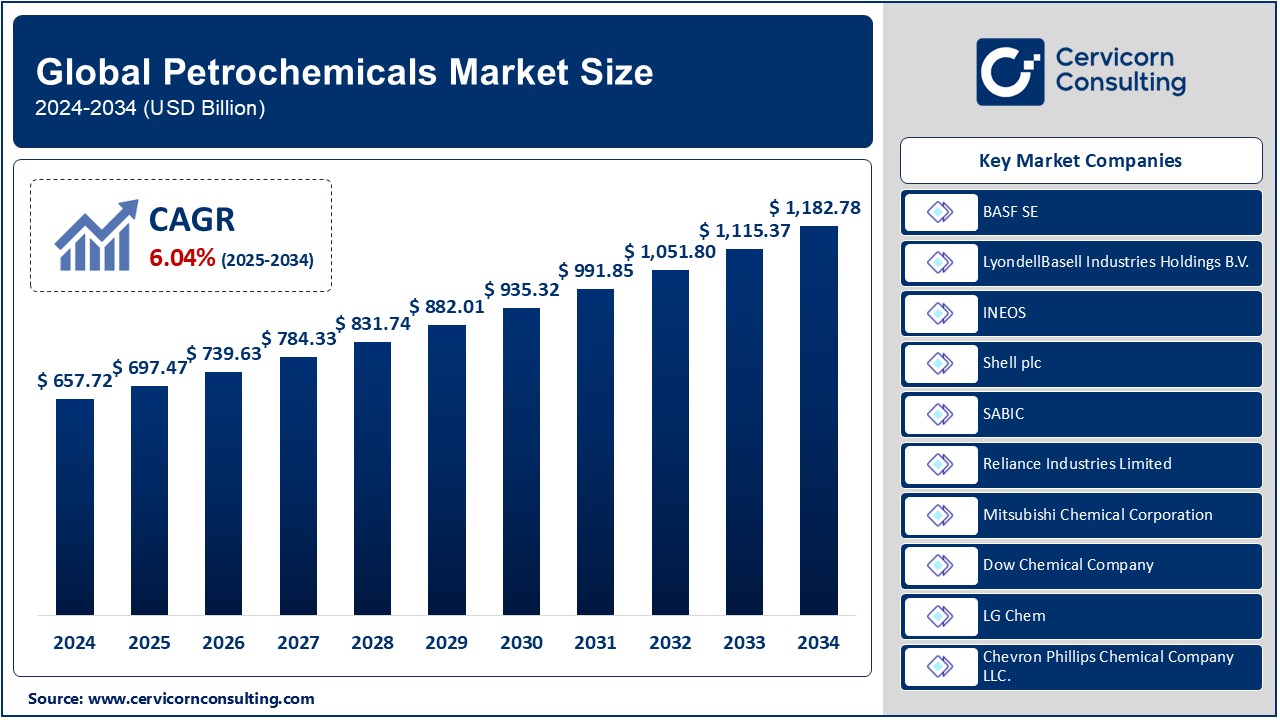

Petrochemicals Market Growth: Top Trends Driving USD 1,182.78 Billion Industry

Petrochemicals Market Size

The gobal petrochemicals market was worth USD 657.72 billion in 2024 and is anticipated to expand to around USD 1,182.78 billion by 2034, registering a compound annual growth rate (CAGR) of 6.04% from 2025 to 2034.

What is the Petrochemicals Market?

The petrochemicals market revolves around the production and distribution of chemicals derived from petroleum and natural gas. These chemicals are the building blocks for a wide range of products, including plastics, synthetic rubber, solvents, fertilizers, and pharmaceuticals. Key petrochemicals include ethylene, propylene, benzene, toluene, and xylene, among others. These chemicals serve as intermediates that power countless industries, from automotive and construction to textiles and packaging.

Why is the Petrochemicals Market Important?

The petrochemicals market is vital for global economic growth and technological advancement. Petrochemicals underpin the development of everyday essentials, ranging from durable consumer goods to cutting-edge medical equipment. The industry’s significance extends to sustainability, where innovations like bio-based and recycled petrochemical solutions are addressing environmental concerns. Moreover, the sector contributes significantly to employment, trade, and GDP in both developed and emerging economies.

