U.S. Ambulatory Surgery Centers Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

U.S. Ambulatory Surgery Centers Market Size

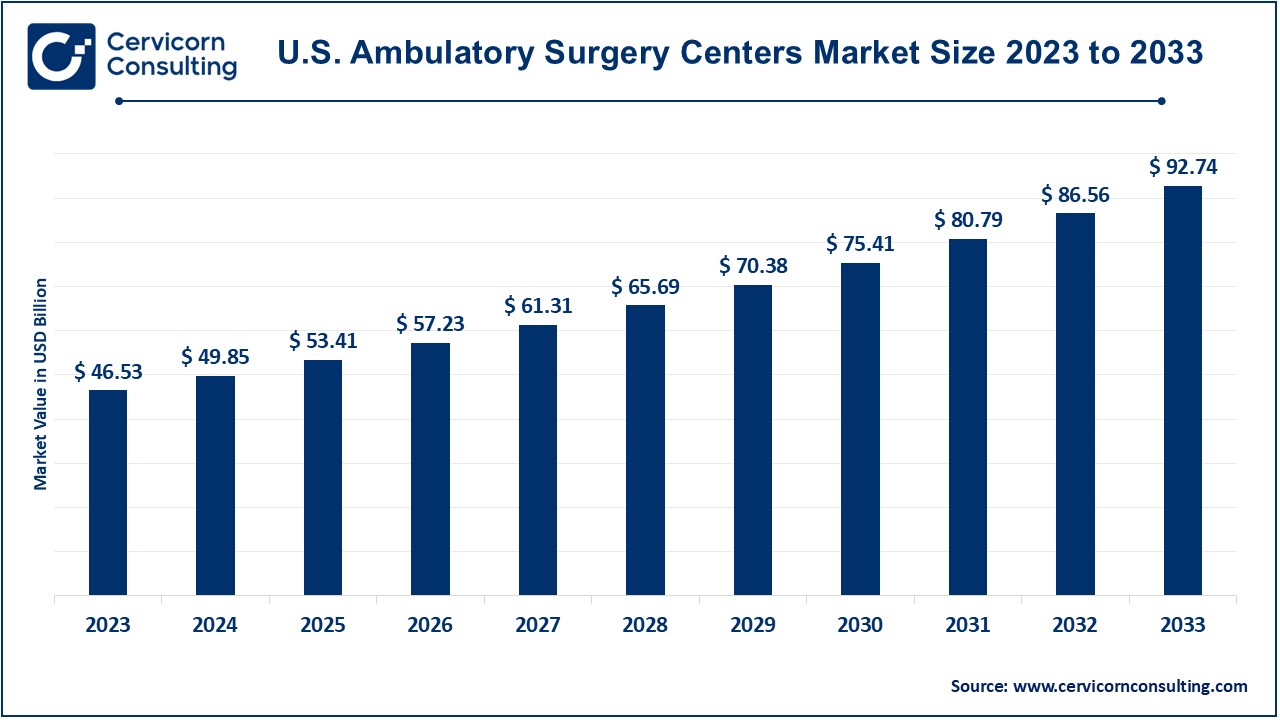

The U.S. ambulatory surgery centers market size was worth USD 99.26 billion in 2024 and is anticipated to expand to around USD 173.55 billion by 2034, registering a compound annual growth rate (CAGR) of 5.75% from 2025 to 2034.

U.S. Ambulatory Surgery Centers Market Growth Factors

The U.S. ASC market is expanding due to a convergence of clinical, economic, and policy forces that favor outpatient surgical venues. Advancements in minimally invasive techniques and anesthesia have broadened the scope of procedures that can safely be performed outside traditional hospitals. Simultaneously, payers and Medicare policies provide incentives to move surgeries to ASCs to reduce overall healthcare spending. Patients increasingly prefer these centers for shorter stays, lower infection risk, and greater convenience. Hospitals are also partnering with ASC operators to offload elective procedures and focus on critical inpatient care.

Additionally, private equity firms and healthcare systems are investing heavily in ASC development, technology upgrades, and specialty expansions across orthopedics, ophthalmology, gastroenterology, and pain management. Government regulations and CMS updates that raise ASC payment rates and expand covered procedures further reinforce market growth.

What Is the U.S. Ambulatory Surgery Centers Market?

The U.S. Ambulatory Surgery Centers market encompasses independent and networked facilities offering outpatient surgical and diagnostic procedures. These include ophthalmic, orthopedic, gastrointestinal, cardiovascular, and cosmetic procedures, among others. Unlike hospitals, ASCs are designed for efficiency — providing scheduled surgeries in a controlled, specialized environment without overnight stays.

The market has seen significant growth over the past decade. In 2024, the total market value was estimated at approximately USD 45–50 billion and is projected to grow steadily over the coming decade. This expansion is driven by technology, healthcare cost pressures, and the shift toward patient-centric care. The sector includes a mix of single-specialty centers focusing on specific procedures and multi-specialty centers catering to a broader patient base.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2434

Why the Market Is Important

The ASC market plays a critical role in the U.S. healthcare ecosystem for several reasons:

- Cost Efficiency: ASCs deliver the same high-quality care at a fraction of hospital costs. This cost advantage makes them attractive to payers, employers, and patients seeking value-based care.

