Next-Generation Sequencing in Precision Medicine Market Insights, Trends, and Forecast by 2034

Next-Generation Sequencing in Precision Medicine Market Size

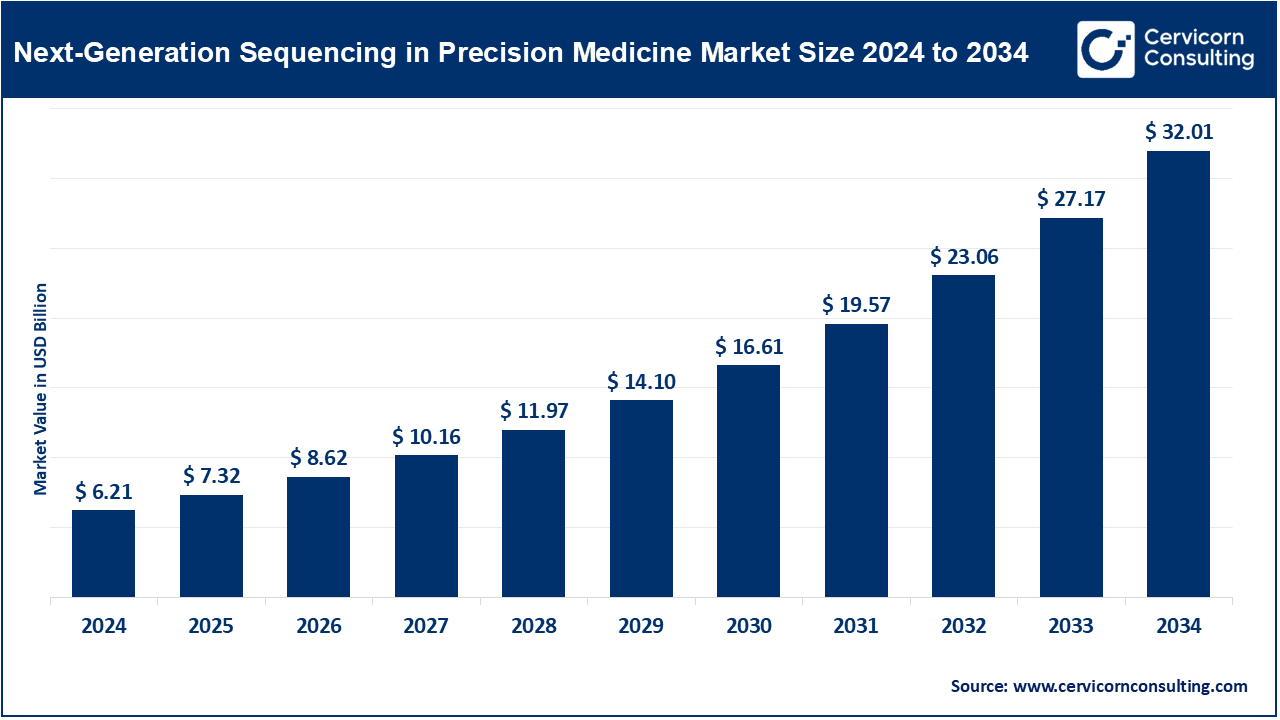

The global next-generation sequencing in precision medicine market size was worth USD 6.21 billion in 2024 and is anticipated to expand to around USD 32.01 billion by 2034, registering a compound annual growth rate (CAGR) of 17.82% from 2025 to 2034.

What is the Next-Generation Sequencing (NGS) in Precision Medicine Market?

Next-Generation Sequencing (NGS) in precision medicine refers to the application of high-throughput DNA sequencing technologies to tailor disease prevention, diagnosis, and treatment based on individual genetic profiles. This market encompasses a suite of advanced sequencing platforms, bioinformatics tools, reagents, and services that enable comprehensive genomic analysis to guide personalized medical decisions. In precision medicine, NGS is primarily used for oncological applications, rare disease diagnosis, pharmacogenomics, and inherited disorders. The market includes both hardware and software components, as well as clinical and research-based services that facilitate real-time and retrospective insights into a patient’s genome.

Why is Next-Generation Sequencing in Precision Medicine Important?

NGS has revolutionized genomics and personalized healthcare by enabling comprehensive, accurate, and cost-effective sequencing of entire genomes or specific gene panels. Its significance in precision medicine lies in its ability to uncover actionable genetic mutations, predict disease susceptibility, guide targeted therapies, and monitor disease progression or recurrence. NGS allows clinicians to tailor therapies based on a patient’s unique genetic makeup, maximizing efficacy while minimizing adverse effects. This is especially critical in oncology, where tumor profiling informs immunotherapies and chemotherapy selections. Furthermore, in rare and undiagnosed diseases, NGS accelerates diagnosis and enables earlier interventions. It also plays a pivotal role in pharmacogenomics, where it helps identify genetic markers that predict drug response.

