Hydrogen Fueling Station Market Growth Drivers and Future Outlook (2025–2034)

Hydrogen Fueling Station Market Growth Factors

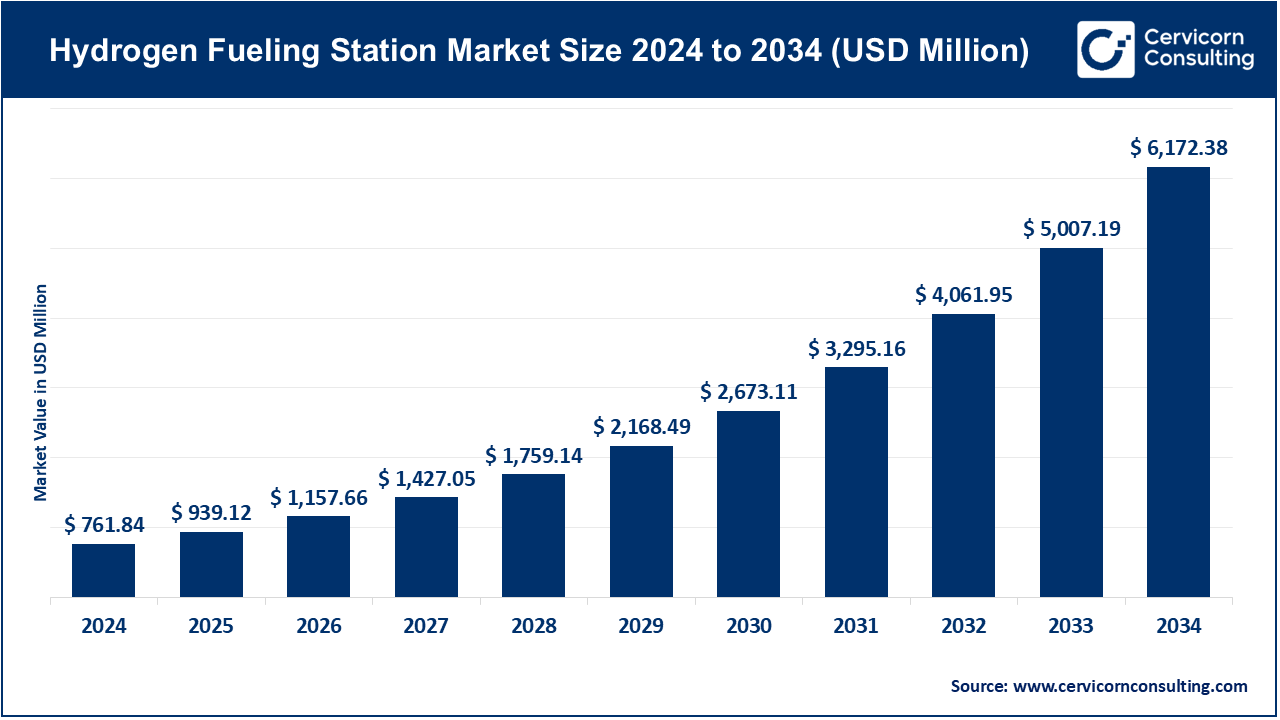

The global hydrogen fueling station market Size was worth USD 761.84 million in 2024 and is anticipated to expand to around USD 6,172.38 million by 2034, registering a compound annual growth rate (CAGR) of 23.27% from 2025 to 2034.

The hydrogen fueling station market is being driven by several powerful forces: stringent global emission regulations and government clean-energy policies mandating zero-emission vehicle infrastructure; accelerating adoption of fuel-cell electric vehicles (FCEVs) in passenger, commercial, and heavy-duty segments; industry-wide public–private partnerships and alliances funding “hydrogen highways” and refueling networks; technological advances in high-pressure compression (350–700 bar) and on-site/on-demand hydrogen generation; and declining green hydrogen production costs via electrolyzers powered by renewables.

What Is the Hydrogen Fueling Station Market?

This market encompasses the planning, engineering, construction, equipment supply, and operation of hydrogen refueling stations (HRS) that dispense compressed (350 or 700 bar) or liquefied hydrogen for fuel cell electric vehicles. Stations vary by:

- Size: Small (capillary), medium (urban hubs), large (highway or fleet sites)

- Type: Fixed vs mobile (trailer/container-based)

- Supply model: On-site generation via electrolyzers vs off-site delivery and storage

- Pressure: High pressure (700 bar) for rapid refueling; lower pressure for short-range or slower fill

Stations target passenger cars, city buses, trucks, trains, even aviation and marine applications.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2647

Why Is It Important?

- Decarbonizing Transport: Hydrogen fueling is crucial to achieving zero-tailpipe emissions in heavy-duty transport, long-haul trucking, public transit, and regional aviation—segments not fully addressable by battery EVs.

- Energy Security & Infrastructure Resilience: Hydrogen stations diversify energy carriers and create infrastructure synergies with power, grid balancing, and renewables .

