Hydrogen Fuel Cell Market Top Players, Trends, and Regional Insights by 2034

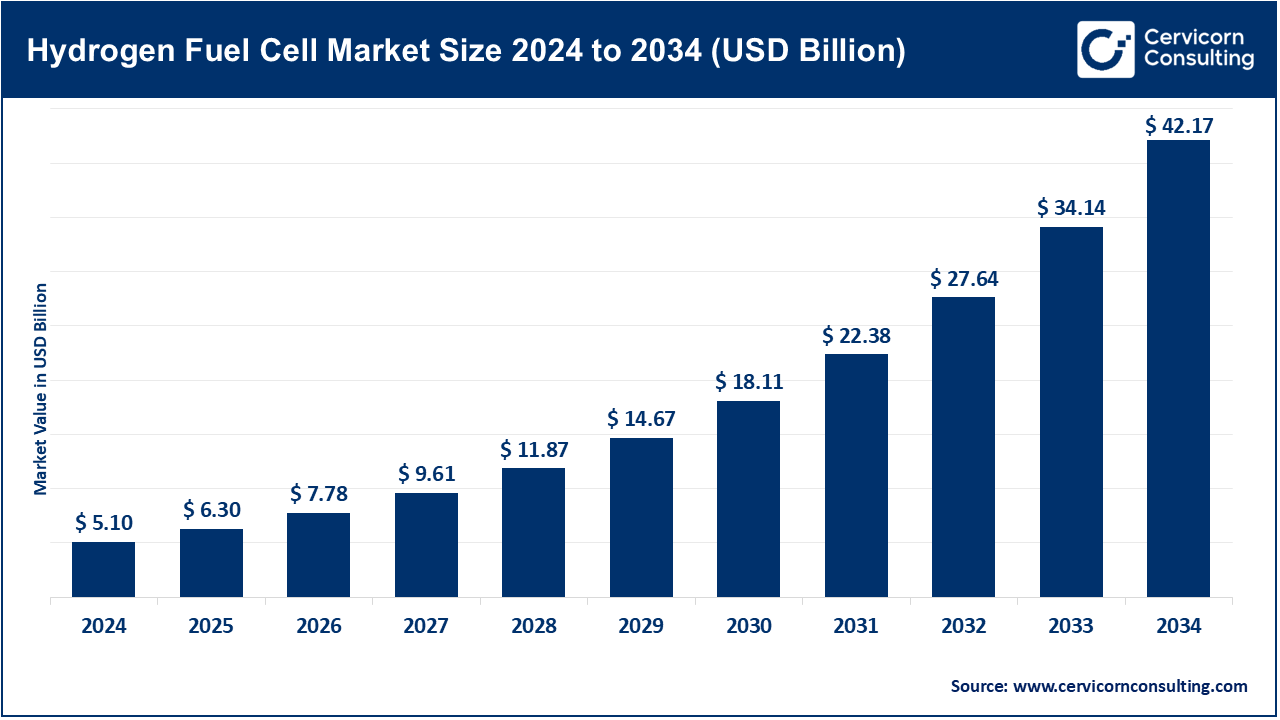

Hydrogen Fuel Cell Market Size

The global hydrogen fuel cell market size was worth USD 5.10 billion in 2024 and is anticipated to expand to around USD 42.17 billion by 2034, registering a compound annual growth rate (CAGR) of 23.52% from 2025 to 2034.

What is the Hydrogen Fuel Cell Market?

The hydrogen fuel cell market revolves around the development, manufacturing, distribution, and commercialization of hydrogen fuel cell technology, primarily used for clean energy generation. Hydrogen fuel cells are devices that convert chemical energy from hydrogen into electricity through an electrochemical reaction. Unlike conventional combustion-based power sources, hydrogen fuel cells emit only water vapor and heat, making them a highly sustainable and environmentally friendly energy solution. This market includes a broad range of applications, including transportation (cars, buses, trucks, trains), stationary power generation, backup power systems, industrial applications, and portable electronics.

Hydrogen fuel cells offer various advantages over traditional batteries and fossil fuel engines, such as higher energy efficiency, faster refueling times, zero emissions, and a longer operational range. The increasing demand for carbon-neutral energy sources, advancements in hydrogen storage and production, and support from governments worldwide are collectively pushing the hydrogen fuel cell market into the mainstream.

Why is the Hydrogen Fuel Cell Market Important?

The hydrogen fuel cell market is pivotal in the global shift toward decarbonization and the reduction of greenhouse gas emissions. As climate change concerns intensify and global energy consumption rises, hydrogen offers a compelling solution due to its abundance, high energy density, and clean combustion process. Fuel cells powered by hydrogen are seen as the cornerstone for achieving zero-emission goals in hard-to-electrify sectors like long-haul transportation, heavy-duty freight, maritime shipping, and aviation.

Additionally, the market promotes energy security and diversification by reducing dependency on fossil fuels. Countries lacking hydrocarbon resources can leverage hydrogen technologies through renewable energy-powered electrolysis to produce green hydrogen. This opens up economic opportunities and supports the development of a sustainable energy ecosystem.

