Insulin Pump Market Growth Outlook to 2034

Insulin Pump Market Size

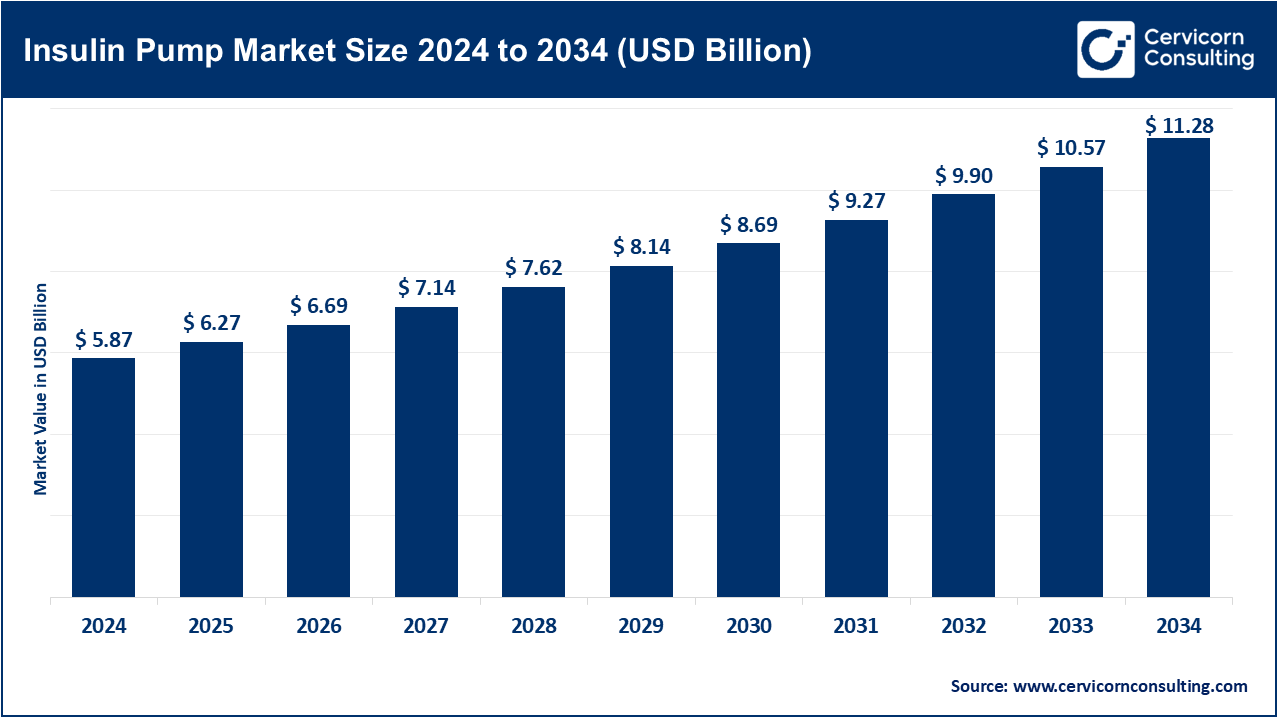

The global insulin pump market size was worth USD 5.87 billion in 2024 and is anticipated to expand to around USD 11.28 billion by 2034, registering a compound annual growth rate (CAGR) of 8.7% from 2025 to 2034.

What Is the Insulin Pump Market?

The insulin pump market consists of companies and healthcare providers involved in the development, manufacturing, distribution, and support of insulin delivery systems. These systems help people with diabetes—especially type 1 and insulin-dependent type 2—regulate blood glucose levels by delivering insulin continuously and automatically through wearable devices. This market includes not just the hardware (pumps, infusion sets), but also the digital ecosystem (apps, control algorithms), consumables (cartridges, adhesives), and connected services such as cloud-based monitoring and AI-driven dosage management. It’s a vital component of the broader diabetes management industry.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2662

Market Growth Factors

The insulin pump market is growing rapidly due to increasing global diabetes prevalence, especially among younger populations. Technological advancements such as AI-integrated dosing algorithms, hybrid closed-loop systems, smartphone app connectivity, and CGM (Continuous Glucose Monitor) integration have revolutionized patient experiences and outcomes. Rising awareness among patients, expanding reimbursement support, growing healthcare infrastructure in emerging economies, and a shift toward value-based care models are also driving market adoption. Regulatory approvals of advanced systems and growing interest in remote, personalized care post-COVID-19 are further fueling this momentum.

Why Is It Important?

1. Improved Glycemic Control

Insulin pumps provide precise and consistent insulin delivery, offering patients better control over their blood glucose levels. Unlike traditional injection methods, pumps can fine-tune basal and bolus insulin doses to match individual needs. Studies consistently show that pump users have lower HbA1c levels and reduced glycemic variability, translating into fewer diabetes-related complications.

2. Enhanced Quality of Life

Insulin pumps eliminate the need for multiple daily injections and allow more freedom around meals, exercise, and sleep. This significantly reduces the mental and physical burden of diabetes management. Features like programmable insulin delivery and discreet wearable designs help patients live more comfortably and confidently.

3. Technological Advancements in Diabetes Care

Today’s insulin pumps are smart. They connect with CGMs, use AI-based algorithms to automate insulin dosing (hybrid closed-loop systems), and can be controlled via smartphones. These advancements not only make diabetes management more intuitive but also increase treatment adherence and effectiveness.