- Industrial Growth & Job Creation: Station deployment supports local investment in electrolyzers, compression, storage, and construction industries.

- Policy Compliance: Enabling FCEV uptake aligns with global climate goals and regulatory targets under frameworks like EU Green Deals, California ZEV mandates, and Japan’s hydrogen highways.

Top Companies in the Hydrogen Fueling Station Market

Here’s an overview of the major players you listed, along with their focus areas and 2024 metrics:

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue & Market Share | Global Presence |

|---|---|---|---|---|---|

| Chart Industries | Cryogenic equipment & on-site H₂ systems | On-site, liquid H₂ equipment for stations | Modular, scalable systems | Not standalone revenue report; major industrial gas supplier segment | Global |

| Air Liquide | Industrial gases & station infrastructure | EPC, compression, HRS deployment | Paris Olympic station; 100+ stations globally | €27.5 B total revenue; strong E&C backlog | 72+ countries |

| Linde Engineering | Industrial gas plants & hydrogen infrastructure | EPC, storage, logistics | World’s largest industrial gas supplier by revenue | US$80 B assets, US$8.6 B operating income | Worldwide |

| FuelCell Energy, Inc. | Fuel cell power & H₂ solutions | On-site generation + fuel cells | Global fuel cell parks for grid support | $70.9 M revenue (2021); hydrogen stream focus | US, South Korea |

| Air Products and Chemicals, Inc. | Industrial gas supply & hydrogen fueling | EPC, hydrogen pipelines, HRS equipment | Major hydrogen logistics integrator | Combined with Linde, €87 B sector; AP EBITDA growth | Global |

Market Context: Chart, Air Liquide, Linde, FuelCell Energy, and Air Products are consistently featured among the top HRS market leaders alongside Nel, McPhy, ITM Power, and TotalEnergies .

Leading Trends & Their Impact

- Rapid Station Expansion

Governments and OEMs are pursuing “hydrogen highways” and widespread refueling networks. Japan’s route from ~80 HRS in 2016 to at least 157 by 2024 exemplifies this. - Transition from Small to Medium Stations

Market preference is shifting toward mid-size urban highway HRS—offering faster deployment, capacity, and cost effectiveness. - On-site Electrolyzer Integration

On-site green hydrogen production reduces logistics costs and carbon footprint. Companies are delivering modular H₂ generation + dispenser “pods”. - High-Pressure Compression

Adoption of 700 bar high-pressure tech ensures fast (≈5–10 min) refuels—vital for commercial fleets and buses. - Mobile Refueling Solutions

Trailer or container-based mobile HRS systems offer flexibility for remote applications, pilot projects, or event-based fueling. - Public–Private Partnerships (PPPs)

Collaborative funding models, e.g. EU InvestEU, California ZEV funding, Japan’s subsidies, accelerate station rollout.

Successful Global Examples

- Air Liquide – Paris Place de l’Alma: Refurbished for Paris 2024 Olympics, it fueled 500 Toyota Mirai FCEVs with 650 km range in 5 min refuel—part of >15,000 cars, 500 buses, 1,000 trucks supported.

- Japan Hydrogen Highways: A strategic network across highways, expanding from 80 HRS in 2016 to 157+ in 2024.

- California, USA: 53 public HRS stations (plus 3 non-public) as of May 2025 under the ZEV mandate. These support light-duty and fleet FCEVs.

- South Korea Fuel Cell Parks: FuelCell Energy supports large-capacity fuel cell and hydrogen park infrastructure in South Korea.

- EU Hydrogen Corridor Initiatives: Several stations deployed along key freight and passenger corridors under EU funding and PPPs.

Global Regional Analysis & Government Initiatives

North America

- Market size: US HRS market ~US$220 M in 2023; projected +23–24% CAGR through 2032.

- Policy: California’s ZEV regulations, federal IRA H₂ credits (45V), and DOE H₂Hubs accelerate deployment.

- Presence: ~54 public stations (CA) plus mobile/refuel networks for fleets.

Europe

- Market size: Europe leads deployment; 2024 sizing ~€0.5 B, forecasted ~€1.8 B by 2030.

- EU support: InvestEU, Connecting Europe Facility, national H₂ strategies in Germany, France, Netherlands.

- Example: France’s Olympic station in Paris; UK’s M25 motorway HRS via ITM Power & Shell JV.

Asia-Pacific

- Market size: APAC dominated global share (~63%) in 2024; forecasted $832 M to over $22 B by 2035 (CAGR ~26–36%).

- Japan: Active hydrogen highway; government subsidies.

- China: 354 HRS end-2023; national H₂ goals tied to FCEV fleets.

- South Korea: Fuel cell parks and test-bed stations; growing industrial strength.

Latin America, Middle East, Africa (LAMEA)

- Data limited, but growth emerging in Gulf states (UAE, Saudi) deploying H₂ for buses and commercial fleets. Brazil and South Africa exploring demo stations.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Boat-to-Grid Technology Market to Reach USD 2,783.87 Billion by 2034, Fueled by Clean Energy Demand