On-Demand Healthcare Market Key Players, Trends, and Global Outlook by 2034

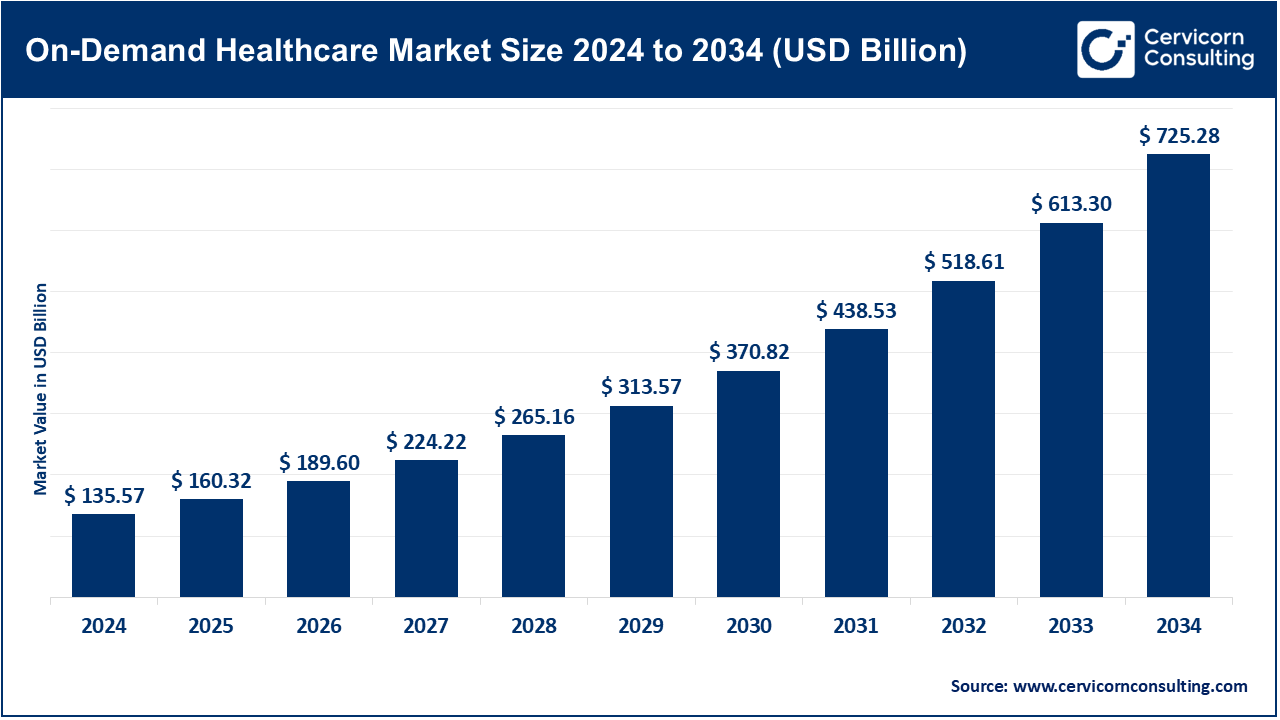

On-Demand Healthcare Market Size

What is the on-demand healthcare market?

The on-demand healthcare market encompasses digitally enabled, immediate-access health services delivered when and where a patient needs them—typically via mobile apps, web platforms, or connected devices. Core offerings include virtual urgent care, on-demand primary/behavioral care, e-prescriptions, asynchronous messaging, AI triage, remote patient monitoring (RPM), at-home diagnostics, and logistics that bring medications, tests, or clinicians (home visits) to the patient. This market sits at the intersection of telehealth, digital front doors, retail health, and last-mile clinical logistics, and it increasingly powers hybrid care models embedded within health systems, employers, and payers. Industry trackers often use telehealth market size as a proxy for revenue scale, with estimates putting the global market around $100–$135 billion in 2024, expanding rapidly through the decade.

Why it matters

On-demand care is now foundational infrastructure for modern health systems because it:

- Expands access (geography, mobility, wait times), especially for rural/underserved populations.

