Engineering Services Outsourcing Market Revenue, Global Presence, and Strategic Insights by 2034

Engineering Services Outsourcing Market Size

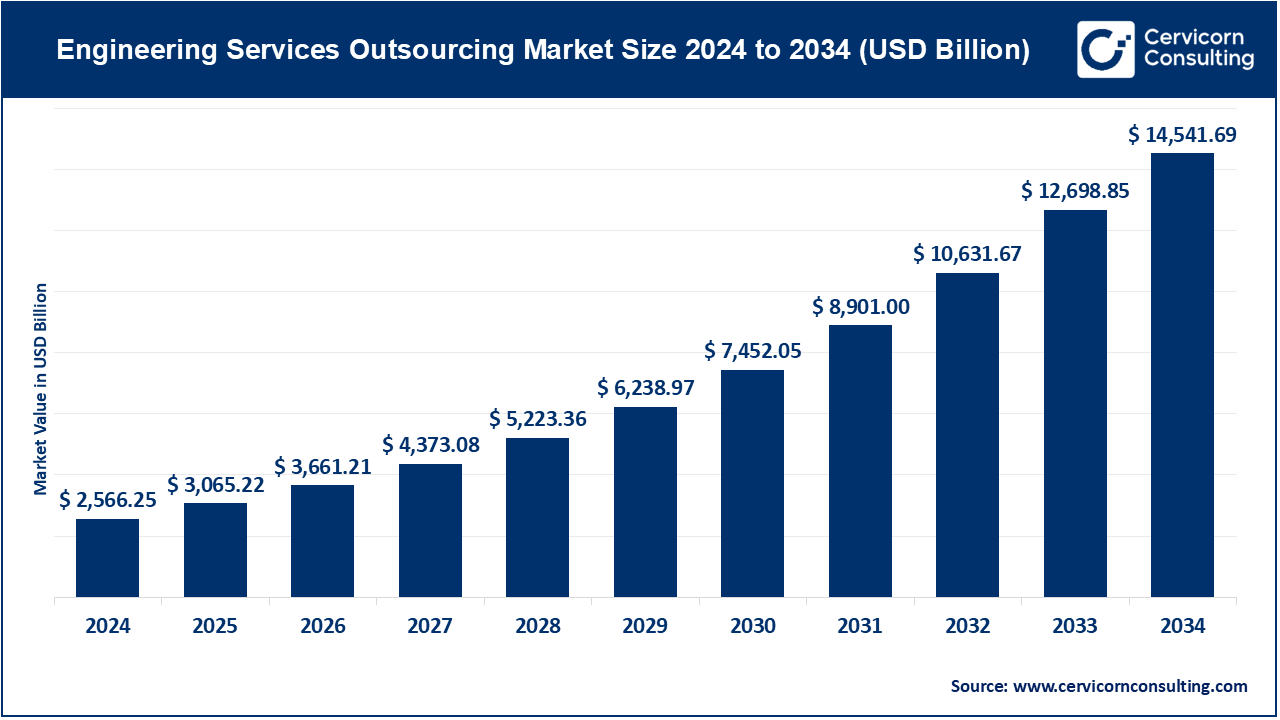

The global engineering services outsourcing market size was worth USD 2,566.25 billion in 2024 and is anticipated to expand to around USD 14,541.69 billion by 2034, registering a compound annual growth rate (CAGR) of 18.94% from 2025 to 2034.

What Is the Engineering Services Outsourcing Market?

The Engineering Services Outsourcing (ESO) market refers to a global ecosystem where organizations delegate portions of their engineering activities—product design, R&D, simulation, prototyping, embedded systems development, manufacturing engineering, PLM management, and digital engineering—to external specialist partners. These services support industries such as automotive, aerospace, industrial machinery, healthcare, energy, telecom, and consumer electronics. Unlike traditional IT outsourcing, ESO blends multidisciplinary engineering expertise with advanced software and hardware skills, enabling companies to accelerate product development, reduce costs, and access specialized capabilities that may be scarce or expensive to build internally.

