Solid-State Battery Market Trends, Growth Drivers and Leading Companies 2024

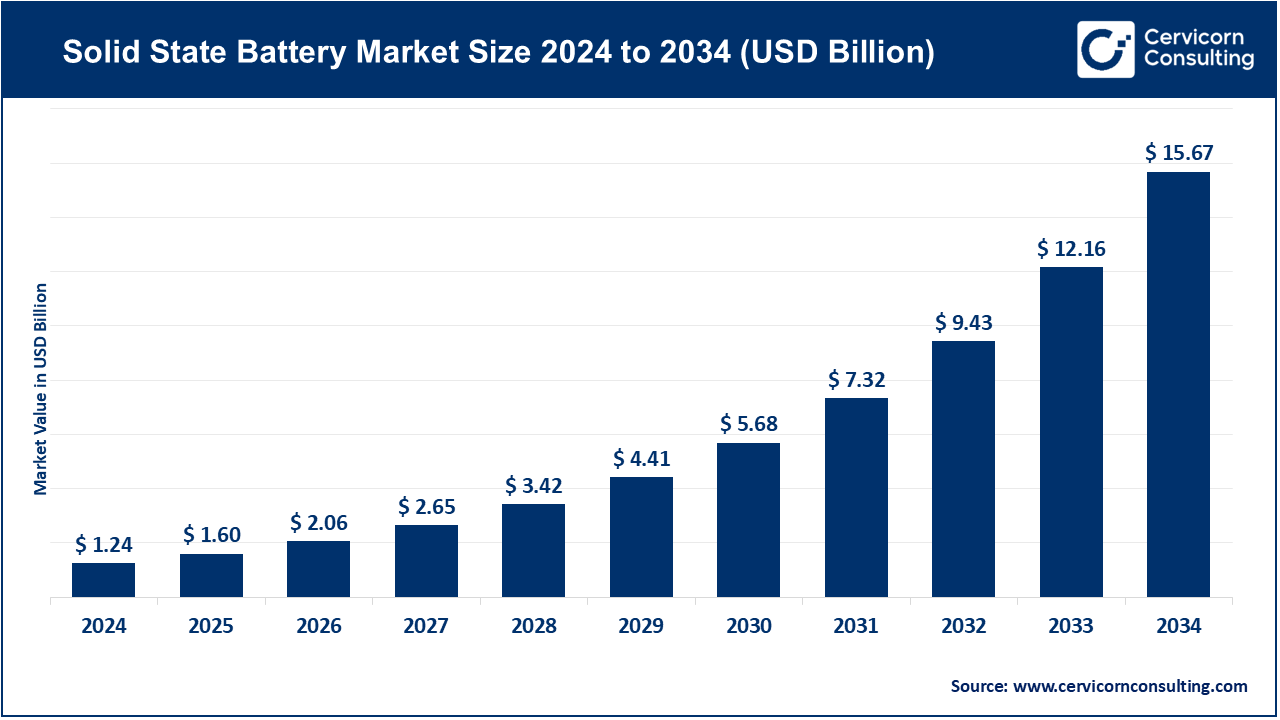

Solid-State Battery Market Size

Solid-State Battery Market — Growth Factors

Rapid growth of the solid-state battery market is being powered by a confluence of factors: surging demand for longer-range and safer electric vehicles that can compete on cost and convenience with internal combustion engine vehicles; increasing investment from automakers, battery suppliers, and venture capital into solid electrolyte technologies and cell designs; government incentives and grants (particularly in the U.S., Europe, and Japan) that lower commercialization and scale-up risk; breakthroughs in materials such as sulfide, oxide, and polymer solid electrolytes that are improving ionic conductivity and manufacturability; strategic partnerships that connect cell developers with gigafactory-scale manufacturers; rising standards and regulations around battery safety and lifecycle (which favor inherently safer solid electrolytes); and advances in manufacturing equipment and process control that are beginning to reduce the high cost premium versus conventional lithium-ion cells.

