Prosthetics and Orthotics Market Key Companies, Trends, Regional Analysis, and Growth Outlook by 2034

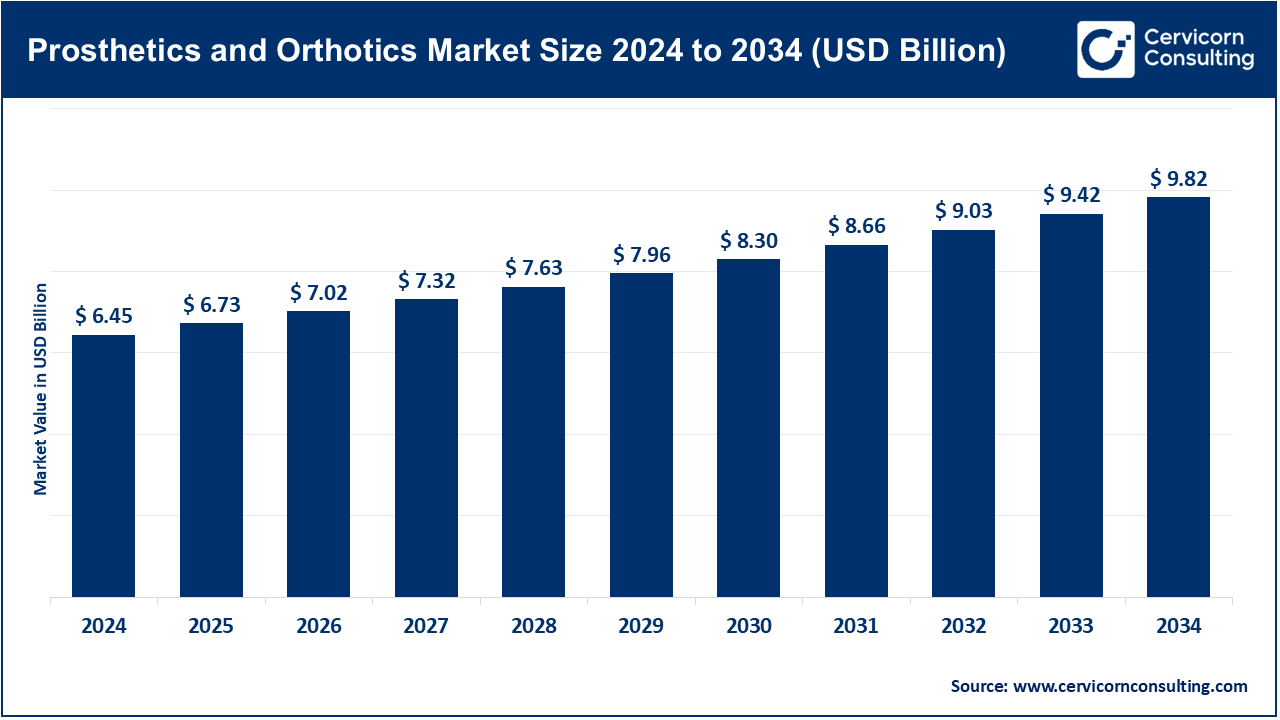

Prosthetics and Orthotics Market Size & Forecast

In 2024, the global prosthetics and orthotics market is estimated to reach approximately USD 6.45 billion, with projections suggesting it could surpass USD 9.82 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.7%. Orthotics currently account for a slightly larger revenue share compared to prosthetics due to the broader range of applications and lower production costs.

North America remains the dominant market, capturing over 41% of global revenue due to robust healthcare infrastructure, advanced reimbursement frameworks, and high prevalence of chronic conditions. Europe is also a key market, especially in countries with strong public health systems. Asia-Pacific is poised to experience the fastest growth owing to improving healthcare access, rising medical tourism, and government investments in local manufacturing. Latin America, the Middle East, and Africa represent smaller but expanding segments driven by humanitarian efforts, public-private partnerships, and non-profit organizations promoting access to assistive technologies.

What Is the Prosthetics and Orthotics Market?