ESO providers handle diverse tasks: CAD/CAE modeling, systems engineering, FEA/CFD simulation, embedded systems development, digital twin modeling, test automation, compliance documentation, and end-to-end product engineering. With the global shift toward digital, connected, and software-defined products, ESO has evolved from a cost-saving mechanism to a strategic catalyst for innovation.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2424

Why Is Engineering Services Outsourcing Important?

Engineering Services Outsourcing plays a crucial role in today’s product-driven industries:

- Access to scarce talent: Complex domains such as embedded systems, AI-driven product design, electronics engineering, battery management systems, and autonomous technologies require niche skills. ESO partners bridge this gap.

- Accelerated time-to-market: External engineering teams increase capacity instantly, allowing organizations to speed up R&D cycles and bring products to market faster.

- Cost optimization: Outsourcing converts fixed engineering overheads into variable costs, giving organizations more financial flexibility.

- Innovation and co-development: Engineering partners bring domain knowledge, reusable IP, proven frameworks, and exposure to global best practices.

- Risk reduction: ESO firms often maintain top certifications and process maturity standards, reducing regulatory, compliance, and quality risks.

- Scalability: As industries cycle through demand peaks—such as EV development surges, aerospace ramp-ups, or energy transition projects—ESO enables rapid scaling without permanent infrastructure investment.

Thus, ESO is no longer just about outsourcing engineering tasks; it is about strategically augmenting product innovation and competitiveness.

Engineering Services Outsourcing Market Growth Factors

The ESO market is expanding rapidly due to increasing product complexity, global competition, higher R&D costs, and the accelerated adoption of digital engineering technologies. Companies are embracing cloud simulation, AI-enabled design automation, digital twins, and model-based systems engineering, creating new opportunities for specialist engineering partners. Additionally, the global push toward electrification, autonomous technologies, sustainability compliance, and connected products requires highly specialized skills that many enterprises lack internally. Geopolitical shifts and supply-chain diversification are also pushing organizations to adopt hybrid offshoring and nearshoring models, strengthening demand for flexible and secure engineering outsourcing. Increased regulatory burdens in automotive, aerospace, healthcare, and energy sectors further boost the need for partners with end-to-end engineering, testing, and compliance capabilities—collectively accelerating market growth.

Profiles of Key Companies in the ESO Market

1. HCL Technologies

Specialization

- Product engineering and R&D services

- Embedded systems, software-defined products

- Semiconductor engineering, digital engineering, and cloud-native engineering

Key Focus Areas

- Automotive, aerospace, industrial machinery, medical devices

- Digital engineering, IoT, platform engineering, and hardware design

Notable Features

- One of the world’s largest engineering services providers

- Strong IP-led engineering solutions

- A vast engineering workforce with deep industry partnerships

2024 Revenue

- Reported approximately $13.3 billion in FY24

Market Position

- Among the top global tier-1 product engineering service providers

Global Presence

- Delivery centers across India, Europe, Americas, and Asia-Pacific

- Dedicated innovation labs and design centers

2. Wipro

Specialization

- Systems engineering, embedded systems, digital product engineering

- PLM, Industry 4.0, and connected systems

Key Focus Areas

- Product lifecycle digitization, IoT engineering, cloud engineering

- Automotive, aerospace, healthcare, energy, telecom

Notable Features

- Strong mix of engineering and consulting capabilities

- Robust partnerships with industry OEMs and ISVs

2024 Revenue

-

Reported ₹897.6 billion (~$10.8 billion)

