3D Printing in Healthcare Market Size, Innovation, Impact & Global Outlook by 2034

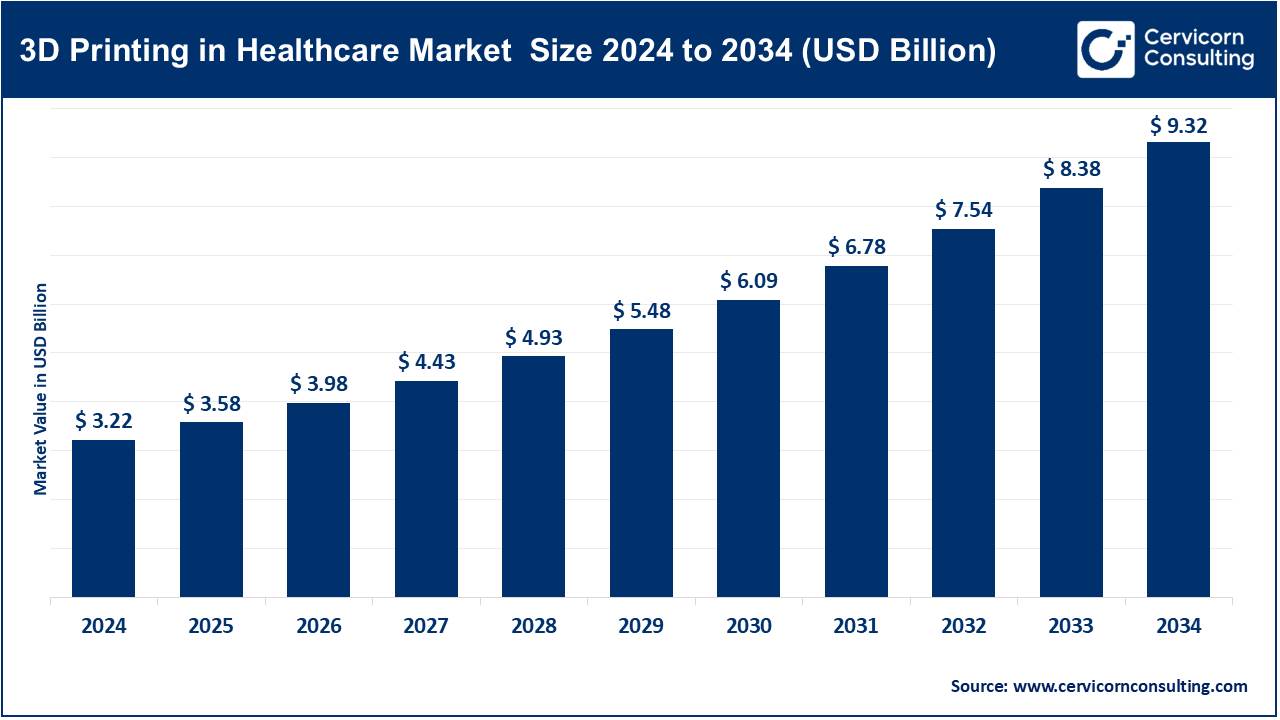

3D Printing in Healthcare Market Size

The global 3D printing in healthcare market size was worth USD 3.22 billion in 2024 and is anticipated to expand to around USD 9.32 billion by 2034, registering a compound annual growth rate (CAGR) of 11.21% from 2025 to 2034.

What is the 3D Printing in Healthcare Market?

The 3D printing in healthcare market includes the manufacturing, materials, services, and software used to create medical devices, anatomical models, prosthetic parts, implants, surgical guides, bioprinted tissue, and customized pharmaceuticals. Key segments include printers and hardware systems (e.g., SLA, SLS, FDM, binder jetting), specialized materials (polymers, metals, ceramics, bioinks), pre‑ and post‑processing services, and clinical software that translates medical images into printable models.

Main end users include hospitals, surgical centers, dental labs, pharmaceutical firms, biotech and academic research institutions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2672

Why is This Market Important?

- Personalized Medicine: Enables tailoring implants, prosthetics, and models to each patient’s anatomy.

- Enhanced Surgical Planning: 3D‑printed anatomical models improve pre‑op precision and reduce operation time.

- Cost & Time Efficiency: Produces low-volume, customized parts faster and at lower cost than traditional machining.

- Innovation in Bioprinting & Drug Delivery: Emerging 3D‑printed tissues, bio‑inks, and patient‑specific pharmaceuticals enable next‑gen therapies.

- Accessibility: Hospital‑based printers democratize advanced healthcare manufacturing globally.

Growth Factors

The 3D printing in healthcare market is driven by rising demand for personalized devices and surgical models; growing adoption of advanced additive manufacturing technologies (SLA, SLS, binder jetting); breakthroughs in bio‑printing and customized pharmaceuticals; increasing hospital and dental lab investments; collaborative partnerships among healthcare firms, software specialists and material providers; regulatory clarity from FDA/EU fostering device approval; surging R&D spending in biopharma; integration of AI to streamline image‑to‑print workflows; and expansion in emerging markets—especially Asia-Pacific—thanks to supportive government initiatives and growing healthcare infrastructure.

Top Companies

1. Formlabs Inc.

- Specialization: Desktop SLA & SLS printers; dental and surgical solutions.

