In Vitro Diagnostics (IVD) Market Trends, Growth, Insights 2025-2034

In Vitro Diagnostics (IVD) Market Overview

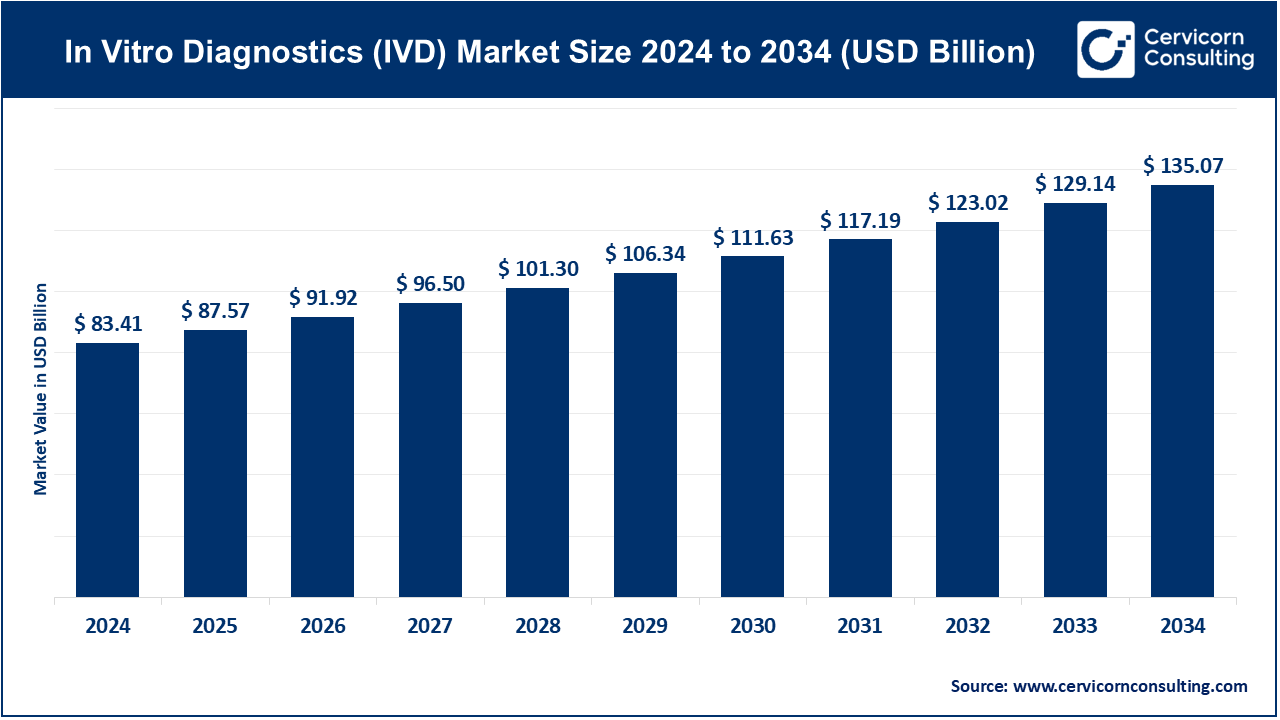

The global in vitro diagnostics (IVD) market was worth USD 83.41 billion in 2024 and is anticipated to expand to around USD 135.07 billion by 2034, registering a compound annual growth rate (CAGR) of 4.97% between 2025 and 2034.

Technological advancements, such as the development of point-of-care testing, automation, and molecular diagnostics fuel the growth of the IVD market. Increasing prevalence of chronic and infectious diseases, a growing geriatric population, and the global emphasis on early diagnosis and preventive healthcare are also major contributors. Government initiatives and rising healthcare expenditures in emerging economies have further propelled the market. Additionally, the COVID-19 pandemic underscored the importance of rapid diagnostics, acting as a significant catalyst for market expansion.

What is the In Vitro Diagnostics (IVD) Market?

The In Vitro Diagnostics (IVD) market encompasses medical devices and reagents used to perform diagnostic tests on biological samples such as blood, urine, and tissues outside the human body. These tests are conducted in controlled laboratory settings, providing critical insights into the detection, monitoring, and prevention of diseases. The market spans a wide range of applications, including infectious disease testing, oncology, cardiology, endocrinology, and genetic testing.

Why is the In Vitro Diagnostics (IVD) Market Important?

