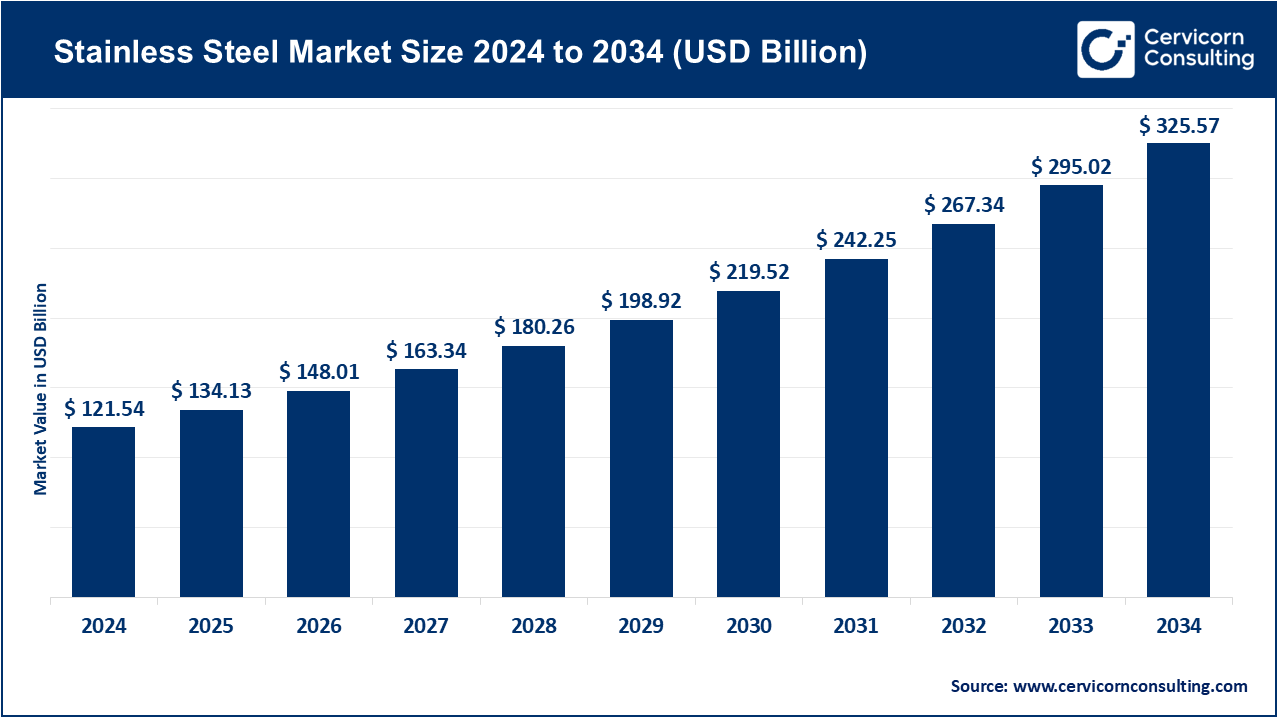

Stainless Steel Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Stainless Steel Market Size

Growth Factors

The stainless steel market is being driven by a constellation of interlocking factors: accelerating demand from construction and infrastructure (façades, roofing, structural elements), automotive and transportation (exhaust systems, structural components), and durable consumer goods (kitchen appliances, cookware, industrial equipment); rising industrialization and urbanization across Asia-Pacific and parts of Africa and Latin America; replacement cycles in mature markets; growing emphasis on corrosion-resistant materials in energy (oil & gas, petrochemicals) and water treatment; advances in low-carbon steelmaking (electric-arc furnaces, hydrogen trials) that open new supply dynamics and attract investment; supply-side consolidation and technological modernization improving quality and cost competitiveness; and regulatory and procurement pushes for sustainable materials and traceable supply chains that favor producers investing in decarbonization and recycling.

These demand and supply drivers, together with volatile raw-material prices and trade policy shifts, create both growth opportunities and short-term price/resiliency challenges for the global stainless steel industry.

What is the stainless steel market?

