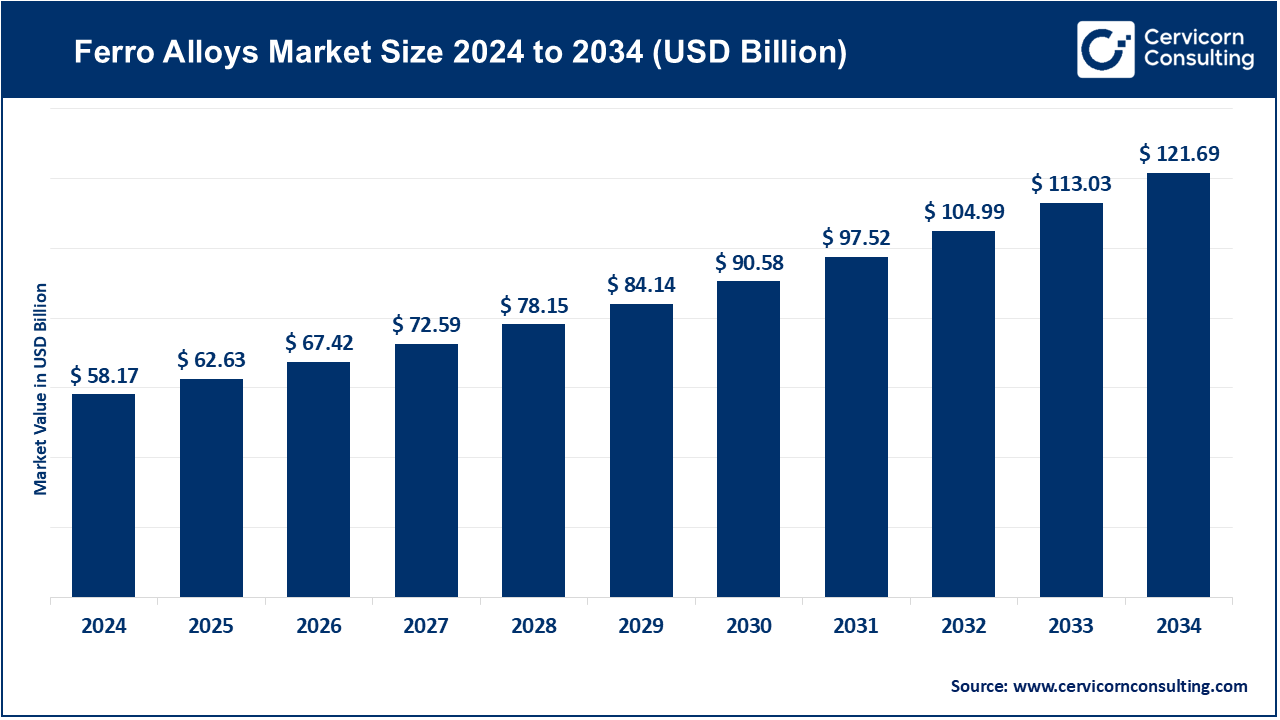

Ferro Alloys Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Ferro Alloys Market Size

What is the Ferro Alloys Market?

The ferro alloys market encompasses the production, distribution, and utilization of iron-based alloys, primarily ferrochrome, ferromanganese, ferrosilicon, silicomanganese, and ferrotitanium. These materials are vital in steel manufacturing, where they serve as alloying agents to enhance specific properties such as strength, corrosion resistance, and durability. Ferro alloys introduce critical elements like chromium (Cr), manganese (Mn), silicon (Si), and titanium (Ti) into molten steel to achieve the desired mechanical and chemical performance characteristics.

Because ferro alloys are indispensable in the steelmaking process, their demand is tightly linked to global steel production trends and broader industrial activity. They play a fundamental role in sectors such as construction, automotive, heavy engineering, and infrastructure development. In essence, the ferro alloys industry forms the backbone of the modern steel ecosystem.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2784

Why the Ferro Alloys Market is Important

Ferro alloys are the essential ingredients that enable the transformation of basic steel into advanced, high-performance materials. These alloys determine how steel behaves under stress, heat, and corrosion — crucial factors in industries that require reliable and long-lasting materials. From skyscrapers and bridges to automobiles and energy pipelines, ferro alloys contribute directly to the world’s industrial and infrastructural growth.

Moreover, ferro alloys hold strategic importance for nations. Countries with domestic ferro alloy production can maintain stability in their steel supply chains, reduce dependency on imports, and secure competitive pricing. As global demand for cleaner and stronger materials rises, ferro alloys are gaining prominence for their role in enabling sustainable and high-quality steel production.

Ferro Alloys Market Growth Factors

The ferro alloys market is growing due to a combination of industrial expansion, technological innovation, and resource-driven factors. Rising global steel production, especially in developing economies, fuels steady demand. Rapid urbanization, large-scale infrastructure projects, and the increasing use of stainless and specialty steels in manufacturing and construction are key contributors to this growth.