- Accessibility and Convenience: ASCs increase access to surgical care by reducing wait times, decentralizing healthcare delivery, and improving geographic reach.

- Enhanced Patient Experience: Streamlined operations, personalized care, and shorter stays contribute to higher patient satisfaction and safety.

- Strategic Alignment with Healthcare Reform: ASCs align with national healthcare goals of lowering costs, improving outcomes, and transitioning toward outpatient, value-driven models.

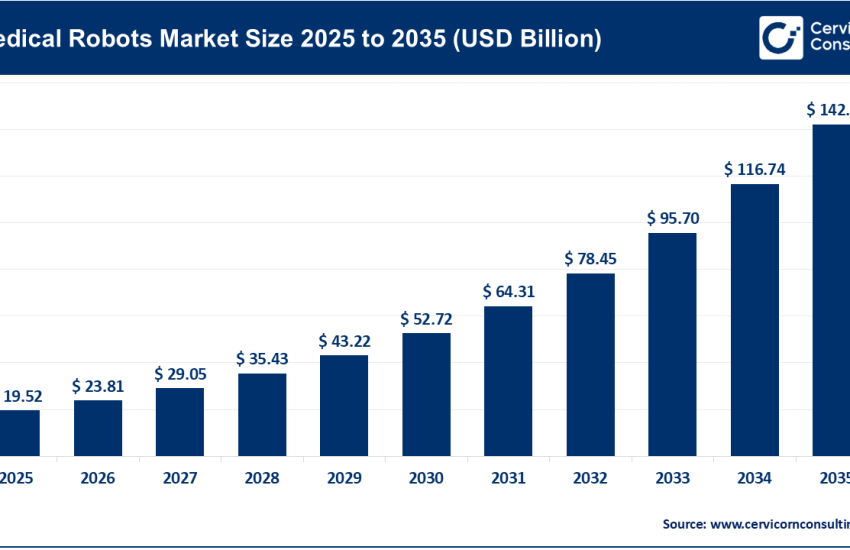

- Innovation Hub: Many ASCs are early adopters of advanced surgical technologies, robotic systems, and telemedicine solutions.

Top Companies in the U.S. Ambulatory Surgery Centers Market

Below are the leading players shaping the market — each with distinct strengths, specializations, and market strategies.

1. Medical Facilities Corporation (MFC)

Specialization:

Medical Facilities Corporation owns and operates specialty surgical hospitals and ASCs across the United States, partnering with physicians to deliver high-quality, cost-efficient surgical care.

Key Focus Areas:

MFC emphasizes operational efficiency, physician engagement, and patient-centered services across its network. The company focuses on orthopedic, spine, and pain management procedures.

Notable Features:

- Longstanding partnerships with physician groups.

- Focus on community-based facilities with specialized service lines.

- Strong governance and operational excellence.

2024 Revenue and Market Share:

In 2024, MFC generated facility service revenues in the hundreds of millions of U.S. dollars, driven by steady patient volumes and an optimized payer mix.

Global Presence:

Primarily focused on the U.S. market, with historical Canadian affiliations, MFC maintains a solid presence in multiple states through joint ventures with physician partners.

2. Constitution Surgery Alliance (CSA)

Specialization:

CSA is a management and development company that partners with physicians and health systems to create high-performing ASCs.

Key Focus Areas:

The company focuses on facility development, operational management, and quality improvement programs to ensure clinical and financial success.

Notable Features:

- Recognized for industry-leading quality and accreditation standards.

- Implements performance-driven management models that enhance outcomes.

- Prioritizes physician alignment and patient safety.

2024 Revenue and Market Share:

As a private company, CSA’s revenue is estimated in the tens of millions annually, reflecting strong regional operations and steady expansion.

Global Presence:

CSA operates exclusively in the U.S., serving diverse regional healthcare systems through partnerships and management contracts.

3. Covenant Physician Partners, Inc.

Specialization:

Covenant Physician Partners develops and operates ASCs across multiple specialties, focusing on partnerships with physicians and healthcare systems.

Key Focus Areas:

Covenant focuses on gastroenterology, ophthalmology, and pain management, leveraging joint ventures and acquisitions to expand its national footprint.

Notable Features:

- Integrates data-driven management and clinical excellence.

- Known for strong physician engagement models and sustainable growth strategies.

- Expanding into new markets through mergers and acquisitions.

2024 Revenue and Market Share:

Estimated to generate around USD 100 million in annual revenue, Covenant remains a key mid-tier ASC platform with a growing presence across multiple U.S. regions.

Global Presence:

The company focuses exclusively on the U.S. healthcare market, with a broad national network of partnered ASCs.

4. Physicians Endoscopy, LLC

Specialization:

Physicians Endoscopy is a leading operator of single-specialty gastrointestinal (GI) endoscopy centers. It partners with physician groups to deliver efficient, high-quality GI care.

