Digital Logistics Market Revenue, Global Presence, and Strategic Insights by 2034

Digital Logistics Market Size

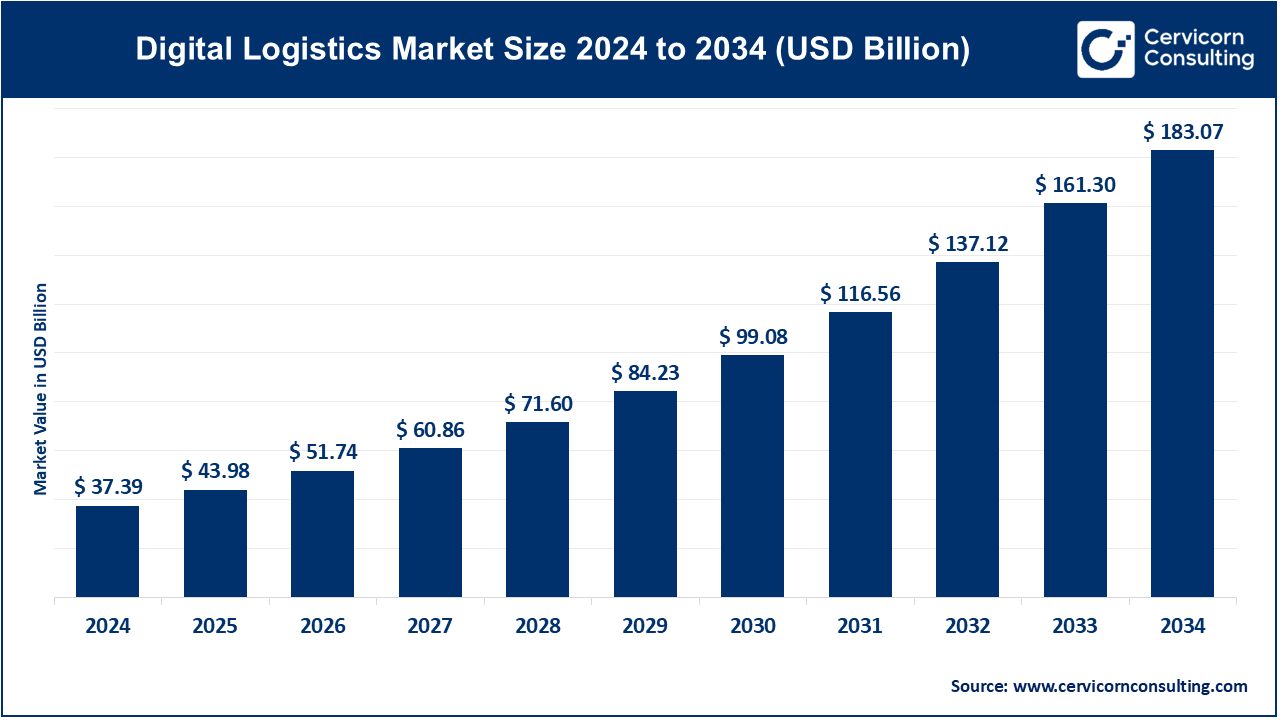

The global digital logistics market size was worth USD 37.39 billion in 2024 and is anticipated to expand to around USD 183.07 billion by 2034, registering a compound annual growth rate (CAGR) of 17.21% from 2025 to 2034.

What is the Digital Logistics Market?

The digital logistics market encompasses all technologies, platforms, software applications, IoT systems, and analytics engines that optimize the planning, execution, and monitoring of logistics processes. This market includes cloud-based Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Order Management Systems (OMS), digital freight marketplaces, supply chain visibility platforms, telematics devices, asset tracking systems, RFID, real-time location systems (RTLS), mobile logistics apps, and AI-driven decision-making tools. Its core purpose is to eliminate manual workflows, digitize documentation, integrate multi-stakeholder operations, and enable synchronized, data-driven logistics networks across global supply chains. Digital logistics solutions unify information flows, automate repetitive activities, minimize waste, and create connected ecosystems where manufacturers, shippers, distributors, 3PLs, carriers, warehouse operators, and customers collaborate seamlessly.

Why Is Digital Logistics Important?