Simultaneously, producers are focusing on efficiency and sustainability — investing in captive power plants, low-emission furnaces, and backward integration into mining operations to secure raw materials and control costs. The global shift toward energy-efficient and low-carbon manufacturing processes has also influenced ferro alloy production technologies.

While challenges such as raw material price volatility and environmental regulations persist, the long-term outlook remains positive. Emerging economies, particularly in Asia-Pacific, continue to be major growth drivers, supported by infrastructure development, rising industrial output, and policies that promote domestic steel and alloy manufacturing.

Ferro Alloys Market Top Companies

1. Indian Metals & Ferro Alloys Ltd. (IMFA)

- Specialization: IMFA is India’s leading fully integrated producer of ferrochrome, a key alloying element used in stainless steel manufacturing.

- Key Focus Areas: Backward integration through captive chromite mines, self-owned power plants, and advanced smelting facilities.

- Notable Features: IMFA’s vertically integrated operations ensure cost efficiency and quality control across the supply chain. Its export-driven model serves major stainless steel producers in Japan, South Korea, and Europe.

- 2024 Revenue and Market Share: IMFA remains one of India’s largest ferrochrome producers, with consistent revenue growth driven by strong export performance.

- Global Presence: The company exports to multiple countries across Asia and Europe and continues to expand its market share through efficiency and sustainability initiatives.

2. Maithan Alloys Ltd.

- Specialization: Maithan Alloys is one of India’s largest producers of ferro manganese, silico manganese, and ferro silicon.

- Key Focus Areas: Focused on operational excellence, sustainable power management, and production optimization to meet both domestic and international demand.

- Notable Features: The company has a diversified product mix and strong presence across India with multiple manufacturing facilities. It emphasizes continuous innovation, cost reduction, and customer-centric alloy grades.

- 2024 Revenue and Market Share: Maithan Alloys reports strong financial performance, consistently ranking among India’s top ferro alloy exporters.

- Global Presence: The company serves global clients across Asia, the Middle East, and Europe, enhancing India’s position as a key supplier in the global ferro alloys market.

3. Sarojini Ferro Alloys

- Specialization: Sarojini Ferro Alloys is a mid-sized Indian manufacturer producing key ferroalloys such as ferrosilicon and ferromanganese.

- Key Focus Areas: Regional market supply, optimized smelting technology, and energy-efficient operations.

- Notable Features: The company emphasizes reliable quality and cost efficiency, serving both domestic steel manufacturers and foundry industries.

- 2024 Revenue and Market Share: Though smaller in scale compared to major players, Sarojini Ferro Alloys contributes significantly to India’s local ferro alloy supply chain.

- Global Presence: Primarily operates in the domestic market, with growing interest in export opportunities as global demand expands.

4. Balasore Alloys

- Specialization: Balasore Alloys manufactures ferrochrome and related alloys, supplying both domestic and international markets.

- Key Focus Areas: Increasing production capacity, enhancing energy efficiency, and expanding its export base.

- Notable Features: Balasore Alloys leverages modern smelting technology and integrated infrastructure to maintain consistent quality and output.

- 2024 Revenue and Market Share: The company continues to perform as a major ferrochrome exporter from India, supported by robust manufacturing capabilities and a diversified client base.

- Global Presence: Balasore exports its products to Asia, Europe, and the Americas, maintaining a strong footprint in the international stainless steel value chain.

5. Tata Steel Ferro Alloys & Minerals Division (FAMD)

- Specialization: Part of Tata Steel, FAMD focuses on producing ferro alloys and managing mineral resources for internal use and external sale.

- Key Focus Areas: Integration with Tata Steel’s supply chain, ensuring a steady supply of high-quality alloys for the company’s steel manufacturing.

- Notable Features: FAMD emphasizes sustainability, innovation, and responsible mining practices while maintaining a balance between internal consumption and external trade.

- 2024 Revenue and Market Share: As a division of Tata Steel, it contributes significantly to the group’s overall performance, with a focus on high-value steel and alloy products.

- Global Presence: Tata Steel’s extensive global footprint gives FAMD access to markets across Asia, Europe, and Africa, enhancing its position as a global ferro alloy player.

Leading Trends and Their Impact

1. Asia-Pacific Dominance

The Asia-Pacific region, particularly India and China, remains the central hub for ferro alloy production and consumption. The region’s rapid industrialization, growing steel capacity, and government-backed infrastructure programs have solidified its leadership position. The close proximity of raw materials, such as chromite and manganese ores, further boosts production efficiency.

2. Backward Integration and Captive Power

To counter rising energy costs and raw material shortages, producers are increasingly investing in captive power plants and mines. This integration enhances self-sufficiency and protects margins, especially during market volatility. It also reduces dependence on external suppliers and ensures a consistent quality of inputs.

