Lab-on-a-Chip Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Lab-on-a-Chip Market Size

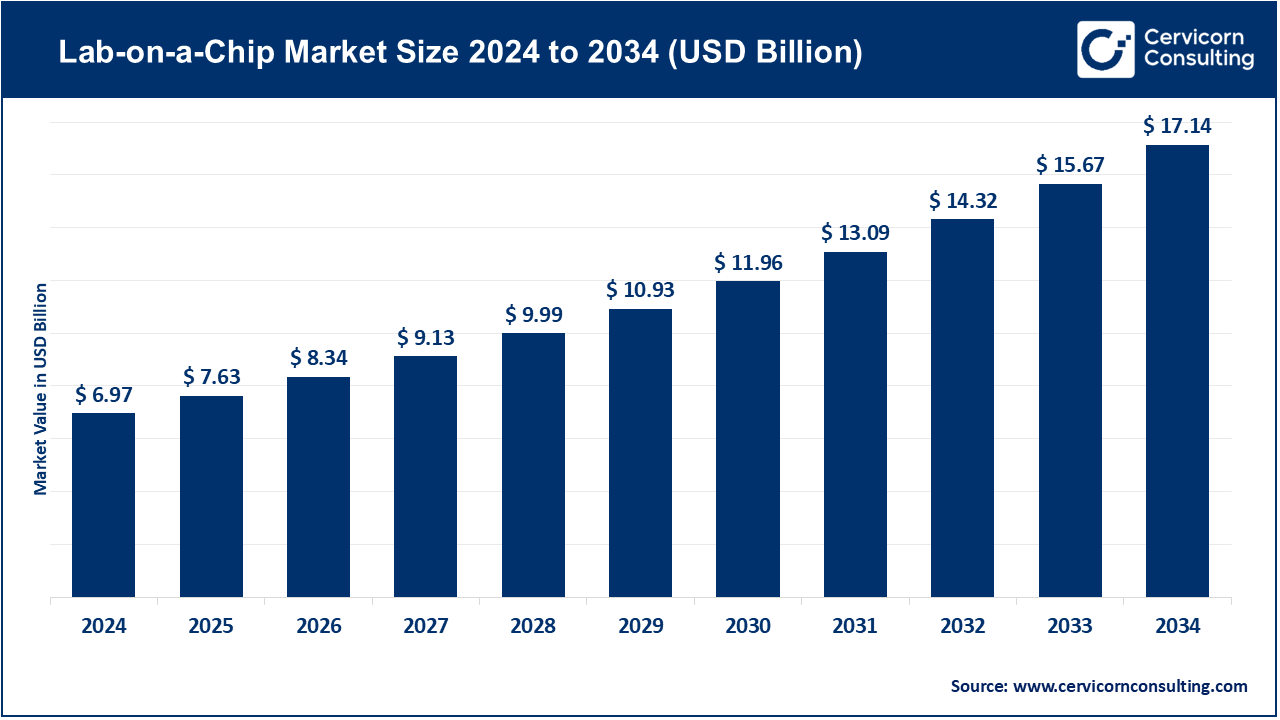

The global lab-on-a-chip market size was worth USD 6.97 billion in 2024 and is anticipated to expand to around USD 17.14 billion by 2034, registering a compound annual growth rate (CAGR) of 9.42% from 2025 to 2034.

Lab-on-a-Chip Market Growth Factors

The lab-on-a-chip market is being pushed forward by multiple converging forces: increasing demand for rapid, decentralized diagnostics accelerated by the COVID-19 pandemic, advances in microfluidics and materials that enable lower-cost and higher-throughput fabrication, rising adoption of point-of-care molecular tests in hospitals and clinics, growth in personalized medicine and single-cell analysis that require miniaturized assay platforms, expanding investment from governments and research programs into microfluidics and semiconductor-style fabrication, and ongoing partnerships between academic labs, diagnostic OEMs and contract manufacturers which shorten product development cycles. Together, these factors are raising manufacturing scale, broadening applications in infectious disease, oncology, environmental testing, and drug discovery, and improving unit economics, which in turn accelerates commercial uptake and market expansion.

What is the Lab-on-a-Chip Market?

Lab-on-a-chip (LOC) refers to miniaturized devices — often microfluidic chips — that integrate multiple laboratory processes such as sample handling, mixing, reaction, separation, and detection onto a single chip or cartridge. LOC platforms range from disposable plastic cartridges to reusable microfabricated discs or cartridges that fit into small benchtop instruments. They can run biochemical assays, nucleic-acid amplification, immunoassays, cell manipulation, and even organ-on-chip workflows. The market includes the chips and cartridges themselves, the instruments and readers, reagents, and software services for connectivity and data analytics. The global LOC market is valued at around USD 6.6–7.0 billion in 2024 and is forecasted to reach the low- to mid-double-digit billions by 2034, growing at a compound annual growth rate (CAGR) of around 9–10%.