The prosthetics and orthotics market is centered around the design, production, and distribution of medical devices that aid individuals with physical impairments due to injury, congenital anomalies, or medical conditions. Prosthetics refer to artificial limbs or body parts that replace missing segments, enabling functionality for upper-limb and lower-limb amputees. Orthotics, on the other hand, are supportive devices used to correct or support musculoskeletal deformities, alleviate pain, or enhance movement. These may include braces, spinal supports, insoles, and more. The market encompasses both custom-fitted solutions and off-the-shelf products, serving clinical facilities, hospitals, rehabilitation centers, and home-based users.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2677

Prosthetics and Orthotics Market Growth Factors

The prosthetics and orthotics market is expanding steadily due to a surge in limb amputations caused by diabetes, vascular diseases, cancer, and traumatic injuries, as well as rising incidences of musculoskeletal disorders and neurological conditions such as stroke or cerebral palsy. The aging global population, which is more susceptible to mobility-related conditions, also contributes to demand. Technological innovations—including smart materials, microprocessor-controlled joints, 3D printing, and artificial intelligence—have dramatically improved the comfort, performance, and accessibility of these devices.

Meanwhile, favorable insurance reimbursement, increasing awareness, better healthcare infrastructure, and economic growth in emerging economies continue to propel market development. Despite challenges such as high costs and limited access in low-income regions, growing initiatives from both governments and NGOs are expanding reach and affordability.

Why Is the Prosthetics and Orthotics Market Important?

The significance of this market extends far beyond economic metrics. For millions of individuals, access to prosthetics and orthotics is the key to regaining autonomy, dignity, and a functional life. These devices dramatically improve mobility, independence, and mental well-being. In elderly populations, orthotic supports reduce the risk of falls and related complications. Among children and young adults, they enable more active participation in education, sports, and social life. From a healthcare systems perspective, early and effective use of orthotic devices can prevent complications such as pressure ulcers or spinal deformities, thereby reducing long-term medical costs.

In addition, the market drives innovation in materials science, biomechanics, and digital health technologies, which can have spillover benefits in other medical and consumer applications.

Top Companies in the Prosthetics and Orthotics Market

1. Össur

- Specialization: Prosthetics, bracing, and support products

- Key Focus Areas: Lower- and upper-limb prosthetics, microprocessor-controlled knees and feet, compression therapy

- Notable Features: Products like the Rheo Knee, Proprio Foot, and Bionic solutions are equipped with sensors and AI for adaptive movement. The company also offers remote patient support and digital fittings.

- 2024 Revenue: Estimated in the range of USD 700–800 million

- Market Share: Approximately 23–24% in the prosthetic components segment

- Global Presence: Headquartered in Iceland with operations in the U.S., Europe, Asia, and Australia

2. Blatchford Limited

- Specialization: High-performance prosthetic systems and clinical services

- Key Focus Areas: Microprocessor-controlled limbs, limb sockets, and sports prostheses

- Notable Features: The Linx system integrates foot, knee, and sensory technology into one seamless system. Emphasis on user feedback and rehabilitation services.

- 2024 Revenue: Not publicly disclosed (privately held)

- Market Share: Prominent player in the UK and EU markets

- Global Presence: Headquartered in the UK with global distribution and clinics in Europe and Asia

3. Fillauer LLC

- Specialization: Prosthetic and orthotic components and systems

- Key Focus Areas: Pediatric prosthetics, athletic performance solutions, orthotic braces

- Notable Features: Utilizes carbon-fiber and high-performance materials in devices designed for functionality and durability. Focus on affordability and customization.

- 2024 Revenue: Not publicly disclosed

- Market Share: Recognized as one of the top 10 global providers

- Global Presence: Based in the U.S. with international partnerships and distributors

4. Bauerfeind

- Specialization: Orthopedic braces, supports, compression stockings

- Key Focus Areas: Sports medicine, geriatrics, post-operative care

- Notable Features: German engineering focused on comfort, aesthetics, and functionality. Products are CE-certified and widely used in professional sports.

- 2024 Revenue: Privately held, but estimated in the hundreds of millions

- Market Share: Leading orthotics provider in Europe

- Global Presence: Headquartered in Germany with operations in more than 20 countries

5. Aether Biomedical

- Specialization: Robotic and AI-based prosthetics

- Key Focus Areas: Smart knees and feet with machine learning-based motion detection

- Notable Features: Offers cloud-based control and real-time performance monitoring. Focuses on customization and post-market software upgrades.

