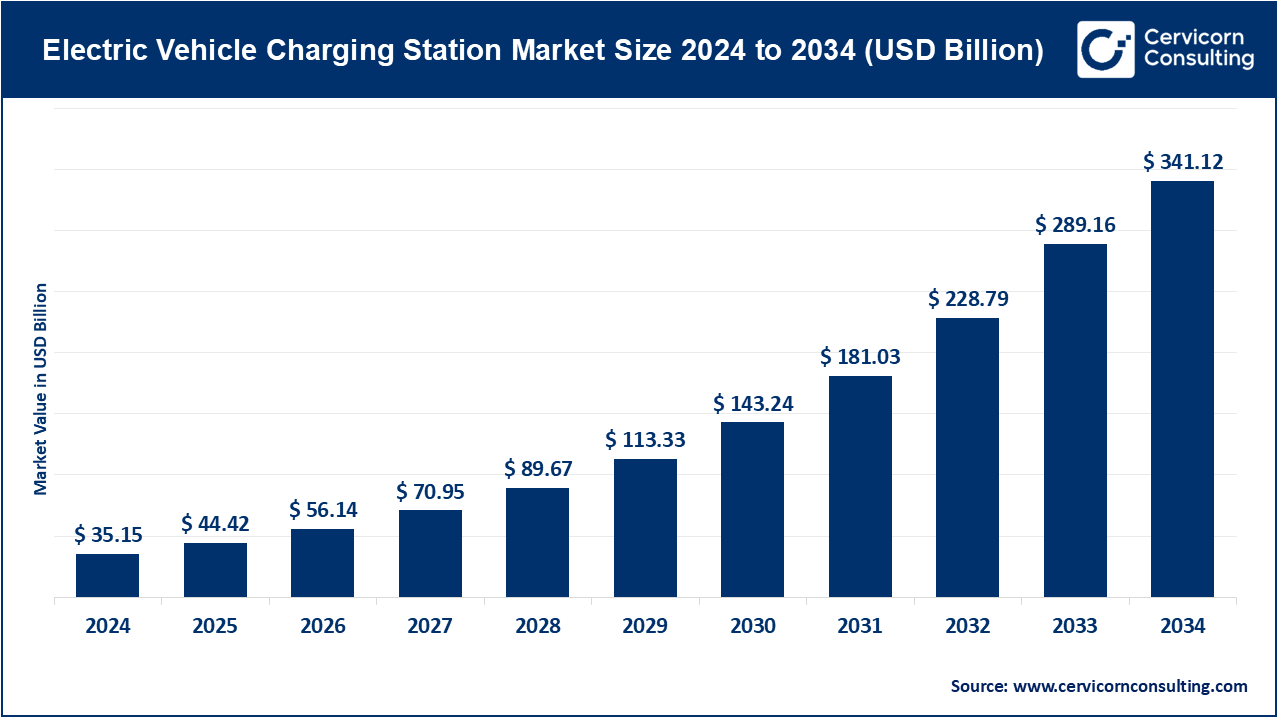

The global electric vehicle (EV) charging station market size was worth USD 35.15 billion in 2024 and is anticipated to expand to around USD 341.12 billion by 2034, registering a compound annual growth rate (CAGR) of 26.38% from 2026 to 2035.

What Is the Electric Vehicle (EV) Charging Station Market?

The EV charging station market encompasses all technologies, equipment, installations, software platforms, and operational services required to charge electric vehicles. It includes:

- Hardware: AC chargers (slow/Level 2) and DC fast chargers

- Software: Charging management systems, roaming solutions, billing platforms, fleet management tools

- Services: Installation, grid connection, civil works, maintenance, site operations, payment services

- Energy Management: Smart charging, peak-load management, vehicle-to-grid integration

- Operators: Charge Point Operators (CPOs) and E-Mobility Service Providers (EMSPs)

The market generates revenue through equipment sales, subscription software, charging sessions (energy sold), maintenance contracts, and value-added services.

This market is considered one of the fastest-growing sectors in the clean-energy and transportation ecosystem due to the combined pull of EV adoption, policy mandates, and rapid technological advancements.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2375

Why the EV Charging Station Market Is Important

The EV charging station market plays a pivotal role in enabling mass EV penetration. Without widespread, reliable, and convenient charging, EV adoption would stagnate. The importance of this market extends across industries and government priorities:

1. Catalyst for EV Adoption

Range anxiety remains one of the biggest barriers to EV purchases. A robust charging network directly boosts consumer confidence.

