Blade Battery Market Growth Trends, Top Companies, Global Insights and Adoption

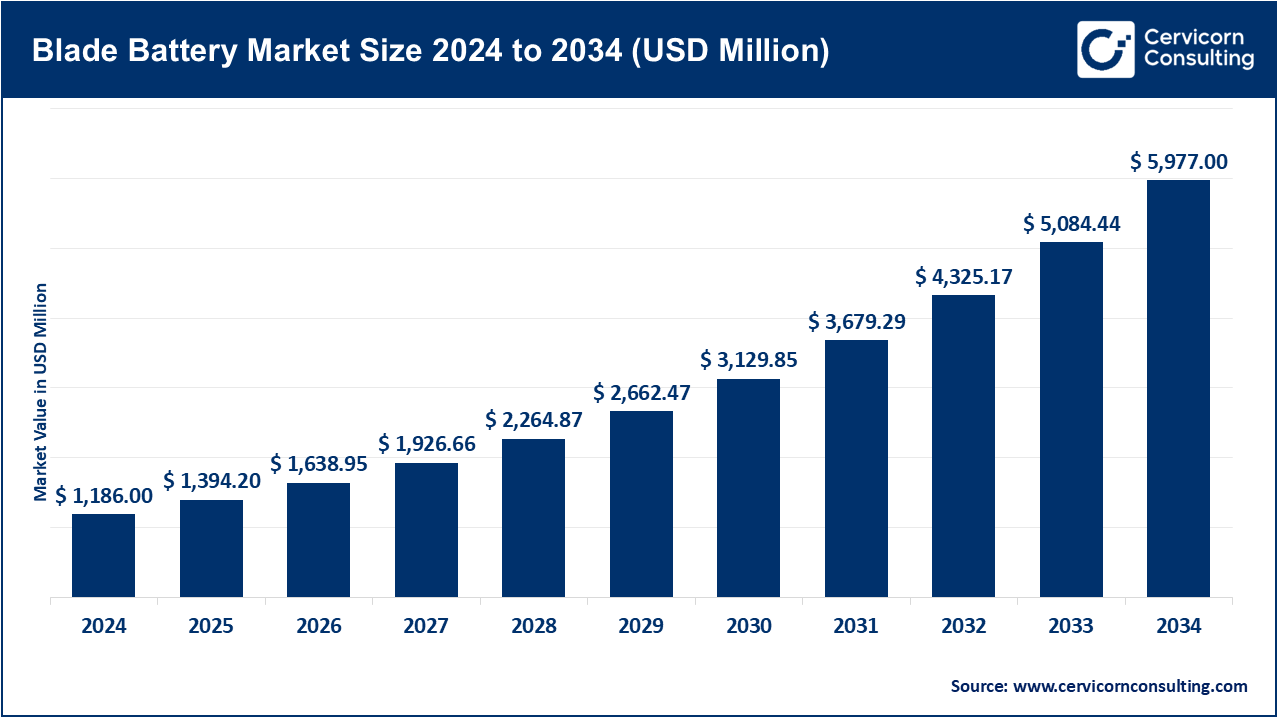

Blade Battery Market Size

Blade Battery Market Growth Factors

The blade battery market is experiencing a remarkable surge, driven by several key factors. Technological advancements have led to the development of batteries with higher energy densities and improved safety features, making them increasingly suitable for applications in electric vehicles (EVs), renewable energy storage, and consumer electronics. The global push towards sustainable energy solutions and the growing adoption of EVs have further accelerated the demand for efficient and reliable energy storage systems. Additionally, government incentives and policies promoting green technologies are fostering an environment conducive to the growth of the blade battery market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2710

What is the Blade Battery Market?

The blade battery market pertains to the segment of the energy storage industry focusing on blade-shaped lithium iron phosphate (LFP) batteries. These batteries are characterized by their unique form factor, which allows for higher energy density and improved safety compared to traditional cylindrical or prismatic batteries. Blade batteries are particularly advantageous in applications requiring compact and efficient energy storage solutions, such as in electric vehicles, renewable energy systems, and portable electronics.

Why is the Blade Battery Market Important?