In an era of volatile global supply chains, rising consumer expectations, and rapid e-commerce expansion, digital logistics has become essential for maintaining competitive advantage. Businesses can no longer rely on manual workflows, traditional documentation, or disconnected systems because customers demand faster deliveries, precise shipment tracking, low-cost shipping options, and sustainable operations. The importance of digital logistics lies in its ability to reduce operational costs, increase speed and accuracy, enhance end-to-end visibility, support demand forecasting, improve asset utilization, and strengthen resilience against disruptions such as port congestion, weather events, and geopolitical challenges. Additionally, digital logistics empowers businesses to reduce emissions, optimize fleet routes for fuel efficiency, manage inventories across multi-node networks, and improve customer satisfaction through real-time, personalized communication.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2418

Digital Logistics Market Growth Factors

The digital logistics market is expanding due to rapid e-commerce growth, omnichannel retail demands, rising pressure for real-time visibility, increasing IoT integration for fleet and asset tracking, cloud migration of logistics operations, adoption of AI/ML for predictive insights, growing need for sustainability and carbon tracking, and government support for digital documentation and interoperable freight data systems. Additional growth is driven by automation in warehouses, expansion of digital freight platforms, emergence of last-mile optimization technologies, and rising disruptions that push companies to invest in resilient, digitally enabled supply chains. Together, these factors create strong momentum for digital logistics adoption across shippers, carriers, 3PLs, manufacturing, retail, and global trade ecosystems.

Company Profiles

Bosch (Robert Bosch GmbH)

Specialization:

Bosch is a leader in industrial IoT and connected logistics solutions, offering software, telematics devices, sensors, and cloud platforms, including products for asset tracking, fleet monitoring, supply chain optimization, and factory-to-warehouse logistics. Bosch integrates hardware and software to deliver real-time data visibility and analytics.

Key Focus Areas:

– Real-time supply chain visibility

– Connected mobility and vehicle telematics

– Warehouse digitalization

– IoT-driven logistics analytics

– Cloud-based Supply Chain Studio and logistics applications

Notable Features:

Bosch’s strength lies in its deep integration of industrial sensors, telematics, automation systems, and cloud analytics. Its solutions support predictive maintenance, smart warehouse flows, cold-chain monitoring, and end-to-end transport visibility.

2024 Revenue:

Bosch Group reported around €90 billion in 2024 revenue across all business units.

Market Share:

Bosch is a major technology provider in IoT and logistics connectivity but does not report a dedicated digital-logistics market share. It holds strong share in telematics-enabled global fleets.

Global Presence:

Active worldwide with strong operations across Europe, Asia, and North America, and growing deployments in emerging markets such as India.

SAP SE

Specialization:

SAP is one of the largest enterprise software providers globally, offering advanced digital logistics solutions integrated into its ERP and supply-chain suites. Key offerings include SAP Transportation Management (TM), SAP Extended Warehouse Management (EWM), and SAP Logistics Business Network (LBN).

Key Focus Areas:

– End-to-end transportation management

– Cloud-based supply chain planning and execution

– Logistics collaboration networks

– Warehouse automation and orchestration

– AI/ML-driven predictive logistics

Notable Features:

Seamless integration between ERP, supply chain planning, logistics execution, and financial systems is SAP’s biggest advantage. SAP supports multimodal shipping, freight tendering, customs processes, and contract management, enabling unified logistics control towers.

2024 Revenue:

SAP reported revenues above €34 billion in 2024.

Market Share:

SAP is one of the globally dominant digital logistics software providers, especially for large enterprises.

Global Presence:

Extensive global footprint across all major continents, with strong influence in Europe, APAC, and North America.

Infosys

Specialization:

Infosys provides digital transformation solutions and IT services across supply chain and logistics domains, integrating leading logistics platforms, modernizing warehouse and transportation systems, and deploying cloud-based analytics and AI solutions.

Key Focus Areas:

– Digital supply-chain consulting

– Implementation of TMS/WMS solutions

– Predictive analytics using AI & ML

– Cloud migration for logistics systems

– Supply-chain digital twins

Notable Features:

Infosys delivers specialized industry accelerators, automation frameworks, and global delivery models. It helps clients modernize legacy logistics systems, integrate IoT platforms, and optimize global logistics operations.

2024 Revenue:

Infosys posted around USD 19+ billion in FY 2024.

Market Share:

Strong global presence as an IT services leader in logistics digital transformation projects.

Global Presence:

Delivery centers in India, Europe, North America, and Asia-Pacific. Works extensively with global retailers, manufacturers, and logistics enterprises.

ORBCOMM

Specialization:

ORBCOMM is a global provider of IoT, satellite communication, and telematics solutions for logistics and transportation. Specialties include reefer monitoring, trailer tracking, container visibility, and remote asset management.

Key Focus Areas:

– Cold-chain monitoring

– Trailer and container telematics

– Satellite and cellular IoT connectivity

– Fleet asset tracking and compliance

– Maritime logistics data

Notable Features:

ORBCOMM’s unique strength is its hybrid satellite–cellular network for remote and global logistics tracking. It provides specialized hardware for refrigerated containers, heavy equipment, and fleet management.

2024 Revenue:

Historically in the hundreds of millions of dollars annually, depending on acquisitions and service lines.

Market Share:

Strong position in global telematics for trailers, containers, and cold-chain logistics.

Global Presence:

Customers span North America, Europe, APAC, and maritime markets.