Petrochemicals Market Growth Factors

The petrochemicals market is experiencing robust growth driven by factors such as the rising demand for lightweight and durable materials in automotive and aerospace industries, expanding applications in healthcare and packaging, increasing urbanization and industrialization in developing economies, and ongoing technological innovations in feedstock processing and sustainability. Additionally, government incentives for recycling and the adoption of circular economy practices are further propelling the market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2544

Petrochemicals Market Top Companies

- BASF SE

- Specialization: Chemicals, plastics, performance products

- Key Focus Areas: Advanced materials, circular economy, sustainability

- Notable Features: Industry leader in innovation and R&D; comprehensive product portfolio

- 2024 Revenue (approx.): $98 billion

- Market Share (approx.): 8%

- Global Presence: Operates in over 90 countries with manufacturing sites across Europe, Asia, and North America

- LyondellBasell Industries Holdings B.V.

- Specialization: Polyolefins, advanced polymers, and catalysts

- Key Focus Areas: Recycling technologies, bio-based plastics, low-carbon solutions

- Notable Features: Leader in polyethylene and polypropylene production; strong focus on sustainability

- 2024 Revenue (approx.): $55 billion

- Market Share (approx.): 4.5%

- Global Presence: Active in 30+ countries, with major operations in the U.S., Europe, and Asia

- INEOS

- Specialization: Olefins, polymers, and specialty chemicals

- Key Focus Areas: Hydrogen energy, sustainable feedstocks, waste-to-value solutions

- Notable Features: Extensive product diversification; focus on renewable energy integration

- 2024 Revenue (approx.): $65 billion

- Market Share (approx.): 5.2%

- Global Presence: Over 180 sites globally, with strongholds in Europe and the Americas

- Shell plc

- Specialization: Olefins, aromatics, and petrochemical feedstocks

- Key Focus Areas: Low-carbon technologies, renewable chemicals, and decarbonization

- Notable Features: Integration with energy operations; leader in carbon capture and utilization

- 2024 Revenue (approx.): $70 billion

- Market Share (approx.): 6%

- Global Presence: Operations in more than 70 countries with significant investments in Asia-Pacific

- SABIC

- Specialization: Polymers, fertilizers, and industrial chemicals

- Key Focus Areas: Circular economy, advanced recycling, energy efficiency

- Notable Features: State-backed innovation; pioneering efforts in chemical recycling

- 2024 Revenue (approx.): $50 billion

- Market Share (approx.): 4%

- Global Presence: Extensive footprint in the Middle East, Asia, Europe, and North America