- 2024 Revenue: Niche high-tech player; revenue under USD 50 million

- Market Share: Small but growing rapidly in AI-enhanced prosthetics

- Global Presence: U.S.-based with expanding partnerships across Europe and Asia

Leading Trends & Their Impact

Microprocessor-Controlled Prosthetics

Advanced knees and ankles integrated with sensors and AI allow real-time gait adaptation and environmental responsiveness. These devices offer significantly improved comfort, safety, and energy efficiency for users.

3D Printing

Additive manufacturing has reduced production costs, shortened delivery times, and allowed for high levels of customization. Clinics and hospitals can now produce patient-specific braces and sockets on-site, revolutionizing the supply chain.

Smart Materials and Sensors

Integration of pressure sensors, temperature regulators, and motion detectors has enhanced patient monitoring. Smart orthotic devices can now provide real-time data for clinicians to adjust therapy regimens remotely.

Telehealth Integration

Tele-rehabilitation platforms are enabling clinicians to fit, monitor, and modify prosthetic and orthotic devices remotely, making services accessible to rural or underserved populations.

Pediatric and Geriatric Focus

The market is evolving to better serve specific demographic groups, with pediatric prosthetics that grow with the child and geriatric orthotics that are lightweight and easy to wear.

Sustainability and Eco-Friendly Solutions

There is growing emphasis on using biodegradable materials, recycled polymers, and energy-efficient production processes to minimize environmental impact.

Sports and Activity-Centric Designs

Athletic amputees and active individuals are increasingly being catered to with performance-optimized prosthetics such as sprinting blades, climbing hands, and waterproof limbs.

Successful Examples of Market Implementation

- United States: East Tennessee State University introduced a degree program in orthotics and prosthetics in 2024, helping address the shortage of certified practitioners.

- United Kingdom: Blatchford’s integration of clinical services with high-performance prosthetics like the Linx system has significantly improved outcomes in NHS-supported clinics.

- India: Public-private collaborations have enabled low-cost manufacturing of essential orthotic devices, supported by government subsidies and vocational training programs.

- South Africa: Mobile prosthetics clinics offer personalized fittings in remote regions, driven by partnerships between NGOs and regional hospitals.

- Japan: Elderly care infrastructure includes widespread adoption of lightweight, spine-supporting orthotics, integrated into national healthcare reimbursements.

- Germany: Bauerfeind’s orthopedic products have become the gold standard in both clinical and sports rehabilitation settings, supported by insurance coverage and athlete endorsements.

Global Regional Analysis & Government Initiatives

North America

The region leads the global market due to advanced healthcare infrastructure, widespread insurance coverage, and robust research and development activity. Medicare and Medicaid programs cover a significant portion of prosthetic and orthotic expenses. Government grants support vocational training and technological innovation in the field. Academic institutions are developing specialized degree programs to bridge the practitioner gap.

Europe

Europe’s strong public health systems ensure high penetration of orthotic and prosthetic solutions. Countries like Germany, France, and the UK provide full or partial coverage for devices. Regulatory harmonization under the EU Medical Device Regulation ensures quality and safety. Investments in sustainable manufacturing and smart clinics are rising.

Asia-Pacific

This region is the fastest-growing market, fueled by population aging, increasing accident rates, and expanding access to healthcare. Countries such as China and India are investing in local manufacturing capabilities and vocational training. Japan is a leader in geriatric orthotic use. Rising awareness and affordability are unlocking new market opportunities.

Latin America

Growth is supported by healthcare reform, international aid, and a growing middle class. Brazil’s public health system offers basic prosthetic support, and countries like Mexico are expanding medical tourism for prosthetic services. Private clinics and NGOs play a crucial role in device accessibility.

Middle East and Africa

These regions are still emerging in terms of market size but show great potential. Gulf countries are investing in rehabilitation centers and importing high-end prosthetic devices. Africa’s market is primarily driven by NGOs and humanitarian programs. Innovations include locally produced, low-cost prosthetics and community-based rehab centers.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: 3D Printing in Healthcare Market Size, Innovation, Impact & Global Outlook by 2034