Display Market Revenue, Global Presence, and Strategic Insights by 2035

Display Market Size

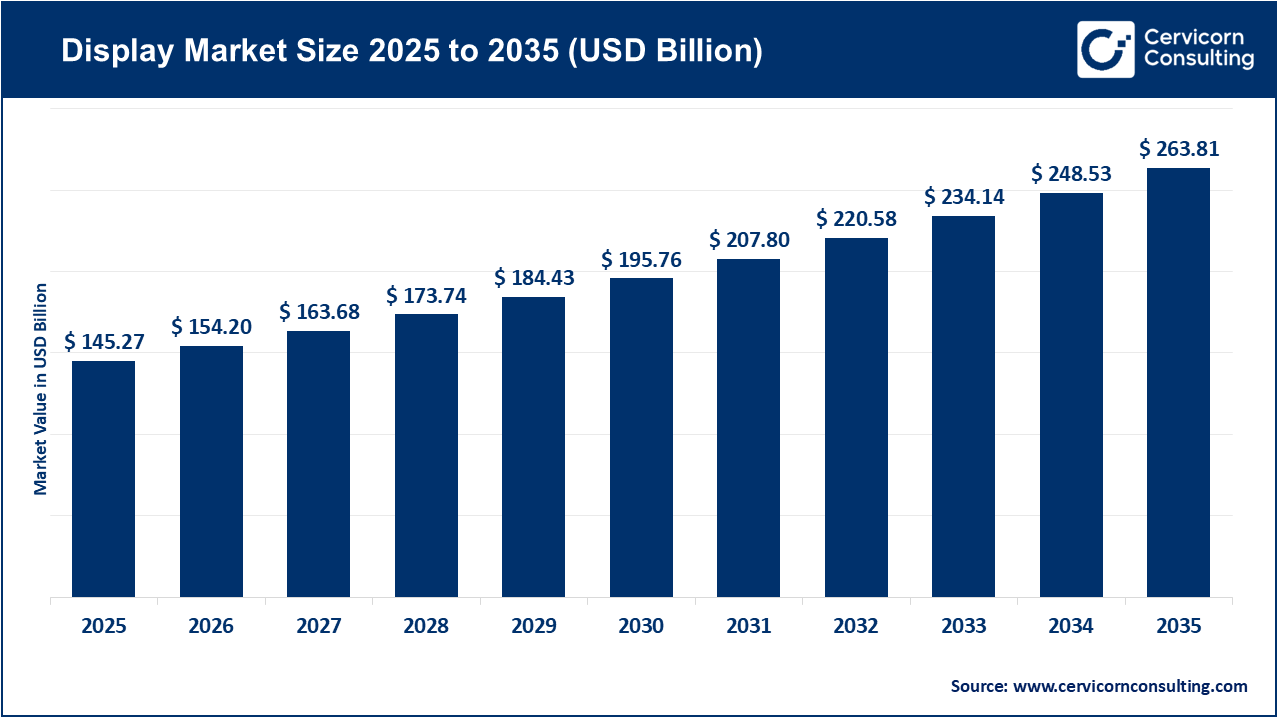

The global display market size was worth USD 145.27 billion in 2025 and is anticipated to expand to around USD 263.81 billion by 2035, registering a compound annual growth rate (CAGR) of 6.49% from 2026 to 2035.

Display Market Growth Factors

The display market continues to grow due to rising consumer demand for high-resolution, energy-efficient, and immersive screens, coupled with the rapid proliferation of smart devices such as foldables, smartwatches, AR/VR systems, and home displays. Advancements in materials—including quantum dots, OLED emitters, micro-LED components, and specialized glass—are improving product performance, longevity, and design flexibility. The automotive industry’s shift toward digital cockpits and advanced driver-assistance systems (ADAS) is expanding the use of curved, flexible, and high-brightness displays. Industrial, retail, and transportation sectors are also adopting large-format LED signage and video walls to enhance advertising, wayfinding, and visual communication.

Meanwhile, technological developments in backplane TFTs, local dimming, HDR, and high refresh rates are pushing premium upgrades in consumer electronics. Capacity expansion in Asia, combined with economies of scale, continues to reduce production costs, fueling global adoption. Additionally, macro trends—including remote work, cloud gaming, smart manufacturing, and AI-driven visual experiences—are increasing reliance on high-quality displays across all application areas.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2836

What Is the Display Market?

