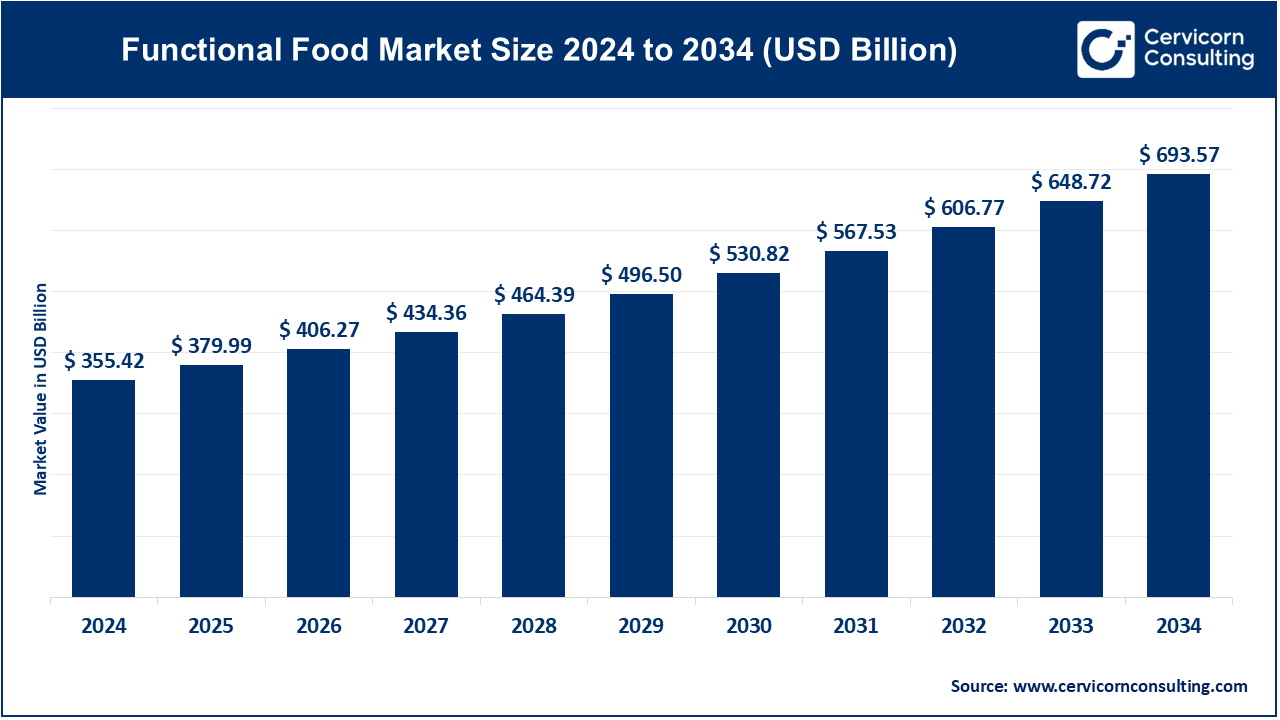

Functional Food Market Size to Reach USD 693.57 Billion by 2034

Functional Food Market Size and Growth Factors

The global functional food market surged to approximately USD 355.42 billion in 2024 and is projected to nearly double to USD 693.57 billion by 2034, growing at a CAGR of 6.91% from 2025–2034. This momentum is fueled by heightened consumer awareness of lifestyle-related illnesses (obesity, diabetes, cardiovascular diseases), rising demand for products enriched with vitamins, minerals, probiotics, prebiotics, and proteins, and the aging global population seeking targeted nutrition. Urban lifestyles, digital access to health knowledge, and breakthroughs in food science—enabling precise fortification—further accelerate adoption. Manufacturers are heavily investing in R&D and clean-label innovation, while regulatory frameworks in regions like North America, Europe, and APAC support fortified and sustainable foods.

What Is the Functional Food Market?

Functional foods are foods formulated or processed to provide specific health benefits beyond basic nutrition, targeting areas such as gut health, immunity, weight management, and heart or brain function . They span categories like fortified dairy, probiotic drinks, omega‑3 eggs, dietary protein snacks, prebiotic-fiber cereals, and functional beverages.

Why It’s Important

- Health Optimization: Consumers increasingly seek proactive, preventative health through diet — combating chronic diseases and declining vitality.

- Economic Potential: With double-digit market growth forecasted, the functional food segment represents a lucrative opportunity for food manufacturers and retailers.

- Innovation & Diversification: Drives creativity in ingredients, flavors, and processing—from exotic adaptogens to fortified staples.

- Regulatory & Sustainability Trends: Global regulatory frameworks demand accurate health claims and sustainable packaging, aligning with consumer values.

- Market Accessibility: Affordable and functional options democratize health benefits, bridging gaps in preventative care.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2645

Top Functional Food Market Companies: Profiles & 2024 Insights

Nestlé S.A.

- Specialization: Broad portfolio spanning baby foods, dairy, cereals, supplements, and medical nutrition.

- Key Focus: Developing nutrient-dense, clean-label, fortified offerings (e.g., probiotic yogurts, plant-based supplements).

- Notable Features: World’s largest food company, 447 factories, operations in 197 countries, 275,000 employees.