Leading Trends and Their Impact

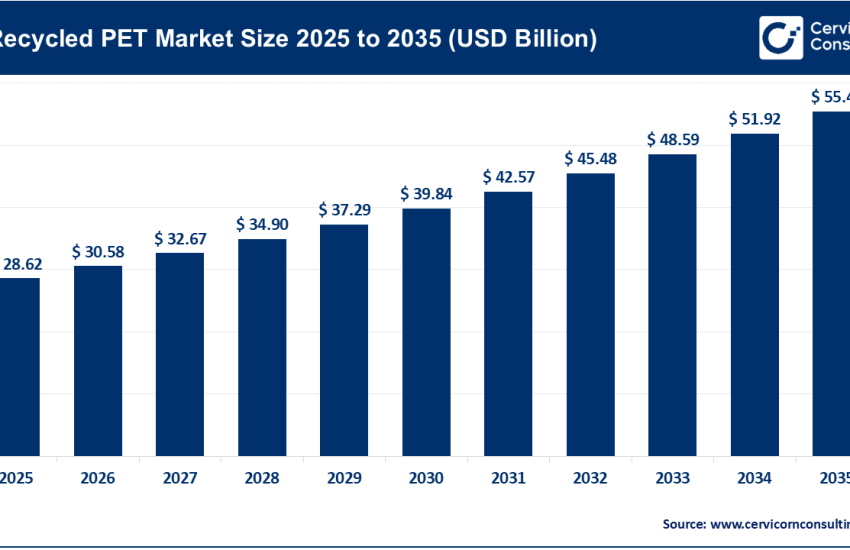

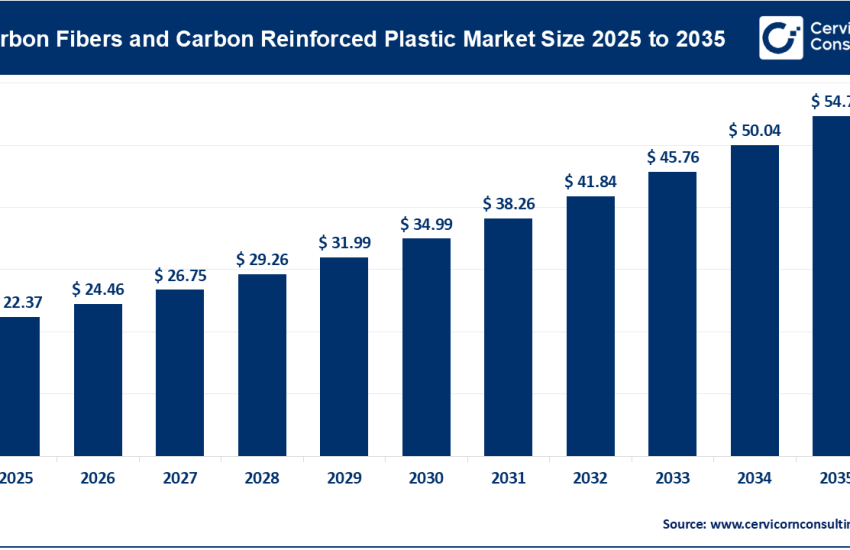

- Circular Economy and Recycling:

- The shift towards sustainable practices is driving innovations in chemical recycling and bio-based solutions. Companies like SABIC and LyondellBasell are leading the charge with advanced recycling facilities that transform plastic waste into high-quality raw materials. This trend is reducing landfill waste and mitigating dependency on fossil-based feedstocks.

- Digitalization and Automation:

- Digital technologies such as AI, IoT, and predictive analytics are optimizing petrochemical operations. Shell and BASF SE are leveraging these tools to enhance operational efficiency, reduce downtime, and minimize emissions. Automation is enabling precise monitoring and control of complex processes, improving safety and profitability.

- Feedstock Diversification:

- The industry is exploring alternative feedstocks such as bioethanol, waste plastics, and hydrogen. INEOS’ focus on renewable feedstocks and BASF’s bio-based solutions exemplify this trend. This diversification reduces reliance on conventional petroleum and contributes to lowering the carbon footprint.

- Government Regulations and Policies:

- Stricter environmental regulations are compelling companies to invest in cleaner technologies. Initiatives like the European Green Deal and the U.S. Inflation Reduction Act are reshaping the petrochemicals market by incentivizing low-carbon and circular economy practices.

- Regional Expansion in Asia-Pacific:

- Asia-Pacific is emerging as a major growth hub due to increasing industrialization, urbanization, and demand for consumer goods. Companies like SABIC and LyondellBasell are expanding their footprints in the region to capitalize on the booming markets of China, India, and Southeast Asia.

Successful Examples of Petrochemicals Market Around the World

- China’s Petrochemical Hub:

- China is home to some of the world’s largest petrochemical complexes, such as the ZPC Petrochemical Park. These hubs integrate refining and chemical operations to produce high-value chemicals efficiently, catering to both domestic and global markets.

- Saudi Arabia’s Petrochemical Clusters:

- SABIC’s operations in Saudi Arabia exemplify the integration of petrochemicals with energy production. The Kingdom’s Vision 2030 emphasizes diversifying the economy through downstream petrochemical investments, boosting production and global competitiveness.

- United States’ Shale Gas Revolution:

- The U.S. has leveraged its abundant shale gas reserves to establish a competitive edge in ethylene production. Companies like Shell and LyondellBasell have invested heavily in ethane crackers, producing low-cost petrochemicals for global exports.

- Europe’s Sustainability Leadership:

- European players like BASF SE are setting benchmarks in sustainability by adopting carbon-neutral practices and advanced recycling. BASF’s ChemCycling project is a notable example of turning plastic waste into valuable feedstocks.

Regional Analysis: Government Initiatives and Policies Shaping the Market

- North America:

- The U.S. government’s support for the shale gas industry has bolstered petrochemical production, with policies favoring investments in ethane crackers and downstream facilities. Tax incentives and trade agreements are also enhancing the global competitiveness of American petrochemical exports.

- Asia-Pacific:

- Governments in China and India are promoting investments in petrochemical clusters through policy reforms and subsidies. China’s “Made in China 2025” initiative and India’s Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) policy aim to establish the region as a global petrochemical hub.

- Europe:

- The European Union’s Green Deal and Emission Trading System are pushing the industry towards decarbonization and circular economy practices. Subsidies for green hydrogen and bio-based chemicals are fostering innovation and sustainability in petrochemicals.

- Middle East and Africa:

- Governments in Saudi Arabia, Qatar, and the UAE are diversifying their economies by investing in downstream petrochemical projects. State-backed companies like SABIC are driving regional growth through partnerships, advanced technologies, and export-oriented strategies.

- Latin America:

- Brazil’s investments in bio-based chemicals, supported by government policies promoting renewable energy and feedstocks, are gaining momentum. Petrochemical firms are leveraging the region’s abundant biomass resources to produce sustainable chemicals.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Green Methanol Market Overview: Growth, Trends, and Key Companies by 2033