3. Shift Toward High-Value Alloy Grades

With growing demand for stainless steel, specialty steel, and high-strength alloys, manufacturers are producing higher-grade ferro alloys with precise chemical compositions. This shift not only adds value but also helps producers cater to industries such as aerospace, defense, and renewable energy, where performance materials are critical.

4. Environmental Regulations and Decarbonization

The ferro alloys industry faces rising pressure to reduce carbon emissions and adopt sustainable production methods. Companies are investing in cleaner smelting technologies, energy-efficient furnaces, and renewable energy integration. Environmental compliance has become a competitive differentiator, especially for exporters to regions with strict sustainability norms.

5. Trade Policies and Geopolitical Factors

Trade regulations, tariffs, and export restrictions influence global ferro alloy prices and trade flows. For example, export duties on raw materials like manganese or chromite can shift production to countries with favorable policies. Producers are adapting by diversifying export destinations and forming strategic alliances with steel manufacturers.

Successful Examples of the Ferro Alloys Market

India – Integration and Export Leadership

India’s ferro alloys industry showcases successful integration across the supply chain. Companies like IMFA and Balasore Alloys have secured captive chromite mines and established captive power generation to achieve cost efficiency. This model has positioned India as a competitive exporter to stainless steel hubs in Japan, South Korea, and Europe.

China – Scale and Vertical Integration

China dominates global ferro alloy production through its vertically integrated operations that combine mining, smelting, and steelmaking within large industrial clusters. Its massive domestic steel demand provides a strong internal market, while cost efficiencies from scale make Chinese ferro alloys globally competitive.

South Africa – Resource-Driven Export Model

South Africa is a leading exporter of ferrochrome and manganese-based alloys, supported by rich mineral reserves. The country’s ferro alloy producers have successfully leveraged these resources to serve global stainless steel markets, though energy costs and infrastructure challenges remain ongoing concerns.

Europe – Focus on Specialty and Green Alloys

European producers emphasize high-quality specialty ferro alloys that meet strict environmental and performance standards. Many European firms are investing in low-carbon ferro alloy production technologies to align with EU decarbonization targets, setting an example for sustainable metallurgy.

Global Regional Analysis

Asia-Pacific

Asia-Pacific dominates both production and consumption, accounting for more than 70% of global demand. India and China lead the region, supported by strong government initiatives to promote domestic steel capacity. Industrial policies, mining reforms, and infrastructure investments are key growth drivers.

North America

The North American market is characterized by stable demand from construction, automotive, and oil & gas industries. Policies encouraging domestic manufacturing and supply chain security are likely to spur localized ferro alloy production in the coming years.

Europe

Europe’s ferro alloys market is driven by the need for high-quality alloys that comply with stringent environmental regulations. The focus on decarbonization and circular economy principles encourages investment in cleaner production methods and recycling technologies.

Latin America

Brazil, with its vast mineral resources, leads Latin America’s ferro alloy production. The region’s demand is tied to its domestic steel industry, with opportunities for expansion as industrial and construction sectors recover.

Middle East & Africa

South Africa continues to be a dominant player due to its abundant chromite and manganese reserves. The government’s policies promoting local beneficiation aim to retain more value within the country, encouraging new smelting and processing projects.

Government Initiatives and Policies Shaping the Market

- Mining Reforms and Beneficiation Policies:

Governments in resource-rich countries are encouraging local processing rather than raw material exports. This drives investment in ferro alloy smelting within mining regions, creating jobs and retaining value locally. - Energy Efficiency and Emission Standards:

Environmental regulations are prompting companies to modernize furnaces and adopt renewable power sources. Cleaner technologies are becoming essential for maintaining export eligibility, especially in developed markets. - Trade Protection Measures:

Import tariffs and anti-dumping duties are shaping international trade dynamics, protecting domestic producers but also creating temporary supply-demand imbalances. Manufacturers are responding by exploring new export destinations. - Infrastructure Development Programs:

National infrastructure projects — from housing to transport networks — are driving steel demand, indirectly boosting ferro alloy consumption. Emerging economies are using these programs to stimulate domestic industries. - Incentives for Sustainable Manufacturing:

Governments are offering tax benefits and subsidies for companies adopting low-carbon technologies and energy-efficient equipment. This trend supports the industry’s long-term transition toward sustainable growth.

Industry Response and Outlook

The ferro alloys industry is adapting to evolving market dynamics through innovation, investment, and diversification. Leading companies are expanding capacity, integrating mining and power assets, and focusing on higher-grade alloy production. Sustainability initiatives — including renewable energy adoption and emissions reduction — are becoming central to business strategies.

As the world continues to urbanize and industrialize, demand for steel and its essential components like ferro alloys will remain strong. The ongoing transformation toward cleaner production and advanced materials ensures that the ferro alloys market will play a vital role in shaping the future of global metallurgy and sustainable development.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Pharmaceutical Market Revenue, Global Presence, and Strategic Insights by 2034