- 2024 Revenue: Total group revenue ~CHF 94 billion (~USD 102 billion); functional food share not isolated but embedded within health-centric product lines.

- Market Share & Presence: Dominates global R&D with high market share across all regions.

The Kellogg’s Company

- Specialization: Cereals, snack bars, plant-based and fortified nutrition lines.

- Key Focus: High-fiber, protein-rich snacks, probiotic cereals, and bakery with added health benefits.

- Notable Features: Strategic partnerships (e.g., with Kirin for wheat‑bran and postbiotic innovations).

- 2024 Revenue & Share: Global food giant with estimated ~$14 billion revenue; a key functional cereal and snack bar producer.

- Global Presence: Strong reach in North America, Europe, and expanding in APAC and Latin America.

Hearthside Food Solutions LLC

- Specialization: Co-manufacturing for functional bakery, snacks, protein treats.

- Key Focus: Custom formulations like fiber-enhanced and protein-packed bakery goods.

- Notable Features: Serves major CPG brands with private-label and white-label production.

- 2024 Market Position: Privately held; functions as a key B2B influencer in fortification space.

- Global Presence: Operates primarily in North America.

Lotus Bakeries

- Specialization: Biscuits, snacks with clean ingredients and fortified options.

- Key Focus: Reformulating traditional baked goods with health-forward ingredients.

- Notable Features: Recognized globally for digestives and stroopwafels with functional enhancements.

- Market Position: Gaining share in premium healthy snacks.

- Global Presence: Strong in Europe; growing reach in Asia and Americas .

Valio Eesti AS

- Specialization: Dairy-based functional foods—protein yogurts, probiotic milks.

- Key Focus: Leveraging Finnish dairy science to develop health-benefit products.

- Notable Features: Valio Ltd has SEK 2 billion turnover, ~15 plants in Finland and Estonia; pioneer in functional dairy globally.

- 2024 Revenue: Parent Valio’s net turnover in Finland around EUR 2 billion; Eesti as part of that cluster.

- Global Presence: Exports 60 countries, with subsidiaries in the U.S., China, Sweden.

Leading Trends & Their Impact

Gut Health & Probiotics

– Yogurts, kefirs, probiotic beverages, and bars are booming (e.g., mint chocolate probiotic ice cream, kefir).

– Probiotic-enhanced snacks target digestion and immunity.

Protein-Rich Innovation

– Protein-enhanced milks (e.g., Fairlife), snacks, dairy drinks align with fitness and anti-aging goals.

– On-the-go protein bars & cereals satisfy casual health seekers.

Exotic Functional Ingredients

– Adaptogens and botanicals (e.g., ashwagandha, turmeric) integrated into yogurts, ghee, and beverages.

– Trend toward adventurous flavors with functional benefits (e.g., chai-flavored yogurt).

Clean Label & Sustainability

– Demand for minimal processing and natural ingredient transparency is rising .

– Eco-friendly packaging and traceability are consumer priorities.

Personalized Nutrition & Tech Integration

– Digital tools match consumers with functional products tailored to their health profiles.

– Subscription-based and AI‑driven product recommendations are growing.

Regulatory-Backed Fortification

– Europe’s EFSA, Asia’s dietary guidelines, OECD initiatives support fortification of staples (milk, cereals).

Successful Functional Food Examples Worldwide

- Probiotic Dairy Innovations (USA): Mint-chocolate probiotic ice cream and flavored kefir capturing niche consumer interest.

- Plant-Based Probiotic Drinks (Asia): fermented plant-based beverages with health claims gaining traction in Japan and India.

- Valio’s Exports (Finland): probiotic milks and yogurts exported to 60 countries with recognized quality.

- Kellogg-Kirin Postbiotic Bars (Japan): leveraging collaboration to launch products with wheat-bran derived L. lactis plasma.

- Fairlife Ultra-filtered Milk (USA): 50 % more protein, health positioning, +31% sales growth.

Global Regional Analysis & Government Policies

North America

- Market Size: Dominates functional food consumption (US ~$112.9 b by 2034 projected, per Cervicorn).

- Regulation: FDA regulates health claims; USDA and state bodies promote fortified staples.

- Initiatives: Public health programs encourage vitamin/mineral fortification; school nutrition standards include functional products.

Europe

- Market Size: ~$89.2 b in 2024; projected ~$174 b by 2034 .

- Policy: EFSA oversight ensures evidence-based health claims; Nutri-Score implemented voluntarily in Germany, France, Belgium.

- Support: Farm to Fork and EU health policy encourage nutrient-rich, low-additive foods.

Asia-Pacific

- Market Size: Largest regional share (~$134.4 b in 2024; up to ~$262 b by 2034) .

- Growth Drivers: Rising incomes, health awareness in China, India, Japan, S. Korea.

- Policies: Government-led dietary guidelines promoting fortified staples (e.g., rice fortification) and fermented staples.

Latin America, Middle East & Africa (LAMEA)

- Market Size: Emerging region; estimated $26.3 b in 2024, growing to $51.3 b by 2034.

- Challenges: Infrastructure limits, fragmented markets.

- Opportunities: Fortified staples (dairy, bakery), school nutrition programs, urban health trend adoption.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Food Retail Market Size to Reach USD 22.54 Trillion by 2034