Digital Transformation in Chemical Market Revenue, Global Presence, and Strategic Insights by 2034

Digital Transformation in Chemical Market Size

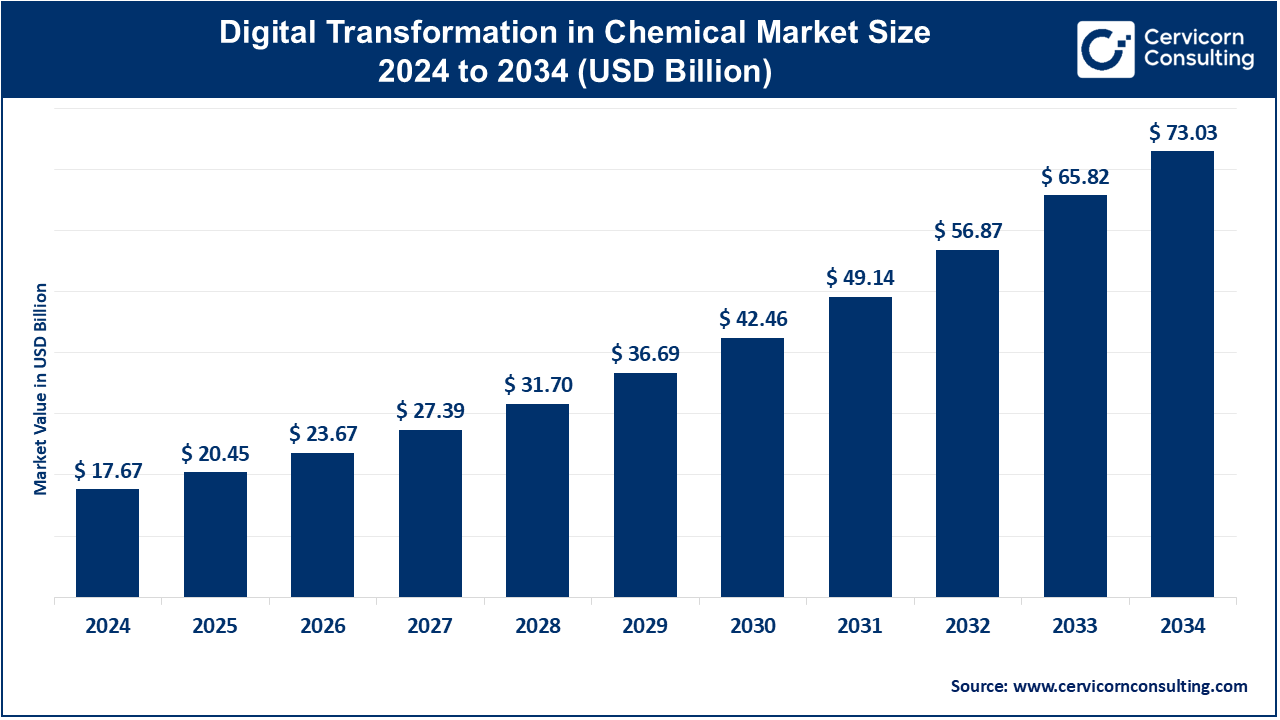

The global digital transformation in chemical market size was worth USD 17.67 billion in 2024 and is anticipated to expand to around USD 73.03 billion by 2034, registering a compound annual growth rate (CAGR) of 15.25% from 2025 to 2034.

Growth factors

Investment in digital transformation in the chemical market is being driven by an urgent mix of cost pressures, sustainability targets and new business models: the need to improve asset utilization and reduce energy/raw-material intensity in aging, capital-heavy plants; stricter regulatory and ESG reporting requirements that push companies to digitally measure and reduce emissions and waste.

Rising customer demand for customized, higher-value formulations which requires more flexible production enabled by advanced process control and digital twins; supply-chain volatility and the desire for end-to-end visibility that drives adoption of cloud platforms, advanced analytics and blockchain; availability of affordable sensors, IIoT connectivity and more powerful AI/ML tools that can convert plant and lab data into actionable insights; and competitive pressure from new entrants and strategic partnerships with software and data players that lower the barrier to entry for digital solutions.

Together, these factors accelerate capex productivity, shorten R&D cycles and create new revenue streams such as services and digital offerings for chemical companies. Analysts estimate the digital transformation in chemical market at nearly USD 17–19 billion in 2024 with strong double-digit growth forecasts through 2034.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2420

What is “digital transformation” in the chemical market?

Digital transformation in chemicals means the systematic use of digital technologies to change how value is created and delivered — from molecule discovery to manufacturing, logistics and customer support. It includes:

- Digitizing lab workflows and using AI for molecular design and formulation screening.

- Connecting plant equipment with IIoT sensors and edge computing for predictive maintenance and real-time optimization.

- Building digital twins of processes and assets to test changes virtually before implementing them in plants.

- Using advanced analytics and AI to optimize energy use, raw-material consumption and emissions.

- Applying cloud platforms and integrated planning tools to synchronize procurement, production and distribution.

