Pharmaceutical Water Market Growth, Key Drivers and Forecast to 2034

Pharmaceutical Water Market Size

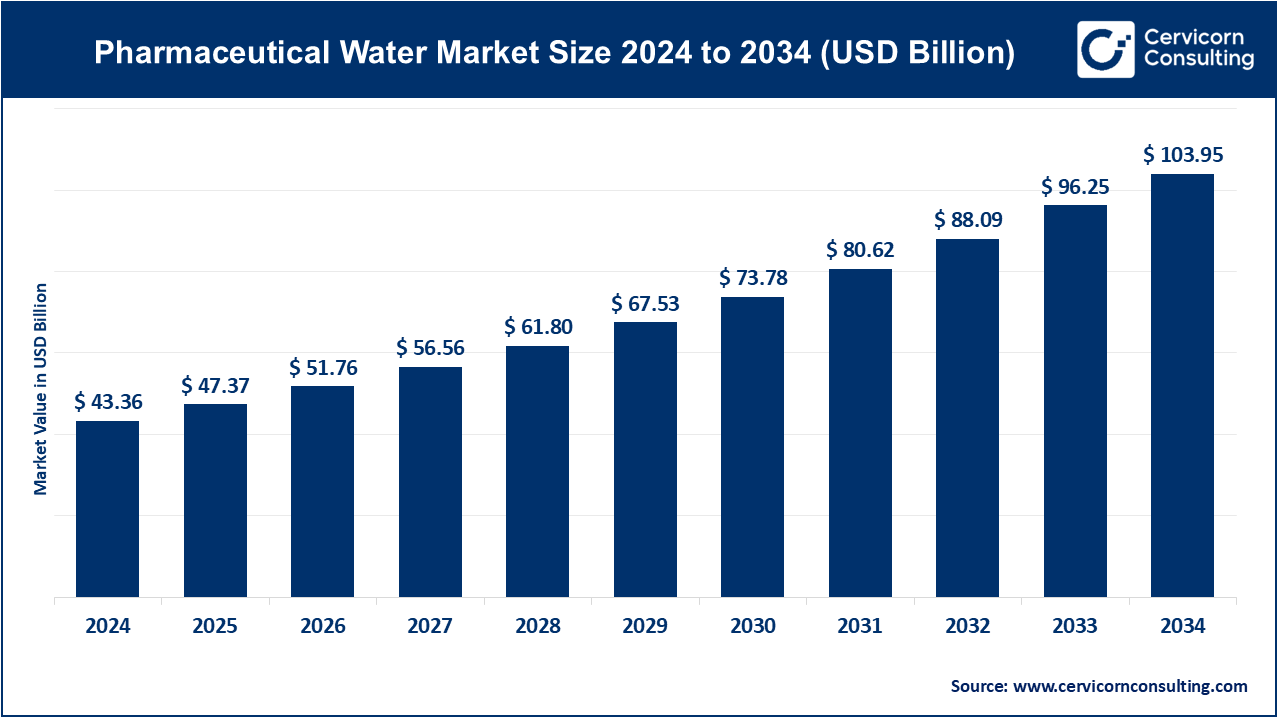

The global pharmaceutical water market was valued at USD 43.36 billion in 2024 and is projected to grow to approximately USD 103.95 billion by 2034, with a compound annual growth rate (CAGR) of 9.26% from 2025 to 2034.

What is the Pharmaceutical Water Market?

The pharmaceutical water market revolves around the production, distribution, and utilization of high-quality water that meets stringent regulatory standards for use in the pharmaceutical industry. Pharmaceutical water is essential for drug manufacturing processes, ranging from cleaning equipment to acting as a solvent in formulations. The market includes various grades of water, such as Purified Water (PW), Water for Injection (WFI), and Sterile Water, each serving specific purposes within pharmaceutical production.

Why is the Pharmaceutical Water Market Important?

Pharmaceutical water is critical to ensuring the safety, efficacy, and quality of pharmaceutical products. Given its direct impact on patient health, the water used in pharmaceutical manufacturing must meet precise standards for purity, free from microbial contamination, and devoid of harmful impurities. Regulatory bodies like the United States Pharmacopeia (USP), European Pharmacopoeia (EP), and World Health Organization (WHO) set stringent guidelines for water used in this industry. As a result, the market for pharmaceutical water is indispensable, driving innovation in water purification technologies and ensuring compliance with international standards.

Growth Factors Driving the Pharmaceutical Water Market

The pharmaceutical water market is experiencing robust growth due to factors such as increasing demand for biopharmaceuticals, stringent regulatory requirements for water purity, advancements in water purification technologies, and the expansion of pharmaceutical manufacturing in emerging economies. Additionally, rising investments in healthcare infrastructure and the growing need for high-quality water in vaccine production have further fueled market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2348

Global Pharmaceutical Water Market: Top Companies

1. Veolia Water Technologies

- Specialization: Water purification systems, advanced filtration technologies.

- Key Focus Areas: Providing turnkey solutions for pharmaceutical water systems, including design, installation, and maintenance.

- Notable Features: Expertise in sustainable and energy-efficient water treatment systems.

- 2024 Revenue (Approx.): $3.5 billion.