The stainless steel market comprises production, processing, distribution and sale of corrosion-resistant steel alloys (primarily containing chromium and often nickel, molybdenum or other alloying elements) in forms such as slabs, hot-rolled coils, cold-rolled coils, sheets, strips, bars, pipes and specialty products. It includes integrated steelmakers, specialty stainless producers, toll processors (cold-rollers, surface finishers), service centers and end-users across automotive, construction, appliances, chemical, energy and industrial machinery sectors. Market sizing typically measures output (tons) and value (USD or local currency) and is segmented by grade (austenitic, ferritic, martensitic, duplex), product form and end-use industry.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2759

Why is stainless steel important?

Stainless steel is a strategic industrial material because it combines strength, longevity, hygiene and corrosion resistance — attributes that reduce lifecycle costs for buildings, vehicles, infrastructure and equipment. It is indispensable in sanitary and food-grade applications (kitchens, medical equipment), in high-temperature and corrosive environments (chemical plants, offshore platforms), and increasingly in architectural projects where aesthetics and durability matter. Moreover, stainless steel’s high recyclability and the possibility of low-carbon production routes make it central to decarbonization strategies in heavy industry. Its cross-sector utility means shifts in stainless steel demand often signal broader trends in manufacturing, infrastructure investment and sustainability policy.

Stainless Steel Market — Top Companies

1) Tata Steel

Specialization: Integrated steelmaking across flat and long products; strong presence in construction steel and specialty stainless through group companies and joint ventures.

Key focus areas: Capacity expansion in India, value-added flat products, low-carbon pathways and local market penetration in Europe (selected assets) and Southeast Asia.

Notable features: One of India’s largest steelmakers; record domestic crude steel production in FY2023–24; active investments in decarbonization projects in Europe (e.g., IJmuiden discussions).

2024 revenue: Consolidated revenue for FY2023–24 reported at INR 2,29,171 crore.

Market share & global presence: Large market share in India’s steel market and foothold in Europe and Southeast Asia via facilities and acquisitions; competes across commodity and value-added segments.

2) Zhangjiagang Pohang Stainless Steel (ZPSS)

Specialization: Cold-rolled stainless steel coils and strips; EAF-based stainless production geared to high-value cold-rolled products.

Key focus areas: Cold-rolled quality leadership, serving appliance, auto and industrial OEMs in China and export markets.

Notable features: Joint venture origins tied to POSCO and Chinese partners; positioned as a China local leader in cold-rolled stainless.

2024 revenue: ZPSS is a privately held JV and does not centrally publish a standalone global USD revenue figure; company turnover estimates from trade filings indicate substantial regional sales.

Market share & global presence: Significant regional share in China’s cold-rolled stainless segment; strategic importance as a foreign-local JV enabling technology and product transfer.

3) POSCO (POSCO Holdings)

Specialization: Large diversified steelmaker producing flat products and stainless grades through subsidiaries and joint ventures.

Key focus areas: Efficiency in integrated steelmaking, expanding green steel initiatives, portfolio optimization (recent asset sales and restructuring), and strengthening stainless product lines.

Notable features: Major Korean steel group with global trading, downstream & raw-material integrations; produces a broad range of stainless and specialized steels.

2024 revenue: POSCO Holdings reported consolidated sales of KRW 72.688 trillion for 2024.

Market share & global presence: One of the world’s larger steel producers with significant presence in Asia and global trade networks; involvement in stainless through joint ventures such as ZPSS.

4) Thyssenkrupp

Specialization: Germany-based diversified industrial group with steelmaking operations (including flat carbon and certain stainless capabilities through subsidiaries and joint ventures), plus engineering and materials services.

Key focus areas: Restructuring its steel business, decarbonization (hydrogen/electric furnaces), efficiency improvement, and aligning product mix to European demand.

Notable features: Facing restructuring and ownership changes in steel units; EU policy and government support shaping its transformation.

2024 revenue: Group sales for year ended Sept 30, 2024 reported at approximately €35–37 billion depending on segment adjustments.

Market share & global presence: Strong European footprint, with strategic focus on keeping competitiveness in high-cost markets through green investments and specialization.