These changes are both technological and cultural, requiring new skills, data governance and deeper partnerships with software and cloud providers.

Why it’s important

The chemical sector is capital-intensive and energy-hungry, so even small improvements in yield, energy efficiency or uptime generate outsized economic impact. Digital tools transform historical and sensor data into predictable, optimized outcomes: fewer unplanned shutdowns, faster product development cycles, better quality control and lower environmental footprints. They also enable new commercial models, such as predictive services, pay-per-use chemistry, product lifecycle tracking and digital customer platforms. Digital transformation helps companies comply with increasingly strict sustainability and reporting requirements, manage volatile global supply chains and maintain competitiveness as new digital entrants reshape the industry.

Company snapshots

BASF SE

Specialization & Focus:

A globally diversified chemical group active in basic chemicals, materials, industrial solutions, surface technologies, agricultural solutions and nutrition & care. BASF’s digital strategy emphasizes R&D digitalization, advanced process optimization, digital twins and IIoT deployment across its Verbund sites.

Notable Features:

- Industry-leading integration through its “Verbund” manufacturing network

- Deep focus on data-driven sustainability and operational efficiency

2024 Revenue:

€65.26 billion (sales).

Global Presence:

Operations worldwide with more than 100,000 employees and major sites in Europe, North America and Asia.

Dow Inc.

Specialization & Focus:

A leading materials-science company focused on performance materials, coatings, polymers and specialty intermediates. Dow invests heavily in advanced process control, manufacturing automation, digital supply-chain orchestration and predictive maintenance.

Notable Features:

- Strong emphasis on reliability and cost optimization

- Scale-driven digital implementation across global assets

2024 Revenue:

$43.0 billion (net sales).

Global Presence:

Global manufacturing footprint with major hubs in the U.S., Europe and Asia.

Solvay

Specialization & Focus:

A key player in specialty and performance chemicals (soda ash, peroxides, performance chemicals). Solvay focuses on digital performance management, data-driven lean operations, R&D analytics and plant digital transformation.

Notable Features:

- Strong shift toward specialty and sustainability-linked products

- Digital initiatives integrated into transformation plans

2024 Revenue:

€4.686 billion (net sales).

Global Presence:

European headquartered with widespread global operations and markets.

SABIC

Specialization & Focus:

One of the largest global diversified chemical manufacturers specializing in petrochemicals, specialty materials and agri-nutrients. Digital initiatives include automation, end-to-end supply-chain digitization, low-carbon product development and data-driven customer platforms.

Notable Features:

- Heavy investment in Industry 4.0 capabilities

- Strong sustainability and advanced materials strategy

2024 Revenue:

SAR 140.0 billion.

Global Presence:

Headquartered in Saudi Arabia with extensive operations in the Middle East, Europe, the Americas and Asia.

Covestro AG

Specialization & Focus:

A global leader in high-performance polymers with a strong focus on polyurethanes, coatings and advanced materials. Covestro emphasizes digital manufacturing, predictive maintenance and digital R&D platforms.

Notable Features:

- Agile digital deployment across key sites

- Strong sustainability-driven innovation pipeline

2024 Revenue:

€14.179 billion (sales).

Global Presence:

Significant operations in Europe, North America and Asia with global customer reach.

Leading trends and their impact

1. Digital R&D acceleration

AI/ML-driven molecular modeling and automated laboratories reduce physical experiments, shorten product-development timelines and allow faster commercialization of new formulations. This increases innovation throughput and reduces R&D costs.

2. Digital twins for process optimization

Digital replicas of plants allow operators to simulate changes before implementing them in real systems. This minimizes disruptions, enhances safety, increases throughput and reduces energy consumption.

3. Predictive maintenance powered by IIoT

Sensors and edge analytics monitor assets in real time, helping identify failures before they occur. This reduces downtime, extends equipment life, lowers spare-parts costs and improves overall equipment effectiveness (OEE).

4. Cloud-enabled supply-chain orchestration

Integrated cloud platforms enhance visibility across procurement, manufacturing and logistics. Companies can respond to demand fluctuations faster, reduce working capital and prevent stockouts or overproduction.

5. Sustainability and emissions digitalization

Real-time emissions tracking, automated reporting and lifecycle assessments help chemical firms comply with global regulations, achieve ESG targets and optimize energy efficiency.