- Market Share (Approx.): 15%.

- Global Presence: Operations in over 60 countries, with significant installations in North America, Europe, and Asia-Pacific.

2. SUEZ Water Technologies & Solutions

- Specialization: Comprehensive water management solutions for the pharmaceutical industry.

- Key Focus Areas: Advanced reverse osmosis (RO), electrodeionization (EDI), and membrane technologies.

- Notable Features: Focus on compliance with stringent pharmaceutical water standards.

- 2024 Revenue (Approx.): $2.8 billion.

- Market Share (Approx.): 12%.

- Global Presence: Strong foothold in North America, Europe, and growing presence in Asia and the Middle East.

3. Pall Corporation (Danaher Corporation)

- Specialization: Filtration, separation, and purification solutions.

- Key Focus Areas: Ensuring water quality for injectable drugs and aseptic manufacturing.

- Notable Features: Cutting-edge membrane technology and a robust product portfolio.

- 2024 Revenue (Approx.): $1.9 billion.

- Market Share (Approx.): 10%.

- Global Presence: Operations spanning the Americas, Europe, and Asia-Pacific.

4. Merck KGaA

- Specialization: Laboratory-grade water systems and quality assurance tools.

- Key Focus Areas: Innovation in water testing and compliance monitoring.

- Notable Features: Comprehensive solutions for WFI and PW applications.

- 2024 Revenue (Approx.): $1.5 billion.

- Market Share (Approx.): 8%.

- Global Presence: Active in over 70 countries, with a significant presence in Europe and the United States.

5. Thermo Fisher Scientific Inc.

- Specialization: Laboratory and pharmaceutical-grade water systems.

- Key Focus Areas: Integration of water purification with laboratory workflows.

- Notable Features: Focus on innovation and modular water systems.

- 2024 Revenue (Approx.): $2.2 billion.

- Market Share (Approx.): 9%.

- Global Presence: Operations in over 50 countries, with key markets in North America, Europe, and Asia.

Leading Trends and Their Impact

- Automation and Digitalization:

- Integration of IoT and AI in water purification systems allows for real-time monitoring, predictive maintenance, and enhanced efficiency.

- Impact: Reduced operational costs and improved compliance with stringent regulatory standards.

- Focus on Sustainability:

- Adoption of energy-efficient and environmentally friendly purification technologies.

- Impact: Companies gain competitive advantages and align with global sustainability goals.

- Expansion of Biopharmaceutical Manufacturing:

- Increased demand for pharmaceutical water due to the growth of biologics and biosimilars.

- Impact: Accelerated development of high-capacity water purification systems.

- Stringent Regulatory Standards:

- Heightened scrutiny on water quality by regulatory authorities.

- Impact: Continuous innovation in purification technologies to meet evolving standards.

Successful Examples of Pharmaceutical Water Market Implementation

- Pfizer’s Vaccine Production Facility (USA):

- Utilized Veolia’s advanced water purification system for WFI, ensuring consistent quality during large-scale vaccine production.

- Outcome: Enabled rapid scaling of COVID-19 vaccine manufacturing.

- Novartis’ Biopharmaceutical Plant (Switzerland):

- Implemented SUEZ’s modular EDI system for purified water.

- Outcome: Reduced operational costs and enhanced regulatory compliance.

- AstraZeneca’s Asia-Pacific Expansion:

- Partnered with Pall Corporation for high-purity water systems in new manufacturing plants.

- Outcome: Strengthened regional production capabilities for oncology drugs.

- Merck’s Laboratory Water Solutions (Germany):

- Developed custom water systems for advanced drug testing and research.

- Outcome: Enhanced accuracy and efficiency in pharmaceutical R&D.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- Key Drivers: Advanced healthcare infrastructure, stringent FDA regulations, and significant investments in pharmaceutical manufacturing.

- Government Initiatives:

- The U.S. FDA’s cGMP (Current Good Manufacturing Practices) regulations mandate strict water quality standards.

- Funding programs for biopharmaceutical innovation indirectly boost demand for pharmaceutical water systems.

Europe

- Key Drivers: High demand for biopharmaceuticals and well-established regulatory frameworks.

- Government Initiatives:

- European Medicines Agency (EMA) guidelines emphasize water quality in drug manufacturing.

- Subsidies for sustainable water purification technologies.

Asia-Pacific

- Key Drivers: Rapidly expanding pharmaceutical manufacturing hubs in India and China.

- Government Initiatives:

- India’s “Pharma Vision 2020” promotes the development of world-class pharmaceutical infrastructure.

- China’s “Made in China 2025” strategy includes investments in pharmaceutical innovation.

Latin America

- Key Drivers: Growing demand for generics and increasing investment in healthcare infrastructure.

- Government Initiatives:

- Brazil’s ANVISA regulations focus on water quality compliance for pharmaceutical exports.

Middle East & Africa

- Key Drivers: Expanding healthcare access and pharmaceutical manufacturing in the Gulf Cooperation Council (GCC) countries.

- Government Initiatives:

- Initiatives like Saudi Arabia’s Vision 2030 promote healthcare and pharmaceutical sector growth.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: CAR T-Cell Therapy Market Growth, Key Trends, and Leading Companies (2024-2033)