Telehealth 2.0 Market Revenue, Global Presence, and Strategic Insights by 2034

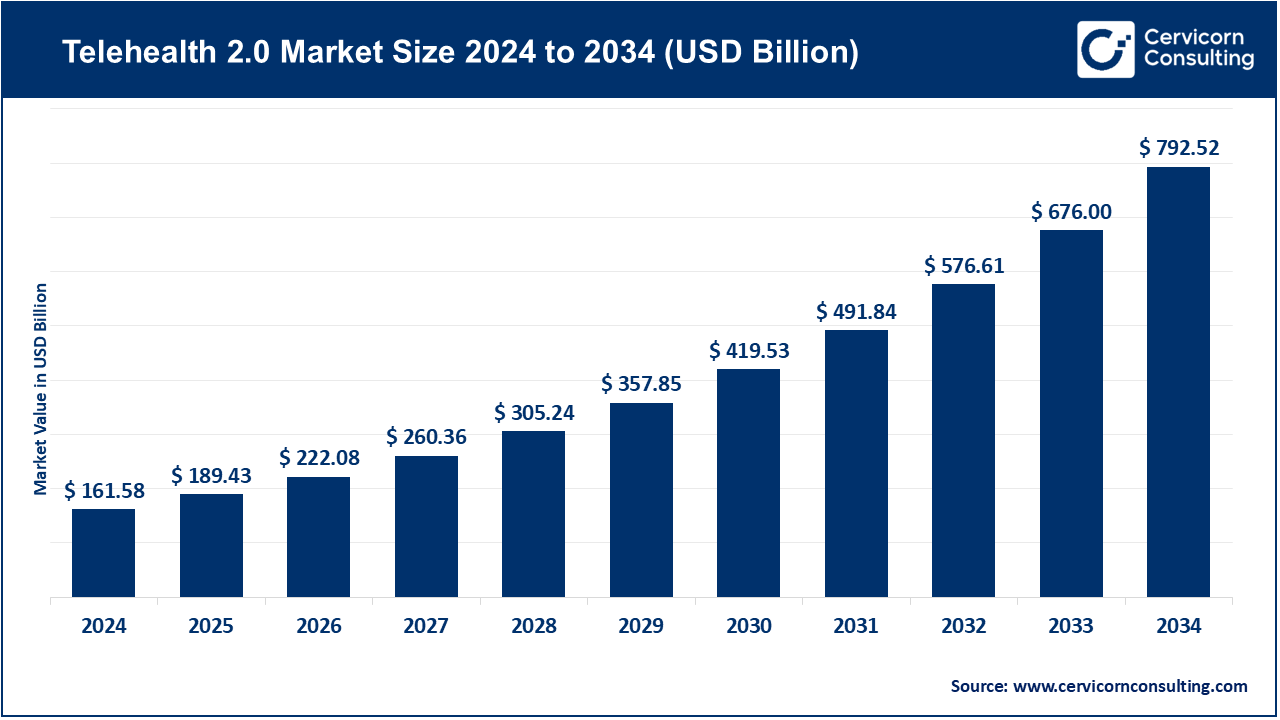

Telehealth 2.0 Market Size

Growth factors

Several converging forces are accelerating Telehealth 2.0: firstly, sustained patient demand for convenience and access (especially for behavioral health and chronic-condition check-ins); secondly, advances in remote monitoring hardware and the falling cost of IoT sensors that make longitudinal data reliable for clinical decision-making; thirdly, more sophisticated software — AI for triage, natural-language clinical documentation, predictive analytics and clinical decision support — which raises the clinical value of virtual encounters; fourthly, payers experimenting with value-based contracts and Medicare/insurer policy extensions that improve reimbursement economics for virtual services; fifthly, provider system digital transformation programs and the rise of digital-first primary care models that embed telehealth into care pathways.

