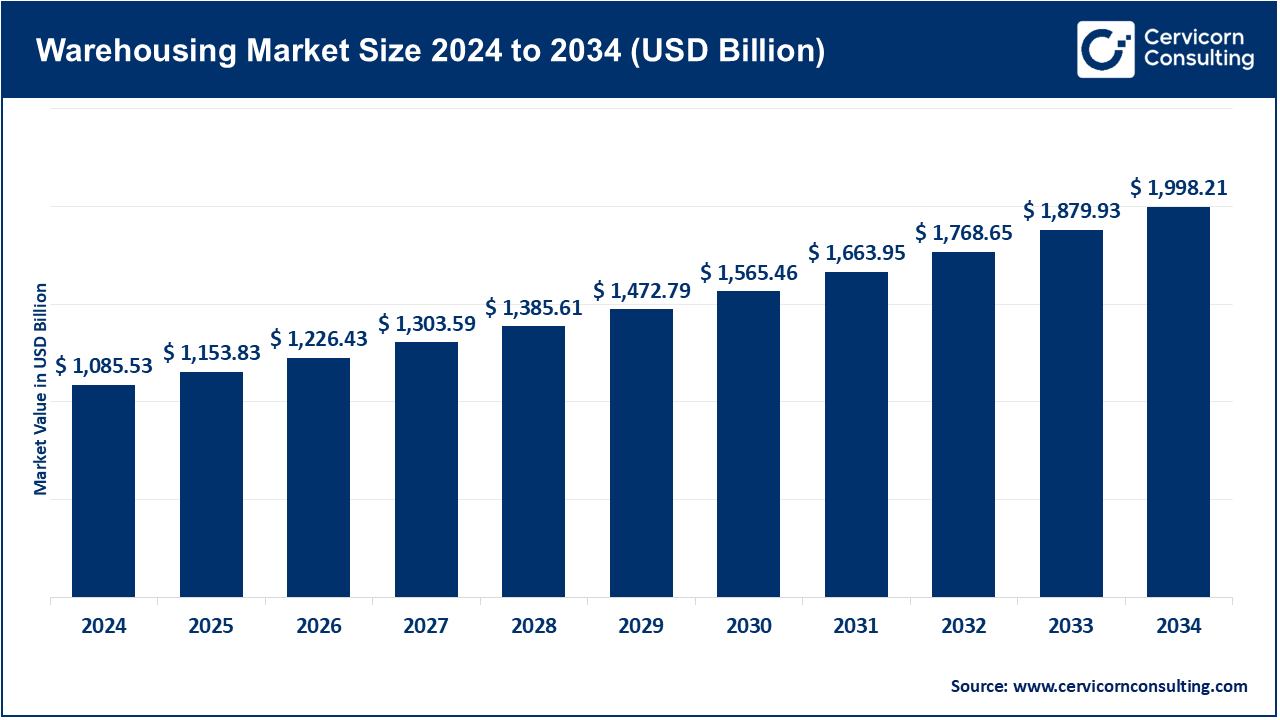

Warehousing Market Growth Drivers, Key Players, Trends & Regional Insights by 2034

Warehousing Market Size

What is the Warehousing Market?

The warehousing market encompasses the facilities, services, and technologies dedicated to storing and managing goods before they are transported to their final destination. This includes general storage, temperature-controlled (cold chain), bonded and free-trade zone warehousing, cross-docking, e-commerce fulfillment, and specialized services such as kitting, postponement, and light assembly. It also integrates advanced contract logistics operated by third-party logistics (3PL) providers. Warehousing has evolved beyond simple storage into a strategic supply chain function, acting as a control tower for inventory management, order fulfillment, compliance, and real-time visibility. It supports just-in-time manufacturing, enables fast delivery in e-commerce, and increasingly leverages automation, robotics, and AI to enhance efficiency.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2720

Why is it Important?

