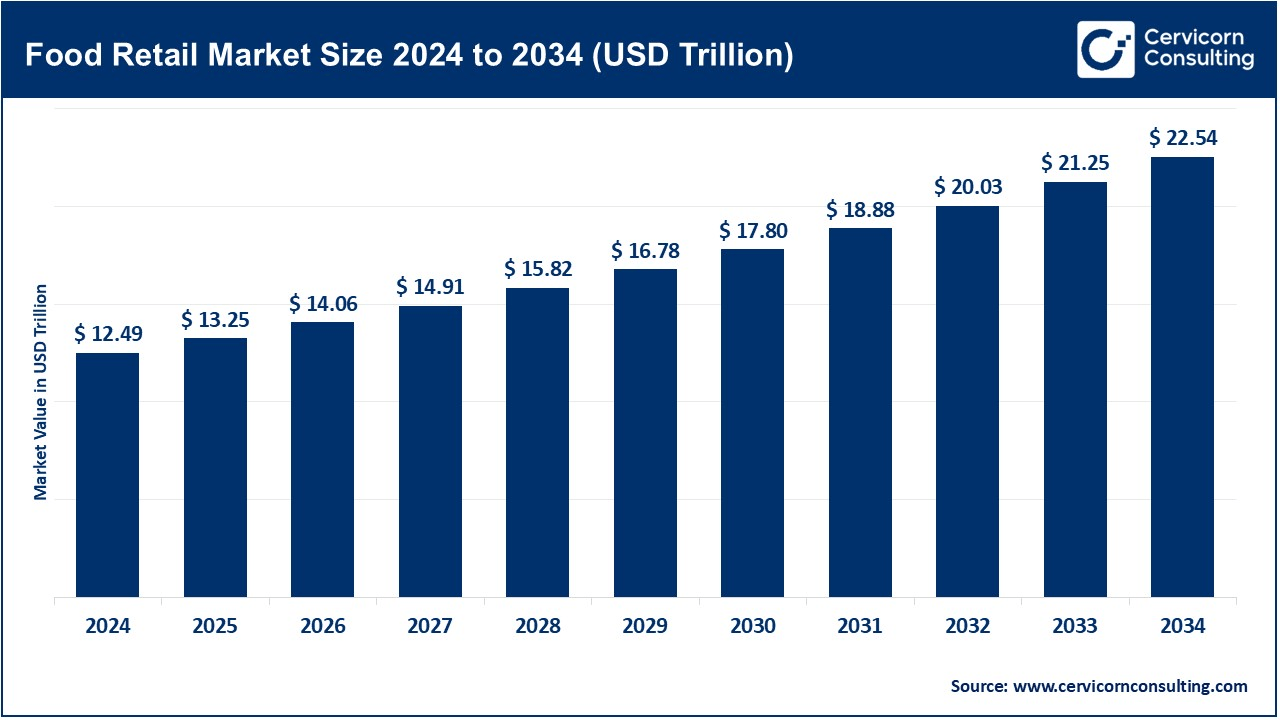

Food Retail Market Size to Reach USD 22.54 Trillion by 2034

Food Retail Market Size

The global food retail market was worth USD 12.49 trillion in 2024 and is anticipated to expand to around USD 22.54 trillion by 2034, registering a compound annual growth rate (CAGR) of 6.08% from 2025 to 2034.

Understanding the Food Retail Market

The food retail market encompasses all businesses that sell food products directly to consumers for off-premise consumption. This includes supermarkets, grocery stores, convenience stores, and online food retailers. These establishments serve as the final link in the food supply chain, ensuring that consumers have access to a variety of food products.

Importance of the Food Retail Market

The food retail market plays a crucial role in society by ensuring food accessibility, influencing dietary habits, and contributing significantly to the economy. Retailers determine product availability, pricing, and marketing, which directly impact consumer choices and nutrition. Moreover, the sector provides employment opportunities and stimulates economic growth through infrastructure development and technological advancements.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2604

Growth Factors of the Food Retail Market

The global food retail market is projected to grow from an estimated $12.6 trillion in 2024 to $21.5 trillion by 2034, at a CAGR of 5.5% . This growth is driven by factors such as urbanization, rising disposable incomes, changing consumer preferences towards convenience and health, technological innovations like AI and automation, and the expansion of e-commerce platforms.