Sixthly, cross-border and consumer-platform adoption that scales networks and lowers marginal delivery costs; seventhly, cybersecurity and privacy standards maturing so healthcare organizations can deploy telehealth at scale; and finally, continued investment and consolidation in digital health (M&A and partnerships) that helps platforms expand service breadth — all of which combine to make Telehealth 2.0 an investable, operationally attractive, and clinically credible sector.

What is the Telehealth 2.0 market?

Telehealth 2.0 refers to the market for integrated virtual-care technologies and services that go beyond point-to-point video visits. It includes platforms and services for remote patient monitoring (RPM), virtual-first primary care, digital mental health programs, async (store-and-forward) specialist consults, hybrid workflows that connect virtual care to brick-and-mortar follow-ups, tele-ICU and hospital-at-home models, and the analytics/AI layers that orchestrate population health and quality measurement.

The market involves SaaS platforms sold to payers and providers, virtual-care clinics sold to employers/benefit managers, device + data bundles, and care-delivery partnerships. Market sizing estimates differ by methodology, but leading research providers put the global telehealth/telemedicine market in the tens to low hundreds of billions in 2024, with multi-year CAGRs in the double digits as Telehealth 2.0 capabilities expand.

Why Teleheal th 2.0 is important

Telehealth 2.0 matters because it converts episodic convenience into measurable, scalable clinical value. By enabling continuous monitoring, earlier intervention, and richer data exchange between patient and care team, Telehealth 2.0 can reduce avoidable ED visits and hospital readmissions, support better chronic-disease outcomes, expand behavioral-health access, and lower total cost of care when deployed within value-based arrangements. For health systems, it unlocks capacity and patient retention; for payers and employers, it promises better outcomes and engagement; and for patients, it reduces friction, travel time, and access gaps — especially in rural or underserved communities. Policy momentum and ongoing advances in AI/analytics also mean telehealth is being designed to be safer, more accountable, and more measurable than the first-wave point-solution era.

Telehealth 2.0 Market — Top Companies

Teladoc Health

- Company: Teladoc Health, Inc.

- Specialization: Virtual primary and specialty care, chronic care management, mental health (BetterHelp), and integrated care services.

- Key Focus Areas: Integrated care programs for chronic conditions, behavioral health delivery, enterprise contracts with health systems and employers, remote monitoring and care navigation.

- Notable Features: Broad enterprise footprint, product breadth from RPM to behavioral health, large employer/payer contracts; has moved emphasis toward Integrated Care after mixed BetterHelp performance.

- 2024 Revenue: Around $2 billion+.

- Market Share (estimate): One of the largest U.S. telehealth providers and market leaders.

- Global Presence: Operates across North America and internationally through partnerships.

Amwell (American Well)

- Company: Amwell Corp.

- Specialization: Telehealth platform and telemedicine software that connects providers, health systems, and payers; white-label and enterprise telehealth solutions.

- Key Focus Areas: Building hybrid care ecosystems, subscription models for payers/employers, and digital mental health integrations.

- Notable Features: Strong health-system and payer partnerships; developer/API model; emphasis on interoperability.

- 2024 Revenue: About $254 million.

- Market Share (estimate): Among the top U.S. telehealth platform vendors with significant share.

- Global Presence: Primarily U.S.-focused but works with international partners.

MDLIVE (Evernorth / Cigna)

- Company: MDLIVE (acquired by Cigna/Evernorth)

- Specialization: On-demand virtual urgent care, behavioral health, and primary care.

- Key Focus Areas: Virtual urgent care, integration with insurer/payer networks, B2B contracts serving employers.

- Notable Features: Strong payer integration after Cigna’s acquisition.

- 2024 Revenue: Estimated in the low hundreds of millions.

- Market Share (estimate): Significant in insurer-integrated virtual care.

- Global Presence: Primarily U.S.-centric.

