Energy Recovery Ventilator Core Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Energy Recovery Ventilator Core Market Size

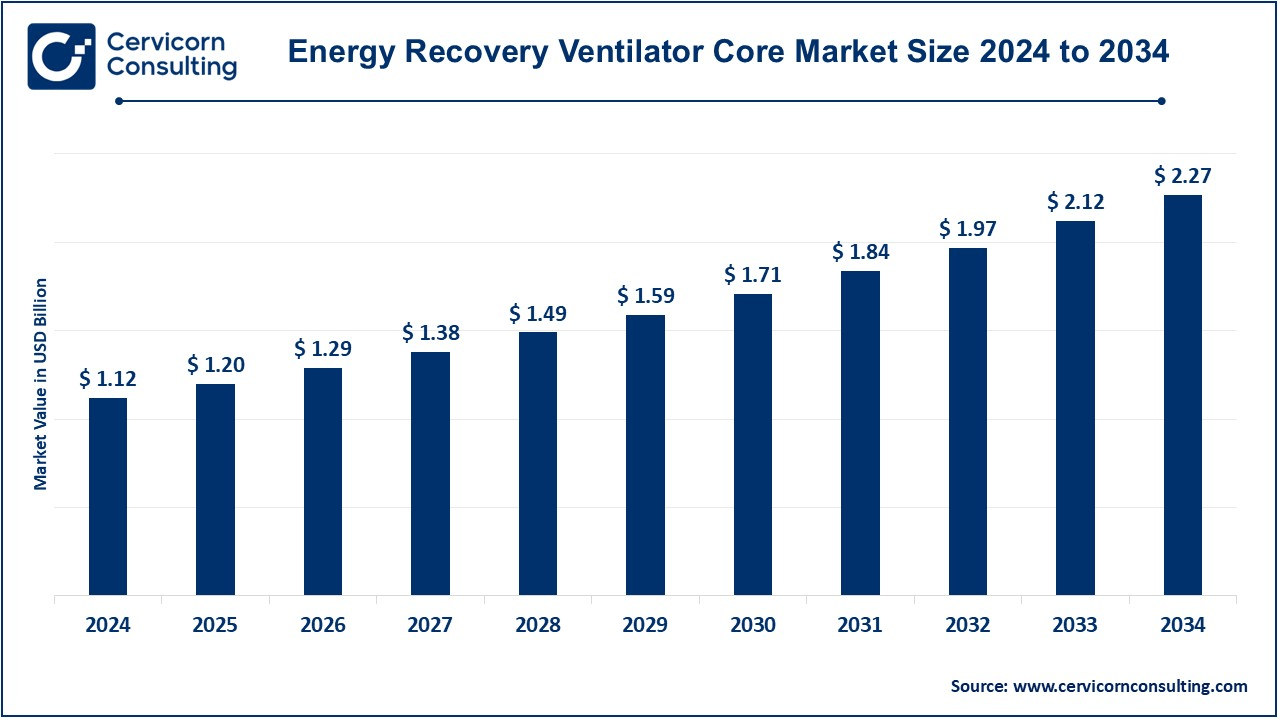

The global energy recovery ventilator core market size was worth USD 1.12 billion in 2024 and is anticipated to expand to around USD 2.27 billion by 2034, registering a compound annual growth rate (CAGR) of 7.32% from 2025 to 2034.

Market Growth Factors

The global Energy Recovery Ventilator (ERV) Core Market was valued at around USD 1.0–1.1 billion in 2024 and is expected to expand steadily at a CAGR of approximately 8–10% through 2034. Several interrelated factors are fueling this growth: stringent building energy codes, rising adoption of sustainable architecture, the increasing need for high indoor air quality, and rapid urbanization across Asia-Pacific and the Middle East. The growing prevalence of respiratory health concerns and the focus on carbon reduction have accelerated the demand for energy-efficient ventilation systems in both residential and commercial spaces.

