Polyethylene Glycol (PEG) Market Revenue, Global Presence, and Strategic Insights by 2034

Polyethylene Glycol (PEG) Market Size

Polyethylene Glycol (PEG) Market Growth Factors

The polyethylene glycol (PEG) market is being driven by a combination of robust demand from pharmaceutical and personal-care formulations, expanding industrial applications (as solvents, plasticizers, dispersants, antistatic agents and processing aids), and steady growth in end-use industries such as cosmetics, pharmaceuticals, paints & coatings, agrochemicals and polymer processing.

Rising demand for higher-purity, pharmacopeia-grade PEGs and specialized molecular-weight grades for drug-delivery systems and topical formulations is encouraging producers to upgrade capacities and quality controls. Simultaneously, growth in developing-market healthcare spending and increased contract manufacturing for cosmetics and generics is lifting regional demand — while raw-material availability (ethylene oxide feedstock), evolving environmental and safety regulations, and supply-chain optimization (regional production hubs and trade patterns) shape investment decisions and pricing. Finally, formulation innovation (PEG-based surfactants and PEG derivatives), and the use of PEGs in advanced applications such as biologics conjugation and controlled-release matrices, are expanding per-unit value and encouraging specialty suppliers to invest in tailored grades and regulatory compliance.

What is the Polyethylene Glycol (PEG) Market?

Polyethylene glycol (PEG) is a family of polyether compounds produced by polymerizing ethylene oxide and terminating chains with hydroxyl groups. PEGs are typically described by their average molecular weight (e.g., PEG-200, PEG-400, PEG-600, PEG-4000), with properties — viscosity, melting point, solubility — changing dramatically across grades. The PEG market covers production, purification, packaging and sale of standard PEGs and specialty PEG derivatives (e.g., methylated PEGs, PEGylated intermediates, block copolymers and reactive PEGs) to manufacturers in pharmaceuticals (excipients and drug-delivery), cosmetics & personal care (humectants, solvents), industrial processes (lubricants, corrosion inhibitors), paints/coatings, textiles, agrochemicals and others. Market sizing typically tracks both tonnage and value (USD), because specialty, pharm-grade PEGs command much higher prices than commodity grades.

Why is PEG Important?

PEG is a near-ubiquitous excipient and functional polymer: it improves solubility, stabilizes formulations, acts as a carrier or lubricating agent, controls viscosity and functions as a humectant in personal-care products. In pharma, PEG is critical as an excipient and as a building block for PEGylation (attaching PEG chains to biologics to prolong half-life) and drug-delivery matrices.

In cosmetics, PEG grades are prized for skin feel, water retention and solvent properties. Beyond life sciences and cosmetics, PEGs are used across industries for antistatic agents, mold release agents, inks, dyes and as intermediates in chemical synthesis. Because PEG bridges commodity and specialty chemical markets, shifts in PEG supply and quality directly affect drug and personal-care formulation costs and, by extension, product availability and R&D decisions.

