Electronic Components Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

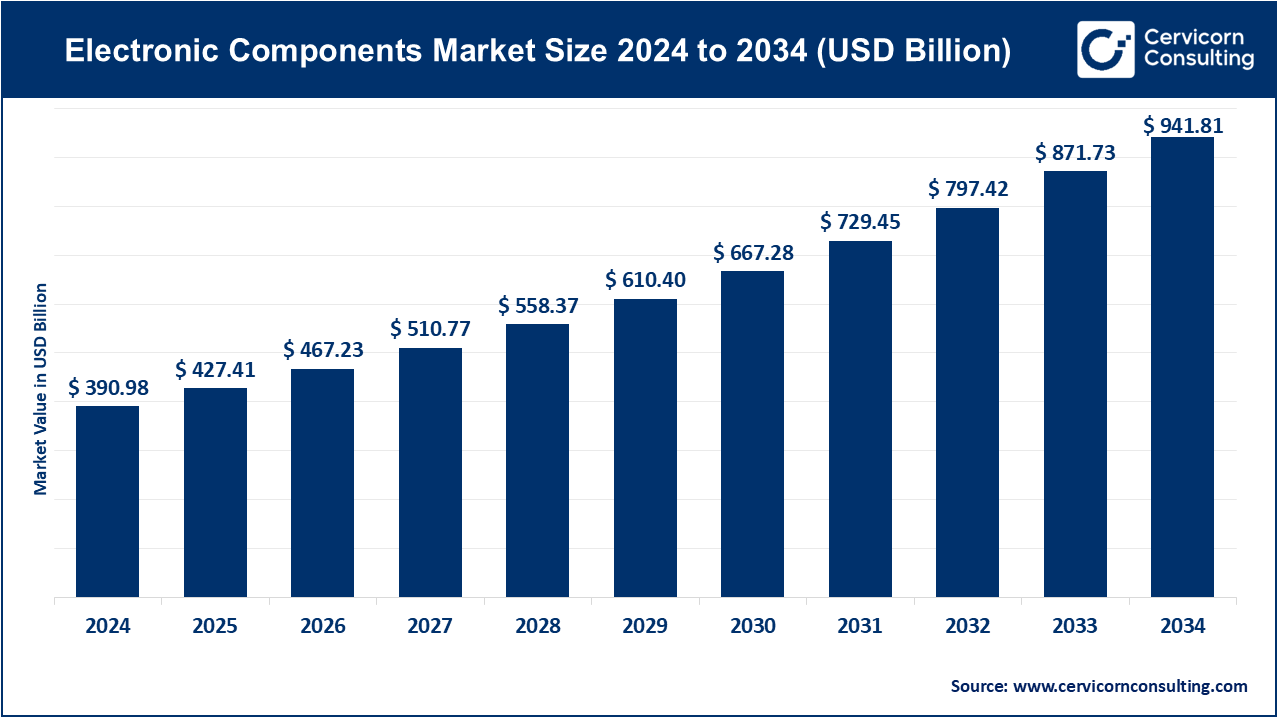

Electronic Components Market Size

The global electronic components market size was worth USD 390.98 billion in 2024 and is anticipated to expand to around USD 941.81 billion by 2034, registering a compound annual growth rate (CAGR) of 9.31% from 2025 to 2034.

What is the electronic components market?

At its core, the electronic components market encompasses the manufacturing and distribution ecosystem responsible for producing discrete electronic parts (resistors, capacitors, diodes), passive elements (MLCCs, chip inductors), active devices (transistors, ICs, power modules), electromechanical parts (connectors, switches), sensors of all types, and the packaging and assembly services required to integrate these into modules and final devices. It includes commodity items used in mass electronics as well as highly specialized components used in automotive, aerospace, medical, defense, industrial automation, telecommunication infrastructure, and renewable energy systems. The entire value chain — materials, fabrication, assembly, testing, distribution, and OEM integration — falls within this market’s scope.

