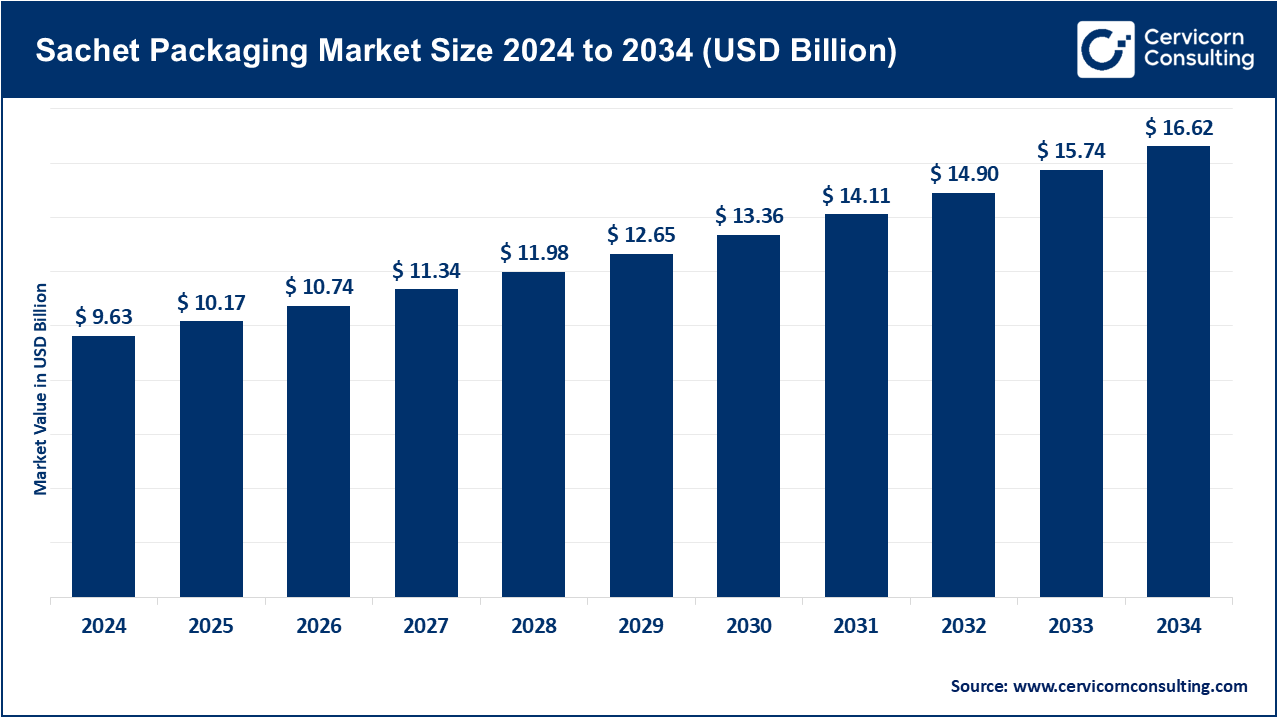

Sachet Packaging Market Revenue, Global Presence, and Strategic Insights by 2034

Sachet packaging market size

Sachet packaging market Growth Factors

Demand for sachet packaging is being driven by a mix of socio-economic, technological and regulatory forces: rising urbanization and the growth of micro-retail and informal channels in emerging economies create huge demand for low-unit-cost, single-use sachets; busy lifestyles and preference for on-the-go, single-serve formats push adoption in developed markets (e.g., sample cosmetics, meal kits, and nutraceuticals); manufacturers pursue cost-efficient portion control and reduced product spoilage through high-barrier laminated sachets; brands use sachets for trial and promotional strategies that lower the barrier to purchase; advances in flexible packaging films, barrier coatings and digital printing have improved shelf life, branding and short-run personalization.

Meanwhile, regulatory pressure and circular-economy targets are accelerating investment in recyclable mono-materials and post-consumer-recycled (PCR) content, prompting shifts in material selection and design for recyclability — together these factors create steady growth while also introducing new cost and compliance challenges for producers and brand owners.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2743

What is the sachet packaging market?

