Graphics Processing Unit Market Revenue, Global Presence, and Strategic Insights by 2035

Graphics Processing Unit Market Size

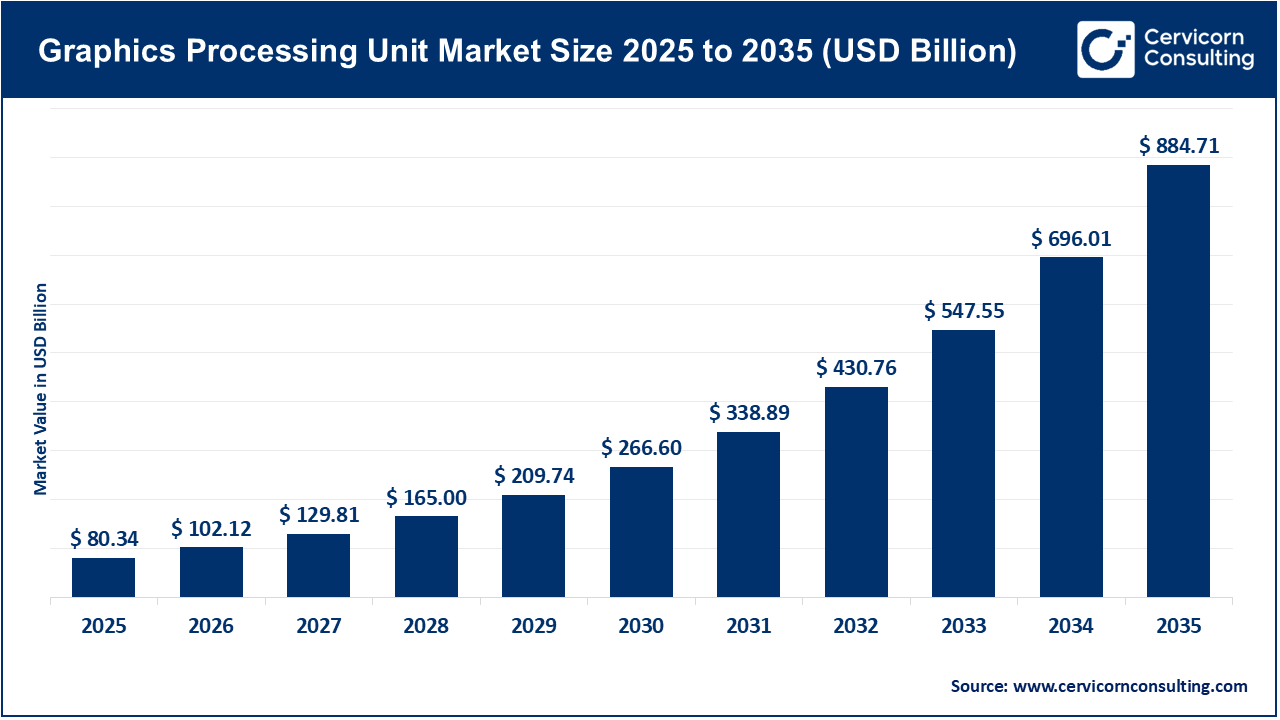

The global graphics processing unit market size was worth USD 80.34 billion in 2025 and is anticipated to expand to around USD 884.71 billion by 2035, registering a compound annual growth rate (CAGR) of 27.12% from 2026 to 2035.

Graphics Processing Unit Market Growth Factors

The GPU market is expanding rapidly due to surging global demand for AI training and inference, widespread adoption of generative AI and large language models across industries, rapid growth in hyperscale data centers, increasing dependency on GPU-accelerated cloud services, the rise of autonomous vehicles and edge AI applications, innovations in chiplet architectures and high-bandwidth memory, expansion of real-time rendering and ray tracing in gaming, increasing use of GPU acceleration in scientific research and industrial simulations, accelerated digitalization in developing regions, growing investment in semiconductor manufacturing capacity, and global government incentives designed to strengthen chip supply chains, enhance domestic semiconductor production, and support AI and high-performance computing infrastructure — all contributing to strong, sustained growth across discrete, integrated, and data-center GPU segments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2810

What is the Graphics Processing Unit (GPU) Market?