Additionally, advancements in ERV core designs—such as enhanced plate materials, anti-corrosion coatings, and high-efficiency rotary wheels—have improved system performance, making ERVs more cost-effective and easier to maintain. Government sustainability programs, green building certifications, and retrofitting initiatives in older infrastructure are further bolstering the market’s expansion, driving innovation and competitiveness across the value chain.

What is the Energy Recovery Ventilator Core Market?

The Energy Recovery Ventilator (ERV) Core Market represents the segment of the HVAC industry focused on the production and sale of the heat and energy exchange components that form the centerpiece of ERV systems. These cores facilitate the transfer of thermal and, in many cases, latent energy (moisture) between exhaust and incoming fresh air streams. The main product types include rotary (enthalpy) wheels, crossflow plate exchangers, and counterflow cores, manufactured using materials like aluminum, resin, plastic, paper, or composites.

The ERV core’s purpose is to capture and reuse energy from expelled indoor air to pre-condition incoming air, thereby significantly reducing HVAC energy loads. The market encompasses manufacturers, OEMs, and system integrators involved in the design, fabrication, and distribution of these components. Segmentation is often based on material, airflow configuration, end-user industry, and application. Residential, commercial, industrial, and healthcare facilities are among the most common users. The core’s performance defines the overall efficiency of the ERV system, making this component pivotal in determining both energy savings and indoor air quality outcomes.

Why is the ERV Core Market Important?

The significance of the ERV core market extends far beyond ventilation. It directly supports global sustainability objectives and energy policy frameworks. Here’s why it matters:

- Energy Efficiency: ERV cores reduce heating and cooling loads by recovering energy that would otherwise be lost, lowering building energy consumption by up to 70% in some systems.

- Environmental Impact: These systems contribute to carbon reduction goals, supporting governments and corporations aiming for net-zero emissions.

- Health and Comfort: By maintaining a steady flow of filtered, conditioned air, ERV cores improve indoor air quality, humidity control, and occupant comfort.

- Regulatory Compliance: They enable adherence to evolving building energy codes, green certifications, and indoor air standards.

- Operational Cost Savings: Reduced HVAC energy demand results in significant operational savings, enhancing long-term return on investment for property owners.

Collectively, the ERV core market represents a vital intersection of technology, sustainability, and human well-being.

Top Companies Driving the ERV Core Market

1. Xiamen AIR-ERV Technology Co., Ltd.

Company Overview:

Founded in 1996 and based in China, Xiamen AIR-ERV Technology Co., Ltd. is one of the most established global manufacturers of energy recovery ventilator cores. The company specializes in air-to-air heat exchangers and enthalpy recovery components.

Specialization & Focus:

AIR-ERV focuses on both OEM and ODM manufacturing, producing rotary wheels, crossflow cores, and total heat exchangers tailored to various HVAC systems. Its products are used widely in residential and commercial ventilation.

Notable Features:

The company emphasizes product customization, quality control, and international certification standards (CE, ISO). It has a strong export presence, particularly across Asia-Pacific, Europe, and North America.

2024 Highlights:

While detailed revenue figures are not publicly disclosed, AIR-ERV is estimated to be among the top three Asian manufacturers by volume, maintaining a significant share of the regional ERV core export market.

2. Ruskin

Company Overview:

Headquartered in the United States, Ruskin is a leading provider of air control solutions, including energy recovery ventilators, dampers, and louvers.

Specialization & Focus:

Ruskin integrates ERV cores within larger HVAC systems, catering primarily to commercial and institutional facilities. Its focus on precision engineering and robust air management makes it a preferred supplier for high-performance building systems.

Notable Features:

Ruskin’s ERV cores are designed for superior airflow control, low leakage, and durability. Its distribution network spans North America, with a growing international presence through partnerships.

