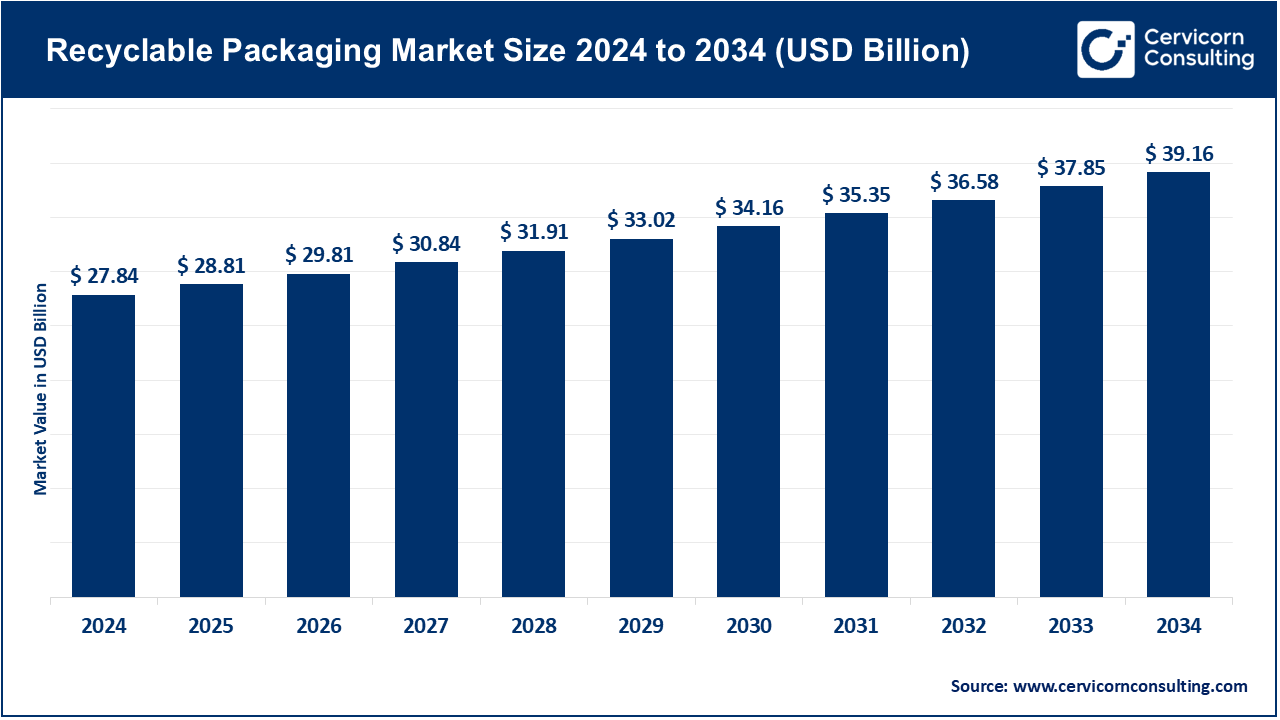

Recyclable Packaging Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Recyclable Packaging Market Size

What is the recyclable packaging market?

The recyclable packaging market comprises materials, formats and services designed so packaging can be collected, sorted and processed back into feedstock for new packaging or other products. It includes paper & board, recyclable plastics (mono-polymer PET, HDPE, PP where recycling streams exist), recyclable flexible films designed for curbside systems, metal (aluminium, steel), and reusable systems that reduce single-use waste.

The market spans raw-material suppliers (recycled content producers), converters and packagers (bottles, trays, cartons, flexible pouches), brand owners adopting recyclable designs, waste collection/sorting infrastructure, and service companies offering take-back, refill or closed-loop logistics. Market sizing varies by definition—some reports focus strictly on “recyclable” labelled packaging and others on the broader category of “recycled materials in packaging”—but all point to a multi-billion-dollar and steadily growing space.

Why is recyclable packaging important?

Recyclable packaging reduces landfill and incineration, lowers demand for virgin feedstocks (cutting upstream emissions and resource extraction), helps brands meet regulatory and retailer requirements, and responds to a fast-growing consumer preference for sustainable products. It also helps companies manage costs and reputational risk: as extended producer responsibility (EPR) fees and packaging taxes spread, brands that design for recyclability can avoid higher end-of-life fees and secure better shelf access. Beyond environmental gains, recyclable packaging is a business imperative—retailers, investors and regulators increasingly treat packaging performance as a competitive dimension.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2748

Recyclable packaging market — Growth Factors

The recyclable packaging market is expanding thanks to a convergence of factors: stricter government regulation that requires higher recycled content and recyclability, rising consumer demand for low-impact and transparent packaging, falling costs and improved availability of recycled feedstocks driven by investments in collection and sorting technologies, brand and retailer sustainability commitments that force redesigns, rapid innovation in recyclable and mono-material flexible films and adhesives, and circular-economy business models such as refill and reuse systems that reduce single-use volumes. Together these push both supply and demand toward recyclable alternatives and make investment in recycling infrastructure—both mechanical and chemical—more commercially attractive.

Recyclable Packaging Market — Top Companies

Below are profiles of the companies you requested.

Amcor

Specialization: Flexible and rigid packaging (films, cartons, containers); large emphasis on recyclable solutions and recycled content.

Key focus areas: Recyclable mono-material films, increasing recycled content, lightweighting, healthcare packaging, beverage closures.