2. Decarbonization and Climate Goals

Nations aiming to reduce transportation emissions rely heavily on electrified mobility paired with clean energy and smart charging.

3. Energy System Benefits

Smart charging helps utilities balance grids, integrate renewables, and reduce peak-load pressures.

4. New Business Models

Retailers, fuel stations, real estate developers, and fleet operators are unlocking new revenue lines through EV charging services.

5. Economic Development

Charging manufacturing, installation jobs, site operations, and software create employment across multiple sectors.

6. Urban Air Quality and Public Health

More EVs powered by clean energy directly contribute to cleaner cities and lower pollution.

Growth Factors

The EV charging station market is experiencing rapid growth due to a combination of strong EV sales, favorable government incentives, declining charger and battery costs, expansion of high-power fast-charging corridors, rising demand from commercial fleets, technological advancements in smart charging and vehicle-to-grid integration, increasing investments from utilities and oil companies entering the electrification space, the adoption of universally compatible standards such as NACS and Plug-and-Charge, expanding public-private partnerships to accelerate infrastructure rollout, improved grid modernization, growing consumer concern for clean mobility, and the emergence of profitable business models including subscription-based charging, roaming networks, and integrated energy and software platforms. Together, these factors fuel a global acceleration in the deployment and utilization of EV charging infrastructure.

Top Companies in the EV Charging Station Market

Below are detailed profiles of the top companies you requested — all formatted with company description, specialization, key focus areas, notable features, global presence, revenue (2024), and approximate market position. Please note that some companies do not publicly disclose charging-only revenue.

1. Tesla, Inc.

Specialization:

Electric vehicles, proprietary charging hardware, and the globally recognized Supercharger fast-charging network.

Key Focus Areas:

- Expanding its network of DC fast chargers

- Opening NACS (North American Charging Standard) technology to other OEMs

- Enhancing seamless payment and driver experience

- Integrating charging with solar and stationary energy systems

Notable Features:

- One of the world’s largest and most reliable fast-charging networks

- High levels of vertical integration

- Industry-leading charging speeds and uptime

- Convenient “plug-and-charge” user experience

2024 Revenue:

Approx. $97.69 billion (company-wide; Tesla does not separately report Supercharger-only revenue).

Market Share:

Largest proprietary fast-charging network in North America; expanding globally.

Global Presence:

North America, Europe, Middle East, Asia-Pacific.

2. ChargePoint, Inc.

Specialization:

Charging hardware + cloud-based charging software platform. Strong in Level 2 and workplace charging.

Key Focus Areas:

- Enterprise charging

- Fleet electrification

- Subscription-based software

- Interoperability and roaming

Notable Features:

- One of the largest charging networks in North America

- Strong SaaS revenue stream

- Highly integrated software ecosystem

- Supports both AC and DC chargers

2024 Revenue:

Approx. $506.6 million (total revenue).

Market Share:

One of the leading EV charging providers in North America by number of charging ports deployed.

Global Presence:

United States, Canada, various European countries.

3. Blink Charging Co.

Specialization:

Manufacturer, owner, and operator of EV charging equipment for public and commercial use.

Key Focus Areas:

- Network expansion

- Public charging

- Retail and hospitality charging partnerships

- Hardware manufacturing capabilities

Notable Features:

- Mix of owned and partner-operated charging stations

- Offers turnkey solutions to businesses and public agencies

- Growing service revenue

2024 Revenue:

Approx. $126.2 million.

Market Share:

Fast-growing network, primarily in the United States.

Global Presence:

North America, Europe, Middle East, Latin America.

4. ABB Ltd.

Specialization:

Global supplier of electrification, automation, and high-power charging hardware.

Key Focus Areas:

- High-power DC charging

- Commercial fleet chargers

- Smart-grid integration

- Equipment manufacturing and global distribution

Notable Features:

- Pioneer in next-generation fast-charging hardware

- Strong relationships with utilities and industrial clients

- Large-scale manufacturing and R&D

2024 Revenue:

Approx. $32.9 billion (company-wide; EV charging is part of its electrification segment).

Market Share:

One of the world’s top suppliers of DC fast-charging hardware.

Global Presence:

Europe, North America, Asia-Pacific, global industrial markets.

5. BP Chargemaster / BP Pulse

Specialization:

Public EV charging network owned by global energy major BP.