The Graphics Processing Unit market includes the global ecosystem involved in designing, manufacturing, and commercializing GPUs, accelerators, and GPU intellectual property (IP) solutions. GPUs are highly parallel processors optimized for performing billions of simultaneous mathematical operations, originally created for rendering complex visual graphics. Over time, their architecture has proven ideal for a wide range of compute-intensive workloads such as machine learning, data analytics, simulation, visualization, medical imaging, cryptocurrency mining, and real-time 3D content creation.

The market consists of several segments:

-

Discrete GPUs used in gaming PCs, workstations, and professional visualization.

-

Data-center GPUs powering AI, HPC, cloud computing, and enterprise workloads.

-

Integrated GPUs built into CPUs or SoCs for mobile devices, laptops, and mainstream computing.

-

GPU IP licensing provided to chip designers through licensable GPU cores for mobile, embedded, automotive, and consumer devices.

-

Cloud-based GPU services offered by hyperscale providers for on-demand AI and compute workloads.

Market estimates vary by segmentation, but industry research consistently places the GPU market value in the tens of billions of dollars, with double-digit compound annual growth driven primarily by the AI revolution and exponential compute demand.

Why is the GPU Market Important?

GPUs are crucial to the global computing landscape because they enable the next generation of innovation in AI, automation, visualization, and digital transformation. As the world moves deeper into the era of artificial intelligence, GPUs have become the primary engines powering large neural networks and training models such as computer vision systems, generative AI applications, speech recognition engines, robotics, and autonomous driving algorithms.

Beyond AI, GPUs are essential for scientific research, molecular modeling, engineering design, weather prediction, seismic analysis, medical imaging, and virtual simulations. In consumer markets, they drive immersive gaming, 4K/8K visual experiences, and creative workflows such as video editing, 3D modeling, VR/AR content development, and animation.

Because GPUs require advanced semiconductor manufacturing processes, the GPU market is also a strategic component of global tech sovereignty. Nations view GPUs as essential infrastructure for defense, national security, industrial competitiveness, and leadership in AI-driven future economies.

Top Companies in the Graphics Processing Unit Market

(Company • Specialization • Key Focus Areas • Notable Features • 2024 Revenue • Market Share Snapshot • Global Presence)

1. NVIDIA Corporation

Specialization: High-performance GPUs and AI accelerators for data centers, gaming, automotive, and professional visualization.

Key Focus Areas: AI training and inference, HPC, cloud AI infrastructure, enterprise AI software, autonomous driving systems, professional graphics.

Notable Features: Cutting-edge GPU architectures (Ampere, Ada, Hopper, Blackwell), leadership in CUDA ecosystem, dominance in AI computing hardware, advanced networking and interconnect technologies.

2024 Revenue: Approximately $60.9 billion in fiscal 2024.

Market Share: NVIDIA held the overwhelming majority of the AI data-center GPU market and a significant share of the discrete GPU market.

Global Presence: Headquarters in the U.S. with worldwide operations, R&D centers, OEM partnerships, and cloud collaborations.

2. Advanced Micro Devices, Inc. (AMD)

Specialization: CPUs (Ryzen, EPYC), discrete GPUs (Radeon), data-center accelerators (Instinct series).

Key Focus Areas: AI accelerators, gaming GPUs, chiplet-based architecture, energy-efficient designs, end-to-end heterogeneous computing platforms.

Notable Features: Strong combination of CPUs + GPUs, leadership in chiplet technology, competitive data-center GPU roadmap.

2024 Revenue: Around $25.8 billion in 2024.

Market Share: Strong in consumer gaming and integrated GPUs, smaller but fast-growing share in data-center AI accelerators.