2024 Highlights:

Ruskin’s ERV product line contributes significantly to its HVAC segment revenue. The company’s leadership in air control technology and product reliability reinforces its position as a key player in the North American ERV market.

3. Oji Industrial Materials Management Co., Ltd.

Company Overview:

Part of the larger Oji Holdings Group of Japan, Oji Industrial Materials Management focuses on engineered materials and specialty paper products that serve as substrates in ERV cores and air filtration systems.

Specialization & Focus:

The division emphasizes fiber-based materials used in fibrous and paper-type ERV cores. Sustainability and advanced material science are central to its innovation strategy.

Notable Features:

Oji’s proprietary paper technologies enhance heat and moisture exchange efficiency while resisting mold and bacterial growth. These qualities make Oji a leading supplier of core materials globally.

2024 Highlights:

Oji Holdings reported strong consolidated net sales for FY2024, driven by materials and packaging divisions. The company continues to expand its global footprint, especially in Asia and Europe.

4. Klingenburg GmbH

Company Overview:

Germany-based Klingenburg GmbH is a highly respected name in energy recovery, known for its expertise in rotary and plate heat exchangers.

Specialization & Focus:

Klingenburg produces enthalpy wheels, plate exchangers, and humidity control cores used in industrial, commercial, and data center applications.

Notable Features:

The company emphasizes efficiency, precision, and reliability. Its cores are recognized for durability, corrosion resistance, and adaptability across varying climatic conditions.

2024 Highlights:

With an estimated annual turnover in the multi-million Euro range, Klingenburg serves customers worldwide through subsidiaries and distributors in Europe, Asia, and the Americas.

5. Innergy Tech Inc.

Company Overview:

Innergy Tech Inc., based in North America, specializes in energy recovery solutions including heat pipes, plate exchangers, and rotary wheels.

Specialization & Focus:

The company focuses on innovation and R&D, developing high-performance cores for both standard and custom applications. Its designs are optimized for ease of installation and long service life.

Notable Features:

Innergy Tech emphasizes manufacturing quality, offering products suitable for extreme climates and heavy-duty applications such as hospitals and laboratories.

2024 Highlights:

Innergy Tech’s annual revenue is estimated in the tens of millions (USD), making it a mid-sized but influential player with a strong reputation in North America and Europe.

Leading Trends and Their Impact

1. Energy Efficiency Regulations

Governments worldwide are tightening building codes to meet net-zero carbon goals. As a result, ERV systems with advanced cores are becoming mandatory in new constructions and major renovations. This trend is accelerating innovation in materials and design to achieve higher heat recovery rates with minimal pressure drops.

2. Material and Design Innovation

Manufacturers are adopting advanced polymers, composite coatings, and engineered resins to enhance corrosion resistance and microbial protection. These improvements extend the life of ERV cores, especially in humid or saline environments, reducing maintenance needs and lifecycle costs.

3. Smart Integration

The convergence of ERV technology with IoT and smart building systems is transforming HVAC operations. Automated sensors now regulate airflow, bypass frost conditions, and optimize recovery efficiency in real time, significantly improving operational efficiency and system longevity.

4. Modular and Retrofit Solutions

Compact, modular ERV cores are being developed to retrofit existing HVAC systems in older buildings. This trend is particularly strong in mature markets like North America and Europe, where upgrading infrastructure is more practical than new construction.

5. Regional Production Shifts

Asia-Pacific continues to dominate ERV core manufacturing, particularly China and Japan. However, increasing localization efforts in Europe and North America—driven by supply chain resilience strategies—are reshaping production networks and fostering new joint ventures.

