Electric Air Taxi Market Revenue, Global Presence, and Strategic Insights by 2034

Electric Air Taxi Market Size

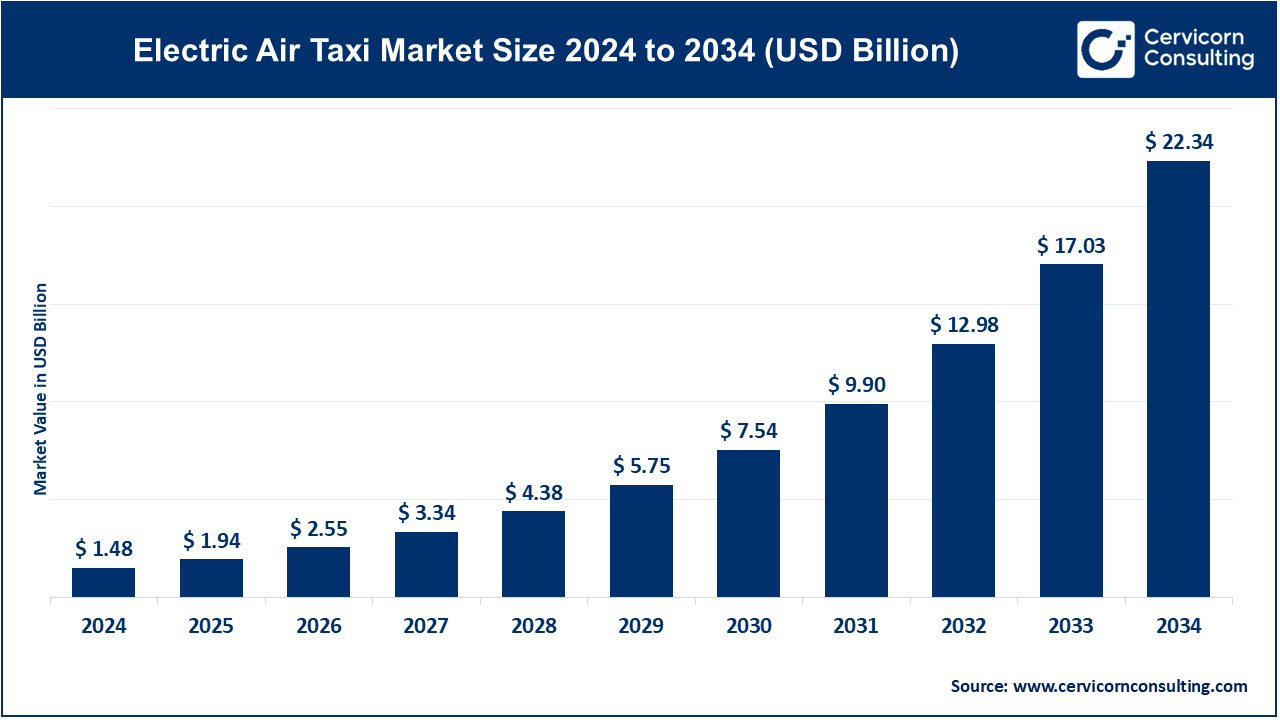

The global electric air taxi market size was worth USD 1.48 billion in 2024 and is anticipated to expand to around USD 22.34 billion by 2034, registering a compound annual growth rate (CAGR) of 31.18% from 2025 to 2034.

Electric Air Taxi Market — Growth Factors

The growth of the electric air taxi market is propelled by a convergence of technological, economic, and societal factors. Advances in battery energy density and power management systems have made electric vertical takeoff and landing flights feasible, while urbanization and traffic congestion are creating strong demand for high-speed, point-to-point aerial mobility solutions. Growing investments from automotive and aerospace giants have strengthened production capabilities and improved supply chain efficiency.

Meanwhile, global sustainability goals and city-level decarbonization policies favor electric mobility solutions, making eVTOLs an attractive option for clean transport. Regulatory agencies such as the FAA and EASA are providing clearer certification pathways, reducing market uncertainty. In parallel, vertiport infrastructure development, public-private partnerships, and increasing public acceptance of autonomous and electric transport systems are enhancing commercial viability. Together, these elements form a strong foundation for accelerated market growth and broader adoption of electric air taxis worldwide.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2629

What Is the Electric Air Taxi Market?

The electric air taxi market encompasses the ecosystem of electric-powered vertical takeoff and landing aircraft, supporting infrastructure, service providers, and technological solutions that enable short-distance passenger flights across and between urban areas. These eVTOL aircraft rely on distributed electric propulsion and battery power, allowing vertical takeoff and landing without the need for long runways. The market includes several key components—manufacturers of aircraft and propulsion systems, operators and fleet owners, software developers for flight management and air traffic integration, charging and vertiport infrastructure providers, and regulatory and certification bodies. The market’s aim is to create a fully functional urban air mobility network that complements existing transportation systems, enabling faster, quieter, and cleaner travel options for commuters and businesses.

Why Is It Important?