Why it is important

Electronic components are the backbone of modern technology. Advances in component performance, miniaturization, and reliability directly influence what end-products can achieve. Smaller MLCCs enable slimmer smartphones; advanced power modules increase EV range and efficiency; RF filters and wireless modules enable 5G/6G connectivity; and sensors make wearables, smart factories, and medical diagnostics possible. Modern innovation in AI, digital infrastructure, autonomous systems, and green energy would not be possible without continuous improvements in semiconductors and passive components. The market’s importance extends beyond technology—it impacts national security, manufacturing resilience, supply-chain stability, and sustainable development.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2425

Growth Factors

The electronic components market is being propelled by several converging forces, including soaring demand for semiconductors and passive components due to AI workloads and datacenter capacity build-outs; rapid global rollout of 5G and future 6G networks, which require advanced RF components and base-station hardware; accelerating EV adoption and vehicle electrification, driving the need for power semiconductors, sensors, and automotive-grade passive components; widespread IoT adoption across industrial, retail, and consumer segments increasing demand for low-power and miniaturized components; expanding consumer appetite for high-performance mobile and wearable devices.

The global shift toward renewables and energy-efficient power systems requiring advanced power electronics; and major government incentives and reshoring policies encouraging new semiconductor fabs and component manufacturing facilities. Together, these trends are pushing suppliers to prioritize reliability, miniaturization, and sustainable production while scaling global capacity.

Company Profiles

1. TDK Corporation

- Specialization: Passive components, including MLCCs, inductors, power supplies, magnetic materials, sensors, and energy devices.

- Key Focus Areas: High-capacitance MLCCs, automotive-grade electronics, sensors for industrial and mobility applications, and advanced power solutions.

- Notable Features: Strength in materials science, leadership in miniaturized components, extensive global manufacturing footprint in Japan, China, Malaysia, and Europe.

- 2024 Revenue: TDK’s 2024 integrated reports highlight substantial revenue contributions from its passive components and sensor businesses.

- Market Share & Global Presence: One of the top global MLCC suppliers with significant influence in automotive, mobile, and industrial electronics markets.

2. KYOCERA AVX Components Corporation

- Specialization: Ceramics, capacitors, filters, RF components, interconnects, and custom electronic modules.

- Key Focus Areas: Automotive-grade passives, high-frequency components for telecom, and custom assemblies for medical and industrial use.

- Notable Features: Strong synergy between Kyocera’s advanced ceramics expertise and AVX’s passive component portfolio.

- 2024 Revenue: KYOCERA Group’s 2024 reports show meaningful contributions from the electronic components division, including AVX.

- Market Share & Global Presence: Established global manufacturing footprint across the Americas, Europe, and Asia with solid market share in passives and RF components.

3. Murata Manufacturing Co., Ltd.

- Specialization: MLCCs, wireless modules, RF solutions, sensors, power modules, and embedded components.

- Key Focus Areas: RF front-end modules for smartphones, advanced ceramic technologies, automotive electronics, and IoT modules.

- Notable Features: Extremely high vertical integration, industry-leading MLCC portfolio, and deep collaboration with major mobile and automotive OEMs.

- 2024 Revenue: Murata’s 2024 financial results reflect strong revenue from MLCCs and wireless modules.

- Market Share & Global Presence: One of the top global leaders in MLCCs and wireless modules with plants across Japan, China, Singapore, and other Asian regions.

4. Samsung Electronics Co., Ltd.

- Specialization: Semiconductors—including memory (DRAM, NAND), advanced logic, foundry services, imaging sensors, and system LSI—along with displays and consumer electronics.

- Key Focus Areas: High-performance memory for AI and datacenters, advanced logic nodes, semiconductor packaging, and mobile components.

- Notable Features: Large-scale R&D capabilities, world-class fabs, and vertically integrated manufacturing aligned with mobile and datacenter markets.

- 2024 Revenue: Samsung reported approximately KRW 300.9 trillion in consolidated 2024 revenue, buoyed heavily by semiconductor recovery.

- Market Share & Global Presence: Regained its position as the top semiconductor supplier in 2024; global presence includes manufacturing in Korea, the U.S., and multiple Asian regions.

5. Panasonic Corporation

- Specialization: Electronic components (capacitors, sensors, connectors), industrial equipment, automotive systems, EV battery systems (through partnerships), and consumer technologies.