Successful Examples of ERV Core Implementation

- Scandinavian Passive Buildings:

In Norway, Sweden, and Finland, ERV cores are integral to passive house construction. They enable exceptional thermal retention in sub-zero climates while maintaining optimal humidity levels indoors. - North American School Renovations:

Several school districts across the U.S. and Canada have integrated ERV cores into HVAC retrofits to improve air quality post-COVID-19. This has improved energy efficiency while safeguarding student health. - European Data Centers:

ERV cores are now standard in data centers across Germany, the Netherlands, and the U.K., where they regulate humidity and reduce cooling loads. Companies like Klingenburg lead in designing specialized cores for these controlled environments. - High-Rise Residential Complexes in Asia:

Cities like Shanghai, Seoul, and Tokyo have adopted ERV systems in high-rise apartments, addressing dense urban air quality challenges and energy conservation targets simultaneously.

Global Regional Analysis and Government Initiatives

North America

The U.S. and Canada are leading adopters of ERV technology due to stringent ASHRAE standards, energy efficiency mandates, and growing awareness of IAQ. Federal and state incentives for green building retrofits, along with widespread adoption in educational and healthcare institutions, support steady growth. Manufacturers in this region are focusing on innovation and high-performance solutions to meet certification standards such as LEED and WELL.

Europe

Europe represents a mature and technologically advanced ERV core market. The EU Energy Performance of Buildings Directive (EPBD), carbon neutrality pledges, and green recovery funds have spurred large-scale adoption. Northern and Western Europe, especially Germany and the Nordics, are pioneers in integrating ERVs into nearly all new residential and commercial projects.

Asia-Pacific

Asia-Pacific dominates global manufacturing and demand. China, Japan, and South Korea are the epicenters of ERV core production, while India and Southeast Asia are emerging markets with increasing construction activities. National programs encouraging energy-efficient buildings, coupled with rapid urbanization and infrastructure expansion, make this region the fastest-growing ERV core market.

Middle East & Africa

Energy recovery systems are gaining traction in hot, arid regions of the Middle East. Countries like the UAE and Saudi Arabia are promoting sustainable building practices under initiatives like Vision 2030, driving adoption of ERV cores to reduce massive cooling loads in commercial structures. African markets are still nascent but show potential as urbanization accelerates.

Latin America

Latin America’s ERV core market is gradually expanding, with Brazil, Mexico, and Chile at the forefront. Government-backed sustainability initiatives, green building incentives, and partnerships with international HVAC manufacturers are helping to introduce advanced ventilation systems into the regional market.

Government Policies and Their Market Influence

- Energy Efficiency Standards: Regulations in the U.S., EU, and Japan mandate minimum recovery efficiency levels, directly impacting product design and material innovation.

- Green Building Certifications: LEED, BREEAM, and local certification schemes require energy-efficient ventilation, creating strong demand for compliant ERV systems.

- Subsidies and Incentives: Several governments provide tax credits or funding for HVAC retrofits incorporating energy recovery systems.

- Public Infrastructure Initiatives: Ventilation upgrades in public schools, hospitals, and government buildings are major market drivers, especially in developed economies.

- Climate Action Goals: Global carbon neutrality commitments have positioned ERV cores as key tools for reducing building-related emissions.

Market Outlook and Strategic Insights

The ERV core market is poised for significant evolution in the coming decade. Manufacturers are investing heavily in R&D to enhance core durability, performance, and recyclability. Strategic partnerships between Western HVAC integrators and Asian component manufacturers are expected to expand, ensuring innovation while maintaining cost efficiency.

Key areas of opportunity include:

- Cold-climate and humid-environment solutions with frost prevention and anti-microbial coatings.

- Hybrid ventilation technologies combining ERV cores with advanced filtration or UV sterilization.

- Integration with renewable energy systems, enabling synchronized building energy optimization.

- Smart, self-adjusting ERV systems that dynamically balance energy savings and air quality based on occupancy.

As nations continue to prioritize health, sustainability, and energy efficiency, the Energy Recovery Ventilator Core Market will remain an essential part of global HVAC innovation—bridging the gap between environmental responsibility and indoor comfort.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Containerised Electrolyzer Market Growth Drivers, Trends, Key Players, and Regional Insights by 2034