The IVD market plays a pivotal role in modern healthcare systems by enabling early diagnosis, effective disease management, and personalized treatment strategies. These diagnostics are crucial for reducing healthcare costs and improving patient outcomes by guiding clinical decisions with accuracy and precision. Amid a global rise in chronic diseases, aging populations, and emerging infectious diseases, the demand for IVD solutions has surged significantly.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2353

Global In Vitro Diagnostics (IVD) Market Top Companies

Roche Diagnostics

- Specialization: Molecular diagnostics, immunoassays, and clinical chemistry

- Key Focus Areas: Oncology, infectious diseases, and cardiovascular conditions

- Notable Features: Industry-leading portfolio of PCR technologies and integrated analyzers

- 2024 Revenue (approx.): $15 billion

- Market Share (approx.): 15%

- Global Presence: Strong foothold in Europe, North America, and Asia-Pacific

Siemens Healthineers

- Specialization: Automation systems, clinical chemistry, and point-of-care diagnostics

- Key Focus Areas: Diabetes, infectious diseases, and hematology

- Notable Features: High-throughput analyzers and AI-driven diagnostics

- 2024 Revenue (approx.): $12 billion

- Market Share (approx.): 12%

- Global Presence: Extensive reach in over 70 countries

Abbott Laboratories

- Specialization: Point-of-care testing, molecular diagnostics, and core laboratory systems

- Key Focus Areas: Infectious diseases, diabetes management, and cardiology

- Notable Features: Renowned for its Alinity and ID NOW platforms

- 2024 Revenue (approx.): $10 billion

- Market Share (approx.): 10%

- Global Presence: Strong market presence across North America, Europe, and emerging markets

Danaher Corporation

- Specialization: Molecular diagnostics and immunoassays

- Key Focus Areas: Oncology, genetic testing, and infectious diseases

- Notable Features: Advanced tools like GeneXpert and precision diagnostics

- 2024 Revenue (approx.): $9 billion

- Market Share (approx.): 9%

- Global Presence: Prominent in North America, Europe, and Asia-Pacific

Thermo Fisher Scientific

- Specialization: Molecular diagnostics, clinical chemistry, and laboratory instruments

- Key Focus Areas: Genetic testing, infectious diseases, and oncology

- Notable Features: Comprehensive portfolio with high-throughput testing capabilities

- 2024 Revenue (approx.): $8 billion

- Market Share (approx.): 8%

- Global Presence: Operations in over 80 countries

Leading Trends and Their Impact

- Rise of Point-of-Care Testing (POCT): POCT has transformed diagnostics by offering rapid and accurate results at the patient’s location. This trend is particularly impactful in remote areas with limited access to healthcare facilities, ensuring timely treatment.

- Adoption of Molecular Diagnostics: Molecular diagnostics, including PCR and next-generation sequencing (NGS), have revolutionized the detection of infectious diseases and genetic disorders. These technologies enable personalized medicine, a growing priority in modern healthcare.

- Integration of AI and Big Data: AI-powered diagnostics improve accuracy by identifying patterns in complex datasets, while big data enhances predictive analytics. Together, these technologies are driving precision medicine and streamlining clinical workflows.

- Focus on Automation: Automation in laboratories reduces human error, enhances throughput, and optimizes resource utilization. Automated systems are becoming integral to large-scale diagnostic operations.

- Telemedicine and Remote Monitoring: The integration of IVD with telehealth platforms facilitates real-time monitoring and diagnosis, especially for chronic disease management and during global pandemics.

Successful Examples of In Vitro Diagnostics (IVD) Market Around the World

- COVID-19 Testing: The rapid development and deployment of COVID-19 diagnostic kits by companies like Roche Diagnostics and Abbott Laboratories highlighted the market’s capacity to respond to global health emergencies.

- GeneXpert by Cepheid: This molecular diagnostic platform offers rapid and accurate detection of tuberculosis and drug resistance, playing a crucial role in addressing public health challenges in low-resource settings.

- Alinity by Abbott: The Alinity system’s scalability and modular design have improved diagnostic efficiency in laboratories worldwide.

- NGS Applications in Oncology: Companies like Thermo Fisher Scientific have made significant strides in applying NGS for cancer diagnostics, aiding in the identification of actionable mutations.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- Key Drivers: Robust healthcare infrastructure, high R&D investments, and favorable reimbursement policies

- Government Initiatives: The U.S. FDA’s streamlined approval process for innovative diagnostic devices and funding for precision medicine projects

Europe

- Key Drivers: Aging population and increasing chronic disease burden

- Government Initiatives: The European Union’s In Vitro Diagnostic Regulation (IVDR) ensures quality and safety standards, fostering market growth

Asia-Pacific

- Key Drivers: Growing healthcare expenditure, rising awareness, and expanding middle-class populations

- Government Initiatives: Initiatives like ‘Make in India’ and investments in healthcare infrastructure by China and Japan boost local production and adoption of IVD technologies

Latin America

- Key Drivers: Expanding access to healthcare services and rising prevalence of infectious diseases

- Government Initiatives: National programs for disease surveillance and affordable diagnostics in countries like Brazil and Mexico

Middle East and Africa

- Key Drivers: Increasing focus on disease prevention and improving healthcare infrastructure

- Government Initiatives: Public-private partnerships and funding for diagnostic laboratories in countries like Saudi Arabia and South Africa

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Health and Wellness Market Growth Factors, Key Players, Trends, and Regional Insights by 2033