At the same time, parallel improvements in cathode chemistry, interface engineering, and supply chain investments are compressing timelines for initial low-volume production and pilot deployments. Together, these technical, financial, and policy drivers explain the steep CAGR projections expected for the rest of the 2020s.

What Is a Solid-State Battery?

A solid-state battery replaces the liquid or gel electrolyte used in conventional lithium-ion cells with a solid electrolyte. That solid electrolyte can be ceramic (oxide), sulfide-based, or a polymer, and it conducts lithium ions between the anode and cathode while physically separating them. In some designs, the anode is lithium metal (enabling higher energy density) rather than graphite; in others, the anode remains a modified composite. The result is higher volumetric and gravimetric energy density, reduced risk of flammable electrolyte fires, faster charge rates, and better temperature performance — though these gains come with challenges around interfaces, manufacturability, and cost.

Why Solid-State Batteries Are Important

Solid-state batteries are crucial because they address three core tradeoffs that have constrained battery-powered mobility and portable energy to date: energy density (how far an EV can go per kilogram), safety (risk of thermal runaway when batteries are damaged or abused), and fast charging (how quickly an EV can regain usable range). If manufacturers can reliably produce solid-state cells at automotive scale and at competitive cost, SSBs could extend EV range, reduce weight, simplify thermal management, and enable charging times closer to refueling — accelerating EV adoption and enabling new vehicle architectures. Beyond mobility, SSBs also matter for aerospace, high-end portable electronics, and stationary storage where volume, weight, or safety are critical.

Solid-State Battery Market — Top Companies

Below are profiles of five leading companies with key focus areas, notable features, 2024 revenues, and global presence.

Bolloré Group (BlueSolutions)

- Specialization: Lithium-metal polymer batteries and integrated energy storage solutions for commercial mobility and stationary storage.

- Key Focus Areas: Low-temperature polymer solid electrolyte packs for urban EVs, integrated battery systems for mobility and stationary energy use, vehicle electrification projects, and recycling programs.

- Notable Features: Vertical integration across mobility services and battery packs, with experience deploying fleet-scale systems such as electric buses and car-sharing fleets.

- 2024 Revenue: Approximately €3.13 billion for the group (BlueSolutions is part of this structure).

- Market Share: Niche player focusing on polymer-based solid-state systems for specific fleet and urban applications.

- Global Presence: Headquartered in France with operations across Europe and selected international markets.

QuantumScape Corporation

- Specialization: All-solid-state lithium-metal anode cell architectures designed for high-energy electric vehicle applications.

- Key Focus Areas: Anode-free lithium-metal cell design, scalable separator/stack manufacturing, and partnerships for mass production (notably with Volkswagen/PowerCo).

- Notable Features: Publicly traded U.S. company known for its proprietary separator technology and strong R&D focus. QuantumScape’s model centers on licensing technology to global OEMs.

- 2024 Revenue: No commercial product revenue in 2024; focused on R&D and pilot development.

- Market Share: No measurable market share yet as commercial shipments have not begun, but a strategic leader with potential future impact.

- Global Presence: Based in the U.S., with R&D and pilot lines domestically and partnerships with global automakers.

Toyota Motor Corporation

- Specialization: Automotive OEM investing heavily in all-solid-state batteries for next-generation EVs.

- Key Focus Areas: Developing advanced solid-state batteries, securing supply chains for cathode and electrolyte materials (e.g., collaborations with Sumitomo Metal Mining and Idemitsu), and preparing for pilot production.

- Notable Features: Extensive R&D resources, partnerships across the materials and automotive supply chain, and government-backed initiatives for industrial scaling. Toyota aims to launch SSB-powered EVs by the late 2020s.

- 2024 Revenue: Approximately ¥45 trillion (around $300 billion) in total sales. Solid-state battery revenue remains in development stages.

- Market Share: Strategic leader in SSB development; expected to gain significant share once large-scale production begins.

- Global Presence: Global operations with major manufacturing in Japan and facilities across North America, Europe, and Asia.

Solid Power, Inc.

- Specialization: Sulfide-based solid electrolytes and full-cell development for automotive and high-performance applications.

