Energy Retrofit Systems Market Growth, Trends & Top Companies by 2034

Energy Retrofit Systems Market Growth

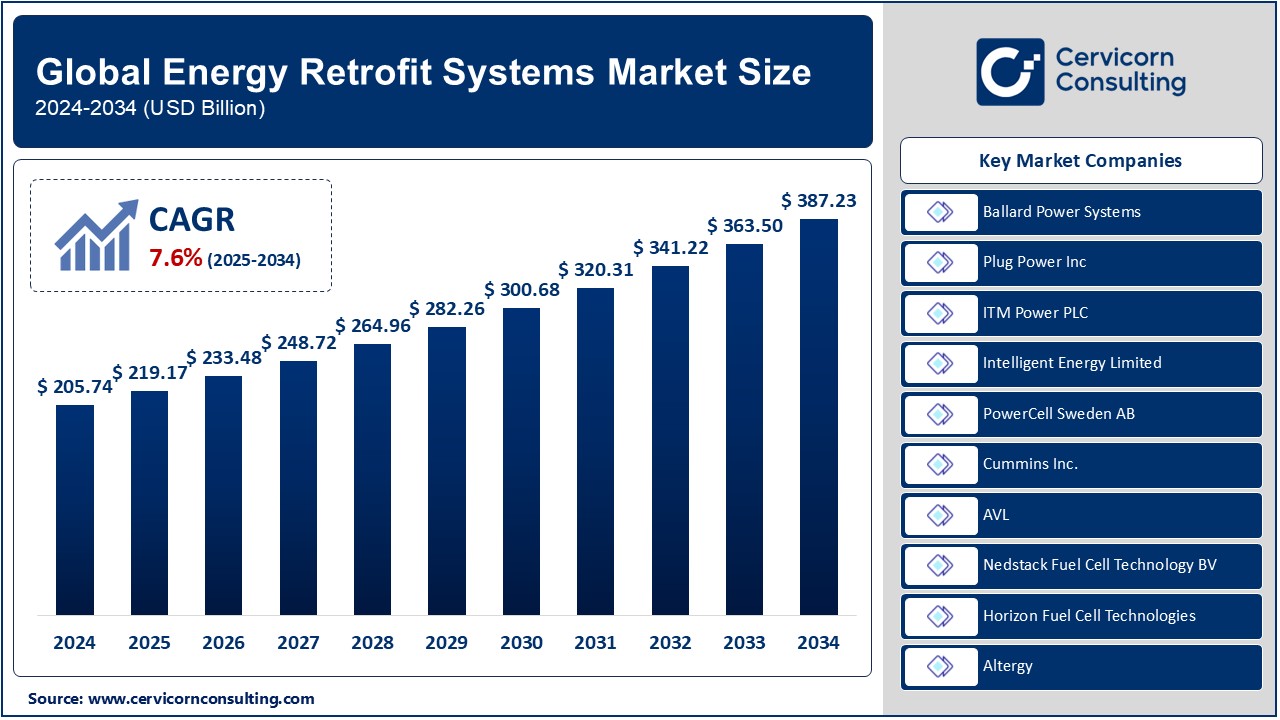

The global energy retrofit systems market was valued at USD 205.74 billion in 2024 and is projected to grow to approximately USD 387.23 billion by 2034, with a compound annual growth rate (CAGR) of 7.6% from 2025 to 2034.

The growth of the energy retrofit systems market is fueled by increasing government regulations promoting energy efficiency, the rising cost of conventional energy, and heightened awareness of climate change. Advancements in technology, including IoT-enabled energy monitoring and the integration of AI for predictive maintenance, have also made energy retrofitting more accessible and cost-effective. Furthermore, financial incentives like tax credits, subsidies, and green loans encourage property owners and corporations to invest in retrofitting initiatives.

What is the Energy Retrofit Systems Market?