Key Focus Areas:

The company concentrates on outpatient colonoscopies, upper endoscopies, and other GI procedures — offering specialized clinical and operational support.

Notable Features:

- Focused on high-volume endoscopy and GI services.

- Offers turnkey development, management, and operational optimization.

- Strong relationships with GI physician groups across the U.S.

2024 Revenue and Market Share:

Private estimates place Physicians Endoscopy’s annual revenue in the range of USD 70–80 million.

Global Presence:

The company operates exclusively in the U.S., with centers in multiple states specializing in gastrointestinal care.

5. HCA Healthcare

Specialization:

HCA Healthcare is the largest integrated healthcare provider in the United States, operating hospitals, outpatient departments, and ASCs through partnerships and owned facilities.

Key Focus Areas:

HCA’s ASC strategy centers on expanding outpatient services, integrating with hospital networks, and providing seamless patient care transitions.

Notable Features:

- Extensive national hospital and ASC footprint.

- Advanced data analytics and operational integration.

- Focus on scaling ambulatory care delivery.

2024 Revenue and Market Share:

HCA Healthcare reported total 2024 revenues of approximately USD 70.6 billion across its operations, with a growing portion attributable to outpatient and ASC services.

Global Presence:

Primarily focused on the U.S., HCA Healthcare also operates select international facilities, solidifying its position as a global healthcare leader.

Leading Trends and Their Impact

1. Migration to Outpatient Settings

Technological advances in surgical methods, anesthesia, and patient monitoring continue to shift procedures from inpatient to outpatient environments. Complex surgeries such as joint replacements and spinal procedures are increasingly being performed in ASCs.

Impact: Increased patient throughput, higher profitability per case, and expanded service offerings.

2. Policy and Reimbursement Support

CMS has consistently expanded the list of approved ASC procedures and applied payment increases that match hospital market basket updates.

Impact: Strengthened financial stability for ASCs and greater incentive for hospitals and physicians to migrate eligible procedures.

3. Consolidation and Private Equity Investment

Private equity firms and large healthcare systems continue to acquire independent ASCs, creating larger, more efficient platforms.

Impact: Enhanced economies of scale, centralized administration, and improved purchasing power for equipment and supplies.

4. Specialization and Focused Centers

Single-specialty centers focusing on ophthalmology, orthopedics, or gastroenterology achieve greater operational efficiency and patient satisfaction.

Impact: Improved profitability, consistency of care, and reduced operational complexity.

5. Technology Integration and Digital Health

ASCs are adopting telehealth for pre-operative consultations and remote patient monitoring post-surgery. Digital check-in systems and AI-driven scheduling tools are optimizing efficiency.

Impact: Better patient engagement, reduced cancellations, and improved workflow management.

Successful Examples of ASC Models Around the World

The U.S. ASC model has influenced healthcare systems worldwide. Below are examples of successful implementations across different regions:

Australia — Day Hospitals

Australia’s “day hospitals” are private, accredited facilities that perform a wide range of same-day surgeries. Government support and standardized accreditation processes have made these facilities integral to Australia’s healthcare system. They demonstrate how a strong regulatory framework can facilitate quality and cost-effective outpatient care.

United Kingdom — Day Surgery and Independent Treatment Centers

The UK’s National Health Service (NHS) uses independent treatment centers and day-case units to enhance elective care capacity. Standardized procedures and national performance benchmarks have improved access and efficiency.

India — Specialty Day Surgery Expansion

In India, rising healthcare demand and urbanization have fueled the growth of specialty day-care surgery centers, especially in ophthalmology, gastroenterology, and orthopedics. The private sector’s role has been pivotal in expanding access to affordable surgical services.

These international examples confirm that the ASC concept is highly adaptable across different regulatory and healthcare systems, provided that accreditation, physician leadership, and cost efficiency are prioritized.

Regional Analysis — Government Initiatives and Policies

United States

- CMS Payment Reforms: The Centers for Medicare & Medicaid Services (CMS) continuously update the ASC Payment System, providing payment parity with hospital outpatient departments and expanding covered procedures.

- Quality Reporting and Accreditation: Federal and state programs require ASCs to participate in quality reporting initiatives to maintain reimbursement rates and promote transparency.

- State Regulations: Some states have “Certificate of Need” (CON) laws that regulate ASC establishment, influencing the rate of new center development.

Role of Payers and Private Sector

- Insurance companies in the U.S. increasingly incentivize patients to use ASCs through lower copayments and bundled payments.

- Employers and accountable care organizations (ACOs) are steering patients toward outpatient settings to control costs.

Challenges and Considerations

- Reimbursement Risks: Changes in Medicare or private payer reimbursement policies could impact profitability.

- Regulatory Complexity: State-level licensing and accreditation requirements may delay expansion in certain regions.

- Workforce and Staffing: Recruiting specialized surgical nurses and staff remains a growing challenge for ASC operators.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Hybrid Train Market Revenue, Global Presence, and Strategic Insights by 2034