Quantum Sensor Market Growth Trends, Top Companies, Applications and Global Insights by 2034

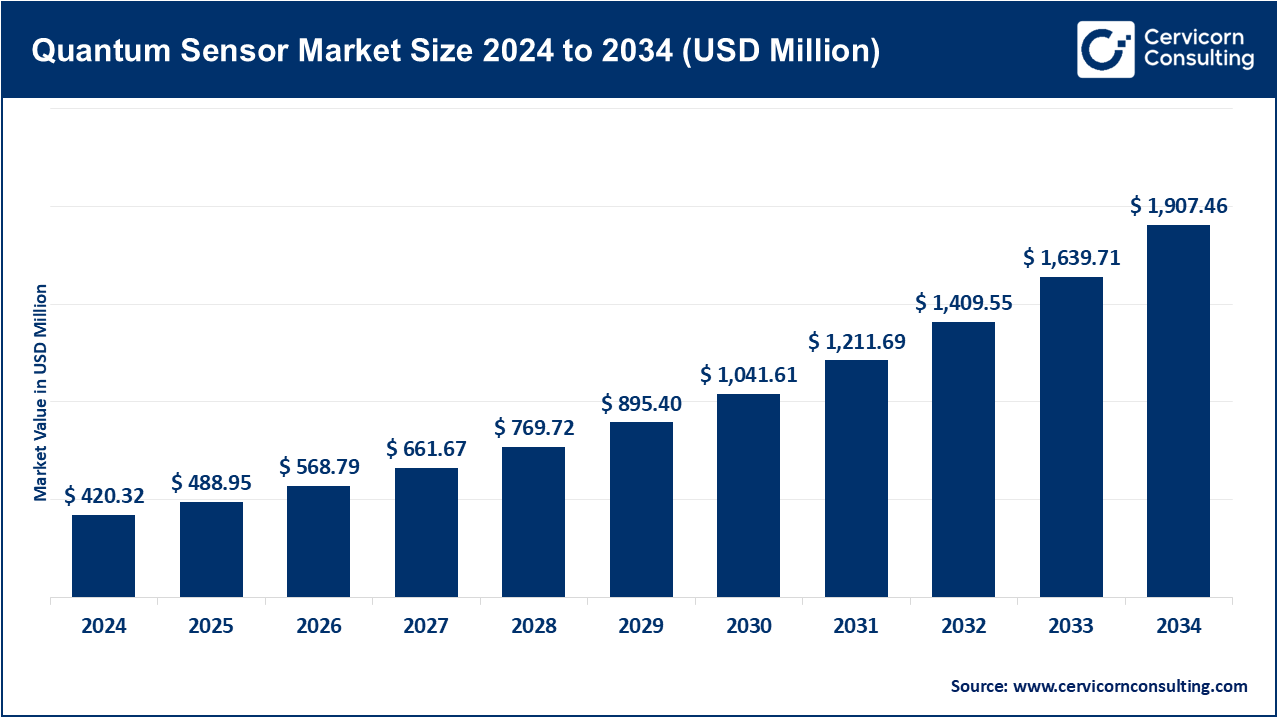

Quantum Sensor Market Size

The global quantum sensor market size was worth USD 420.32 million in 2024 and is anticipated to expand to around USD 1,907.46 million by 2034, registering a compound annual growth rate (CAGR) of 16.32% from 2025 to 2034.

What is the Quantum Sensor Market?

The quantum sensor market refers to the global ecosystem encompassing the research, development, manufacturing, commercialization, and deployment of sensors that utilize quantum technologies. These devices use quantum properties of particles—like electrons, atoms, or photons—to measure physical quantities such as magnetic fields, time, gravity, acceleration, or temperature with unmatched precision. Quantum sensors are differentiated from traditional sensors in their ability to detect minute changes in the environment at atomic and subatomic levels.

Why is the Quantum Sensor Market Important?

The quantum sensor market is significant due to its transformative impact across multiple sectors:

- Defense & Aerospace: Quantum sensors can detect submarines or underground bunkers, offering strategic military advantages.

- Healthcare: Ultra-precise MRI systems and biomagnetic field measurements can improve diagnosis and treatment.

- Navigation: Quantum gyroscopes and accelerometers offer GPS-independent navigation.

- Geophysics and Exploration: Quantum gravimeters can detect mineral resources and water tables buried deep underground.

- Fundamental Science: Quantum sensors help advance atomic clocks and experimental physics, enabling new discoveries.