- Matches consumer expectations set by instant digital services in other industries.

- Reduces total cost of care by shifting lower-acuity episodes away from ERs and enabling early interventions via RPM/virtual wards.

- Eases workforce strain by optimizing clinician time with asynchronous workflows and AI-assisted triage.

- Improves outcomes & experience when integrated with longitudinal, team-based care and EHRs.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2716

Snapshot of utilization & permanence

Post-pandemic, telehealth use has stabilized at many multiples of pre-2020 levels across specialties, and policymakers in major markets have made significant extensions or permanent changes to virtual-care reimbursement and rules—clear signals that on-demand care is here to stay.

Growth Factors

Market growth is propelled by a convergence of demand, supply, policy, and technology: consumers expect frictionless access; clinicians seek flexible, safer workflows; payers and employers want steerage to lower-cost settings; governments have extended or formalized telehealth rules and benefits, cementing reimbursement and licensure pathways; health systems deploy virtual wards and hospital-at-home to increase capacity and lower carbon impact; AI (triage, ambient scribing, navigation) reduces administrative load and shortens time-to-care; broadband and smartphone penetration widen addressable populations; chronic disease burden and aging increase need for continuous, remote support; retail and tech entrants intensify competition and consumer awareness; and digital identity/data-sharing initiatives gradually improve interoperability and strengthen on-demand care economics.

On-Demand Healthcare Market: Top Companies (Profiles & 2024 Stats)

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue | Indicative Market Share | Global Presence |

|---|---|---|---|---|---|---|

| Teladoc Health, Inc. | Virtual primary & urgent care; chronic/behavioral; expert medical opinions | Enterprise payer/employer contracts; chronic care management; mental health | Integrated platform (Primary360), Best Doctors second opinions; chronic care devices | $2.57B (FY2024) | ~1.9%–2.5% | Multinational; medical opinions in 100+ countries |

| Amwell (American Well Corp.) | White-label virtual care infrastructure for health systems & payers | Digital front door; automated care programs; care navigation | Converge platform; EHR integration | $254.4M (FY2024) | ~0.19%–0.24% | Primarily U.S.; international via partners |

| MDLIVE, Inc. (Evernorth/Cigna) | Virtual urgent care, behavioral health, dermatology | Payer-integrated benefits; 24/7 urgent care | Part of Cigna’s Evernorth; national clinician network | Not disclosed | N/A | U.S. nationwide network via Evernorth plans |

| Doctor On Demand, Inc. (Included Health) | Virtual primary/urgent/behavioral care for employers & health plans | Hybrid care navigation, LGBTQ+ programs, second opinions | Integrated with Included Health navigation | Not disclosed (profitable in 2024) | N/A | U.S. national; employer/payer clients |

| HealthTap, Inc. | Virtual primary care membership & teleconsults | Subscription PCP, AI symptom checker | Consumer subscriptions and payer integrations | Not disclosed | Very small share | U.S. focus; global consumer reach |

Leading Trends—and How They’re Reshaping the Market

- Virtual-first & hybrid care becomes the default

Health systems and payers are standardizing a virtual-first entry point for many conditions, escalating to in-person as needed. Utilization has stabilized well above pre-pandemic baselines, and virtual wards/hospital-at-home extend this logic to higher acuity. - Virtual wards & hospital-at-home

Countries such as the U.K. have scaled virtual ward “beds” with national reporting. Studies suggest lower carbon footprint vs. inpatient beds and potential cost savings. Impact: increased capacity & sustainability. - Policy normalization

The U.S. extended Medicare telehealth flexibilities into 2025; Australia made telehealth reimbursement permanent; Singapore issued licensing standards under HCSA; and the EU advanced the European Health Data Space. Reimbursement certainty unlocks scaling, while clearer guardrails enhance safety and data use. - AI-everywhere in clinical ops

From triage chatbots and ambient scribing to navigation and risk flagging, AI is lowering clinician workload. Impact: higher productivity and faster cycle times, though governance remains critical. - Employer & payer integration

Vendors increasingly sell outcomes—absenteeism reduction, steerage away from ER, chronic-care improvements—rather than visit volume. Impact: stronger value-based contracts. - Retail & platform entrants

Retailers, pharmacy chains, and tech players expand direct-to-consumer funnels. Impact: more convenience and price transparency, pressuring legacy networks to improve UX.