The energy retrofit systems market encompasses solutions, technologies, and services designed to upgrade existing buildings and infrastructure for improved energy efficiency. These retrofits typically involve modifications to lighting, heating, cooling, ventilation, and electrical systems, as well as the integration of renewable energy sources like solar panels. The primary goal of energy retrofitting is to reduce energy consumption, lower operational costs, and minimize carbon footprints, aligning with global sustainability goals.

Why is the Energy Retrofit Systems Market Important?

Energy retrofits are pivotal in the fight against climate change and rising energy costs. With over 40% of global energy consumed by buildings, retrofitting existing structures presents an efficient way to reduce emissions without the need for entirely new constructions. Energy retrofits not only contribute to environmental sustainability but also enhance property value, improve occupant comfort, and often comply with stringent government energy regulations. Moreover, these solutions play a vital role in achieving national and corporate net-zero targets, making them an essential component of modern energy strategies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2471

Top Companies in the Energy Retrofit Systems Market

Ballard Power Systems

- Specialization: Hydrogen fuel cell technology

- Key Focus Areas: Energy storage, transportation, and stationary power generation

- Notable Features: Known for its PEM fuel cells with high efficiency and durability

- 2024 Revenue (Approx.): $120 million

- Market Share (Approx.): 8%

- Global Presence: North America, Europe, Asia-Pacific

Plug Power Inc

- Specialization: Hydrogen and fuel cell systems for clean energy

- Key Focus Areas: Material handling, stationary power, and transportation

- Notable Features: Comprehensive hydrogen ecosystem including production, storage, and deployment

- 2024 Revenue (Approx.): $1.4 billion

- Market Share (Approx.): 20%

- Global Presence: Strong presence in North America and Europe

ITM Power PLC

- Specialization: Electrolyzers for green hydrogen production

- Key Focus Areas: Renewable energy integration, industrial hydrogen applications

- Notable Features: Modular, scalable electrolyzer systems

- 2024 Revenue (Approx.): $100 million

- Market Share (Approx.): 6%

- Global Presence: Predominantly in Europe and growing in North America

Intelligent Energy Limited

- Specialization: Lightweight hydrogen fuel cells

- Key Focus Areas: Drones, aerospace, and portable power solutions

- Notable Features: Compact, high-efficiency designs ideal for off-grid applications

- 2024 Revenue (Approx.): $75 million

- Market Share (Approx.): 5%

- Global Presence: Europe, Asia, and North America

PowerCell Sweden AB

- Specialization: Fuel cell stacks and systems for stationary and mobile applications

- Key Focus Areas: Marine, automotive, and industrial energy solutions

- Notable Features: Cutting-edge hydrogen fuel cell technology with high efficiency

- 2024 Revenue (Approx.): $110 million

- Market Share (Approx.): 7%

- Global Presence: Europe, Asia, North America

Leading Trends and Their Impact on the Energy Retrofit Systems Market

- Smart Building Technologies: The integration of IoT and AI in retrofit systems is revolutionizing energy management by enabling real-time monitoring and predictive maintenance. Smart technologies optimize energy consumption, reducing waste and lowering costs.

- Green Hydrogen Integration: Hydrogen is emerging as a key component in energy retrofit systems, particularly in industrial and large-scale applications. Companies like Plug Power and ITM Power are advancing hydrogen-based solutions, further driving market adoption.

- Policy-Driven Adoption: Government initiatives mandating energy efficiency and providing incentives for retrofitting have significantly increased market demand. For example, Europe’s Green Deal and the U.S. Inflation Reduction Act include substantial funding for energy retrofits.