Global Presence: Worldwide R&D and partnerships, manufacturing through leading foundries, major collaborations with cloud and system vendors.

3. Intel Corporation

Specialization: CPUs (Core, Xeon), integrated GPUs, discrete GPUs (Arc series), AI and inference accelerators, advanced chiplet and packaging technologies.

Key Focus Areas: Integrated graphics leadership, data-center acceleration, rebuilding semiconductor manufacturing leadership, expanding discrete GPU ecosystem.

Notable Features: Extensive manufacturing footprint, broad software ecosystem, strong presence in client PCs via integrated GPUs.

2024 Revenue: Approximately $53 billion in 2024.

Market Share: Dominates integrated GPU segment; smaller share in discrete GPUs; expanding position in AI accelerators.

Global Presence: A global network of fabrication plants, design centers, and OEM partnerships across North America, Europe, and Asia.

4. Imagination Technologies

Specialization: GPU intellectual property (PowerVR), AI and graphics IP for SoCs in mobile, automotive, and embedded markets.

Key Focus Areas: Low-power GPUs for mobile devices, AI-capable graphics IP, automotive-grade GPU cores, custom GPU licensing solutions.

Notable Features: Known for PowerVR architecture, strong mobile and embedded GPU IP portfolio, focus on tile-based rendering and power efficiency.

2024 Revenue: Estimated in the low hundreds of millions (private company; publicly reported investments rather than full earnings).

Market Share: Leading provider in GPU IP licensing, used by SoC designers globally; not directly competing in data-center/discrete GPU hardware.

Global Presence: Headquarters in the UK with widespread licensing relationships across Asia, the EU, and the U.S.

5. Qualcomm Incorporated

Specialization: Mobile SoCs (Snapdragon), integrated Adreno GPUs, on-device AI accelerators, XR/AR chipsets, automotive SoCs.

Key Focus Areas: Mobile AI performance, energy-efficient mobile GPUs, 5G-connected devices, extended reality (XR), automotive computing platforms.

Notable Features: Adreno GPUs power billions of mobile devices worldwide; focus on low-power AI acceleration; strong smartphone ecosystem dominance.

2024 Revenue: Approximately $39 billion in 2024.

Market Share: Leading in integrated mobile GPU market; extensive share in smartphone SoC graphics.

Global Presence: Global design centers, relationships with nearly all major smartphone manufacturers, and expanding automotive partnerships.

Leading Trends in the GPU Market and Their Impact

1. AI and Generative AI Unleashing Unprecedented GPU Demand

Generative AI models require massive parallel processing power, causing explosive growth in demand for high-performance GPUs. Enterprises, startups, governments, and research labs are investing heavily in GPU servers and clusters.

Impact: Rapid market expansion, GPU shortages, and accelerated innovation in new architectures.

2. Shift Toward Cloud-Based GPU Access

Cloud service providers offer GPU compute instances, making AI development accessible without on-premise hardware investment.

Impact: Democratization of AI, increased GPU utilization rates, greater recurring revenue for vendors.

3. Rise of Specialized Accelerators and Heterogeneous Computing

Instead of relying solely on general-purpose GPUs, industries are adopting domain-specific accelerators and chiplet-based modular architectures.

Impact: GPU vendors focusing on interoperability, broader AI acceleration ecosystem, competitive pressure to innovate.

4. Advances in High-Bandwidth Memory & Packaging

High-bandwidth memory (HBM), 3D stacking, chiplets, and advanced cooling solutions are reshaping GPU performance.

Impact: Larger AI models can run on fewer GPU units, reducing training costs and enabling more energy-efficient compute clusters.

5. Energy Efficiency and Sustainability Constraints

As GPU clusters grow, so do power and cooling needs. Vendors now prioritize performance-per-watt metrics.

Impact: Shift to liquid cooling, energy-efficient architectures, and optimized data-center designs.