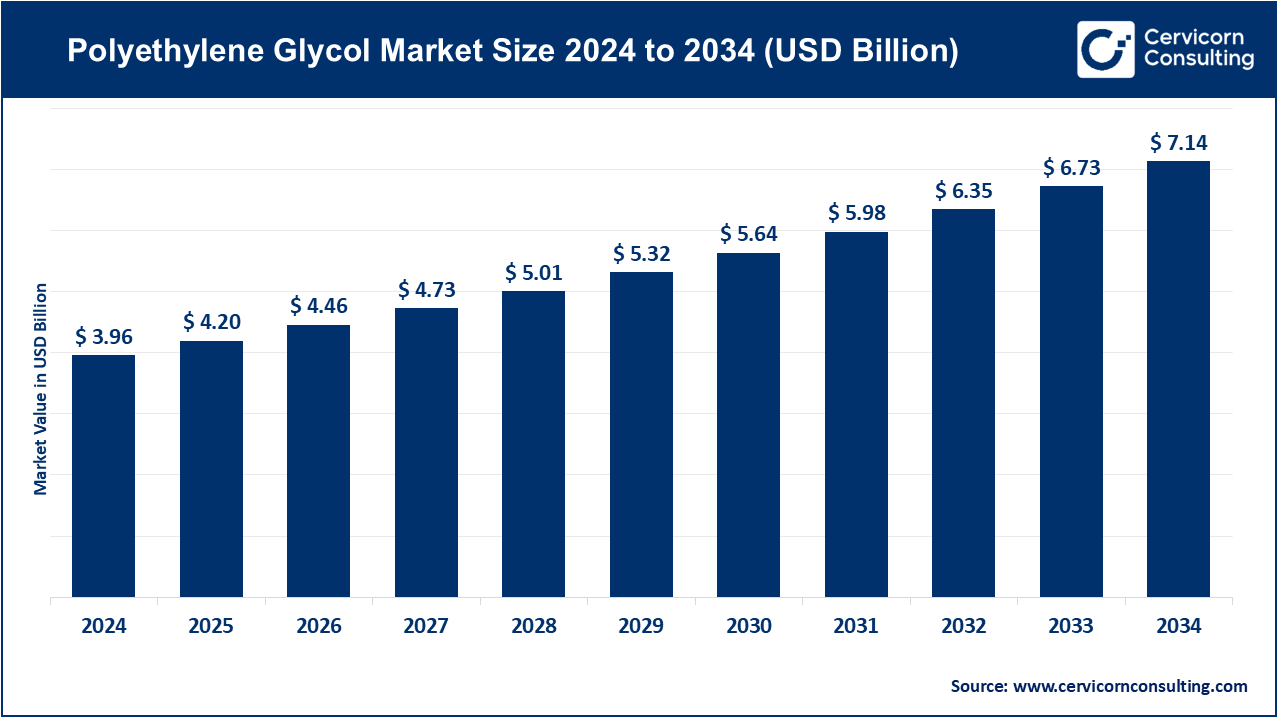

Polyethylene Glycol (PEG) Market Size & Growth — Headline Figures

Recent market reports vary slightly by methodology, but they converge on a multi-billion-dollar market in 2024 and moderate compound annual growth. Representative published estimates include:

- Global PEG market valued at ~USD 3.9 billion in 2024, projected to grow at a CAGR of around 6.2% (2024–2029).

- Alternative estimates place the market at USD 4.4 billion in 2024, with a 4.7% CAGR extending to 2034.

- Other analysts estimate 2024 volumes in the mid-hundreds of thousands of tonnes and CAGRs in the 3–6% range depending on scope (tonnage vs. value; inclusion of derivatives). These ranges reflect differences in whether reports emphasize commodity PEG volumes or higher-value, pharmaceutical-grade segments.

Polyethylene Glycol (PEG) Market — Top Companies (Profiles)

1) SABIC (Saudi Basic Industries Corporation)

- Specialization: Diversified petrochemicals and performance products — plastics, polymers, specialty chemicals, and ethoxylates (including PEG grades). SABIC sells multiple PEG grades such as PEG-200, PEG-300, PEG-400, PEG-600 and pharmaceutical grades.

- Key focus areas: Large-scale commodity production, regional feedstock integration, tailored specialty grades for industrial & pharma markets, and sustainability initiatives.

- Notable features: Global integrated footprint, technical service for formulators, pharma-grade PEG offerings and scale advantages across feedstock pipelines.

- 2024 Revenue (company): Approximately USD 37.3 billion.

- Market share (PEG): Recognized as a large global PEG supplier; exact share not publicly disclosed.

- Global presence: Manufacturing and sales across the Middle East, Europe, Asia, Americas and Africa, with multi-region availability of PEG products.

2) Sinopec Group (China Petroleum & Chemical Corporation)

- Specialization: State-owned integrated oil & petrochemicals giant with massive chemical throughput (including ethoxylation and glycol value chains).

- Key focus areas: Refining & petrochemical integration, domestic supply to China’s downstream industries, and capacity expansion projects.

- Notable features: Scale of feedstock access and expansion of downstream chemical assets through major projects.

- 2024 Revenue (company): Total revenue in the trillions of CNY, reflecting one of the world’s largest petrochemical producers.

- Market share (PEG): Significant in Asia due to scale and integration, though exact PEG share not disclosed.

- Global presence: Strong domestic footprint in China with exports and international partnerships via subsidiaries and trading arms.

3) Braskem

- Specialization: Latin America’s largest petrochemical producer, focusing on polyethylene and specialty resins. Braskem is a supplier of polyethylene derivatives, with PEG available in regional markets.