Warehousing is critical for global commerce because it forms the backbone of resilient and efficient supply chains. It ensures inventory availability, supports cost optimization, and enables businesses to meet customer expectations for faster delivery. The importance of warehousing lies in its ability to:

- Safeguard service levels: By keeping inventory closer to demand centers.

- Lower costs: Through optimized transport, consolidation, and efficient handling.

- Enable omnichannel distribution: Facilitating same-day or next-day delivery through strategically located urban and micro-fulfillment centers.

- Mitigate risks: Acting as a buffer during disruptions such as trade disputes, weather events, or pandemics.

- Support compliance and quality: Maintaining regulatory standards for food, pharmaceuticals, and hazardous goods.

- Advance sustainability goals: Through energy-efficient buildings, renewable energy adoption, and advanced data-driven optimization.

In short, warehousing enables companies to maintain competitiveness, resilience, and operational excellence.

Warehousing Market—Growth Factors

The warehousing market is expanding due to the rapid rise of e-commerce, reshoring and nearshoring strategies that demand localized inventory, and diversification of supplier bases in response to geopolitical risks. Digitization through warehouse management systems (WMS), robotics, and AI-driven solutions is increasing throughput and labor productivity. Specialized sectors such as pharmaceuticals, electric vehicles, and cold chain logistics are driving demand for compliant and highly customized facilities. Sustainability initiatives, such as renewable-powered warehouses and smart energy management, are increasingly influencing site selection and tenant decisions. Furthermore, government policies, industrial strategies, and infrastructure programs—such as logistics corridor development, tax reforms, and customs modernization—are fueling investments in modern, multi-story, and energy-efficient warehouses, particularly in high-growth markets.

Warehousing Market—Top Companies

Here’s a breakdown of leading players, their specializations, and 2024 performance:

Deutsche Post AG (DHL Group)

- Specialization: Contract logistics, warehousing, e-commerce fulfillment, and value-added services through DHL Supply Chain.

- Key Focus Areas: Automotive, retail, consumer, life sciences, healthcare, and technology sectors.

- Notable Features: Largest global contract logistics provider by revenue with extensive automation and sustainability roadmaps.

- 2024 Revenue: €17.7 billion (Supply Chain division).

- Market Share: Market leader in global contract logistics.

- Global Presence: 220+ countries and territories.

GEODIS

- Specialization: Contract logistics, warehousing, freight forwarding, and e-commerce logistics.

- Key Focus Areas: Omni-channel fulfillment, technology, healthcare, automotive, and retail.

- Notable Features: Strong focus on innovation and digital platforms; one-third of revenues derived from contract logistics.

- 2024 Revenue: €11.3 billion.

- Market Share: Top-tier global player in contract logistics.

- Global Presence: Operations in more than 170 countries.

NIPPON EXPRESS HOLDINGS, INC. (NX Group)

- Specialization: Global logistics services including warehousing, air/ocean forwarding, and distribution.

- Key Focus Areas: Automotive, electronics, healthcare, and cross-border e-commerce.

- Notable Features: Strong footprint in Asia and growing presence across Europe and the Americas.

- 2024 Revenue: ¥2,577.6 billion.

- Market Share: Leading warehousing and logistics player in Asia-Pacific.

- Global Presence: Over 700 global locations.

FedEx

- Specialization: Global transportation and logistics services; warehousing through FedEx Supply Chain and FedEx Logistics.

- Key Focus Areas: Omni-channel fulfillment, reverse logistics, healthcare, retail, and technology.

- Notable Features: Leverages its global transport network to complement warehouse services.

- 2024 Revenue: US$87.7 billion (group revenue).

- Market Share: Strong in transportation; smaller share in warehousing relative to parcel services.

- Global Presence: More than 220 countries and territories.

BrightKey, Inc.

- Specialization: U.S.-based fulfillment and warehousing, including kitting, mail, and distribution.

- Key Focus Areas: Associations, nonprofits, government, and corporate clients.

- Notable Features: Niche provider with tailored fulfillment and customer engagement services.

- 2024 Revenue: Not publicly disclosed (private company).

- Market Share: Niche and mid-market positioning in U.S. warehousing.