Key Focus Areas:

- Rapid charger installations at fuel forecourts

- Urban charging hubs

- Fleet solutions

- Integrating EV charging with bp retail stores and convenience services

Notable Features:

- Strong capital backing

- Access to a large network of fuel stations

- Scalability through retail partnerships

2024 Revenue:

BP does not publicly report standalone charging revenue; estimated to be in the low hundreds of millions.

Market Share:

Strong in the UK and growing across Europe and the US.

Global Presence:

United Kingdom, United States, Europe, Australia.

Leading Trends and Their Impact

1. High-Power Fast Charging (HPC)

DC fast chargers delivering 150–350 kW are becoming standard.

Impact: Reduces charging time, enables long-distance EV travel, increases hardware and grid upgrade demand.

2. Standardization (NACS, CCS2, Plug & Charge)

Universal connectors and seamless authentication reduce compatibility issues.

Impact: Facilitates global interoperability, boosts adoption, and encourages OEM–CPO partnerships.

3. Smart Charging & Energy Flexibility

Intelligent software manages load balancing and off-peak charging.

Impact: Supports grid stability, lowers energy costs for consumers and fleets.

4. Fleet Electrification

Commercial fleets—delivery vans, trucks, and taxis—require dedicated depot charging.

Impact: Huge demand for high-utilization charging sites with predictable revenue.

5. Retail & Real Estate Convergence

Charging hubs at shopping centers, restaurants, fuel stations, and workplaces.

Impact: New revenue streams + increased foot traffic for businesses.

6. Renewable Integration & V2G

Vehicle-to-grid and vehicle-to-home technologies provide system flexibility.

Impact: Turning EVs into mobile storage assets supports renewable energy.

7. Government Funding Accelerating Deployment

Many regions offer subsidies, tax credits, and grants for charging installations.

Impact: Speeds up infrastructure rollout but introduces policy dependence.

Global Success Stories in EV Charging Infrastructure

1. Tesla Supercharger Network (Global)

- One of the most reliable charging networks globally

- Thousands of stations and tens of thousands of connectors

- Now increasingly open to non-Tesla vehicles

2. IONITY (Europe)

- High-power European charging corridor backed by major automakers

- Located on major highways, enabling cross-country EV travel

3. Fastned (Netherlands and Europe)

- Bright yellow, solar-powered stations with multiple fast chargers

- High utilization rates and profitable high-traffic locations

4. EVgo + GM Collaboration (United States)

- Thousands of fast chargers rolled out with OEM partnerships

- Focus on urban fast charging

5. China’s Nationwide Public Charging Network

- The world’s largest charging ecosystem

- Millions of chargers across public and private networks

- Strong government coordination enables rapid scale

Global Regional Analysis & Government Initiatives

Asia-Pacific

China

- Massive government support with subsidies and mandates

- Largest global share of public chargers

- Strong integration with smart-grid infrastructure

- Charging infrastructure installed at a record rate annually

India

- Mobile-app-based charging networks rapidly growing

- Government policies include FAME incentives, state subsidies, and public-private partnerships

- Growing fleet electrification among ride-hailing and delivery companies

Japan & South Korea

- Focus on CHAdeMO standard (Japan) and fast-charging infrastructure

- Emphasis on reliability and integration with hydrogen/EV mixed infrastructure

Europe

European Union

- Strict regulations under AFIR (Alternative Fuels Infrastructure Regulation)

- Mandates minimum charger density on highways

- Requires transparent pricing and roaming standards

- Strong focus on high-power charging

United Kingdom

- Large investments in rapid-charging hubs

- Policies supporting workplace and residential charging

- Fuel retailers required to provide EV charging availability

Nordic Countries

- Among the highest EV adoption rates globally

- Charging networks deeply integrated with renewable energy

- Strong public–private cooperation

North America

United States

- Federal tax credits for commercial charging

- Large-scale funding through infrastructure programs

- Accelerating rollouts on interstate corridors

- Widespread adoption of NACS across automakers

Canada

- Significant incentives for businesses to install chargers

- Focus on rural and highway charging coverage

Middle East

- High investment in premium fast-charging hubs

- Integration with luxury retail districts

- EV adoption rising due to sustainability goals (UAE, Saudi Arabia)

Latin America

- Growing urban deployment of AC and DC chargers

- Fleet electrification (buses, delivery) leading demand

- Government incentives vary widely by country

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Corporate Wellness Market Revenue, Global Presence, and Strategic Insights by 2035