Next-Generation Sequencing in Drug Discovery Market Top Companies, Trends & Global Outlook by 2034

Next-Generation Sequencing in Drug Discovery Market Size

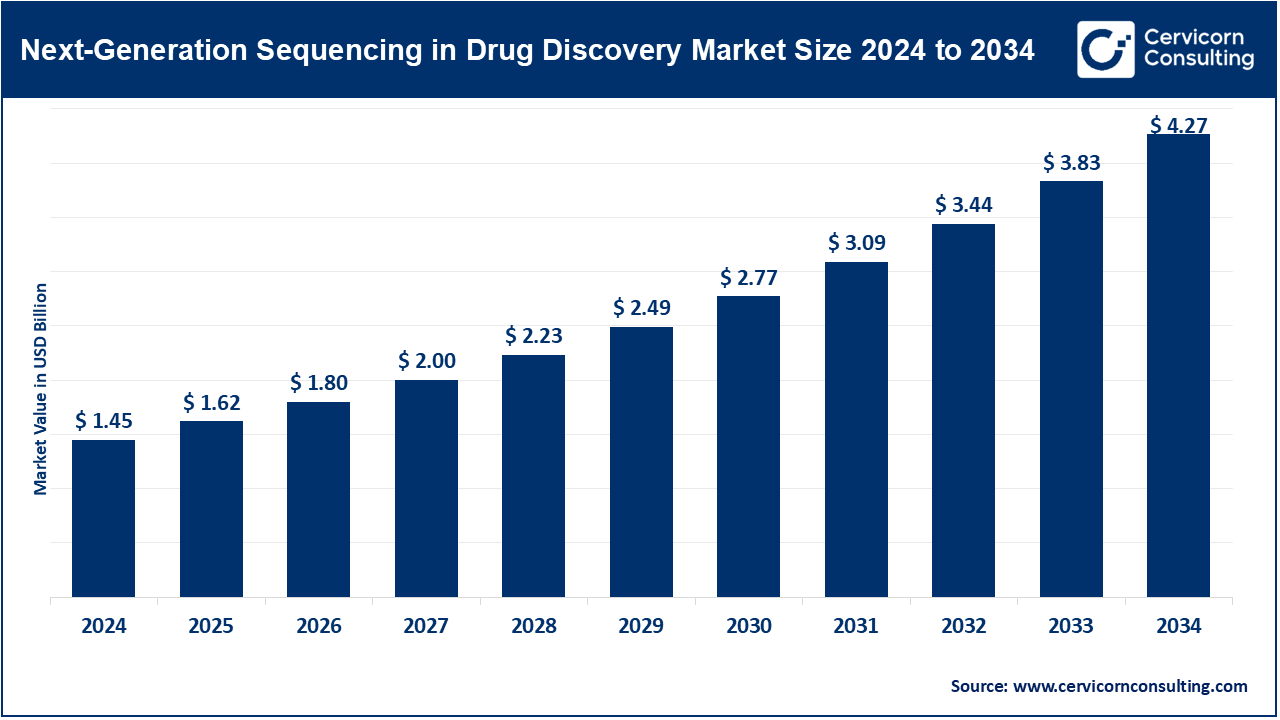

The global next-generation sequencing in drug discovery market size was worth USD 1.45 billion in 2024 and is anticipated to expand to around USD 4.27 billion by 2034, registering a compound annual growth rate (CAGR) of 18.3% from 2025 to 2034.

What is the Next-Generation Sequencing (NGS) in Drug Discovery Market?

Next-Generation Sequencing (NGS) in drug discovery refers to the application of advanced high-throughput sequencing technologies in identifying, validating, and developing novel therapeutics. It enables the rapid sequencing of entire genomes or targeted regions, offering deep insights into disease mechanisms, genetic variations, and responses to drugs. NGS technologies have revolutionized the way pharmaceutical and biotechnology companies understand disease pathways and identify potential drug targets. This has made it a cornerstone in precision medicine, especially in oncology, rare genetic disorders, and infectious diseases.

Why is NGS in Drug Discovery Important?