Quantum Sensor Market Growth Factors

The quantum sensor market is experiencing strong growth due to a convergence of several driving factors: significant investments in quantum technology research and development by governments and private players; increasing demand for high-precision sensing in defense, healthcare, and navigation applications; rising interest in GPS-denied navigation systems; growing deployment of quantum sensors in geophysical and biomedical fields; supportive policies and international collaborations (e.g., EU’s Quantum Flagship, U.S. National Quantum Initiative); miniaturization of sensors enabled by nanotechnology; and advancements in quantum computing and quantum communication, which synergize with quantum sensing.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2683

Quantum Sensor Market Top Companies

1. ADVA Optical Networking SE

- Specialization: Quantum sensing for secure communication and optical time distribution

- Key Focus Areas: Time synchronization, network timing, and quantum key distribution (QKD)

- Notable Features: Integrates quantum clock technologies with fiber-based communication networks

- 2024 Revenue: Estimated USD 750 million

- Market Share: ~5–6% in timing and synchronization segment

- Global Presence: Europe, North America, and Asia-Pacific

2. AdSense

- Specialization: Photonic and atomic quantum sensors

- Key Focus Areas: Commercial-grade magnetometers and accelerometers

- Notable Features: Scalable sensor modules for mobile applications

- 2024 Revenue: USD 55 million

- Market Share: ~2–3% in photonic sensor development

- Global Presence: U.S., Europe, South Korea, India

3. Biospherical Instruments Inc.

- Specialization: Quantum light sensors for marine and environmental applications

- Key Focus Areas: Radiometric and photometric measurements in aquatic environments

- Notable Features: Quantum efficiency sensors for underwater light detection

- 2024 Revenue: USD 18 million

- Market Share: ~1% (dominant in niche marine segment)

- Global Presence: North America, Australia, Japan, Nordics

4. GWR Instruments Inc.

- Specialization: SQUIDs and quantum gravimeters

- Key Focus Areas: Geophysical and gravity field mapping

- Notable Features: Supplies sensors for volcanology, earthquake studies, and civil engineering

- 2024 Revenue: USD 32 million

- Market Share: ~4% in quantum gravimetry

- Global Presence: U.S., Canada, EU (partnered with NASA)

5. Microchip Technology Inc.

- Specialization: Quantum clocks and ultra-precise timing modules

- Key Focus Areas: Defense navigation, space systems, and telecom

- Notable Features: Manufactures Chip Scale Atomic Clocks (CSAC)

- 2024 Revenue: USD 9.4 billion (Quantum segment: ~$150 million)

- Market Share: ~8–10% in quantum clock systems

- Global Presence: 70+ countries, strong U.S. defense links

Leading Trends and Their Impact

- Miniaturization of Quantum Sensors: Enables deployment in mobile and wearable devices.

- Quantum Sensor Integration in Autonomous Vehicles: Enhances GPS-free navigation.

- Adoption in Biomedical Imaging: Improves diagnosis accuracy through MEG and low-field MRIs.

- Quantum Internet & Clock Technologies: Boosts demand for time-synchronization sensors.

- Climate Science Applications: Quantum gravimeters used for ice melt and ocean monitoring.

Successful Quantum Sensor Use Cases Around the World

- UK Gravity Sensor Trials: Used in London for underground mapping during infrastructure projects.

- NASA Magnetometers: Applied on Mars for planetary magnetic field exploration.

- Microchip CSACs: Integrated into portable, GPS-free defense navigation systems.

- EU Quantum Flagship: Accelerated development of commercial quantum accelerometers.

- Japan’s Marine Sensors: Enabled precise light measurement for coral reef conservation.

Global and Regional Market Analysis

North America

- United States: Supported by the National Quantum Initiative and military contracts. DARPA and IARPA driving sensor innovation.

- Canada: Focus on gravity sensors for geophysics and space applications.

Europe

- Germany, UK, France: Driving commercial adoption through the EU Quantum Flagship and national R&D funds.

- Notable Projects: UK’s Quantum Technology Hub for Sensors and Timing; Fraunhofer Institutes’ developments in Germany.

Asia-Pacific

- Japan: Oceanographic applications and national quantum strategy emphasize sensors.

- China: Prioritizing defense and geophysics applications under the 14th Five-Year Plan.

- South Korea: Investments in quantum gyroscopes and time-sensing technologies.

Latin America

- Brazil: Targeting water and mineral exploration using quantum gravimetry.

Middle East & Africa

- Israel: Military use of quantum clocks and accelerometers; growing startup ecosystem.

- UAE and Saudi Arabia: Implementing quantum sensor

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Silicon Photonics Market Revenue, Trends, and Regional Forecasts by 2034