4. Systemic Healthcare Benefits

Better diabetes control leads to lower long-term healthcare costs by reducing emergency visits, hospitalizations, and chronic complications like neuropathy, nephropathy, and retinopathy. Insulin pumps help healthcare systems shift from reactive to proactive chronic care management.

Top Companies in the Insulin Pump Market

Below are some of the key players dominating the global insulin pump market, highlighting their specializations, 2024 revenues, global presence, and market strategies.

1. Medtronic

- Specialization: Advanced hybrid closed-loop systems.

- Key Focus: MiniMed 780G system, SmartGuard technology with meal detection capabilities, Guardian 4 CGM integration.

- Features: FDA-cleared algorithms, automatic basal adjustments, extended-wear infusion sets.

- 2024 Revenue: Diabetes segment revenue estimated at $2.8 billion.

- Market Share: Holds a dominant position among insulin pump manufacturers.

- Global Presence: Headquartered in the U.S., operates in 150+ countries.

2. Hoffmann-La Roche AG (Roche Diabetes Care)

- Specialization: Digital diabetes ecosystems.

- Key Focus: Accu-Chek insulin delivery systems and mySugr app integration.

- Features: Bluetooth-enabled BGM devices, mobile-controlled pumps, personalized diabetes coaching via apps.

- 2024 Revenue: Not individually disclosed; among top global players.

- Market Share: Strong foothold in Europe and Latin America.

- Global Presence: Extensive presence in over 100 countries, with innovation hubs across Europe.

3. Tandem Diabetes Care, Inc.

- Specialization: User-friendly touchscreen insulin pumps.

- Key Focus: t:slim X2 and t:Mobi systems with Control-IQ technology.

- Features: Compact design, remote software updates, Dexcom CGM integration.

- 2024 Revenue: Previous revenues around $360 million; current estimates growing with product adoption.

- Market Share: Major player in the U.S. with increasing global reach.

- Global Presence: North America focused, expanding into Europe and Asia-Pacific regions.

4. Insulet Corporation

- Specialization: Tubeless, wearable insulin pumps.

- Key Focus: Omnipod 5 automated insulin delivery system.

- Features: Smartphone-controlled, CGM-compatible, patch-style pumps with no tubing.

- 2024 Revenue: Q4 alone recorded over $500 million in product sales.

- Market Share: Rapidly gaining in the U.S. and international markets.

- Global Presence: Primarily North America, expanding distribution in Europe and Asia.

5. Ypsomed

- Specialization: Compact, app-integrated insulin pumps.

- Key Focus: mylife YpsoPump with Bluetooth connectivity.

- Features: Smartphone dosing control, simplified cartridge refills, personalized settings.

- 2024 Revenue: Growing steadily, primarily focused on European markets.

- Market Share: Mid-tier player with strong European positioning.

- Global Presence: Primarily active in Europe; entering new markets through strategic partnerships.

Leading Trends & Their Market Impact

1. Hybrid Closed-Loop Systems

These “artificial pancreas” systems automatically adjust insulin delivery based on real-time glucose levels. Devices like Medtronic’s 780G, Tandem’s Control-IQ, and Insulet’s Omnipod 5 are transforming diabetes care by significantly improving time-in-range metrics and reducing the burden of manual dosing.

2. Miniaturization & Wearability

Consumers increasingly demand small, discreet, and wearable devices. Tandem’s Mobi—one of the world’s smallest durable pumps—is designed for comfort and portability, while Omnipod’s tubeless patch format remains unobtrusive under clothing.

3. CGM Integration

Nearly all modern insulin pumps now integrate seamlessly with CGMs like Dexcom G7 or Abbott’s FreeStyle Libre. This allows continuous feedback and more responsive insulin delivery, reducing both hypoglycemia and hyperglycemia.

4. Smartphone & App Control

App-based pump management allows users to view glucose trends, adjust insulin doses, and receive alerts. These apps enhance user engagement and allow clinicians to monitor patients remotely, improving care outcomes.

5. Artificial Intelligence (AI) & Machine Learning

AI algorithms are enabling predictive insulin dosing by learning from patient behavior, meal patterns, and CGM data. Some pumps even anticipate glucose spikes and preemptively deliver corrective insulin, mimicking natural pancreatic function.

6. Dual-Hormone Pumps

Emerging systems, like those under development by Beta Bionics, incorporate both insulin and glucagon to more closely replicate human hormonal balance. This approach offers better protection against low blood sugar episodes.

7. Remote Monitoring & Telehealth Integration

Post-pandemic demand for virtual care is driving integration of insulin pumps with telehealth platforms. Care teams can now adjust pump settings remotely, reducing the need for in-person visits.

Challenges Faced by the Market

Despite growth, the market faces key challenges:

- High Device Costs: Initial costs for pumps and ongoing expenses for consumables remain a barrier, especially in low-income regions.

- Limited Reimbursement in Some Countries: Insulin pump therapy is not universally covered, delaying adoption in certain healthcare systems.

- User Learning Curve: New users may find it difficult to manage pump settings, especially in complex closed-loop systems.

- Supply Chain Pressures: Global component shortages and shipping delays impact pump production and delivery.

- Data Security & Privacy: Increased connectivity raises concerns about patient data protection and cybersecurity.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Asthma Treatment Market Size, Revenue Share, and Forecast to 2034