Electric air taxis are significant because they address critical challenges faced by modern urban environments—traffic congestion, long commute times, and high emissions from traditional transportation. By introducing a vertical dimension to mobility, eVTOLs can drastically reduce travel time between key urban points such as airports, city centers, and business districts. Their electric propulsion systems contribute to lower carbon footprints and minimal noise pollution compared to helicopters, aligning with global sustainability initiatives.

Economically, the sector opens opportunities for advanced manufacturing, battery innovation, software development, and smart city integration. Governments see eVTOLs as part of the future of multimodal transportation, supporting environmental objectives and stimulating investment in next-generation infrastructure. For consumers, they promise a new mode of efficient, time-saving, and sustainable travel.

Electric Air Taxi Market — Top Companies

1. Joby Aviation

- Specialization: Joby Aviation specializes in the development and production of all-electric piloted eVTOL aircraft designed for urban and regional air taxi services.

- Key Focus Areas: FAA certification, full-scale production readiness, safety validation, and noise reduction technology.

- Notable Features: Joby’s aircraft uses a tilt-rotor design for efficient forward flight and quiet takeoff and landing operations. It emphasizes minimal environmental impact and operational efficiency.

- 2024 Revenue & Market Position: Joby was one of the most financially stable and advanced companies in the sector in 2024, supported by significant investment from Toyota and other strategic partners. It continued large-scale certification trials and pre-production work in preparation for commercial launch.

- Global Presence: Headquartered in California, USA, with manufacturing partnerships and potential launch operations in North America, Japan, and select European markets.

2. Archer Aviation

- Specialization: Archer Aviation focuses on the development of eVTOL aircraft optimized for short urban routes, emphasizing cost-effective manufacturing and commercial scalability.

- Key Focus Areas: FAA certification, industrialization of aircraft production, and strategic airline partnerships.

- Notable Features: Archer’s “Midnight” aircraft is designed for rapid 10–20-minute city flights, featuring fast charging capabilities and a simplified design suited for mass production.

- 2024 Revenue & Market Position: In 2024, Archer raised substantial capital from institutional and strategic investors, ensuring its continued progress toward certification and production readiness. It entered partnerships with major airlines to launch pilot routes and operational trials.

- Global Presence: Based in the United States with partnerships in North America and plans to expand operations to Europe and the Middle East.

3. Lilium GmbH

- Specialization: Lilium is developing high-speed regional air mobility solutions with its ducted-fan electric jet, the Lilium Jet, capable of longer ranges than most rotor-based eVTOLs.

- Key Focus Areas: Range extension, performance optimization, and regional route development.

- Notable Features: The Lilium Jet uses multiple small electric ducted fans for quieter, efficient vertical and horizontal flight, enabling both urban and inter-city operations.

- 2024 Revenue & Market Position: Lilium experienced financial difficulties in 2024, highlighting the capital-intensive nature of eVTOL development. Despite its challenges, its design remains influential for high-speed electric flight.

- Global Presence: Headquartered in Germany, with global partnerships and demonstration plans in Europe, the Middle East, and Asia.

4. Vertical Aerospace

- Specialization: Vertical Aerospace designs eVTOL aircraft for urban and regional routes, with a focus on certification and industrial scalability through established aerospace engineering partnerships.

- Key Focus Areas: Prototyping, regulatory certification in coordination with UK and U.S. authorities, and strategic supplier alliances.

- Notable Features: The VX4 eVTOL is designed for up to four passengers, offering quiet operations and high energy efficiency.

- 2024 Revenue & Market Position: In 2024, the company continued developing and testing prototypes while securing additional funding for ongoing R&D and production readiness.

- Global Presence: Based in the United Kingdom, with strategic partnerships across Europe, North America, and Asia-Pacific.

5. Volocopter

- Specialization: Volocopter focuses on multi-rotor eVTOL aircraft designed for short urban hops and airport-city connections.

- Key Focus Areas: Certification for urban operations, vertiport infrastructure partnerships, and integration with existing transport networks.

- Notable Features: The VoloCity model features 18 rotors, redundant systems for safety, and low noise emissions, making it ideal for city environments.

- 2024 Revenue & Market Position: Volocopter remained a leading player in 2024 with strong funding rounds and successful test flights. It was among the first to conduct public demonstration flights in major cities, moving toward commercial operations.

- Global Presence: Headquartered in Germany, Volocopter operates across Europe, Asia, and the Middle East, collaborating with airports and local governments.

Leading Trends and Their Impact

1. Certification and Regulation

A key market driver is the formalization of certification standards by aviation authorities like the FAA and EASA. These frameworks establish clear requirements for airworthiness, pilot training, and operational safety. The progress in regulation reduces market uncertainty and accelerates the commercial timeline for eVTOL operators.

2. OEM and Automotive Partnerships

Collaboration between eVTOL startups and major OEMs—such as Toyota’s partnership with Joby and Stellantis’s investment in Archer—has strengthened manufacturing capabilities. These alliances provide expertise in production, logistics, and quality control, essential for scaling aircraft manufacturing.

