Next-Generation IVD Market Trends, Market Forecast & Leading Companies by 2034

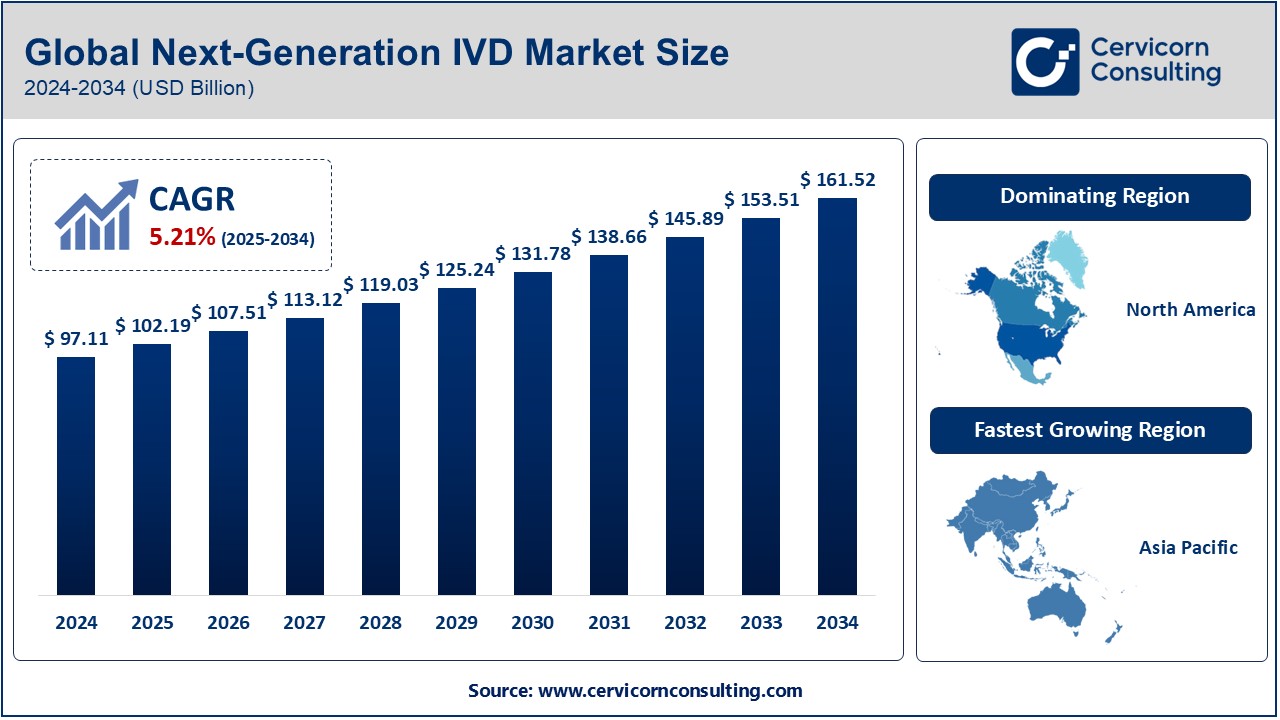

Next-Generation IVD Market Size

The global next-generation IVD market was worth USD 97.11 billion in 2024 and is anticipated to expand to around USD 161.52 billion by 2034, registering a compound annual growth rate (CAGR) of 5.21% from 2025 to 2034.

Next-Generation IVD Market Growth Factors

The next-generation in vitro diagnostics (IVD) market is witnessing significant growth due to increasing demand for precision medicine, technological advancements in molecular diagnostics, rising prevalence of chronic and infectious diseases, growing adoption of automation and digitalization in laboratories, and supportive government initiatives promoting early disease detection. Additionally, the COVID-19 pandemic has accelerated the need for advanced IVD solutions, further boosting market expansion.

What is the Next-Generation IVD Market?

Next-generation in vitro diagnostics (IVD) refers to advanced diagnostic technologies and methodologies that improve the accuracy, speed, and efficiency of disease detection. These diagnostics encompass molecular diagnostics, next-generation sequencing (NGS), digital pathology, liquid biopsy, and point-of-care testing. They leverage cutting-edge innovations like artificial intelligence (AI), big data analytics, and automation to enhance patient outcomes and streamline laboratory workflows. These advancements contribute to early diagnosis, personalized treatment, and real-time monitoring of diseases.

Why is it Important?

