Direct Air Capture Market Growth Drivers, Key Players, Trends and Regional Insights by 2034

Direct Air Capture Market Size

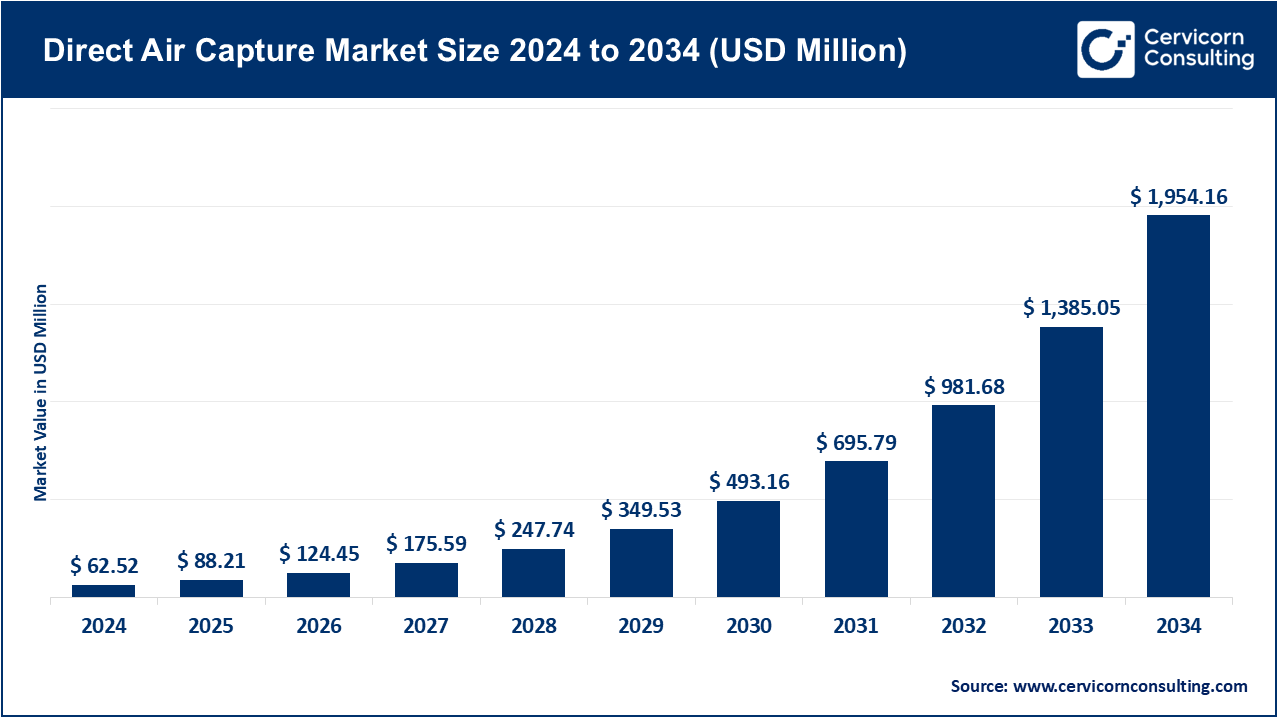

The global direct air capture market size was worth USD 62.52 million in 2024 and is anticipated to expand to around USD 1,954.16 million by 2034, registering a compound annual growth rate (CAGR) of 49.5% from 2025 to 2034.

What is the containerized direct air capture market?

Containerized DAC refers to DAC systems that are designed as modular units — commonly housed in ISO shipping containers or similar prefabricated enclosures — that can be rapidly deployed, scaled by replication, and sited where needed (buildings, industrial sites, remote wind/solar farms, or near permanent CO₂ storage or utilization facilities). Compared with bespoke, large, fixed DAC plants, containerized systems prioritize lower upfront capex per module, standardized manufacturing, easier transport, and paired deployment with local energy sources or CO₂ sinks.

These units typically contain sorbent or solvent capture stages, fans/blowers, heat or regeneration systems, and compressors or interfaces for CO₂ conditioning and transport. Containerized DAC sits between small point-of-use capture (e.g., building HVAC retrofits) and megascale facilities, and is attractive for early commercial rollouts, testing, and modular scaling of removal capacity.