5) ArcelorMittal

Specialization: The world’s largest steelmaker by many metrics — wide portfolio across flat, long, tubular and specialty steels (including stainless via integrated operations and affiliates).

Key focus areas: Geographic diversification, mining integration, decarbonization investments, and high-value alloys.

Notable features: Very high geographic diversification (substantial production in the Americas and Europe); large R&D and capex reserves to pursue low-carbon steel routes.

2024 revenue: ArcelorMittal reported consolidated sales in its 2024 annual report and factbook, covering regional production and sales figures.

Market share & global presence: Leading global share by output and revenue across multiple segments; integrated supply chain including mining gives pricing and security advantages.

Leading trends and their impact

Decarbonization & “green steel”

Producers are piloting electric-arc furnaces (EAFs), hydrogen-based reduction and increased scrap use to lower Scope 1 emissions. This shifts capital toward specialized assets and favors firms with scrap access or renewable power contracts. Policy incentives and carbon pricing in Europe accelerate this trend; producers willing to invest in low-carbon stainless will gain access to premium contracts from OEMs and public projects.

Regionalization and trade policy dynamics

Anti-dumping, tariffs and strategic decarbonization subsidies prompt sourcing closer to end markets and encourage domestic investment. This reduces some historical dependence on long global supply chains, benefiting regional stainlessmakers and service centers while pressuring lowest-cost exporters.

Product premiumization — high-grade & duplex steels

Demand for higher-performance grades (duplex, super-austenitic) in oil & gas, desalination and chemical sectors raises margins for producers with alloying and processing expertise. Manufacturers are investing in capability to produce tighter-tolerance cold-rolled and specialty coils.

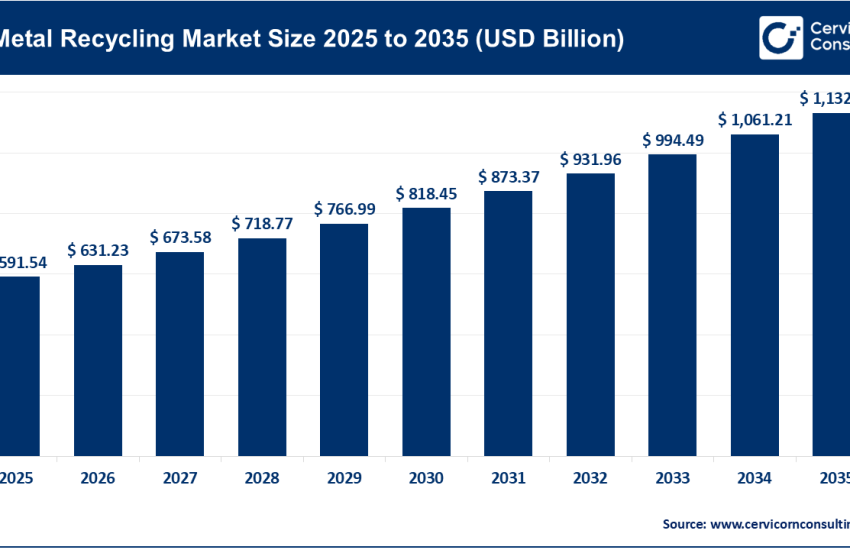

Circularity & recycling

Stainless scrap collection and traceability are becoming commercial advantages — EAF routes require quality scrap streams, and buyers are increasingly conscious about circular content. This creates secondary-market opportunities for scrap processors and service centers.