Notable features: Global manufacturing footprint, extensive R&D in recyclable flexible packaging, strong sustainability commitments and public reporting.

2024 revenue / market position: Amcor announced a transformative acquisition of Berry Global in 2024, creating combined annual revenue of about USD 24 billion.

Global presence: Operations in 40+ countries; market leadership across flexible and rigid packaging.

Graham Packaging Company

Specialization: Blow-molded rigid containers—especially PET and HDPE bottles and containers for beverages, food and household chemicals.

Key focus areas: Lightweighting of rigid containers, recycled PET (rPET) integration, circular solutions for beverage packaging.

Notable features: Long history in rigid blow molding; emphasis on supply collaboration with large beverage and CPG customers and sustainability reporting.

2024 revenue / market share: A major player in North American and global rigid packaging; revenue estimates are private but it is recognized among the top rigid container producers.

Global presence: Serves global food, beverage and household brands with operations primarily in North America and Europe.

Ebro Color GmbH

Specialization: Masterbatches, colorants and functional additives for the plastics industry (including packaging).

Key focus areas: Color consistency, additive formulations that support recycling (compatibilizers, antioxidant packages), and color solutions for recycled resins.

Notable features: German manufacturer with strong European presence; smaller, technology-focused business compared with global packagers.

2024 revenue / market share: Private German firm; operates as a specialist supplier rather than a mass-market packager.

Lacerta Group, Inc.

Specialization: Thermoformed packaging—clear and barrier containers for foodservice, bakery, ready meals and retail.

Key focus areas: Customer-specific designs, recyclable resins (mono-PET trays, PCR content), fast turnaround customization.

Notable features: Focus on U.S. customers with thermoforming expertise; a mid-sized manufacturer with regional strength.

2024 revenue / market share: Annual revenue is estimated at about USD 7.5 million; positioned as a regional mid-market player rather than a global giant.

Salazar Packaging, Inc.

Specialization: Sustainable packaging solutions—100% recyclable molded pulp, recycled paperboard, recycled content packaging and eco-friendly print/inks.

Key focus areas: FSC-certified materials, molded pulp alternatives to plastics, high recycled content paperboard, and curbside-friendly formats.

Notable features: Markets itself around 100% recycled content and recyclability; strong emphasis on brand storytelling and sustainable inks.

2024 revenue / market share: A private U.S.-based company, positioned as a niche sustainable packaging provider with growing demand among eco-conscious brands.

Leading trends and their impact

- Regulatory pressure & EPR: Expanding laws require higher recyclability and recycled content, pushing brands toward design-for-recycling practices.

- Mergers & consolidation: Deals like Amcor’s acquisition of Berry Global create global packaging giants with scale to invest heavily in recyclable innovations.

- Mono-material flexible packaging: Brands are moving from complex laminates to mono-polymer films that allow mechanical recycling without sacrificing performance.

- Investment in recycling infrastructure: Both mechanical and chemical recycling are growing, increasing supply of rPET and rHDPE.

- Refill and reuse models: Platforms like Loop show that reusable containers can work commercially across categories such as food, beverages and personal care.

- Material substitution: Molded pulp and high-recycled paperboard are increasingly replacing plastic trays, clamshells and secondary packaging.

Successful examples around the world

- Loop by TerraCycle: A reusable packaging platform working with global retailers and brands in Europe, the U.S. and Japan.

- Deposit-return systems in Scandinavia: Norway and Denmark achieve return rates above 90% for beverage bottles and cans, making packaging nearly circular.

- Mono-PET and PCR bottles by major brands: Beverage and personal care companies have adopted bottles with 25–50% recycled content, creating strong demand for rPET.

- Retailer take-back and curbside pilots: Large retailers in the U.S. and Europe are trialing film collection systems to boost recycling yields.

Global regional analysis: Government initiatives & policies shaping the market

Europe

The EU Packaging and Packaging Waste Regulation (PPWR) requires packaging to be recyclable, introduces reuse quotas, and mandates higher collection targets. This legal certainty is pushing faster redesigns and infrastructure investment.

United Kingdom

The UK’s Plastic Packaging Tax requires plastic packaging to contain at least 30% recycled plastic or face additional levies. Extended Producer Responsibility schemes are also being rolled out.

North America

The U.S. operates a patchwork approach with state-level EPR laws in places like Maine, Oregon and Colorado. Canada is implementing EPR systems at the provincial level, pushing brands toward recyclable designs.

Asia-Pacific

Japan and South Korea have strong recycling systems for beverage containers. China’s “National Sword” policy limiting waste imports has pushed domestic recycling investment and stricter quality standards for recyclables.

Latin America & Middle East/Africa

Infrastructure is limited in many countries, but global brands and NGOs are piloting recyclable and fiber-based packaging solutions. Voluntary commitments often lead the way until formal regulation matures.

How companies are responding

- Design for recyclability: Simplifying laminates, switching to mono-materials, and avoiding non-recyclable inks or labels.

- Increased PCR use: Sourcing recycled PET and HDPE to meet recycled content requirements.

- Refill and reuse pilots: Partnering with reuse platforms and launching take-back schemes.

- Partnerships & M&A: Consolidation among packaging leaders to fund large-scale innovation.

Practical considerations for brands & investors

- Define recyclability scope: Decide if recyclability is judged at curbside, industrial, or chemical recycling levels.

- Assess infrastructure: What is recyclable in one market may not be in another.

- Supplier due diligence: Validate recycled content claims and certifications when working with private suppliers.