- Key focus areas: Polyethylene value chain, bio-based ethylene (ethanol-to-ethylene), and sustainability initiatives.

- Notable features: Strong Latin American market presence, technology for bio-based polyethylene, and resilience in production.

- 2024 Revenue (company): Around USD 14 billion.

- Market share (PEG): Regional supplier in Latin America, smaller globally compared to integrated majors.

- Global presence: Strong in the Americas with international distribution partnerships.

4) Celanese Corporation

- Specialization: Engineered materials and specialty chemicals producer, including polymers and acetyl products that connect to PEG-related intermediates.

- Key focus areas: Performance polymers, engineered materials, and higher-value chemistries for medical, automotive and industrial uses.

- Notable features: Strong R&D capacity and global reach in specialty markets.

- 2024 Revenue (company): USD 10.3 billion.

- Market share (PEG): Smaller in commodity PEG compared to majors but significant in specialty and intermediate segments.

- Global presence: North America, Europe, Asia, with global customer base in specialty materials.

5) China National Chemical Corporation (ChemChina)

- Specialization: Large state-owned chemical conglomerate active in chemical manufacturing, agrochemicals, and specialty materials.

- Key focus areas: Agrochemicals, industrial chemicals, global acquisitions, and specialty materials development.

- Notable features: Extensive portfolio, strong state support, and international reach through subsidiaries and acquisitions.

- 2024 Revenue (company): Estimated in the USD 20–30 billion range.

- Market share (PEG): Major Chinese supplier; PEG specifics handled by affiliated producers.

- Global presence: Dominant in China with expanding global reach via international subsidiaries and investments.

Leading Trends and Their Impact

- Pharmaceutical & Biologics Demand: Rising use of PEG in drug delivery and PEGylated biologics is creating strong demand for pharmaceutical-grade PEGs, driving higher margins for specialty suppliers.

- Personal Care Growth: Expanding consumption of skincare and cosmetics worldwide pushes demand for medium molecular-weight PEGs.

- Feedstock & Capacity Dynamics: Ethylene oxide availability and petrochemical expansions influence PEG pricing and capacity economics.

- Regulatory & Sustainability Pressure: Stricter safety and environmental regulations increase production costs but encourage premium pricing for compliant grades.

- Regionalization of Supply Chains: Pharmaceutical and cosmetic companies increasingly source locally, leading to new regional PEG production hubs.

Successful Examples of PEG Use Around the World

- Pharmaceuticals: PEGylated therapeutics enable improved half-life and dosing for biologics, supporting major growth in drug development.

- Cosmetics & Personal Care: PEGs are widely used in lotions, creams and haircare products, delivering humectant and solvent benefits across global brands.

- Industrial Applications: PEGs serve as mold release agents, corrosion inhibitors and processing aids in manufacturing and coatings, providing performance enhancements worldwide.

Global Regional Analysis — Demand, Government Initiatives and Policies

North America

- Demand: Strong in pharmaceuticals (drug delivery, excipients) and industrial uses.

- Policies: FDA oversight ensures high-quality pharm-grade PEGs; government initiatives to reshore pharma supply chains increase local demand.

Europe

- Demand: Dominated by cosmetics/personal care and pharma R&D.

- Policies: REACH compliance drives investment in sustainable, low-impurity PEG production.

Asia-Pacific

- Demand: Fastest-growing region, led by China and India for pharmaceuticals, cosmetics, and industrial sectors.

- Policies: China and India are investing heavily in refining and pharma manufacturing, boosting both supply and demand.

Latin America

- Demand: Moderate but growing, with Braskem leading local supply chains.

- Policies: National trade and industrial modernization efforts shape competitiveness in regional markets.

Middle East & Africa

- Demand: Growing through exports from Middle Eastern petrochemical hubs.

- Policies: State-driven investment in petrochemical complexes ensures large-scale PEG availability for export markets.

Policy and Regulatory Drivers

- Pharmaceutical Regulations: Pharmacopoeial standards drive demand for high-purity PEGs in drug manufacturing.

- Chemical Safety & Environment: Global safety and emission standards increase compliance requirements.

- Industrial Strategy: National policies encouraging chemical capacity expansion (China, Middle East) shape cost and supply dynamics.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Internal Combustion Engine Market Growth Drivers, Key Players, Trends and Regional Insights by 2034