Growth factors

The containerized DAC market is being propelled by a convergence of urgent corporate and national carbon-removal commitments that create demand for permanent CO₂ removal and offtake contracts; large public funding and incentives (notably U.S. DOE hub funding and other national grant programs) that de-risk early commercial deployments; technological improvements in sorbents/solvents and energy integration that are reducing per-ton costs.

The modular economics of mass-manufactured container units which shorten delivery timelines and allow pay-as-you-scale business models; increasing private investment and offtake agreements from heavy emitters (aviation, cement, and oil & gas companies) seeking durable removals; and emerging utilization pathways (synthetic fuels, green chemicals) and improved CO₂ transport/storage infrastructure which together increase the value proposition for geographically distributed, containerized capture. These forces combined are driving rapid capacity additions and an investment pipeline that favors standardization and repeatability.

Why containerized DAC matters

-

Speed and flexibility. Because modules are prefabricated, projects can deploy capacity faster than building bespoke plants, meeting short-term removal targets or serving temporary needs.

-

Lower project complexity. Standardized units simplify permitting, commissioning, and operations compared with large civil works.

-

Distributed deployment. Modules can be sited close to low-carbon energy or CO₂ storage, or in urban settings integrated with building HVAC systems, reducing transport costs and enabling new business models.

-

Incremental scaling. Companies and buyers can start with a handful of units and scale to hundreds as costs fall.

-

Market creation. Containerized DAC can accelerate market formation by offering commoditized, verifiable carbon removal units for corporates and governments needing measurable, permanent removals.

Direct Air Capture — Top companies (containerized and modular players)

Below is a compact profile for the companies you listed. Note: for many privately held DAC companies, audited 2024 revenue or precise market share is not publicly disclosed; where revenue figures are unavailable I note that and provide funding, project, or contract context. Where a company clearly markets containerized or modular solutions (or building-integrated modules), I highlight that.

Climeworks

-

Specialization: Solid-sorbent, modular and large-scale DAC systems (tower/plant scale) and CDR services.

-

Key focus areas: Commercial carbon removal products, large plants (Orca, Mammoth), service offtake contracts, scaling to megaton capacity.

-

Notable features: Market-leading public profile and operational plants (Orca, Mammoth); emphasis on permanent storage via Carbfix mineralization in Iceland; active project pipeline and commercial offtake deals.

-

2024 revenue / market share: Company does not publicly disclose full 2024 revenue in detail; notable funding/grants include major public support for project expansions.

-

Global presence: Headquarters in Switzerland; plants/projects in Iceland, U.S. project activities, and international partnerships.

Carbon Engineering ULC

-

Specialization: Liquid-solvent DAC systems intended for large scale; focus on integration with fuels (e-fuels) and sequestration.

-

Key focus areas: Industrial-scale modular design, licensing to partners, integration with synthetic fuel manufacturing and permanent storage.

-

Notable features: Associated with Occidental Petroleum’s DAC ambitions to scale to many plants; experience in pilot and planned scale builds.

-

2024 revenue / market share: Revenue figures not widely publicized; company has been a target of major strategic investments and acquisitions.

-

Global presence: Founded in Canada; projects and licensing ambitions primarily in North America and partner regions.

Global Thermostat

-

Specialization: Solid-sorbent DAC systems (swing adsorption/desorption) with modular units that can be paired with industrial CO₂ users.

-

Key focus areas: Commercial partnerships to deploy modular capture systems near utilization sites and permanent storage.

-

Notable features: Emphasis on heat-efficient sorbents and pairing with waste heat sources.

-

2024 revenue / market share: Not publicly disclosed; company is VC-backed and has strategic pilot deployments.

-

Global presence: U.S.-based with pilot projects and partner engagements internationally.

Heirloom Carbon Technologies

-

Specialization: Mineralization-based DAC that uses accelerated weathering to lock CO₂ into stable carbonates.

-

Key focus areas: Permanent removal sales, offtake agreements with major corporates, scaling to commercial plants.

-

Notable features: Rapid fundraising and offtake agreements; working on cost reduction via material and process improvements.

-

2024 revenue / market share: Not publicly disclosed; sizable private funding rounds and commercial offtake contracts signal traction.

-

Global presence: U.S.-based with projects and commercial partners across North America and interest globally.

Soletair Power

-

Specialization: Building-integrated DAC modules that retrofit HVAC systems.