- Key Focus Areas: High‑resolution models, surgical guides, dental aligners.

- Notable Features: User‑friendly interface, integrated software, Fuse 1+ for medical use

- 2024 Revenue: ~$120M (estimated from $82.5M in 2021 with sustained growth).

- Market Share: ~10% among desktop and dental medical printers.

- Global Presence: U.S., Europe (Berlin HQ), Asia (expanding via distributors).

2. General Electric (GE Additive)

- Specialization: Industrial metal printers; medical-grade implant manufacturing.

- Key Focus Areas: Surgical instruments, orthopedic and cranio-maxillofacial implants.

- Notable Features: Arcam EBM and binder‑jet systems integrated with GE Healthcare imaging.

- 2024 Revenue: Embedded in GE Additive division—estimated ~$200M in medical contracts.

- Market Share: Leading in industrial medical implant printing.

- Global Presence: North America, Europe, Asia via GE Healthcare.

3. 3D Systems Corporation

- Specialization: Full-stack printers (SLA, SLS, DMP); medical services.

- Key Focus Areas: Surgical planning models, dental, anatomical visualization.

- Notable Features: Pioneered SLA; on‑demand printing, wide material portfolio.

- 2024 Revenue: ~$400M from healthcare vertical.

- Market Share: ~20% of healthcare 3D printing.

- Global Presence: Offices in 80 countries, major R&D in U.S. and Europe.

4. ExOne Company

- Specialization: Binder-jet metal printing for implants & tooling.

- Key Focus Areas: Complex metal medical parts, custom devices.

- Notable Features: Acquired Desktop Metal; high‑precision metal capabilities.

- 2024 Revenue: Estimated $100M+ from medical contracts.

- Market Share: ~8% in metal medical printing.

- Global Presence: U.S., Europe, selective Asia operations.

5. Materialise NV

- Specialization: Software (Mimics, 3‑matic) and services for surgical & dental sectors.

- Key Focus Areas: Anatomical modeling, surgical planning, patient-specific implants.

- Notable Features: AI segmentation, XR planning suite; partnership with Siemens Healthineers.

- 2024 Revenue: ~$150M from healthcare services.

- Market Share: Leading in medical software segment (~30%).

- Global Presence: HQ in Leuven, operations across Europe, North America, Asia.

Leading Trends and Impact

- Bioprinting: Living tissue constructs for drug testing and therapeutic implants; in‑body hydrogel printing achieved in 2025.

- Pharmaceutical Printing: On‑demand tablets with customized dosage and release profiles; technologies able to print pills in 20 seconds.

- Workflow Automation: AI-powered segmentation (e.g. Materialise Mimics AI suite) reduces clinical time burdens.

- Metal Implant Expansion: Binder‑jet and EBM tech allow precision, complex metal implants faster than machining.

- Decentralized Manufacturing: Hospital-based printers (e.g., NHS Bristol Centre) enable rapid production and model support.

- Regulatory Evolution: FDA & EMA are creating frameworks for medical additive devices; pandemic relaxed PPE approvals.

Successful Global Examples

– NHS Bristol 3D Medical Centre, UK

Produces patient-specific prosthetic body parts (noses, eyes, fingers, even baby molds) using 3D scanning and SLA printing. Reduces surgical time, improves rehabilitation, and boosts patient confidence.

– AIIMS Bhopal, India

Printing patient-specific kidney models and guides for complex stone surgeries via DLP/SLA, funded by state council and reducing operative complications.

– e-NABLE / Open Bionics (Global)

Community-driven 3D‑printed prosthetic hands and bionic arms for children—fast, customizable, low-cost.

– Isinnova, Italy (COVID response)

3D printed respirator valves in 24 hours to address equipment shortage during COVID‑19.

– Israel’s Sheba Medical Center

Rapidly prints personalized skull implants and prosthetics post-trauma, enabling same-day treatment.

Global Regional Analysis & Policies

North America

- Market Size: Largest region (~50% share).

- Policies: FDA guidance for medical 3D printing, including device approval and printer validation. VA and major hospitals installing in‑house solutions.

- Infrastructure: University hospitals (e.g. Mayo, Cleveland Clinic) lead clinical use cases.

Europe

- Adoption: NHS Bristol Centre is flagship. Germany, Belgium, Netherlands are investing in implant and surgical model production.

- Regulations: EU MDR mandates traceability for additively manufactured medical devices.

- Funding: Horizon Europe grants for bioprinting and personalized medicine.

Asia-Pacific

- Growth: Fastest-growing market; valued at $1.7B in 2023 with ~20% CAGR.

- India: Government promoting 3D printing through startups (>1,000 firms), targeted job creation and domestic manufacturing capabilities.

- Japan & China: Hospitals deploying 3D surgical models and dental CAD/CAM workflows.

Latin America

- Opportunities: Brazil and Argentina expanding university‑based medical printers; regulatory clarity still evolving.

Middle East & Africa

- Public Hospitals: UAE, Saudi investing in medical 3D printing for implants and surgical planning.

- Egypt & South Africa: Pilot programs in university hospitals and medical research labs.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Next-Generation Sequencing in Precision Medicine Market Insights, Trends, and Forecast by 2034