Top Companies in the Food Retail Market

Walmart Inc.

- Specialization: Mass-market retailing with a focus on affordability and wide product range.

- Key Focus Areas: Omnichannel retailing, supply chain optimization, and private label expansion.

- Notable Features: Launched the “Bettergoods” line in 2024, offering gourmet-inspired groceries at affordable prices .

- 2024 Revenue: Walmart U.S. reported net sales of $441.82 billion, with approximately $260.67 billion from food and grocery .

- Market Share: Accounts for over a quarter of all U.S. grocery sales.

- Global Presence: Operates in multiple countries, including Mexico, Chile, and China.

The Kroger Co.

- Specialization: Supermarket chains with a focus on fresh produce and private-label products.

- Key Focus Areas: Digital transformation, personalized marketing, and sustainability initiatives.

- Notable Features: Operates various store formats, including supermarkets, multi-department stores, and price-impact warehouses.

- 2024 Revenue: Total sales of $147.1 billion .

- Market Share: One of the largest supermarket chains in the U.S.

- Global Presence: Primarily operates within the United States.

Amazon.com, Inc. (Amazon Fresh, Whole Foods)

- Specialization: Online grocery delivery and organic food retailing.

- Key Focus Areas: E-commerce integration, cashier-less stores, and AI-driven personalization.

- Notable Features: Operates Amazon Go stores featuring Just Walk Out technology.

- 2024 Revenue: Amazon’s net sales reached $187.8 billion in Q4 2024 .

- Market Share: Significant player in online grocery retail.

- Global Presence: Operates in North America, Europe, and Asia.

Tesco PLC

- Specialization: Multinational grocery and general merchandise retailer.

- Key Focus Areas: Customer loyalty programs, online retailing, and sustainable sourcing.

- Notable Features: Introduced the “Finest” range, focusing on premium products.

- 2024 Revenue: Reported an adjusted operating profit of £3.13 billion .

- Market Share: Leading supermarket chain in the UK.

- Global Presence: Operations in the UK, Ireland, Central Europe, and Asia.

Carrefour S.A.

- Specialization: Hypermarkets, supermarkets, and convenience stores.

- Key Focus Areas: Digital transformation, private label development, and sustainability.

- Notable Features: Launched “Act for Food” program to promote healthier eating.

- 2024 Revenue: €87.1 billion, up 2.8% from FY 2023 .

- Market Share: One of the largest retailers in Europe.

- Global Presence: Operates in over 30 countries across Europe, Asia, and Latin America.

Leading Trends and Their Impact

The food retail market is experiencing several key trends:

- Omnichannel Retailing: Retailers are integrating online and offline channels to provide a seamless shopping experience.

- Health and Wellness: There’s a growing demand for organic, plant-based, and health-focused products.

- Sustainability: Consumers are increasingly favoring retailers that prioritize sustainable sourcing and reduce food waste.

- Technological Advancements: Implementation of AI, machine learning, and automation to streamline operations and enhance customer experience.

- Personalization: Utilizing data analytics to offer personalized promotions and product recommendations.

Successful Examples of Food Retail Markets Around the World

- H-E-B (USA): Known for exceptional customer service and community involvement, H-E-B has a strong presence in Texas and Mexico.

- Aldi (Germany): Offers a limited assortment of private-label products at low prices, leading to global expansion.

- 7-Eleven (Japan): Pioneered the convenience store model with a focus on ready-to-eat meals and 24/7 operations.

- Mercadona (Spain): Dominates the Spanish market with a focus on quality, low prices, and efficient logistics.

Global Regional Analysis and Government Initiatives

- North America: The U.S. market is characterized by consolidation, with major players like Walmart and Kroger leading. Government initiatives focus on food safety and nutrition labeling.

- Europe: European countries emphasize sustainability, with policies promoting organic farming and reducing food waste.

- Asia-Pacific: Rapid urbanization and rising incomes drive growth. Governments invest in infrastructure to support cold chains and food safety.

- Latin America: Emerging markets with increasing demand for modern retail formats. Policies aim to improve food security and support local producers.

Government policies worldwide are shaping the food retail market by implementing regulations on food safety, nutrition labeling, and sustainability. Initiatives like front-of-pack labeling and fiscal measures (taxes and subsidies) are designed to promote healthier food choices and support sustainable practices .