The sachet packaging market comprises materials, converters, machinery and value-added services involved in producing small, sealed pouches (sachets) typically used for single-use or single-serve quantities of liquids, pastes, powders and granulated products. Sachets can be made from multi-layer laminated films, paper-plastic laminates, biodegradable polymers or metal-foil laminates depending on barrier needs. The market spans raw film suppliers (resins, barrier layers, inks), printing and converting companies (gravure, flexo, laminators, pouch-forming equipment), and downstream brand customers in food & beverage, personal care, pharmaceuticals, homecare and agrochemicals. Revenue streams include film sales, converted sachets, machinery sales and service, plus emerging revenues for take-back/recycling schemes and refill/distribution models.

Why is sachet packaging important?

Sachets matter for business, consumers and public policy. For companies and brands, sachets unlock price points and distribution channels — enabling market entry, trials and incremental sales where full-size SKUs would be unaffordable or impractical. For consumers, sachets provide affordability and convenience, especially where single-use dosing improves access to hygiene, medicine and nutrition in low-income settings. From a logistics standpoint, sachets are space-efficient (high packing density) and reduce product losses by providing precise dosing. But their ubiquity raises environmental concerns because ultra-thin multi-material laminates are often hard to recycle, drawing scrutiny from regulators and NGOs — which in turn is accelerating innovation toward recyclable mono-material sachets and new collection/EPR schemes.

Sachet Packaging Market — Top Companies

1) Amcor plc

- Specialization: Global leader in flexible and rigid packaging, with broad capabilities across flexible films, sachet and pouch converting, specialty cartons and closures.

- Key focus areas: Food & beverage flexible solutions, healthcare/pharma barrier packaging, sustainable materials (recyclable mono-materials), and large-scale global supply chains.

- Notable features: Deep global footprint, extensive R&D in sustainable films and recyclability, large converting capacity across continents. Amcor has pursued major M&A to expand capabilities and reach.

- 2024 revenue: Fiscal year net sales reported at $13.64 billion for FY24.

- Market share & global presence: One of the largest flexible packaging players by revenue and capacity; operates across the Americas, EMEA and APAC with hundreds of plants — giving Amcor a commanding presence in high-volume sachet supply chains.

2) Constantia Flexibles

- Specialization: Flexible packaging specialist focused on consumer (food & personal care) and pharmaceutical applications — including sachets, lidding and multi-layer films.

- Key focus areas: Pharma-grade barrier films, tailored flexible laminates for food safety, sustainability initiatives for aluminium and film recycling.

- Notable features: Strong European presence, recognized ESG credentials, emphasis on pharma quality and anti-counterfeiting features for blister and sachet formats. After private-equity activity in 2023–24, the group has focused on capacity investments in Europe.

- 2024 revenue: The group’s reported sales were around €2 billion in 2024.

- Market share & global presence: Leading flexible packaging supplier in Europe with growing footprint in North America and Asia via targeted acquisitions and partnerships; significant share in pharma sachets and retail flexible formats.

3) Huhtamaki Oyj

- Specialization: Primarily known for fibre and moulded-fibre foodservice packaging, but also a substantial player in flexible and barrier packaging used for single-serve and sachet-style food & beverage applications in certain markets.

- Key focus areas: Sustainable food packaging, compostable/fibre-based alternatives, innovation in barrier coatings and food contact safety.

- Notable features: Strong commitment to sustainability, large foodservice portfolio that complements single-serve and pouch solutions for on-the-go consumption.

- 2024 revenue: Huhtamaki reported net sales of about €4.1 billion in 2024.

- Market share & global presence: Operates in ~36 countries with a historic footprint in Europe and growing presence in APAC and the Americas; market leadership in certain foodservice single-serve segments and sustainable fibre alternatives.

4) Mondi Group

- Specialization: Paper- and fibre-based packaging, flexible packaging solutions and industrial packaging; provides pouches and kraft-based alternatives to plastic sachets, plus flexible films for packaging.

- Key focus areas: Recyclable paper and mono-material solutions, e-commerce and industrial flexible packaging, and integrating recycled content.

- Notable features: Strong packaging engineering capabilities, multiple acquisitions to support e-commerce and sustainable packaging; invests in fibre-based sachet alternatives.