- Global Presence: Primarily U.S. focused.

Leading Trends and Their Impact

- Automation and Robotics: Warehouses are adopting automated storage and retrieval systems, autonomous mobile robots, and goods-to-person technologies. These reduce labor dependency, increase speed, and improve accuracy.

- Multi-story Warehouses: Rising urban land scarcity has led to multi-level facilities, especially in megacities like New York, Hong Kong, and Tokyo, enabling faster last-mile delivery.

- Sustainable Warehousing: Green buildings with rooftop solar, energy-efficient HVAC, and EV charging infrastructure are becoming standard. Occupiers pay a premium for ESG-compliant facilities.

- Cold Chain Expansion: Growth in pharmaceuticals, vaccines, and perishable foods is driving the need for specialized temperature-controlled warehouses.

- Nearshoring and Reshoring: Companies are realigning supply chains closer to consumer markets, increasing demand for modern logistics hubs in Mexico, Eastern Europe, and Southeast Asia.

- Data and AI Integration: Advanced analytics optimize slotting, inventory positioning, labor scheduling, and network design.

- Urban Micro-Fulfillment: Retailers and 3PLs are building smaller, automated nodes close to city centers to meet same-day and next-day delivery expectations.

- Energy Resilience: Rooftop solar and energy storage systems help warehouses manage growing power needs for automation and EV fleets.

Successful Examples Around the World2

- DHL Supply Chain: Deployment of AutoStore and robotics across multiple regions showcases scalable automation for high-volume fulfillment.

- Prologis (U.S.): Multi-story warehouses like Georgetown Crossroads in Seattle demonstrate how vertical facilities address land scarcity while maintaining throughput.

- Cainiao (China): Cainiao’s integrated warehousing and logistics platform enables 24-hour nationwide delivery in China, setting global benchmarks.

- Link Logistics (U.S.): Investment in rooftop solar across industrial facilities highlights the shift to energy-efficient, ESG-ready warehousing.

Global Regional Analysis—Government Initiatives and Policies

North America

- The U.S. is promoting energy-efficient warehouses through tax incentives and industrial policies. Multi-story facilities are emerging in urban centers. Nearshoring to Mexico is boosting demand for cross-dock and bonded facilities.

- Mexico has introduced nearshoring tax incentives, accelerated depreciation, and training credits to attract FDI in EVs and electronics, fueling demand for warehousing in border regions.

- Canada benefits from integrated North American supply chains, with rail-linked inland ports and distribution hubs expanding.

Europe

- The EU’s customs modernization and digital data hubs streamline cross-border flows, making bonded warehouses more efficient.

- Strict sustainability regulations drive demand for energy-efficient and carbon-neutral warehouses, with occupiers accepting rent premiums for green-certified buildings.

- Land scarcity in dense European metros is spurring vertical warehouse development.

Asia-Pacific

- China invests heavily in bonded warehouses and cross-border e-commerce hubs, enhancing logistics predictability.

- Japan and ASEAN are adopting automation and robotics to manage aging labor forces and high service-level requirements.

- India’s National Logistics Policy and PM Gati Shakti initiative focus on multimodal corridors and logistics parks, accelerating demand for modern warehousing.

Middle East & Africa

- Saudi Arabia’s Vision 2030 and National Transport and Logistics Strategy position the country as a logistics hub, driving development of advanced warehouses, including cold chain and e-commerce fulfillment centers.

- The UAE leverages free-zone ecosystems such as JAFZA and Dubai South, offering customs and tax advantages that attract global warehousing investments.

- Africa sees incremental warehousing growth around ports, supported by trade agreements and Gulf-Africa trade initiatives.

Latin America

- Brazil’s tax reforms simplify inter-state trade, encouraging rational placement of distribution centers.

- Mexico’s nearshoring-driven growth continues, particularly in Monterrey, Querétaro, and border metros, where modern warehousing stock remains in high demand.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Construction Technology Market Growth, Trends, Key Players and Global Analysis by 2034