- Key Focus Areas: Automotive power electronics, energy solutions, advanced sensors, and industrial systems.

- Notable Features: Strong legacy in industrial and consumer electronics, growing footprint in EV batteries and automotive power devices.

- 2024 Revenue: Panasonic’s 2024 integrated reports show diversified contributions across components, appliances, and automotive systems.

- Market Share & Global Presence: Presence across all key regions—Asia, North America, and Europe—supporting automotive and industrial electronics markets.

Leading Trends and Their Impact

1. AI Workloads & Datacenter Expansion

Explosive demand for AI computing infrastructure is driving high-volume production of memory, logic chips, and advanced packaging technologies. This also increases the need for high-reliability passives, power modules, and interconnects.

2. Automotive Electrification & ADAS

EVs require significantly more components than traditional vehicles—power modules, sensors, high-voltage passive components, and rugged semiconductors. This is pushing suppliers to prioritize automotive-grade quality standards, long-term reliability, and local sourcing of components.

3. Miniaturization & System Integration

System-in-package (SiP), chiplets, embedded passives, and ultra-compact MLCCs are enabling smaller, more efficient devices. This trend benefits companies with strong materials and packaging innovations.

4. Supply Chain Reshoring

To mitigate geopolitical risks, governments are incentivizing local semiconductor and component production. This is reshaping supply chains and leading companies to operate dual or regional manufacturing hubs.

5. Sustainability Standards

Stricter global regulations are pushing component manufacturers toward eco-friendly processes, recycling initiatives, and reduced energy consumption in fabs.

6. 5G/6G Infrastructure & Edge Devices

Rollout of 5G and preparation for 6G are boosting demand for RF filters, antenna modules, and high-frequency passives, especially from Murata and KYOCERA AVX.

Successful Examples of the Electronic Components Market Around the World

Japan — Ceramic & Passive Component Dominance

Japan continues to lead in MLCCs, advanced ceramics, and high-quality precision components. Companies like Murata and TDK dominate the global supply of compact, high-capacitance MLCCs essential for mobile devices and automotive electronics.

South Korea — Memory & System Semiconductors

Samsung’s global leadership in DRAM and NAND has enabled rapid growth across AI, datacenters, and mobile products. Korea’s strategic focus on semiconductor leadership has created an advanced ecosystem around memory and logic integrated circuits.

United States & Europe — Foundry and Power Electronics Rise

Government incentives such as the U.S. CHIPS and Science Act and European semiconductor strategies have catalyzed new fabs, packaging plants, and power electronics manufacturing, strengthening regional supply resilience.

China & Southeast Asia — Global Manufacturing Hubs

China’s scale and government-backed investment have made it a central hub for commodity components, while Southeast Asian nations (Malaysia, Vietnam, Thailand) have grown into major PCB, sensor, and semiconductor assembly centers.

Global Regional Analysis (Including Government Initiatives & Policies)

Asia-Pacific

- Largest manufacturing base for semiconductors, passives, sensors, and assemblies.

- Japan leads in materials and passive components; Korea excels in memory and foundry; Taiwan dominates advanced logic and packaging; China grows rapidly in commodity and mid-range components.

- Policies: subsidies for semiconductor self-sufficiency, manufacturing incentives, joint ventures, and R&D funding.

North America

- U.S. CHIPS Act promoting domestic fabrication, packaging, and supply chain security.

- Growing investments in power electronics, advanced packaging, and specialty components for aerospace and defense.

- Mexico and Canada supporting electronics assembly and automotive components.

Europe

- EU initiatives promoting clean technology, industrial automation, and semiconductor independence.

- Strong automotive ecosystem driving demand for power electronics, sensors, and safety-critical components.

- Policies include IPCEI programs, environmental regulations, and incentives for local manufacturing.

Latin America & Africa

- Emerging regions for assembly, distribution, and localized manufacturing of industrial and energy-related components.

- Government incentives focused on attracting foreign investment, renewable energy adoption, and digital infrastructure.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Medical Supplies Market Growth Drivers, Trends, Key Players and Regional Insights by 2035