NGS offers an unparalleled depth and breadth of genetic information, which is critical for the success of drug discovery programs. By enabling large-scale, cost-effective genomic analyses, NGS enhances the ability to:

- Identify disease-related biomarkers

- Stratify patient populations

- Predict drug resistance mechanisms

- Reduce clinical trial failure rates

- Accelerate time-to-market for new therapeutics

This has made NGS essential not only for R&D but also for regulatory approval processes and clinical diagnostics. The growing shift towards personalized medicine and pharmacogenomics has amplified its role across the drug development value chain.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2678

Growth Factors Driving the Market

The global NGS in drug discovery market is experiencing robust growth, fueled by a combination of factors such as increasing investments in genomics research, a rising burden of chronic and rare diseases, technological advancements in sequencing platforms, declining sequencing costs, and expanding applications in personalized medicine. Governments and private institutions are investing heavily in genomic research initiatives, which further supports the adoption of NGS technologies in pharmaceutical and biotechnology industries.

Top Companies in the NGS in Drug Discovery Market

1. Illumina, Inc.

- Specialization: Sequencing platforms, consumables, and genomic data analysis

- Key Focus Areas: Oncology, immunology, reproductive health, and infectious diseases

- Notable Features: NovaSeq, NextSeq, and cloud-based bioinformatics

- 2024 Revenue (Est.): ~$4.8 billion

- Market Share: ~60%

- Global Presence: North America, Europe, Asia-Pacific, Latin America

2. Thermo Fisher Scientific Inc.

- Specialization: Genetic sequencing instruments, reagents, and informatics

- Key Focus Areas: Clinical research, companion diagnostics, oncology

- Notable Features: Ion Torrent platform, Oncomine assays

- 2024 Revenue (Est.): ~$3.6 billion

- Market Share: ~20–25%

- Global Presence: 180+ countries

3. Agilent Technologies, Inc.

- Specialization: Genomics, lab automation, analytical instrumentation

- Key Focus Areas: Target enrichment, gene expression, cancer genomics

- Notable Features: SureSelect, custom panels, reagents

- 2024 Revenue (Est.): ~$1.6 billion

- Market Share: ~12% (target enrichment)

- Global Presence: North America, Europe, Asia-Pacific

4. F. Hoffmann-La Roche Ltd. (Roche)

- Specialization: Molecular diagnostics, sequencing systems, personalized healthcare

- Key Focus Areas: Oncology, immunotherapy

- Notable Features: AVENIO oncology panels, NimbleGen

- 2024 Revenue (Est.): ~$1.4 billion

- Market Share: ~10–12%

- Global Presence: Europe, Asia, North America

5. QIAGEN N.V.

- Specialization: Sample prep, NGS, molecular diagnostics

- Key Focus Areas: Infectious diseases, oncology, human genetics

- Notable Features: QIAseq panels, GeneReader, companion diagnostics

- 2024 Revenue (Est.): ~$1.1 billion

- Market Share: ~8–10%

- Global Presence: Europe, Asia-Pacific, Americas

Leading Trends and Their Impact

- AI and Machine Learning: Transforming big data from sequencing into actionable insights for drug development.

- Cloud-based Analytics: Enables faster genomic analysis and collaboration.

- Single-Cell Sequencing: Key for immuno-oncology and cellular therapies.

- Portable Sequencing: Enabling NGS in clinical and remote settings.

- Companion Diagnostics: Personalized therapies driven by genomic profiling.

Successful Examples of NGS in Drug Discovery

- Foundation Medicine (Roche): Comprehensive tumor profiling for targeted therapies.

- Genentech + Illumina: Whole-genome sequencing for novel oncology targets.

- Regeneron Genetics Center: Over a million samples used to identify rare therapeutic targets.

- NIH All of Us: Population-wide sequencing to advance personalized medicine.

Global Regional Analysis and Government Initiatives

North America

- Market Share: ~40%

- Initiatives: NIH’s All of Us, Cancer Moonshot

- Strengths: Strong funding, FDA support, high adoption in pharma

Europe

- Key Markets: Germany, UK, France

- Programs: Horizon Europe, UK Genomics Strategy

- Focus: Ethical genomics, rare disease therapeutics

Asia-Pacific

- Fastest Growth: Driven by China, Japan, India

- Government Support: China Precision Medicine Initiative, Genome India

- Trends: Population genomics, low-cost sequencing platforms

Latin America & Middle East

- Emerging Players: Brazil, UAE, Saudi Arabia

- Challenges: Infrastructure gaps, cost barriers

- Opportunities: Private investments, regional genomic collaborations

Government Policies Shaping the Market

- Data Regulations: GDPR, HIPAA ensure secure use of patient genomic data

- Public Funding: National genome projects accelerate drug target discovery

- Reimbursement Models: Precision medicine coverage boosts adoption

- Regulatory Fast-Track: FDA & EMA supporting genomics-based companion diagnostics

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Next-Generation Sequencing in Precision Medicine Market Insights, Trends, and Forecast by 2034