The next-generation IVD market is crucial as it revolutionizes disease diagnosis and management. It plays a vital role in early detection, reducing healthcare costs, and improving patient survival rates. Advanced IVD technologies enable personalized medicine, which tailors treatments to individual genetic profiles, leading to better therapeutic outcomes. Moreover, the integration of digital tools enhances efficiency and minimizes human error in laboratories. With the rising global burden of chronic diseases, infectious outbreaks, and cancer, next-generation IVD solutions are pivotal for proactive healthcare management.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2517

Next-Generation IVD Market Top Companies

Abbott

- Specialization: Molecular diagnostics, point-of-care testing, immunoassays, clinical chemistry

- Key Focus Areas: Infectious disease detection, chronic disease monitoring, rapid diagnostic solutions

- Notable Features: Wide product portfolio, strong R&D investments, AI-driven diagnostics

- 2024 Revenue (approx.): $45 billion

- Market Share (approx.): 12%

- Global Presence: Strong presence in North America, Europe, and Asia-Pacific

bioMérieux SA

- Specialization: Microbiology, molecular diagnostics, immunoassays

- Key Focus Areas: Infectious disease diagnostics, antimicrobial resistance testing, food safety testing

- Notable Features: Expertise in rapid pathogen detection, AI-driven diagnostic platforms

- 2024 Revenue (approx.): $4.2 billion

- Market Share (approx.): 5%

- Global Presence: Europe, North America, Asia-Pacific, Latin America

QuidelOrtho Corporation

- Specialization: Immunoassays, molecular diagnostics, clinical chemistry

- Key Focus Areas: COVID-19, flu diagnostics, cardiovascular biomarkers

- Notable Features: Leader in rapid point-of-care diagnostics

- 2024 Revenue (approx.): $3.5 billion

- Market Share (approx.): 4%

- Global Presence: North America, Europe, Asia-Pacific

Siemens Healthineers AG

- Specialization: Clinical chemistry, molecular diagnostics, immunoassays

- Key Focus Areas: Cancer diagnostics, infectious diseases, digital healthcare solutions

- Notable Features: AI-powered imaging, integrated laboratory solutions

- 2024 Revenue (approx.): $25 billion

- Market Share (approx.): 10%

- Global Presence: Worldwide operations, strong in Europe and North America

Bio-Rad Laboratories, Inc.

- Specialization: Molecular diagnostics, immunoassays, clinical chemistry

- Key Focus Areas: Genetic testing, infectious diseases, proteomics

- Notable Features: Advanced automation, high-throughput testing

- 2024 Revenue (approx.): $3 billion

- Market Share (approx.): 3%

- Global Presence: North America, Europe, Asia-Pacific

Leading Trends and Their Impact

1. AI and Machine Learning Integration

AI-driven diagnostic tools enhance accuracy and efficiency in disease detection and prognosis, reducing the turnaround time for test results and enabling predictive analytics for better healthcare decisions.

2. Rise of Point-of-Care Testing (POCT)

The increasing demand for decentralized diagnostics and home-based testing solutions is driving innovation in portable and rapid diagnostic devices, allowing real-time disease monitoring.

3. Growth in Liquid Biopsy Technologies

Non-invasive liquid biopsies are revolutionizing cancer diagnostics, enabling early detection and monitoring of tumor progression with high sensitivity and specificity.

4. Next-Generation Sequencing (NGS) for Personalized Medicine

NGS advancements are accelerating the adoption of precision medicine, allowing for targeted therapies based on a patient’s genetic makeup.

5. Digital Pathology and Automation

The digitization of pathology slides and automated laboratory workflows are enhancing diagnostic accuracy and efficiency, particularly in oncology and infectious disease testing.

Successful Examples of Next-Generation IVD Market Around the World

United States

Abbott and Siemens Healthineers lead in AI-powered diagnostics and home-based testing kits, significantly improving patient outcomes and operational efficiency in hospitals.

Europe

bioMérieux’s antimicrobial resistance testing has enhanced infection control in hospitals, reducing the spread of multidrug-resistant bacteria.

China

The rapid adoption of digital pathology and molecular diagnostics has improved cancer detection rates, driven by government initiatives and local biotech investments.

India

QuidelOrtho’s point-of-care COVID-19 tests played a crucial role in mass testing strategies, aiding public health responses during the pandemic.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- The U.S. government has expanded funding for precision medicine and AI-driven diagnostics through agencies like the National Institutes of Health (NIH) and the Food and Drug Administration (FDA).

- Canada’s investment in AI-powered medical research is fostering innovation in diagnostic solutions.

Europe

- The European Union’s In Vitro Diagnostic Regulation (IVDR) is driving standardization and quality improvements in diagnostic products.

- Germany and France are leading investments in molecular diagnostics and personalized medicine.

Asia-Pacific

- China’s “Healthy China 2030” initiative promotes AI-driven diagnostics and automation in healthcare.

- Japan’s regulatory reforms support rapid approval of next-generation diagnostic tools.

- India’s National Health Mission encourages the adoption of cost-effective rapid diagnostic tests.

Latin America

- Brazil’s government is increasing investments in molecular diagnostics for infectious diseases like dengue and Zika virus.

- Mexico’s public health policies prioritize early cancer detection through advanced IVD technologies.

Middle East & Africa

- The UAE and Saudi Arabia are expanding AI-powered diagnostics as part of their Vision 2030 healthcare strategies.

- South Africa is enhancing access to point-of-care testing for tuberculosis and HIV/AIDS through public-private partnerships.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Biologics Market Size: Growth Projections, Key Players, and Emerging Trends