6. Gaming Evolution: Real-Time Ray Tracing and AI-Assisted Rendering

Gaming remains a powerful GPU market driver, with real-time ray tracing and AI upscaling technologies redefining visual quality.

Impact: New GPU generations prioritize hybrid RT + AI cores for cinematic gaming experiences.

7. Regulatory Oversight and Global Competition

Regulators in multiple markets are scrutinizing dominant GPU players due to market concentration and supply chain influence.

Impact: Increased transparency requirements, competition policies, and influence on future mergers or partnerships.

Successful Examples of GPU Market Applications Worldwide

1. AI Supercomputers and Hyperscale Data Centers

Major cloud providers deploy clusters with tens of thousands of GPUs to train AI models for language understanding, robotics, healthcare, and generative design.

2. Cloud Gaming Platforms

Streaming services run demanding games on remote GPU servers, enabling console-level performance on any device.

3. Autonomous Vehicles & Advanced Driver-Assistance Systems (ADAS)

GPU-powered systems process real-time camera, radar, and lidar inputs for perception, localization, and decision-making.

4. Biomedical & Scientific Simulations

Research institutions use GPUs for molecular modeling, DNA sequencing analysis, radiology diagnostics, and fluid dynamics simulations.

5. Edge AI in Mobile, IoT & Embedded Devices

Mobile GPUs like Qualcomm’s Adreno and Imagination’s PowerVR enable efficient AI inference for smartphones, drones, AR glasses, and smart cameras.

Global Regional Analysis — Government Initiatives & Policies Shaping the GPU Market

United States

The U.S. is investing heavily in semiconductor leadership through the CHIPS and Science Act, providing incentives for domestic manufacturing, packaging, and R&D. Policies also emphasize building national AI infrastructure, strengthening supply chains, and regulating export of high-performance chips. The U.S. remains a global hub for GPU innovation, design, and AI development.

European Union

The EU is implementing the European Chips Act to reduce dependency on external regions and boost semiconductor capacity. Policies encourage R&D in AI, edge computing, and HPC systems. The EU’s digital strategy promotes ethical AI, privacy protection, and transparency in hardware-software systems, influencing how GPUs and AI accelerators are deployed.

China

China continues to invest massively in semiconductor self-sufficiency, AI infrastructure, and GPU alternatives. While facing export restrictions for high-end AI GPUs, China is accelerating domestic development in AI chips, data-center accelerators, and foundry capabilities. National initiatives support large-scale AI compute centers, smart city deployments, and university research.

India

India is building its semiconductor and AI ecosystem with policies like the IndiaAI Mission, Production-Linked Incentive (PLI) schemes for chip manufacturing, and support for electronics design. While GPU fabrication is still in early stages, India’s demand for GPUs is rapidly growing due to digital transformation, cloud adoption, AI start-ups, fintech, automotive tech, and public-sector modernization.

East Asia (Taiwan, South Korea, Japan)

East Asia remains the world’s semiconductor manufacturing powerhouse. Taiwan (TSMC) and South Korea (Samsung) produce the most advanced nodes used in leading-edge GPUs. Japan is revitalizing its chip sector through public-private partnerships. Policies across East Asia strongly support R&D, fabrication capacity, and international collaboration to stabilize the semiconductor supply chain.

Rest of Asia, Middle East & Africa

Regions such as Singapore, UAE, Saudi Arabia, and South Africa are making strategic investments in AI infrastructure, cloud data centers, and high-performance computing labs. These initiatives increase regional GPU demand and create new markets for AI acceleration services.

Latin America

Countries like Brazil, Chile, and Mexico are expanding cloud data-center investments and digital transformation strategies. Governments are increasingly investing in AI research centers, accelerating the adoption of GPUs for national digital competitiveness.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Humanoid Robots in Packaging Market Growth Drivers, Trends, Key Players and Regional Insights by 2034