-

Key focus areas: HVAC integration, small-scale capture for buildings, improving indoor air quality while capturing CO₂, monetization via carbon credits.

-

Notable features: Product designed to integrate with existing HVAC, claimed capture up to ~20 tCO₂/yr per unit for standard office ventilation; emphasis on energy and ROI figures for building owners.

-

2024 revenue / market share: Company is scale-up / start-up stage; 2024 revenue not broadly publicized.

-

Global presence: Finland-based with international marketing and pilot sites.

Leading trends and their impact

-

Modular manufacturing and standardization. Moving from bespoke installations to factory-built modules reduces unit costs and shortens deployment timelines. This accelerates roll-out, enables replicable quality and lowers O&M complexity.

-

Policy & public funding acceleration. Governments are allocating funds, prizes, and hubs for DAC scale-up. This de-risks investments, stimulates projects, and increases private investor confidence.

-

Integration with existing infrastructure. Pairing DAC modules with low-carbon electricity, waste heat, or building HVAC improves lifecycle emissions performance and reduces operating cost per tCO₂.

-

Vertical integration and strategic acquisitions. Energy majors and industrial players are acquiring or partnering with DAC firms, increasing access to capital, CO₂ storage and transport infrastructure, and broadening routes to market.

-

Shift to verified, permanent removal markets. Buyers increasingly demand verifiable, permanent removals. Technologies emphasizing permanence command premium pricing and long-term offtake contracts.

-

Cost-reduction R&D. Material science and process engineering improvements are gradually lowering energy and capital intensity, making smaller, containerized units more economically attractive.

Successful examples of containerized / modular DAC deployments

-

Climeworks — Orca and Mammoth (Iceland). Operational experience and modular track record paved the way for larger scale and informs modular designs. Mammoth (2024) scales to ~36,000 tCO₂/yr and demonstrates operational permanence.

-

Soletair Power — HVAC-integrated modules. Retrofit modules capturing ~20 tCO₂/yr per unit when integrated into building ventilation systems, demonstrating urban, distributed capture use cases.

-

Pilot and demonstration packs in North America and Europe. Carbon Engineering’s technology is moving towards larger modular commercial plants. Global Thermostat has pilot deployments with industrial partners.

Global regional analysis — government initiatives and policies shaping the market

North America

The U.S. has become one of the most significant policy drivers for DAC through federal incentives and funding programs. The Department of Energy has provided regional hub funding and grants for DAC projects. Additionally, the 45Q tax credit provides per-ton incentives for CO₂ permanently stored and has been a financial lever driving DAC projects. Private sector investment, particularly Occidental’s role, further accelerates scale. Strong public support and offtake interest make North America an immediate growth market for containerized DAC.

Europe

The EU is actively planning regulatory frameworks for carbon removal and DAC as part of its net-zero strategy. European markets benefit from strong climate policy, grant programs, and countries that offer geothermal or low-carbon power suitable for DAC, such as Iceland’s geothermal support for Climeworks’ plants. Europe favors permanent removal and strong monitoring/verifiability standards; containerized DAC paired with renewable energy and storage is attractive for demonstration and initial commercial deployment.

Asia-Pacific

Some APAC governments including Japan, South Korea, and Australia are increasing R&D support for carbon dioxide removal and low-carbon technologies. However, wide regulatory frameworks for DAC credits are still developing. Containerized units may be attractive in Asia for industrial clusters and island nations with limited land for large plants, but uptake hinges on clear carbon accounting rules and incentive mechanisms.

Latin America, Middle East & Africa

There is emerging interest in both blue hydrogen and carbon dioxide removal in resource-rich countries where geological storage is available. Policy is less mature than in the US or EU. Opportunities exist for modular deployments where low-carbon electricity is available; however, development depends on local incentives, offtake markets, and logistical capacity.

International policy drivers & carbon markets

Governments and standards bodies are increasingly focused on permanence, additionality, and measurement, reporting, and verification. This affects the value and eligibility of removals from containerized DAC — systems that can be reliably monitored and that pair with permanent storage or certified utilization will earn higher premiums. Large public and private offtake agreements are shaping demand and providing revenue certainty to developers. The combination of policy incentives and private demand is critical for the business case for containerized DAC.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Software-Defined Vehicles Market Growth Drivers, Key Players, Trends and Regional Insights by 2034