Why It Is Important

LOC technology matters because it takes laboratory capabilities out of centralized labs and places them where decisions are made — at the bedside, in community clinics, at border checkpoints, or inside mobile testing vans. That reduces turnaround times from days to minutes or hours, enables test-and-treat workflows, lowers sample and reagent usage, and opens diagnostics to low-resource settings. Beyond diagnostics, LOC platforms accelerate drug discovery and precision medicine workflows such as single-cell assays and organ-on-chip toxicity screening, shortening R&D cycles and improving translational relevance. In short: faster results, lower costs, and new biological insights made possible by microscale manipulation.

Lab-on-a-Chip Market Top Companies

Below are profiles of major players influencing or benefiting from the global lab-on-a-chip market, including their specialization, focus areas, notable features, 2024 revenue, approximate market presence, and global reach.

Novo Nordisk A/S

- Specialization: A global leader in diabetes and biopharma; while not a traditional LOC instrument maker, Novo Nordisk employs microfluidic and micro-assay technologies for drug discovery, formulation development, and biologics analytics.

- Key Focus Areas: Diabetes and obesity therapies, biologics R&D, and integrated care partnerships that bridge diagnostics and therapeutics.

- Notable Features: Strong R&D capabilities, extensive partnerships, and a global footprint that supports integration of LOC technologies in R&D workflows.

- 2024 Revenue: DKK 290,403 million.

- Market Share: Limited direct LOC market share; involvement is largely through R&D collaborations and diagnostics integration.

- Global Presence: Operations across Europe, North America, Asia, and emerging markets.

Wockhardt Ltd.

- Specialization: Indian pharmaceutical and biotechnology firm engaged in manufacturing APIs, sterile injectables, vaccines, and biologics. While not a core LOC manufacturer, its capabilities support reagent formulation and contract manufacturing relevant to LOC supply chains.

- Key Focus Areas: Generics, biologics, and contract manufacturing.

- Notable Features: Large manufacturing footprint and growing participation in advanced biotech manufacturing.

- 2024 Revenue: INR 2,879 crore.

- Market Share: Not a primary LOC equipment supplier; influence is through manufacturing support and formulation capabilities.

- Global Presence: Export and operations across India, the UK, and other global markets.

Medtronic

- Specialization: One of the largest medical technology companies focusing on cardiovascular, neuro, diabetes, and surgical technologies. While not an LOC manufacturer per se, Medtronic integrates microfluidic and biosensing technologies into its diagnostic and monitoring devices.

- Key Focus Areas: Cardiovascular devices, diabetes management, neuromodulation, surgical robotics, and connected health.

- Notable Features: Deep clinical integration and strong R&D partnerships supporting micro-scale diagnostic innovations.

- 2024 Revenue: Approximately USD 32.36 billion.

- Market Share: Indirect involvement in LOC; expertise lies in biosensing and device integration.

- Global Presence: Operations spanning North America, Europe, Asia Pacific, and emerging markets.

Roche Holding AG

- Specialization: Global leader in in-vitro and molecular diagnostics. Roche’s cobas® Liat® platform is one of the best-known commercial examples of a cartridge-based lab-on-a-chip molecular testing system.

- Key Focus Areas: Clinical diagnostics, molecular PCR platforms, oncology diagnostics, and companion diagnostics.

- Notable Features: cobas Liat delivers PCR-based results in about 20 minutes, setting a benchmark for POC molecular testing performance.

- 2024 Revenue: Significant year-over-year growth in diagnostics revenue in 2024.

- Market Share: One of the top global suppliers of cartridge-based molecular diagnostic systems; strong commercial presence in LOC-adjacent technologies.

- Global Presence: Extensive diagnostic operations and distribution networks worldwide.

Abbott Laboratories

- Specialization: Diversified healthcare giant with a strong diagnostics division. Abbott’s ID NOW™ platform is a leading isothermal amplification-based point-of-care molecular diagnostic device — a true example of lab-on-a-chip commercialization.

- Key Focus Areas: Diagnostics, medical devices, nutrition, and pharmaceuticals.

- Notable Features: ID NOW™ gained global prominence during COVID-19 for rapid molecular detection; the platform now supports expanded respiratory and infectious panels.

- 2024 Revenue: USD 42.0 billion.

- Market Share: A global leader in point-of-care molecular testing with strong LOC market relevance.

- Global Presence: Operations across all major regions including North America, Europe, Asia, and Latin America.

Leading Trends and Their Impact

- Decentralized Molecular Testing Becomes Routine

The success of rapid molecular testing platforms like Abbott’s ID NOW and Roche’s cobas Liat has proven the commercial potential of portable diagnostics. Their adoption in hospitals, clinics, and pharmacies has shifted the diagnostic paradigm toward decentralized, near-patient testing, improving patient outcomes and reducing hospital burden. - Integration with Digital Health Ecosystems

LOC systems are increasingly paired with cloud connectivity and AI-based analytics. Smart cartridges and connected readers enable remote quality monitoring, epidemiological tracking, and integration with electronic health records. This digital layer enhances usability and creates new data-driven business models. - Advances in Microfabrication and Cost Reduction

New fabrication methods — such as roll-to-roll printing, injection molding, and polymer-based microfluidics — have dramatically lowered production costs. Disposable cartridges can now be produced at scale, opening opportunities for mass-market diagnostics and environmental monitoring applications. - Precision Medicine and Single-Cell Applications

LOC technology has evolved beyond diagnostics into drug discovery and personalized medicine. Platforms that can isolate and analyze single cells or mimic organ functions on chips are enabling more accurate drug screening and toxicity testing, reducing reliance on animal models. - Regulatory and Reimbursement Shifts

Regulatory agencies are adopting faster approval mechanisms for emergency and point-of-care tests, while payers are recognizing the value of rapid diagnostics that reduce downstream healthcare costs. This improved policy environment accelerates commercialization and adoption.