Doctor on Demand (Included Health)

- Company: Doctor on Demand (part of Included Health after merger with Grand Rounds)

- Specialization: Virtual primary and specialty consults, behavioral health, second opinions.

- Key Focus Areas: Longitudinal care navigation, specialty access, employer and health-plan contracts.

- Notable Features: Integration of navigation and virtual care into one platform.

- 2024 Revenue: Estimated ~$135 million for Doctor on Demand.

- Market Share (estimate): Leading employer-facing virtual care provider.

- Global Presence: Primarily U.S.-focused.

HealthTap

- Company: HealthTap, Inc.

- Specialization: AI-enabled triage and clinician Q&A, virtual consults.

- Key Focus Areas: AI-first triage, virtual consults, provider marketplaces.

- Notable Features: Strong emphasis on AI-driven patient intake and routing.

- 2024 Revenue: Estimated ~$25–35 million.

- Market Share (estimate): Smaller but recognized AI-triage player.

- Global Presence: U.S.-headquartered with international reach via digital platforms.

Leading trends and their impact

- Virtual-first primary care & hybrid models — Providers offering a digital-first patient journey (virtual intake, RPM, in-person follow-up) reduce friction, improve preventive care adherence, and drive higher patient lifetime value.

- Remote Patient Monitoring — RPM reimbursement codes are making chronic-condition management financially viable for providers, enabling earlier detection and tighter care loops.

- AI-driven triage & automation — AI symptom-checkers, automated documentation, and decision support increase clinician efficiency but require validation and oversight.

- Behavioral health scaling — Mental health demand is high; virtual therapy, coaching, and digital CBT are central to Telehealth 2.0 growth.

- Hospital-at-home & tele-ICU models — Health systems use these to reduce inpatient length-of-stay and expand higher-acuity virtual care.

- Regulatory evolution & reimbursement uncertainty — Extended pandemic-era telehealth flexibilities provide momentum, but reimbursement rules remain in flux.

- Interoperability and data standards — National and regional frameworks support integration with EHRs and data exchange, critical for telehealth scaling.

- Consolidation & verticalization — Mergers and acquisitions are reducing fragmentation, creating full-service platforms that integrate care delivery, navigation, and analytics.

Successful Telehealth 2.0 examples around the world

- United States (Teladoc): Integrated care programs with chronic-disease management and RPM that reduce hospital utilization.

- United States (Included Health): Combining care navigation with virtual consults to improve member satisfaction and outcomes.

- India: Ayushman Bharat Digital Mission and national telemedicine guidelines support mass adoption, with platforms like Practo scaling services nationwide.

- Europe: National digital health programs and the European Health Data Space drive cross-border interoperability and chronic-care telemonitoring pilots.

- Australia & Canada: Virtual-first primary-care networks funded by public payers reduce wait times and improve specialist access.

Global regional analysis — Government initiatives and policies

North America

- United States: Medicare/Medicaid policies and temporary flexibilities extended into 2025 allow telehealth in the home and audio-only for behavioral health. RPM/RTM reimbursement codes drive adoption. State licensure remains a barrier for interstate practice.

- Canada: Provincial programs drive varied telehealth adoption, with federal initiatives supporting infrastructure growth.

Europe

- EU’s European Health Data Space promotes interoperability and patient access, creating fertile ground for telehealth platforms. National-level digital health strategies continue to push telehealth forward.

Asia-Pacific

- India: Telemedicine guidelines and ABDM initiatives expand access, particularly in rural areas.

- China: Heavy state and private investment in telemedicine platforms, though regulatory landscapes are restrictive for foreign firms.

- Australia & Southeast Asia: Publicly funded programs and private insurer partnerships expand hybrid care models.

Latin America, Middle East & Africa

- Adoption is uneven but rising, driven by mobile penetration and public-private partnerships. National strategies in some countries support digital care scaling, especially for primary care.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Regenerative Agriculture Market Growth Drivers, Key Players, Trends and Regional Insights by 2034