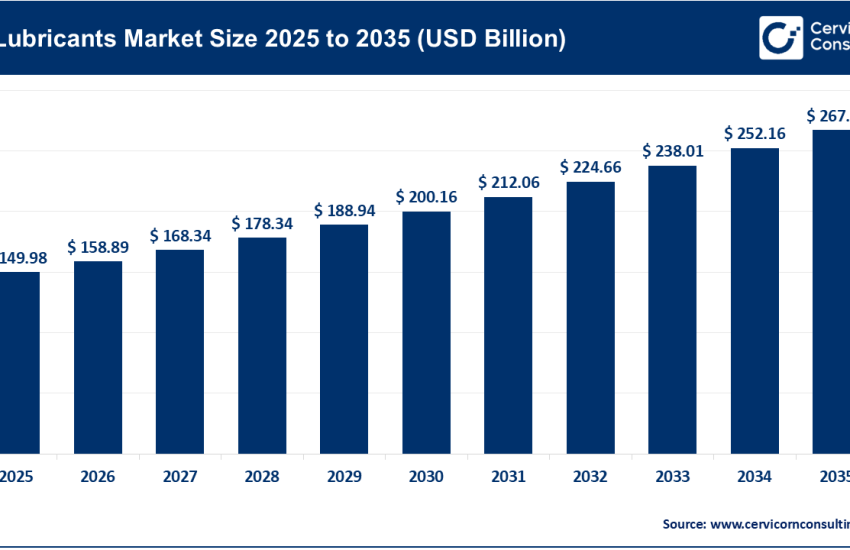

Digitalization & smart mill investments

Industry 4.0 for predictive maintenance, quality control and supply optimization reduces per-ton costs and shortens lead times — important for just-in-time OEM customers.

Impact summary: Together these trends raise barriers to entry for commodity players (capital intensity plus decarbonization cost), favor vertically integrated and diversified groups, and produce a bifurcated market: premium low-carbon/high-value stainless versus lower-cost commodity supply.

Successful examples of stainless steel market implementations worldwide

- Dutch and Nordic low-carbon pilot projects: Several European plants are piloting hydrogen use and electric furnaces to decarbonize stainless and carbon steelmaking — often supported by government grants. These projects show how policy-backed capital can speed transformation.

- ZPSS (China) – localized cold-rolled leadership: Zhangjiagang Pohang Stainless Steel demonstrates a successful JV model where foreign technology and local market access combined to capture a major share of cold-rolled stainless supply in China.

- Tata Steel (India) – scaling production and value-addition: Tata’s record domestic crude steel output and an integrated approach to finished products — with investments in downstream and sustainability — exemplify successful national champions that serve both domestic infrastructure and export markets.

- ArcelorMittal — geographic diversification and mining integration: Its wide footprint and ability to pivot production and product mix across regions provides resilience and scale for large projects (infrastructure, automotive), illustrating the advantage of broad global presence.

Global regional analysis — Governments, initiatives and policy shaping the market

Asia-Pacific (China, India, South Korea, Japan)

Drivers: Rapid urbanization, manufacturing demand (appliances, autos), infrastructure rollouts. China remains the largest stainless consumer and producer; India is scaling capacity and favoring domestic producers via procurement and infrastructure spending.

Policy & initiatives: India supports domestic steel capacity expansion and infrastructure projects that absorb large volumes; China’s industrial policy balances capacity controls with technology upgrades and environmental standards; South Korea invests in green tech and global restructuring. These policies encourage local production, capacity modernization and sometimes protectionist measures.

Europe

Drivers: Demand from construction refurbishment, energy transition projects, and high-value manufacturing.

Policy & initiatives: Strong decarbonization policy packages (EU Green Deal, carbon costs, funding for hydrogen/furnace retrofits) are reshaping capital allocation. Governments provide direct support for green steel projects, increasing cost for incumbents but creating premium markets for low-carbon stainless.

North America

Drivers: Infrastructure upgrades, automotive electrification, and industrial investment.

Policy & initiatives: Infrastructure bills and procurement preferences for domestic or low-carbon steel can favor local stainless and create long-term contracts with industrial OEMs.

Middle East & Africa

Drivers: Large infrastructure and petrochemical projects requiring corrosion-resistant materials, rising manufacturing hubs in GCC countries.

Policy & initiatives: Sovereign investment in industrialization and ports drives demand; some nations include local content rules and incentives for industrial diversification.

Latin America

Drivers: Mining, construction and energy projects.

Policy & initiatives: Policies vary; trade competitiveness often depends on proximity to North American auto and appliance supply chains.

Cross-regional notes: Governments are central in the current industry transition — via subsidies for green steel, carbon pricing, trade remedies and public procurement rules. These levers materially affect where stainless steel capacity is viable over the next decade.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Residential Battery Energy Storage System Market Trends, Growth Drivers and Leading Companies 2024