Hydrogen fuel cells are also crucial in stabilizing grids with intermittent renewable energy sources such as solar and wind. By using excess renewable electricity to produce hydrogen (power-to-gas), energy can be stored and reconverted when needed, thus addressing challenges in grid balancing and energy storage.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2688

Hydrogen Fuel Cell Market Growth Factors

The growth of the hydrogen fuel cell market is primarily driven by a confluence of factors including increased demand for zero-emission transportation, global decarbonization commitments, favorable government policies and subsidies, rapid advancements in hydrogen production and storage technologies, strategic collaborations between automotive and energy companies, and growing investment in hydrogen infrastructure across developed and emerging economies. Additionally, the declining cost of renewable energy is making green hydrogen more viable, while the need for sustainable backup power in data centers and remote areas is creating new market opportunities. These trends, coupled with improved fuel cell efficiencies and scaling economies in manufacturing, are accelerating the adoption of hydrogen fuel cells in both mobility and stationary applications globally.

Top Companies in the Hydrogen Fuel Cell Market

AFC Energy plc

- Specialization: Alkaline fuel cell systems for off-grid, industrial, and EV charging applications.

- Key Focus Areas: Green hydrogen power generation, hydrogen-fueled EV chargers, industrial decarbonization.

- Notable Features: Proprietary high-efficiency alkaline fuel cell technology.

- 2024 Revenue: $25–30 million (est.)

- Market Share: ~0.5%

- Global Presence: UK, Germany, UAE, Asia-Pacific

Audi AG

- Specialization: Hydrogen-powered passenger vehicles under the Volkswagen Group.

- Key Focus Areas: Mobility innovation, hydrogen SUVs and concept vehicles.

- Notable Features: Research on hydrogen propulsion as part of EV strategy.

- 2024 Revenue: Included in R&D budget (hundreds of millions USD)

- Market Share: Niche role in future mobility.

- Global Presence: Europe, North America, Asia

Ballard Power Systems

- Specialization: PEM fuel cell products.

- Key Focus Areas: Buses, trucks, trains, marine, stationary power.

- Notable Features: Extensive IP portfolio, global OEM partnerships.

- 2024 Revenue: $145–160 million (est.)

- Market Share: ~12–15%

- Global Presence: Canada, USA, Germany, China, Japan, UK

Bloom Energy

- Specialization: Solid oxide fuel cell (SOFC) systems.

- Key Focus Areas: On-site clean electricity for industrial and utility scale.

- Notable Features: Energy Servers running on hydrogen or biogas.

- 2024 Revenue: $1.5+ billion (est.)

- Market Share: ~18–20% (stationary market)

- Global Presence: USA, Japan, South Korea, India, Europe

BMW Group

- Specialization: Hydrogen FCEVs

- Key Focus Areas: BMW iX5 Hydrogen and next-gen sustainable mobility.

- Notable Features: Partnership with Toyota on fuel cell tech.

- 2024 Revenue: Part of $7B sustainability initiative

- Market Share: Growing but niche.

- Global Presence: Europe, North America, China

Leading Trends and Their Impact

- Green Hydrogen Integration: Enables cleaner, renewable-based fuel cell use, key for zero-carbon transition.

- Heavy-Duty Mobility: Trucks, buses, and trains shifting to hydrogen FCEVs for long-range and payload capacity.

- Refueling Infrastructure: Growing station networks in Japan, Germany, Korea, and California are key enablers.

- Hybrid Systems: Fuel cells + battery combinations are emerging in aerospace and marine sectors.

- Global Policy Support: Government-led hydrogen strategies are attracting private investment and technology deployment.

Successful Examples Worldwide

- South Korea: Hydrogen-powered buses and taxis deployed in Ulsan; aiming for 80,000 FCEVs by 2025.

- Germany: World’s first hydrogen-powered train (Coradia iLint by Alstom) operational on regional rail lines.

- California: Over 14,000 hydrogen vehicles on the road and 60+ refueling stations supported by public-private partnerships.

- Japan: Hydrogen-powered Olympic village and Sora buses demonstrated zero-emission transportation during Tokyo 2020.

Global and Regional Analysis: Government Initiatives & Policies

North America

U.S. federal initiatives like the Inflation Reduction Act and Infrastructure Investment and Jobs Act provide tax credits, grants, and funding for hydrogen hubs. Canada targets 30% hydrogen share by 2050, with active projects in Quebec and British Columbia.

Europe

EU Hydrogen Strategy plans for 10 million tons of renewable hydrogen by 2030. Germany’s €9B strategy leads the region. France and the Netherlands follow with significant electrolyzer investments and mobility goals.

Asia-Pacific

Japan and South Korea lead global hydrogen adoption through aggressive policy support and infrastructure development. China’s Five-Year Plan identifies hydrogen as a priority industry, supporting heavy-duty FCEVs and local production.

Middle East & Africa

Saudi Arabia’s NEOM and the UAE’s Masdar initiatives position the Middle East as a green hydrogen exporter. South Africa’s Hydrogen Valley project promotes regional hydrogen adoption and export capability.

Latin America

Chile is targeting 25 GW of electrolyzer capacity by 2030 to become a global green hydrogen leader. Brazil and Colombia are piloting hydrogen projects linked to renewable energy abundance.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Silicon Carbon Battery Market to Reach USD 19.25 Billion by 2034 at 20.71% CAGR