3. Infrastructure Development

The emergence of vertiports—dedicated takeoff and landing hubs with charging stations—is shaping a new layer of urban infrastructure. These facilities are becoming investment opportunities themselves, attracting energy companies and infrastructure developers.

4. Shifting Use-Cases

The market is transitioning from experimental to practical operations. Early pilots focus on airport-city routes, tourism corridors, and event mobility services, demonstrating viable use cases and building public trust.

5. Financial Consolidation

With high R&D costs and long certification timelines, financial strength is becoming a key differentiator. Well-funded companies like Joby and Archer are advancing, while smaller firms struggle to secure capital, leading to potential mergers and acquisitions in the coming years.

6. Technology Advancements

Improvements in battery density, lightweight materials, and autonomous flight software continue to expand the operational range and reliability of eVTOLs. These innovations are critical for enabling longer flights and reducing maintenance costs.

Successful Examples Around the World

Joby Aviation – United States

Joby has conducted extensive FAA-certified test flights and is collaborating with local governments to integrate urban air taxi routes in California. The company aims to launch initial services in key U.S. markets once certification is complete.

Volocopter – Europe and Asia

Volocopter has performed public demonstration flights in major cities, including Paris, Singapore, and Dubai. It is working closely with airports and urban developers to plan vertiport infrastructure and service routes.

Archer Aviation – North America

Archer is conducting test flights of its “Midnight” eVTOL and has partnerships with major airlines for commercial operations between airports and city centers. It plans to launch pilot services in the U.S. by mid-decade.

Regional Airport Pilots – Global

Several airports in the United States, the Middle East, and Asia have hosted trial flights and infrastructure studies, testing how eVTOLs integrate with existing air traffic and passenger terminals. These projects demonstrate real-world readiness and safety compliance.

Global Regional Analysis and Government Policies

North America

North America leads in certification and early commercialization efforts. The FAA has developed specific guidelines for eVTOL certification, operational standards, and pilot licensing. U.S. cities like Los Angeles and New York are planning vertiports in collaboration with private developers. Canada is also progressing with pilot projects focusing on intercity connectivity and remote region access.

Europe

Europe is at the forefront of UAM policy development. The European Union Aviation Safety Agency (EASA) provides comprehensive regulatory frameworks for eVTOL certification and urban integration. Governments in France, Germany, and the UK are funding pilot programs, with cities like Paris preparing eVTOL routes ahead of international events. Volocopter and Vertical Aerospace are leading European OEMs, supported by government and private capital.

Asia-Pacific

Asia-Pacific nations are among the most proactive in preparing for eVTOL operations. Singapore has established test corridors and regulatory roadmaps for air taxi deployment. Japan is integrating eVTOLs into its smart city and tourism strategies, while South Korea has unveiled plans for UAM corridors in Seoul. China’s growing eVTOL ecosystem and government-backed innovation programs further reinforce the region’s strong market potential.

Middle East

The Middle East, especially the UAE and Saudi Arabia, has emerged as a major region for early eVTOL adoption. Dubai and NEOM are developing advanced vertiport networks and testing corridors as part of broader smart-city initiatives. The supportive regulatory environment and infrastructure investment make the region an attractive testbed for commercial deployment.

Latin America

Latin America presents significant potential for intercity and regional air taxi services, particularly in large, congested cities like São Paulo and Mexico City. Governments are exploring partnerships with private companies to study feasibility and environmental impact. Regulatory frameworks are still evolving but show growing interest in sustainable aviation solutions.

Africa

In Africa, eVTOL technology could play a role in addressing connectivity challenges in remote and underdeveloped regions. While regulatory infrastructure remains limited, interest in sustainable aerial transport is rising, with pilot projects planned in South Africa and Kenya for logistics and emergency applications.

Government Initiatives and Policy Drivers

- Certification Frameworks: Governments and aviation authorities are providing clearer guidelines for airworthiness, pilot training, and safety standards, reducing uncertainty for manufacturers.

- Infrastructure Investment: Public funding and partnerships for vertiports, charging networks, and power grid upgrades are critical enablers for commercial operations.

- Green Mobility Incentives: Many governments offer grants and subsidies for zero-emission transport projects, directly benefiting electric air taxi developers.

- Urban Airspace Management: Authorities are integrating Unmanned Traffic Management (UTM) systems to safely coordinate low-altitude air traffic with traditional aviation.

- Public–Private Collaboration: Joint initiatives between cities, infrastructure firms, and OEMs are helping accelerate real-world testing and commercial service planning.

Market Dynamics and Outlook

The electric air taxi market is entering a defining phase where technological readiness meets regulatory and commercial milestones. Companies with strong capital bases, robust partnerships, and scalable designs are positioned to dominate early markets. The combination of sustainable energy technology, innovative design, and evolving government support makes this an industry with transformative potential. Regional pilot programs, certification milestones, and vertiport rollouts will determine how quickly air taxis move from prototype to public service. As more governments align on airspace policies and green transport goals, electric air taxis are poised to become a practical, efficient, and sustainable component of future mobility ecosystems.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Ferro Alloys Market Growth Drivers, Trends, Key Players and Regional Insights by 2034