The display market refers to the global industry that develops, manufactures, and sells display panels, materials, components, and the technologies that support them. This encompasses LCD panels, OLED and AMOLED displays, micro-LED, quantum-dot displays, specialty glass, driver ICs, backplane semiconductors, polarizers, emitter materials, color filters, and integration systems. Products range from TVs, monitors, smartphones, and tablets to automotive interfaces, industrial equipment, medical imaging displays, AR/VR devices, and commercial signage. The market comprises panel manufacturers, materials suppliers, OEMs, and technology licensors, all contributing to a complex and interconnected value chain.

Why the Display Market Is Important

Displays are the visual interface that connects humans to technology. Every digital interaction—messaging, streaming, designing, navigating, analyzing data, performing surgery, or driving a car—relies on screen-based communication. Displays significantly impact energy consumption in battery devices, product performance, user experience, and even safety in applications such as automotive and aviation. The market drives innovation across electronics, shaping new product categories like foldable phones and AR glasses. Economically, display manufacturing supports millions of jobs worldwide and fuels entire supply chains—from materials and semiconductors to assembly and retail. Strategically, the industry is critical for national competitiveness as countries race to strengthen their advanced manufacturing capabilities.

Top Companies in the Display Market

1. Samsung Display

Specialization: OLED panels, QD-OLED, flexible displays, premium smartphone and TV screens.

Key Focus Areas: Foldable OLED production, high-brightness AMOLED for mobile, QD-OLED for TVs, and automotive displays.

Notable Features: World leader in OLED manufacturing; advanced backplane technology; strong integration with Samsung Electronics.

2024 Revenue / Market Signal: Reported strong contribution to the Samsung group’s device divisions (including display technologies), with the Samsung group posting consolidated revenue of over KRW 300 trillion in 2024.

Global Presence: Major operations in South Korea, Vietnam, China, plus global sales to leading smartphone and TV OEMs.

2. LG Display

Specialization: Large-format OLED panels for TVs, commercial displays, transparent OLED, and automotive OLEDs.

Key Focus Areas: Scaling OLED TV production, improving yield and cost efficiency, expanding into automotive and industrial markets.

Notable Features: Global pioneer and leader in large OLED TV panel production.

2024 Revenue: Reported annual sales of around KRW 26 trillion in 2024.

Global Presence: Manufacturing facilities in South Korea and China; worldwide partnerships with TV brands, commercial signage providers, and automotive manufacturers.

3. Corning Incorporated

Specialization: Specialty glass products including Gorilla Glass, display glass substrates, optics, and semiconductor-related materials.

Key Focus Areas: Premium cover glass for smartphones, precision glass for OLED and LCD panels, and glass solutions for AR/VR devices.

Notable Features: Decades of materials science leadership and long-term partnerships with major device OEMs.

2024 Revenue Signal: Specialty Materials segment posted strong results, with sales growing to approximately $2 billion.

Global Presence: Manufacturing and R&D centers across the U.S., Asia, and Europe; global supply chain partnerships.

4. Universal Display Corporation (UDC)

Specialization: OLED emitter materials and proprietary phosphorescent OLED (PHOLED) technology.

Key Focus Areas: Licensing OLED IP, supplying high-efficiency organic emitter materials, and extending OLED lifetime and performance.

Notable Features: Royalty-based business model that scales with global OLED adoption.

2024 Revenue: Reported approximately $647 million in 2024 driven by material sales and royalties.

Global Presence: Supplies materials and IP licensing to major OLED panel makers worldwide.

5. Philips (TPV / TP Vision)

Specialization: Consumer televisions (Philips-branded), monitors, and professional displays.

Key Focus Areas: OLED TVs, Ambilight technology, smart home integration, retail displays.

Notable Features: Philips branding combined with manufacturing and distribution through TPV/TP Vision.

2024 Revenue Signal: TPV reported revenues above RMB 55 billion across its TV and monitor businesses.

Global Presence: Strong presence in Europe, Asia, and emerging markets; large manufacturing base in China.

6. Nokia

Specialization: Telecommunications hardware and software; limited direct involvement in display manufacturing today.

Key Focus Areas: Network equipment, enterprise solutions, and technology licensing.

Notable Features: Historical significance in mobile device displays; brand continues through licensed products.

2024 Revenue: Reported revenue was approximately €19 billion in 2024.

Global Presence: Operations and technology centers across Europe, North America, and Asia.