- 2024 revenue: Mondi reported group revenue of about €7.4 billion for full-year 2024.

- Market share & global presence: A major European packaging group with global reach, especially in Europe and emerging positions in North America and South Africa; significant share in paper-based and recyclable flexible formats.

5) Sonoco Products Company

- Specialization: Broad packaging portfolio including flexible films, pouches, metal cans and specialty packaging. Sonoco operates in consumer packaging and rigid/metal packaging that sometimes complements sachet strategies (e.g., single-serve metal ends and closures).

- Key focus areas: Metal packaging expansion, sustainable packaging circularity, flexible packaging solutions for aerosols and foods.

- Notable features: Portfolio transformation via strategic acquisitions to boost metal and rigid packaging; growing emphasis on high-value sustainable formats.

- 2024 revenue: Sonoco reported net sales in the vicinity of $5.3 billion for 2024.

- Market share & global presence: Strong North American presence with growing EMEA capabilities following acquisitions; competes across several packaging segments that intersect with sachet use cases.

Leading trends and their impact on sachet packaging

- Sustainability and recyclable mono-materials. The biggest technical driver is the industry push from multi-layer, difficult-to-recycle laminates toward mono-polymer sachets (e.g., mono-PE with high-barrier coatings, or recyclable PET/PE constructions) that are mechanically or chemically recyclable. Impact: requires R&D investment and retooling but improves regulatory compliance and opens circular-economy claims for brands.

- Regulation and EPR schemes. Governments are accelerating Extended Producer Responsibility (EPR) and packaging regulations (e.g., EU PPWR) that push producers to finance collection and recycling — forcing brands to account for end-of-life in packaging decisions. Impact: increased compliance costs, but also incentives to design recyclable sachets and join recycling coalitions.

- Digital printing and personalization. Short-run digital printing reduces minimum order quantities and enables promotional sachets, regionalized messaging and anti-counterfeiting features. Impact: greater marketing agility and reduced inventory risk for manufacturers and brands.

- Miniaturization and convenience formats. Continued demand for micro-dosing (single-use medicines, hygiene sachets) — especially across emerging markets — sustains volumes. Impact: steady baseline demand even as other segments fluctuate.

- Material innovation (bio-based & compostables). Growing interest in bio-resins and compostable barrier coatings for sachets used in non-hazardous consumer applications. Impact: niche adoption due to cost and composting infrastructure constraints; risks of contamination in recycling streams remain.

- Collection and chemical recycling partnerships. Brands and converters are piloting take-back programs and chemical recycling processes to manage mixed-film sachets. Impact: can transform non-recyclable waste into feedstock but requires scale and favorable economics.

Successful examples of sachet packaging around the world

- India — affordable sachets for FMCG penetration: Multinational and local consumer goods companies (shampoos, detergents, edible oils) have used single-serve sachets to reach low-income rural and urban consumers. Sachets lowered price barriers and dramatically expanded consumption of branded products, even as regulators and NGOs now push recyclable alternatives and EPR compliance.

- Africa — sachets for safe water and nutrition: Sachets are widely used for oral rehydration salts (ORS), fortified single-serve nutrient powders and water purification sachets that help address public health gaps. The small format enables distribution through micro-retail and health workers.

- Latin America — trial and promotional sachets: Beauty and personal-care brands successfully use sachets for trial sizes in urban markets; returned trials often convert into full-size purchases. Sachets are distributed through supermarkets and drugstores as cost-effective sampling tools.

