Regional Air Mobility Market Size, Share & Forecast (2025–2034)

Regional Air Mobility Market Size and Growth Factors

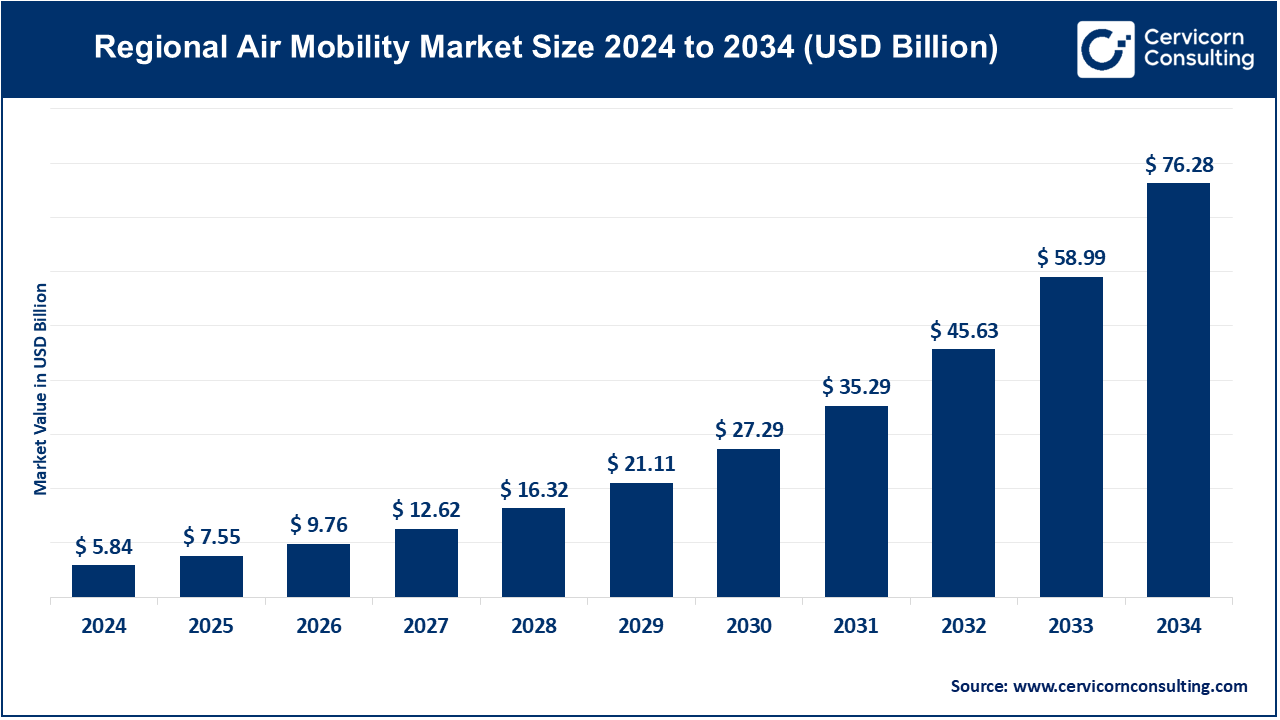

In 2024, the regional air mobility market was valued at around USD 5.84 billion and is forecast to skyrocket to USD 76.3 billion by 2034 at a 29.3% CAGR. The regional air mobility market is surging, driven by converging factors: breakthroughs in electric and hybrid propulsion significantly reduce operating costs and emissions; underutilised regional airports now present untapped connectivity potential; government-backed infrastructure programs (like North America’s vertiport expansion); rising environmental and regulatory pressure encouraging green aviation; and strong venture capital and private investment fueling startups and innovation.

What Is the Regional Air Mobility Market?

Regional Air Mobility (RAM) refers to the emerging sector focused on short- and mid-range flights, typically ranging from 50 to 500 km, that connect smaller communities, secondary airports, and hard-to-access regions. It includes electric/hybrid aircraft, next-gen turboprops, and eVTOL (electric vertical take-off and landing) designs, all aiming to make regional point-to-point air travel more efficient, sustainable, and accessible.