Market Position

- A leading global engineering and technology services provider

Global Presence

- Presence in more than 60 countries

- Large engineering hubs in India, the U.S., Europe, and Latin America

3. Tata Consultancy Services (TCS)

Specialization

- Software-defined products, digital engineering, systems engineering

- Manufacturing engineering and IoT/connected product development

Key Focus Areas

- Automotive, energy, industrials, consumer electronics

- Embedded software, cloud engineering, digital manufacturing

Notable Features

- Massive global delivery scale

- Deep, long-term partnerships with global OEMs

2024 Revenue

- Reported $29.08 billion in FY24

Market Position

- One of the largest global IT and engineering service providers

Global Presence

- Operations in over 50 countries

- Major presence in North America, Europe, and Asia

4. Infosys

Specialization

- Digital engineering, embedded systems, cloud & platform engineering

- Simulation-led engineering, digital twins, automation

Key Focus Areas

- Aerospace, automotive, industrials, healthcare

- Systems engineering, software-defined products, and advanced R&D services

Notable Features

- Advanced engineering labs, co-innovation centers

- Strong focus on automation-led engineering

2024 Revenue

- Reported approximately ₹153,670 crore

Market Position

- A major global influencer in engineering and digital transformation

Global Presence

- Strong footprints in North America, Europe, India, APAC

- Distributed engineering hubs and R&D centers worldwide

5. Tech Mahindra

Specialization

- Telecom engineering, product engineering, embedded systems

- Mobility engineering, connected vehicles, and digital manufacturing

Key Focus Areas

- 5G engineering, network modernization, connected ecosystems

- Automotive, telecom, manufacturing

Notable Features

- Strong heritage in telecom and networking engineering

- Known for engineering complex communications technologies

2024 Revenue

- Reported ₹51,996 crore in FY24

Market Position

- A global player with deep telecom engineering specialization

Global Presence

- Delivery centers in 90+ countries

- Strong presence in India, Europe, U.S., Middle East, and Africa

Leading Trends in the ESO Market and Their Impact

1. Electrification Across Transportation & Industry

EV growth is pushing demand for engineering in battery systems, power electronics, thermal systems, and vehicle electronics.

Impact: ESO firms expand multidisciplinary teams combining mechanical, electrical, and embedded software expertise.

2. Software-Defined Products

Physical products increasingly rely on embedded software and cloud-connected features.

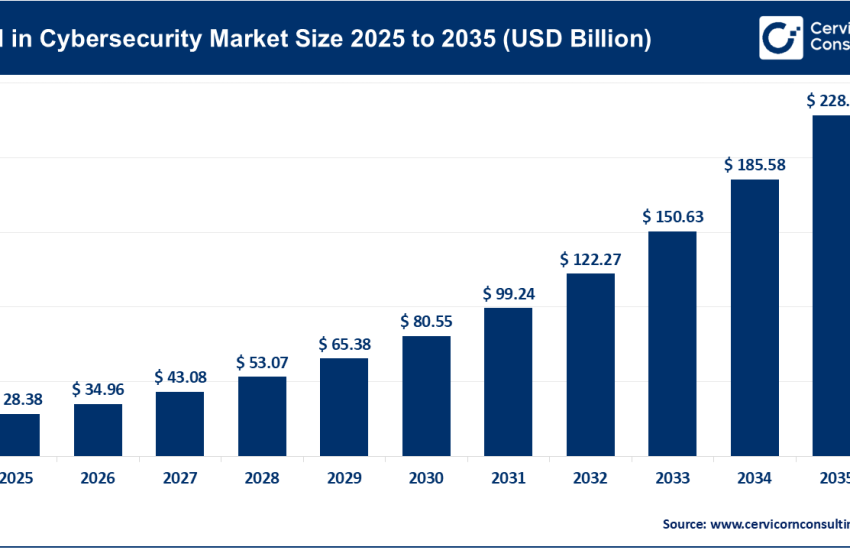

Impact: ESO players invest heavily in embedded engineering, DevOps, cybersecurity, and OTA update ecosystems.

3. AI, Generative Design & Simulation Automation

AI-led engineering—AI-assisted CAD models, automated simulation loops, and predictive design—is transforming R&D.