Market Growth Factors

The growth of the Next-Generation Sequencing in precision medicine market is driven by the increasing prevalence of chronic and genetic diseases, the declining cost of sequencing, rapid technological advancements in bioinformatics and sequencing platforms, rising adoption of personalized treatment strategies, and strong government support through genomics initiatives and funding programs. Additional factors include the expansion of clinical applications in oncology and infectious diseases, growing awareness among healthcare providers and patients about personalized therapies, the integration of artificial intelligence in genomic analysis, and the growing ecosystem of public-private partnerships fostering innovation. Regulatory support for companion diagnostics and increasing investment by biopharma companies to develop precision therapeutics also significantly contribute to the market’s momentum.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2669

Top Companies in the Next-Generation Sequencing in Precision Medicine Market

1. Illumina, Inc.

- Specialization: Sequencing platforms, consumables, and bioinformatics

- Key Focus Areas: WGS, WES, targeted sequencing, oncology-based diagnostics

- Notable Features: Comprehensive platforms (NovaSeq, NextSeq, MiSeq)

- 2024 Revenue: $4.8 billion (est.)

- Market Share: Over 60%

- Global Presence: 140+ countries

2. Thermo Fisher Scientific

- Specialization: Integrated genomic solutions

- Key Focus Areas: Oncology, reproductive health, infectious disease

- Notable Features: Ion Torrent, GeneStudio, cloud bioinformatics

- 2024 Revenue: $3.2 billion (life sciences)

- Market Share: 15–20%

- Global Presence: 80+ countries

3. Roche Sequencing Solutions

- Specialization: Clinical-grade sequencing technologies

- Key Focus Areas: Oncology, companion diagnostics, infectious diseases

- Notable Features: Foundation Medicine, Genia Technologies

- 2024 Revenue: $2.4 billion (NGS diagnostics)

- Market Share: 10–12%

- Global Presence: Europe, Asia-Pacific, North America

4. Danaher Corporation

- Specialization: Molecular diagnostics, sequencing, lab automation

- Key Focus Areas: Infectious diseases, oncology, translational research

- Notable Features: Integrated DNA Technologies, Cepheid

- 2024 Revenue: $1.5 billion (genomics tools)

- Market Share: 5–8%

- Global Presence: 70+ countries

5. QIAGEN N.V.

- Specialization: Sample prep, targeted sequencing, bioinformatics

- Key Focus Areas: Human genetics, oncology, liquid biopsy

- Notable Features: QIAseq, partnership with Illumina

- 2024 Revenue: $1.3 billion (genomics)

- Market Share: 4–6%

- Global Presence: 100+ countries

Leading Trends and Their Impact

- AI Integration: Speeds up variant detection, boosts accuracy

- Single-Cell Sequencing: Helps decode tumor heterogeneity

- Liquid Biopsies: Enables non-invasive cancer monitoring

- Cloud-Based Platforms: Facilitates data sharing & remote access

- Point-of-Care Sequencing: Expands access in remote settings

Successful Examples Around the World

United States: The Cancer Genome Atlas (TCGA)

A collaborative effort by NIH and NCI to profile genetic mutations in over 30 cancers, leading to new biomarkers and therapies.

United Kingdom: 100,000 Genomes Project

Uses NGS to diagnose rare diseases and cancer, creating Genomics England and fueling NHS integration of genomics.

China: China Precision Medicine Initiative

Backed by $9B in funding, this program aims to integrate NGS into national healthcare and early disease detection efforts.

Japan: RIKEN Genomic Initiatives

Uses NGS to study genetic disorders and guide therapeutic choices in aging populations.

India: GenomeIndia Project

Government-funded initiative to map Indian genomes for disease detection, public health, and tailored treatments.

Regional Analysis & Government Initiatives

North America

- Market Share: 45%

- Drivers: High R&D, clinical infrastructure

- Initiatives: All of Us Program, PMI

Europe

- Market Share: 25%

- Programs: Genomic Medicine France 2025, NHS Genomics England

Asia-Pacific

- Growth Rate: CAGR 15%+

- Key Initiatives: China Precision Medicine Initiative, GenomeIndia

Latin America

- Market Share: <5%

- Focus: Oncology, infectious disease via NGS

Middle East & Africa

- Trends: Population genomics in UAE, H3Africa in South Africa

Global Adoption Patterns

Developed nations lead in innovation and regulation, while emerging economies are increasingly focusing on rare disease detection and infectious disease diagnostics. Key global partnerships such as ICGC and G2MC continue to shape equitable access to NGS-based precision medicine.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Red Biotechnology Market Growth Forecast, Trends, and Top Companies by 2034