- Key Focus Areas: Pilot production, electrolyte material scale-up, and partnerships with OEMs such as SK On and Ford.

- Notable Features: Supported by the U.S. Department of Energy and advancing from R&D to pilot-scale production.

- 2024 Revenue: $20.1 million, primarily from technology transfer and development agreements.

- Market Share: Small but growing presence in early-stage pilot production, key player in the U.S. SSB ecosystem.

- Global Presence: U.S.-based with collaborations giving it access to global OEMs and expansion plans in North America.

TDK Corporation

- Specialization: Electronics and materials science giant contributing components and materials to battery technology advancements.

- Key Focus Areas: Advanced materials, passive components, and research in next-generation cell materials.

- Notable Features: Major supplier of electronic components and materials for battery systems and power management devices.

- 2024 Revenue: ¥2,103.9 billion in fiscal 2024, with overall growth across divisions.

- Market Share: Contributes to materials and components rather than complete SSB systems.

- Global Presence: Global operations with 90% of sales outside Japan, strong footprint in Asia, Europe, and the Americas.

Leading Trends and Their Impact

- OEM and Supplier Partnerships: Automakers are partnering with specialized SSB startups to gain early access to technology and accelerate commercialization. These partnerships combine the innovation of startups with the manufacturing scale of established OEMs.

- Government Support and Industrial Policies: Grants, subsidies, and national industrial policies in the U.S., EU, and Japan are catalyzing investment in solid-state R&D and pilot production, helping companies overcome the early-stage cost barrier.

- Advances in Materials: Innovations in solid electrolyte conductivity and cathode interfaces are closing the performance and cost gap between SSBs and traditional lithium-ion cells.

- Focus on Scalable Manufacturing: The shift toward manufacturing processes compatible with existing lithium-ion production lines is reducing costs and improving scalability.

- Diverse Technological Approaches: Multiple electrolyte chemistries (sulfide, oxide, polymer, and hybrid) are being explored simultaneously, leading to segment-specific applications rather than a single universal standard.

Successful Examples and Early Deployments

- Prototype Vehicles: Toyota and Volkswagen have demonstrated prototype EVs using solid-state or hybrid designs, validating the feasibility of the technology under real-world conditions.

- Pilot Production Agreements: Solid Power’s technology transfer deals with OEMs like SK On illustrate commercial interest even before mass production.

- Upstream Industrialization: Companies such as Idemitsu are establishing lithium sulfide plants to supply future SSB production, signaling that supply chain readiness is advancing.

Global and Regional Analysis

North America

The United States is leading with strong federal backing for battery manufacturing and R&D. The Department of Energy’s grants, combined with tax incentives under the Inflation Reduction Act, have stimulated domestic production. Several startups, including Solid Power, are benefiting from these initiatives, with new facilities aimed at building sulfide electrolyte materials and pilot cell production.

Europe

Europe’s strategy focuses on sustainability and self-sufficiency in energy storage through the EU Battery Regulation and Net-Zero Industry Act. These policies encourage circularity, carbon neutrality, and recycling infrastructure. The region also supports gigafactory construction through financial incentives and innovation programs. European automakers are partnering with startups and research institutes to develop solid-state cells tailored to regional energy standards.

Japan

Japan remains a pioneer in solid-state technology. The government, through METI, supports next-generation battery projects, while leading corporations like Toyota, Nissan, Panasonic, and Idemitsu are developing integrated domestic supply chains for solid-state production. Japan’s coordinated strategy combines government aid, academic research, and private sector investment to secure technological leadership.

China and South Korea

China dominates global lithium-ion battery production and is investing heavily in solid-state research to maintain its lead. Chinese firms are building pilot lines for SSBs while leveraging their raw material advantages. South Korean battery giants such as LG Energy Solution and Samsung SDI are also developing semi-solid and solid-state prototypes aimed at the EV market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report:

Extended Reality Market Trends, Growth Drivers, and Leading Companies 2024

Surge Arrester Market Growth, Trends, and Leading Players

Air Conditioner Market Growth Driven by Smart Cooling & Sustainable Technologies (2025–2034)