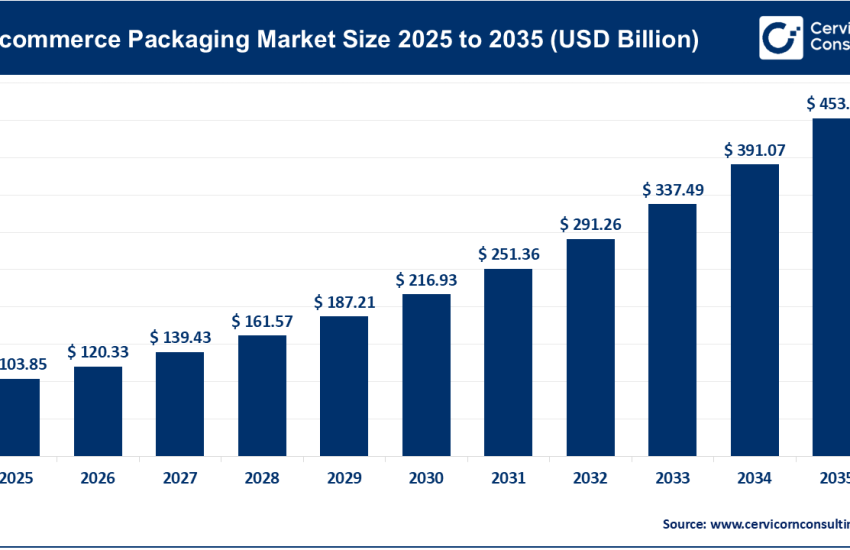

- E-commerce and subscription models in developed markets: Sample sachets of coffee, health supplements and meal condiments are integrated into subscription boxes and online trial campaigns — leveraging digital printing and small batch converting to test new SKUs quickly.

- Corporate circular pilots: Several brand and converter coalitions in Europe have piloted mono-PE sachets that are accepted by film recycling streams, showing that design for recycling can scale when collection and sorting are aligned with packaging design.

Global regional analysis — Government initiatives and policies shaping the market

Europe

The EU has moved aggressively on packaging regulation. The Packaging and Packaging Waste Regulation (PPWR) and related measures (building upon the Single-Use Plastics Directive) introduce harmonized requirements aimed at making packaging recyclable, reducing waste and setting recycled-content and design-for-recycling obligations. These rules directly affect sachet design, pushing converters and brands toward recyclable mono-materials and higher recycled content while exposing non-compliant multi-layer sachets to potential restrictions or surcharges. The PPWR’s lifecycle focus pushes upstream design changes and industry investment in recyclable sachet solutions.

Impact: European brands and converters are accelerating substitution to recyclable materials, investing in new film technologies, and participating in national/regional EPR programs. Countries with advanced collection/sorting systems benefit most from recyclable sachet adoption.

North America (U.S. & Canada)

North America’s policy landscape is a patchwork of state/provincial rules, with growing interest in EPR and packaging taxes. The U.S. federal approach is fragmented, but several states and Canadian provinces have introduced EPR-like schemes and packaging taxes that push producers to internalize end-of-life costs.

Impact: Larger brands must manage complex compliance portfolios across jurisdictions; this favors large global converters and spurs investment in recyclable sachet formats to avoid future liabilities.

Asia (India, China, Southeast Asia)

Asia is the largest volume market for sachets due to micro-retail prevalence. Governments are increasingly reclaiming policy space on plastics: India’s Plastic Waste Management Rules and moves toward banning certain single-use plastics have spurred EPR rules and mandatory recycled content targets; China has layered bans/restrictions and pilot sorting/reuse programs. These policies force sachet manufacturers and brands to rethink material choices and take responsibility for collection and recycling, but enforcement and infrastructure vary greatly between countries.

Impact: Brands operating in Asia face high volumes but growing regulatory complexity; sustainable sachet innovation and take-back schemes are critical competitive advantages.

Latin America & Africa

Policy maturity varies. Some countries are implementing bans on specific single-use items and exploring EPR. Informal recycling sectors are significant, particularly in Africa, so practical solutions for sachet waste (collection, aggregation, mechanical/chemical recycling) need to be tailored to local realities.

Impact: In markets with limited collection infrastructure, sachets remain ubiquitous; international NGOs and brands have piloted community collection and aggregation projects to recover multi-layer film waste for recycling.

Global regulatory crosscut: Extended Producer Responsibility (EPR)

EPR is one of the fastest-spreading policy tools globally. OECD and other bodies champion EPR as a mechanism to shift end-of-life costs to producers, incentivizing design for recyclability and circular business models. This is shaping sachet markets by internalizing waste costs and encouraging collaborative recycling solutions.

Impact: EPR introduces predictable but potentially material costs for sachet producers and brand owners. Companies that innovate early (recyclable mono-materials, take-back) will mitigate costs and gain market access advantages.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Applied AI Market Trends, Growth Drivers and Leading Companies 2024