Successful Examples Around the World

- India – eSanjeevani (National Telemedicine Service). The world’s largest government telemedicine platform has delivered hundreds of millions of consultations, expanding access especially in rural areas.

- United Kingdom – NHS Virtual Wards. England tracks monthly virtual-ward capacity nationally; early evidence points to capacity, experience, and environmental benefits.

- China – Ping An Good Doctor. One of the largest digital-health platforms reported profitability in 2024 and robust user growth.

- Nordics – KRY/LIVI. A Europe-based provider that operates within public health systems, reporting double-digit growth with improving margins.

- United States – Hospital-at-Home Programs. Large health systems use RPM kits and Medicare-supported waivers to deliver acute care at home, reducing admissions and length of stay.

- India – Telangana Digital Telemedicine. State-level telemedicine program with strong uptake in rural and tribal communities.

Regional Landscape: Government Initiatives & Policies Shaping the Market

United States

Medicare telehealth flexibilities extended into 2025 allow the home as an originating site, audio-only options, and Hospital-at-Home waivers. Telehealth use remains far above pre-pandemic levels, anchoring its permanence in healthcare delivery.

European Union & U.K.

The European Health Data Space (EHDS), expected to phase in after 2024, aims to enable cross-border health-data use, vital for virtual care interoperability. In the U.K., NHS Virtual Wards are rapidly scaling, with thousands of virtual “beds” now tracked as part of national capacity.

Asia-Pacific

- Australia: Permanent Medicare telehealth reimbursement items anchor access in primary and specialist care.

- Singapore: HCSA circulars mandate clear professional and advertising standards for telemedicine.

- India: eSanjeevani national platform plus state-led programs like Telangana’s strengthen access in underserved regions.

- China: Ping An and other super-app models combine online/offline delivery with profitable growth.

Latin America

- Brazil: Law No. 14,510/2022 permanently authorizes and regulates telehealth across professions and systems, accelerating adoption in a country with vast healthcare access gaps.

Competitive Moves & Company Notes (2024)

- Teladoc Health. Continued multibillion-dollar revenue with a focus on chronic care, expert opinions, and global expansion via Best Doctors.

- Amwell. Migrated clients to its Converge platform, emphasizing automation and integration with provider EHRs.

- MDLIVE (Evernorth). Operates as part of Cigna’s ecosystem, deeply integrated into payer offerings.

- Doctor On Demand (Included Health). Reached profitability in 2024, offering navigation + virtual care for employers and health plans.

- HealthTap. Focuses on a membership-driven virtual primary-care model.

Impacts That Matter

- Access & equity: National and state-level platforms prove telemedicine’s ability to bridge urban–rural divides.

- Capacity & cost: Virtual wards provide system relief while lowering costs and carbon emissions.

- Quality & safety: Utilization stabilizes without unnecessary volume spikes; clear licensing standards improve trust.

- Interoperability & data liquidity: Platforms integrated with EHRs and policies like EHDS enable connected, data-rich care journeys.

Practical Takeaways for Strategy Teams

- Anchor on integration, not video. Buyers want workflow fit, automation, and measurable outcomes, not just virtual visits.

- Treat policy as product-market fit. Markets with clear telehealth rules—U.S., Australia, Singapore, Brazil—are better for scaling.

- Design for hybrid. Build pathways that start virtually but integrate at-home diagnostics and in-person escalation.

- Invest in AI governance. Productivity gains are clear, but safety, bias mitigation, and transparency are critical to adoption.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Internet of Medical Things (IoMT) Market Growth Drivers, Trends, Key Players & Regional Insights