Why It Matters

- Connectivity and Accessibility: RAM bridges mobility gaps—especially in rural, island, or mountainous areas—offering lifelines for business travel, healthcare, and tourism.

- Environmental Sustainability: Electric and hybrid propulsion means cleaner flight with reduced CO₂ and noise pollution.

- Economic Opportunity: Stimulates regional economies through airport development, supply-chain growth, and new transport corridors.

- Efficiency for Short Trips: Replaces lengthy ground commutes with quicker air hops, optimizing travel time in sprawling metropolitan and rural regions.

- Future-Ready Aviation: Serves as a testbed for emerging tech like automation, sustainable aviation fuels (SAF), and vertiport-rollout frameworks.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2644

Top Companies in the RAM Space

Below is a deeper look into key industry players:

Textron Aviation

- Specialization: General aviation (Cessna, Beechcraft), certified turboprops and business jets; pushing into RAM via hybrid-upgrades.

- Key Focus Areas: Modernizing Citation and King Air platforms, integrating Garmin Autoland, hybrid-electric retrofits.

- Notable Features: Global network of ~20 service centers; backlog of US $7.8 billion at end‑2024.

- 2024 Revenue / Market Share: Parent Textron Inc. generated US $13.7 billion in total revenue, with Textron Aviation responsible for ~38.6 % (~US $5.3 billion).

- Global Presence: Extensive global footprint across North America, Europe, Asia–Pacific; 2% YoY revenue growth in Q1 2025 .

Pipistrel

- Specialization: Light sport and trainer electric aircraft; Velis Electro is the first certified electric plane.

- Key Focus Areas: Pilot training platforms, innovation in battery-electric systems.

- Notable Features: Velis Electro certification boost; leading light-electrics player.

- 2024 Revenue / Market Share: Private firm; individual revenues unavailable but recognized as a trendsetter in electric trainers.

- Global Presence: Active mainly in EU/US markets, training schools, and general aviation growth zones.

Eviation Aircraft

- Specialization: The Alice, a nine-passenger, fully electric commuter plane (prototype first flew Sep 27, 2022).

- Key Focus Areas: Scaling production and securing commercial orders.

- Notable Features: Over 600+ Letters of Intent (LOIs) totaling ~$5 billion secured; Cape Air indicates early customer interest.

- 2024 Revenue / Market Share: Not revenue-active yet; in pre-order/prototype production.

- Global Presence: Israel‑headquartered with an eye on North American regional carriers.

Heart Aerospace

- Specialization: ES‑30 hybrid‑electric regional airliner (30‑seat capacity).

- Key Focus Areas: Electrification and zero‑emission technologies at scale.

- Notable Features: Samba R&D facility in Los Angeles; AAM Reality Index score of 5.1.

- 2024 Revenue / Market Share: Startup phase—no revenues yet.

- Global Presence: Headquarters in Gothenburg (Sweden); expanding ties in U.S., securing investment interest from United Airlines.

Surf Air Mobility

- Specialization: Scheduled/on-demand commuter services – electrifying Cessna Caravans.

- Key Focus Areas: Electrified retrofits, point-to-point commuter routes.

- Notable Features: Publicly listed (NYSE), subsidiary networks (Mokulele, Southern Airways), active electrification MOUs in US and Brazil.

- 2024 Revenue / Market Share: 2024 full-year revenue was US $119.4 M (+6 % YoY); Q4 revenue US $28.05 M, and GAAP net loss improved to US $74.9 M.

- Global Presence: Primarily North America, expanding into South America via partnerships.

Leading Trends & Their Impact

Electrification (EV/Hybrid)

Aligned with climate goals, major eVTOL and commuter-electric aircraft are trending. This boosts lower-carbon operations and supports ESG agendas.

Vertiport & Infrastructure Expansion

Governments and private entities are accelerating vertiport rollouts—e.g., U.S. Biden-era investments, EU’s SESAR AAM, Japan’s MassDOT-led frameworks.

Retrofit Electrification Programs

Plug-and-play retrofit solutions (Surf Air, Heart Aerospace) offer rapid electrification without the wait for next-gen certified new designs.