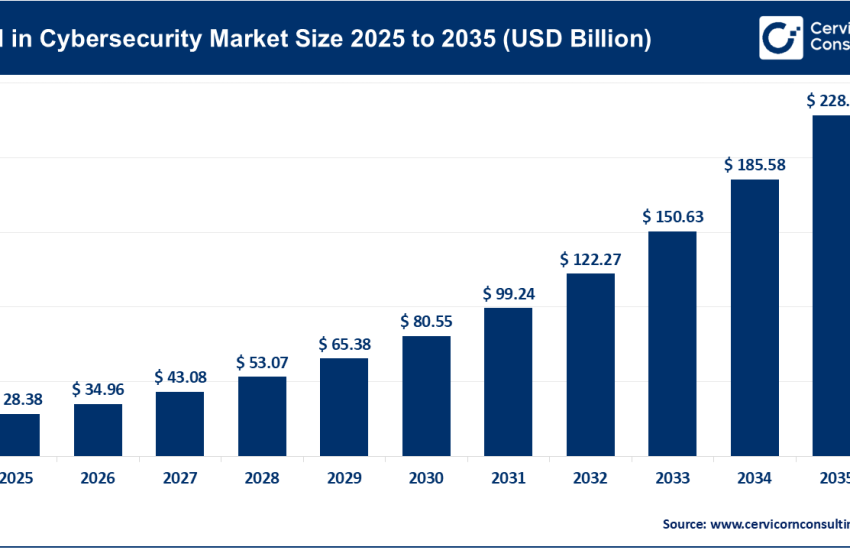

6. Cybersecurity & data governance

As OT systems become connected to IT networks, chemical companies are strengthening cybersecurity frameworks to prevent operational disruption and data breaches.

Successful examples of digital transformation in chemicals

BASF (Germany/global)

- Deployment of digital twins across R&D and production

- Data-driven optimization of energy and feedstock usage

- Digital planning integrated with the company’s Verbund manufacturing model

Dow Inc. (U.S./global)

- Use of predictive maintenance and advanced process control to reduce downtime

- Automation of plants to enhance reliability and lower production costs

- Cloud-based planning and manufacturing integration

SABIC (Middle East/global)

- End-to-end supply-chain digitization across global plants

- Plant automation and robotics for safer, more efficient manufacturing

- Digital customer platforms for specialized product delivery

Covestro AG (Europe/NA)

- Predictive maintenance deployed across polymer production units

- Digital R&D tools accelerating sustainable polymer development

Public-private industrial digitalization programs

Global collaborations between chemical hubs, governments and technology providers support pilot programs for Industry 4.0, sustainability measurement, and industrial data-sharing.

Global regional analysis — adoption patterns, government initiatives & policies

Europe

Adoption Pattern:

Europe is a global leader in sustainability-driven digital transformation. Digital twins, advanced analytics and emissions measurement tools are widely used.

Government Role:

- EU Green Deal and strict emissions trading mandates

- Mandatory sustainability reporting (ESRS)

- Public funding through Horizon programs and national Industry 4.0 initiatives

These policies accelerate digital adoption, particularly in energy optimization, circular economy and traceability.

North America

Adoption Pattern:

Strong adoption of OT automation, cloud analytics and digital reliability programs. U.S.-based manufacturers emphasize efficiency, safety and advanced materials innovation.

Government Role:

- Federal incentives for decarbonization and clean energy

- Infrastructure modernization support

- Emphasis on industrial competitiveness and cybersecurity

These create favorable conditions for digital upgrades across chemical plants.

Middle East

Adoption Pattern:

The region is rapidly modernizing petrochemical infrastructure with extensive automation and digitization efforts. Companies like SABIC are global digital-transformation leaders.

Government Role:

- National industrial policies (e.g., Saudi Vision initiatives)

- Major investment in smart industrial clusters

- Support for digital sustainability solutions

This makes the region one of the fastest-growing adopters of digital chemical technologies.

Asia-Pacific

Adoption Pattern:

China leads in capacity expansion and rapid digitization of new plants. Japan and South Korea focus on specialty chemicals and advanced materials with highly automated facilities. India is accelerating digital adoption for efficiency and compliance.

Government Role:

- Strong industrial modernization programs

- Emissions-reduction regulations

- Funding for smart manufacturing and AI innovation

Asia-Pacific is expected to be one of the largest growth regions for digital chemical transformation.

Latin America & Africa

Adoption Pattern:

Digital adoption is growing selectively among major producers. Partnerships with global firms support digital modernization in manufacturing and sustainability tracking.

Government Role:

- Industrial modernization policies

- Environmental regulation compliance

- International development funding for sustainability projects

These regions show strong potential for efficiency-oriented digital deployments.

Government initiatives shaping the global digital-chemicals landscape

- Regulatory reporting requirements — Mandatory emissions, energy-use and product lifecycle disclosure drive adoption of automated measurement and reporting tools.

- Public–private innovation funding — Collaboration among government agencies, chemical clusters and technology providers lowers costs and improves digital maturity.

- Tax incentives for decarbonization — Digital tools that reduce energy intensity, such as optimization and monitoring systems, benefit directly from these incentives.

- Cyber and data governance rules — Data localization, cybersecurity laws and industrial standards shape how and where chemical companies deploy cloud and analytics solutions.

Practical considerations for chemical companies

- Begin with high-ROI use cases like predictive maintenance, yield improvement and energy optimization.

- Strengthen data foundations through OT/IT integration, data governance and standardization.

- Build cybersecurity frameworks for connected plants.

- Combine technology rollouts with workforce training.

- Leverage partnerships with cloud providers, startups and industrial software vendors.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cloud Computing Market Revenue, Global Presence, and Strategic Insights by 2034