Impact: These trends collectively make lab-on-a-chip systems more affordable, scalable, and clinically integrated, transitioning the field from academic innovation to mainstream healthcare and research tools.

Successful Examples Around the World

- Abbott ID NOW (United States and Global): A leading point-of-care molecular testing system offering rapid results within minutes. It became one of the most deployed platforms during the COVID-19 pandemic and continues to expand its assay portfolio.

- Roche cobas® Liat® (Global): A compact PCR-based point-of-care device that offers laboratory-grade accuracy within 20 minutes. It is widely used in emergency departments and pharmacies, setting the commercial standard for LOC diagnostics.

- Academic and Startup Innovations: Numerous research institutions have developed 3D-printed or disk-based LOC devices for multiplexed detection of infectious diseases. Many of these prototypes have evolved into startups or licensed technologies, contributing to market diversification.

- European Union Initiatives: Programs such as Horizon Europe’s NextGenMicrofluidics have successfully funded testbeds and pilot production facilities that help small and medium enterprises transition from prototypes to mass production, fueling Europe’s LOC industry.

Global and Regional Analysis

North America

North America leads the lab-on-a-chip market due to strong R&D infrastructure, venture capital availability, and high adoption of molecular diagnostics. The United States, through agencies like NIH and DARPA, provides substantial grants for microfluidic research and commercialization. The Food and Drug Administration’s flexible emergency-use authorizations during the pandemic accelerated the validation and deployment of LOC devices. Manufacturing incentives and semiconductor investment programs further support scaling of LOC production facilities.

Europe

Europe’s market is strengthened by collaborative innovation frameworks and public funding. The European Union’s Horizon programs support microfluidics research, open-innovation testbeds, and industrial pilot lines. Countries such as Germany, France, and the Netherlands are fostering local production ecosystems through joint academia-industry projects. Regulatory harmonization and data-sharing policies promote the use of LOC systems in public health and clinical diagnostics.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions due to high healthcare demand, strong manufacturing capabilities, and increasing investment in biotech infrastructure. China, Japan, South Korea, and India are emerging as major producers and consumers of LOC devices. India’s pharmaceutical manufacturing base and companies like Wockhardt contribute to the reagent and consumables supply chain. Government healthcare programs and diagnostic modernization initiatives drive further adoption.

Latin America and Africa

These regions show rising demand for portable diagnostics in resource-limited settings, where access to centralized labs is restricted. International collaborations, donor-funded programs, and NGO partnerships are enabling deployment of LOC-based testing for infectious diseases such as HIV, tuberculosis, and malaria. However, sustainable adoption will depend on cost reduction, supply-chain development, and local manufacturing support.

Government Initiatives and Policies Shaping the Market

- Research Funding and Innovation Support

Governments worldwide are investing heavily in LOC technologies through national innovation programs. In the United States, NIH and NSF grants support organ-on-chip and microfluidic diagnostics research. In the European Union, initiatives like NextGenMicrofluidics and Microfluidics Innovation Hubs provide open-access testbeds and funding vouchers for SMEs. - Procurement and Reimbursement Incentives

Public procurement programs for POC diagnostics during the pandemic have demonstrated how government policies can create instant demand for LOC systems. Continued inclusion of rapid tests in healthcare reimbursement schedules is essential for market growth. - Manufacturing and Industrial Policy

LOC devices benefit from national strategies that support advanced manufacturing. Programs like the U.S. CHIPS Act and EU semiconductor policies indirectly strengthen the LOC industry by funding microfabrication facilities and component supply chains. - Regulatory Frameworks

Evolving regulatory guidance is making it easier for companies to bring LOC systems to market. Agencies now recognize the unique challenges of microfluidic systems and are issuing clearer validation and quality standards, improving time-to-market for innovators.

Market Outlook

The lab-on-a-chip market is transitioning from research-driven innovation to commercial maturity. With continued advances in materials, design, and manufacturing, LOC systems are expected to become integral to healthcare delivery, pharmaceutical R&D, environmental monitoring, and food safety testing. The increasing convergence of diagnostics with digital health, alongside growing government and private investment, indicates strong growth momentum through the next decade.

By integrating laboratory-scale capabilities into portable, automated devices, lab-on-a-chip technology is redefining how and where testing is performed — from centralized labs to the patient’s side, making precision healthcare faster, more accessible, and more affordable.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Reports: Robotic Process Automation in Chemical Market Growth Drivers, Trends, Key Players and Regional Insights by 2034