Impact: Engineering service providers integrate AI tools to accelerate development cycles.

4. Digital Twins and Model-Based Systems Engineering (MBSE)

Digital twins allow simulation of complete product lifecycles.

Impact: ESO firms build digital twin frameworks for automotive, industrial equipment, and aerospace clients.

5. Nearshoring and Regional Engineering Hubs

Companies shift from pure offshoring to balanced global engineering footprints.

Impact: ESO firms expand to Eastern Europe, LATAM, and Southeast Asia to meet regional compliance and cultural needs.

6. Regulatory and Safety Compliance

Aerospace, automotive, medical device and energy sectors face rising compliance requirements.

Impact: ESO firms strengthen safety engineering, certification-readiness, and documentation services.

7. IP-Led Engineering

Reusable IP—prebuilt modules, reference design libraries, simulation models—reduces time-to-market.

Impact: Providers with strong IP portfolios achieve higher efficiency and competitive differentiation.

Successful Examples of ESO Projects Globally

Automotive Engineering (Europe & India)

- Outsourced development of EV powertrains, in-vehicle infotainment systems, and ADAS components

- Long-term co-engineering between global OEMs and Indian engineering firms

Aerospace Systems Engineering (North America & Europe)

- Outsourced aerodynamic simulations, avionics integration, and certification-ready engineering

- ESO accelerates product cycles and reduces R&D overhead

Medical Device R&D (Global)

- Engineering providers build prototypes, embedded firmware, and regulatory documentation

- Enables startups to launch compliant products without building internal labs

Industrial IoT & Smart Manufacturing (APAC & Europe)

- ESO firms retrofit aging industrial systems with IoT sensors and predictive maintenance

- Digital twin development for factories improves operational efficiency

These examples highlight how ESO partnerships unlock innovation and accelerate development across sectors.

Global Regional Analysis

Asia-Pacific

India

Government programs like Make in India, PLI incentives, and R&D tax benefits encourage domestic and export-focused engineering capabilities.

India remains the world’s largest hub for outsourced engineering talent.

China

Industry modernization programs, local manufacturing incentives, and EV-led industrial expansion drive ESO demand within the country.

However, policies also encourage domestic engineering development, balancing outsourcing with local capability building.

Japan & South Korea

Focus on robotics, AI, automotive electronics, and semiconductor engineering drives specialized ESO adoption.

North America

- Strong demand for aerospace, EVs, medical device engineering, and industrial digitalization

- R&D tax incentives and reshoring trends encourage nearshoring (Canada, Mexico)

- High compliance and safety requirements increase demand for certified ESO partners

Europe

- Automotive electrification, Industry 4.0, and renewable energy engineering drive ESO needs

- Germany, France, U.K. lead adoption of engineering outsourcing for digital transformation

- Strict data protection laws influence hybrid and nearshore delivery

Middle East & Africa

- Investments in energy transition, mega infrastructure projects, and industrial diversification

- GCC countries emphasize local manufacturing and engineering skill development

- ESO demand increases for EPC engineering, digital twins, and predictive maintenance

Latin America

- Growing nearshore destination for the U.S.

- Rising investments in automotive, aerospace parts, and industrial engineering

- Governments support technology clusters and engineering skill development

Additional Market Dynamics

- Market definitions vary widely; some narrow definitions track only pure engineering R&D outsourcing, while broader definitions include the entire engineering services ecosystem.

- The rise of global engineering hubs, digital engineering platforms, and reusable IP is reshaping competitive dynamics.

- Major Indian firms—HCL, TCS, Infosys, Wipro, Tech Mahindra—continue to expand global engineering delivery centers and domain expertise.

- OEMs increasingly seek long-term strategic engineering partners rather than transactional outsourcing.

- AI-driven engineering, electrification, and software-defined products will remain the dominant demand drivers for the next decade.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Biomarkers Market Revenue, Global Presence, and Strategic Insights by 2034