Leading Trends in the Display Market and Their Impact

1. Expansion of OLED Across All Segments

OLED’s deep blacks, high contrast, flexibility, and premium performance continue to push adoption in TVs, smartphones, wearables, and automotive.

Impact: Higher margins for OLED suppliers, increased material sales, and a shift away from traditional LCD.

2. Emergence of Micro-LED

Micro-LED promises superior brightness, lifespan, and energy efficiency with emissive performance.

Impact: Expected to disrupt high-end TVs, AR devices, and digital signage; creates new demand for mass-transfer and precision manufacturing equipment.

3. Growth of Foldable, Rollable, and Flexible Displays

Flexible substrates and ultra-thin glass are enabling new product designs.

Impact: Expands premium smartphone categories; strengthens partnerships between panel makers and materials companies.

4. Automotive Digital Cockpits

The rise of EVs and ADAS systems is transforming dashboards into fully digital interfaces.

Impact: Creates long-term, stable demand for high-reliability, curved, and high-brightness displays.

5. Energy Efficiency + Long Lifetime Materials

With growing focus on sustainability and battery life, energy-efficient display technologies are becoming standard.

Impact: Increases demand for advanced OLED emitters, quantum dots, local dimming technologies, and durable glass solutions.

6. Asia’s Manufacturing Dominance

South Korea, China, Taiwan, and Vietnam continue to expand production capacity.

Impact: Competitive pricing, increased innovation cycles, but higher supply-chain concentration risks.

Successful Examples of the Display Market in Practice

South Korea’s OLED Leadership

South Korean companies have achieved global dominance in OLED for both mobile and TV applications. Their successes include mass production of flexible OLED used in premium flagship smartphones worldwide.

China’s Scale in LCD and Emerging OLED

China’s investments have driven LCD prices down globally and expanded access to large-format TVs and monitors. The country is now accelerating OLED capacity to compete in higher-end segments.

Automotive Digital Cockpits Worldwide

Brands like Mercedes-Benz, BMW, Tesla, and Hyundai have adopted dashboard-wide screens, HUDs, and center-stack displays that enhance user safety, UX, and vehicle aesthetics.

LED-Based Commercial Displays in Urban Environments

Cities like Tokyo, New York, Dubai, and Singapore deploy massive LED video walls for advertising, public information, and entertainment, showcasing the scalability of modern display systems.

Global Regional Analysis and Government Initiatives Shaping the Market

Asia Pacific (China, South Korea, Japan, Taiwan)

- Governments in China and South Korea provide significant subsidies, tax benefits, and R&D funding to strengthen domestic display manufacturing.

- China’s industrial policy has expanded LCD and OLED fabrication, making the region the largest exporter of display panels.

- South Korea invests heavily in OLED research, retaining leadership in high-end displays.

- Japan continues to focus on materials, optics, and advanced manufacturing equipment.

Impact:

Accelerated innovation cycles, cost reductions, and supply-chain dominance.

North America (United States)

- U.S. initiatives to boost domestic semiconductor and advanced materials manufacturing indirectly support the display ecosystem.

- Funding programs encourage production of specialty glass, AR/VR optics, and display components.

- Strong R&D ecosystem drives breakthroughs in micro-LED, quantum dots, and new materials.

Impact:

Strengthens upstream materials availability and reduces reliance on Asian supply chains.

Europe

- Emphasis on sustainability and environmental regulations influences display energy standards and product lifecycle guidelines.

- Automotive regulations accelerate demand for advanced in-vehicle displays.

- Europe supports innovation in optics, micro-displays, and medical imaging technologies.

Impact:

Drives high-value, specialized display applications, especially in automotive and healthcare.

India, Southeast Asia, and Emerging Markets

- Growing consumer electronics demand fuels rapid adoption of TVs, smartphones, and affordable monitors.

- Countries like Vietnam and India are becoming major assembly hubs due to favorable investment policies and production-linked incentives.

- Governments promoting digitalization and smart-city projects drive demand for signage and public-display solutions.

Impact:

Creates new regional demand centers and manufacturing alternatives outside China.

Policy Themes Across Regions

- National policies prioritize semiconductor and advanced electronics security, which indirectly influences the display sector.

- Export controls, manufacturing incentives, and R&D grants shape where fabs are built and where expertise concentrates.

- Sustainability guidelines push display makers toward recyclable materials, reduced energy consumption, and longer product lifespans.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Pea Starch Market Revenue, Global Presence, and Strategic Insights by 2035