Private-Public Funding & Regulation

Venture capital, government grants, and landmark regulations, e.g., CAA’s UK AAM standards, U.S. financial awards like Tulsa TRAM Corridor.

Digitization & Autonomy

Instrumenting AI-enabled route ops, airspace integration, and safety automation (Garmin Autoland).

Market Diversification & Route Expansion

New operators deploying under‑served paths (e.g., Surf Air’s routes: Purdue–Chicago, Williamsport–Dulles), focusing on avoiding congested hubs.

Successful Global Examples

- Cape Air + Eviation Alice: Northeast U.S. regional service agreements with fully electric commuter planes underway.

- Surf Air’s Purdue–O’Hare Shuttle: A novel commuter model enhancing small-market connectivity .

- SESAR AAM Projects in Europe: Demonstration flights in EU-led projects aiming to integrate RAM into urban and regional infrastructure.

- Heart’s U.S. R&D Hub: Building credibility and advancing certification of hybrid airliner prototypes.

Global Regional Analysis: Markets & Policy Landscapes

North America

- Market: Largest RAM segment (~$2.32 B in 2024) with strong forecast growth.

- Policies & Government: U.S. DOT, DOE, NASA grants; Civil Aviation Authority frameworks; active FAA electrification initiatives.

- Infrastructure: Spot expansions, like Tulsa TRAM Corridor investment; regulatory sandboxing for test routes and vertiports.

Europe

- Market: Region valued at ~$2 B in 2024; projected to reach ~$26 B by 2034.

- Regulation & Sustainability: EU SESAR AAM project supporting electric RAM integration; strict CO₂ and noise standards boost eRAM.

- Support: EASA developing certification pathways for hybrid/electric aircraft; major funding allocated for regional airports and infrastructure.

Asia-Pacific

- Growth Leader: $1.38 B market in 2024, projected to exceed $18 B by 2034.

- Government Programs: China’s CAAC developing AAM standards; Japan’s AAM Expo and Osaka Expo flight targets .

- Use Cases: Island hopping (Australia), remote area servicing (India, Southeast Asia), commuter air links (Japan, Korea).

LAMEA (Latin America, ME & Africa)

- Scale & Opportunity: $0.34 B in 2024 expanding to ~$4.4 B by 2034 .

- Challenges: Inadequate regional infrastructure, policy fragmentation, underinvestment.

- Progress: Early pilots (e.g., Brazil retrofit deals), increasing private interest for cargo, medevac, and agri‑connectivity services.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

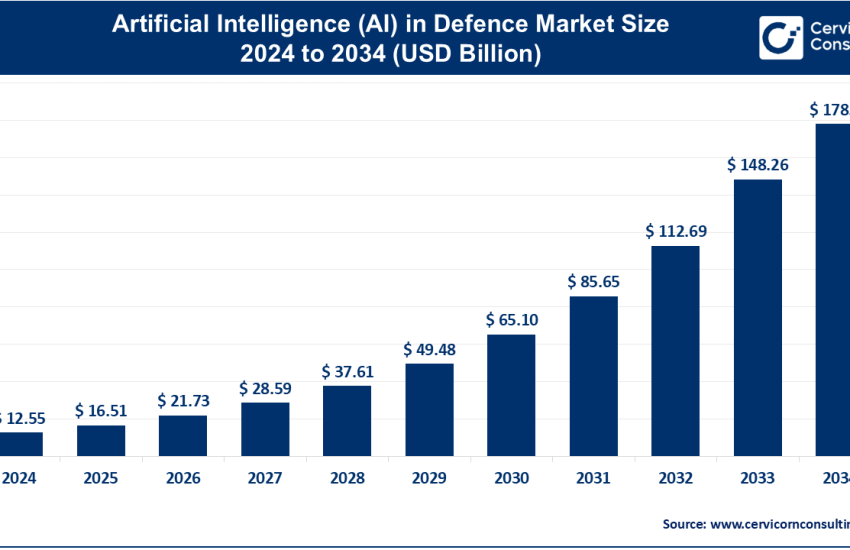

Read Report: Generative AI in Aerospace and Defense Market Size, Growth Trends, and Key Players (2024–2034)