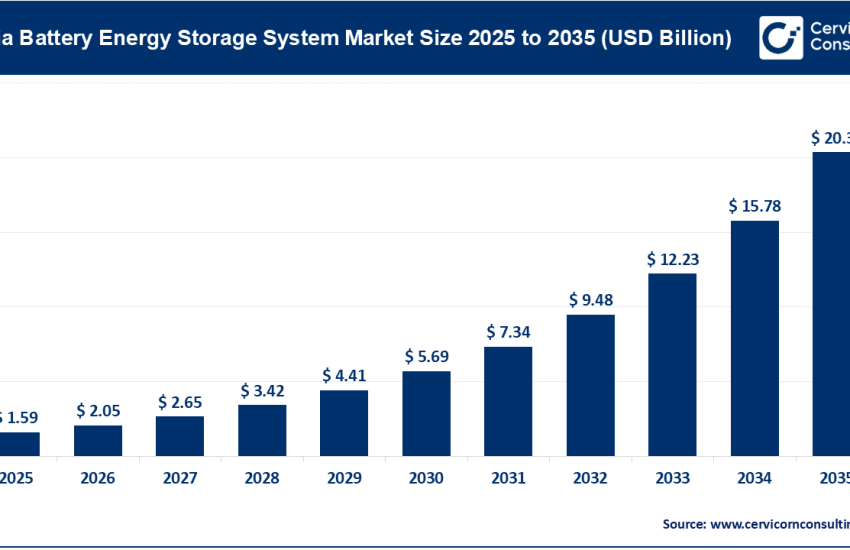

- Energy Storage Solutions: The addition of advanced energy storage technologies, such as batteries and hydrogen storage, enhances the reliability and efficiency of retrofitted systems. These innovations allow better energy utilization and reduce dependency on the grid.

- Focus on Carbon Neutrality: Corporations and governments aiming for net-zero emissions by 2050 are heavily investing in retrofit solutions. This trend is expected to accelerate as environmental, social, and governance (ESG) criteria gain prominence in business strategies.

Successful Examples of Energy Retrofit Systems Around the World

- Empire State Building, USA: A comprehensive energy retrofit reduced energy use by 38%, saving $4.4 million annually. Upgrades included window retrofits, improved insulation, and advanced energy management systems.

- Torre Reforma, Mexico: This skyscraper achieved LEED Platinum certification after incorporating energy-efficient HVAC systems, high-performance glazing, and renewable energy integration.

- City of Melbourne, Australia: The 1200 Buildings Program retrofitted numerous commercial buildings, resulting in significant energy savings and reduced emissions across the city.

- The Edge, Amsterdam, Netherlands: Known as the “world’s smartest building,” it features IoT-enabled systems, solar panels, and energy storage, setting a benchmark for future retrofit projects.

- Shanghai Tower, China: A retrofit initiative incorporated double-layered glass façades, rainwater harvesting, and geothermal heating, achieving significant energy efficiency.

Regional Analysis and Government Initiatives

North America:

The U.S. and Canada are leading markets in North America, driven by strong government support and stringent energy regulations. The U.S. Inflation Reduction Act of 2022 allocated $369 billion for climate and energy programs, including retrofitting grants and incentives. In Canada, the Greener Homes Initiative offers rebates for residential energy retrofits, further propelling market growth.

Europe:

Europe’s Green Deal aims to achieve net-zero emissions by 2050, with a significant focus on retrofitting existing buildings. Programs like Renovation Wave and funding under Horizon Europe are spurring demand for advanced energy retrofit systems. Countries like Germany, France, and the UK are at the forefront, with aggressive targets for reducing building-related emissions.

Asia-Pacific:

Rapid urbanization and growing energy demand are key drivers in the Asia-Pacific region. China’s 14th Five-Year Plan emphasizes energy efficiency and retrofitting public buildings, while India’s Energy Efficiency Building Code (EBC) promotes retrofitting in commercial sectors. Japan and South Korea are also investing heavily in retrofitting projects to meet their carbon neutrality goals.

Latin America:

Countries like Brazil and Mexico are increasingly adopting energy retrofit systems due to rising energy costs and government incentives. Brazil’s Energy Efficiency Program (PEE) and Mexico’s Sustainable Building Program are noteworthy initiatives supporting market growth.

Middle East and Africa:

While the market is still nascent, growing awareness of energy efficiency and sustainability is driving adoption. The UAE’s Energy Strategy 2050 and South Africa’s Integrated Resource Plan include provisions for retrofitting infrastructure to enhance energy efficiency.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Perovskite Solar Cell Market Growth, Top Companies & Insights by 2033