The significance of the blade battery market lies in its potential to address critical challenges in energy storage. With the increasing demand for electric vehicles and renewable energy sources, there is a pressing need for batteries that offer higher energy densities, enhanced safety, and longer lifespans. Blade batteries meet these requirements, providing a viable solution for sustainable energy storage. Furthermore, their compact design allows for more efficient use of space, making them ideal for integration into various applications.

Blade Battery Market Top Companies

1. CATL (Contemporary Amperex Technology Co., Limited)

- Specialization: LFP batteries, cell-to-pack (CTP) technology

- Key Focus Areas: Advancements in battery technology, expansion into machinery and shipping sectors

- Notable Features: Leading in technological innovation and market share, particularly in China and Europe

- 2024 Revenue: Approximately $10.6 billion

- Market Share: Dominant global market share of nearly 30%

- Global Presence: Extensive operations in China, Europe, and other regions

2. BYD Co., Ltd.

- Specialization: Blade batteries, electric vehicles

- Key Focus Areas: Development of safe and efficient battery technologies, expansion into global markets

- Notable Features: Innovative blade battery design offering enhanced safety and energy density

- 2024 Revenue: Approximately $10.6 billion

- Market Share: Significant presence in the global EV and battery markets

- Global Presence: Operations in over 30 countries, including China, Europe, and Latin America

3. LG Energy Solution

- Specialization: Lithium-ion batteries, solid-state battery research

- Key Focus Areas: Optimization of existing capacities, expansion into U.S. and European markets

- Notable Features: Focus on sustainability and circular economy through battery reuse and recycling initiatives

- 2024 Revenue: Approximately $10.6 billion

- Market Share: Strong presence in the global battery market, particularly in the automotive sector

- Global Presence: Operations in over 20 countries, including South Korea, the U.S., and Europe

4. Panasonic Corporation

- Specialization: Lithium-ion batteries, energy storage systems

- Key Focus Areas: Advancements in battery technology, expansion into global markets

- Notable Features: Partnership with Tesla for battery supply, focus on high-density EV battery cells

- 2024 Revenue: Approximately $10.6 billion

- Market Share: Significant presence in the global battery market

- Global Presence: Operations in Japan, the U.S., and other regions

5. Samsung SDI Co., Ltd.

- Specialization: Lithium-ion batteries, solid-state technology

- Key Focus Areas: Expansion into premium EV battery solutions, exploration of energy storage systems market

- Notable Features: Focus on high-density electric vehicle battery solutions for luxury cars

- 2024 Revenue: Approximately $10.6 billion

- Market Share: Strong presence in the global battery market

- Global Presence: Operations in South Korea, the U.S., and Europe

Leading Trends and Their Impact

- Solid-State Batteries: Higher energy density, quicker charging, and better safety than typical lithium-ion batteries

- Fast-Charging Technology: Development of batteries capable of full charge in 10 minutes, reducing downtime for EVs

- Battery Recycling & Circular Economy: Emphasis on sustainable manufacturing and advancements in battery management systems

- Vehicle-to-Grid (V2G) Technology: Integration of EVs with the grid to enhance energy distribution and storage

- Alternative Battery Materials: Exploration of new materials to improve battery performance and reduce costs

Successful Examples of Blade Battery Adoption

- BYD’s Blade Battery in Electric Vehicles: BYD’s blade battery technology has been successfully integrated into their electric vehicles, offering enhanced safety and energy density

- CATL’s Expansion into Machinery and Shipping Sectors: CATL’s advancements in battery technology have led to expansion into machinery and shipping sectors, demonstrating the versatility of blade batteries

Global Regional Analysis and Government Initiatives

- China: Leading in battery production and adoption, with government policies supporting the development of electric vehicles and energy storage systems

- United States: Policies promoting clean energy and electric vehicles, with investments in battery manufacturing and research

- European Union: Emphasis on sustainability and green technologies, with initiatives supporting battery recycling and circular economy

- India: Government initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme promote the adoption of electric vehicles and associated technologies

These regional policies and initiatives play a crucial role in shaping the blade battery market by providing support for research, development, and adoption of advanced energy storage solutions.

The blade battery market is poised for significant growth, driven by technological advancements, increasing demand for sustainable energy solutions, and supportive government policies. Key players such as CATL, BYD, LG Energy Solution, Panasonic, and Samsung SDI are at the forefront of this revolution, contributing to the development and adoption of blade battery technologies across various applications.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Automotive Electronics Market size, Innovations & Global Outlook 2024