Tech Mahindra

Specialization:

Tech Mahindra is a global IT services provider offering digital supply-chain solutions, logistics automation, IoT-driven transport management, and last-mile digitalization services for retail, telecom, and logistics clients.

Key Focus Areas:

– Digital transformation of logistics systems

– Last-mile optimization

– AI-driven route and demand forecasting

– TMS/WMS implementation services

– Blockchain and connected logistics applications

Notable Features:

Tech Mahindra combines telecom, IT, and IoT expertise to deliver connected logistics platforms, predictive analytics, and warehouse digitalization. It provides strong integration capabilities for large enterprises.

2024 Revenue:

Reported quarterly revenues exceeding ₹12,800 crore, with overall FY 2024 annual revenue in the multi-billion-dollar range.

Market Share:

Significant share in APAC and emerging markets as a systems integrator for logistics transformation programs.

Global Presence:

Large global network across India, Europe, the US, Middle East, and APAC.

Leading Trends and Their Impact

1. Real-Time Visibility and IoT Expansion

The widespread adoption of IoT sensors, GPS devices, and telematics systems allows logistics operators to monitor fleets, containers, and cargo in real time. This reduces theft, spoilage, and delays, while enabling dynamic rerouting and efficient utilization of trucks, ships, and containers.

2. Cloud-Based Logistics Platforms

SaaS-based TMS and WMS platforms enable rapid deployment, lower upfront cost, and scalability. This trend is making enterprise-grade logistics technologies accessible to mid-sized companies and emerging markets.

3. AI and Predictive Decision-Making

Artificial intelligence enhances forecasting accuracy for demand, inventory, and fleet operations. Predictive analytics help companies avoid congestion, reduce stockouts, and improve route efficiency.

4. Platformization & Logistics Ecosystems

Global logistics networks increasingly depend on shared data platforms where shippers, carriers, and 3PLs collaborate. Digital freight exchanges, networked control towers, and cloud ecosystems are transforming how logistics partners share data and coordinate decisions.

5. Digital Documentation & Compliance

Governments worldwide are pushing adoption of electronic freight documents, customs digitalization, cross-border trade data systems, and secure digital identities. This drives the need for systems with standardized APIs and compliance mechanisms.

6. Sustainability & Green Logistics

Digital solutions help track emissions, monitor fuel usage, plan eco-efficient routes, reduce idling, and support ESG reporting. Sustainability is becoming a regulatory and customer expectation.

7. E-Commerce & Last-Mile Innovation

The explosion of online retail is driving investments in micro-fulfillment centers, autonomous delivery pilots, robotics, and AI route optimization. Last-mile delivery remains the most expensive and complex part of logistics, making optimization essential.

Successful Digital Logistics Examples Around the World

DHL

DHL has developed advanced analytics platforms for risk assessment, visibility, and customer insights. Its digitalization strategy includes automated sorting systems, robotics, digital twins, and predictive demand engines. DHL’s digital initiatives have created a benchmark for global logistics modernization.

Maersk

Maersk has transformed from a shipping company into an integrated logistics technology provider, with digital booking systems, container tracking platforms, and unified supply chain visibility networks. Its digital-first approach influences ocean freight, warehousing, inland transport, and customs.

Amazon Logistics

Amazon’s logistics network includes real-time delivery tracking, robotics-driven fulfillment centers, AI-powered last-mile routing, and predictive inventory positioning. Its digital logistics backbone has reshaped consumer expectations globally.

ShipBob

ShipBob provides e-commerce brands with cloud-based fulfillment and real-time inventory visibility. Its distributed micro-fulfillment network demonstrates how digital logistics supports SMEs and enables rapid scaling.

European Freight Digitalization Projects

The European Union’s large-scale digital freight initiatives promote interoperable data exchange, electronic documentation, and cross-border trade visibility. These projects demonstrate successful public–private digital transformation.

Global Regional Analysis With Government Policies

North America

North America leads in adoption of telematics, warehouse automation, and last-mile delivery optimization. Government policies support electronic logging devices, emissions reporting, infrastructure digitalization, and safety compliance. The region’s large retail and e-commerce sectors accelerate investment in real-time tracking and warehouse robotics.

Europe

Europe is pushing strongly toward digital freight documentation, sustainability regulations, interoperable logistics data platforms, and intelligent transportation systems. European governments promote e-CMR, digital transport corridors, and unified logistics data spaces. These policies significantly accelerate digital logistics adoption among shippers, ports, and carriers.

Asia-Pacific

APAC is witnessing large investments in smart ports, IoT-enabled warehouse parks, autonomous logistics vehicles, and national digital trade platforms. China, Singapore, India, and Japan lead with government-backed logistics digitization programs.

India (PM Gati Shakti & Digital Logistics Mission)

India’s national logistics modernization initiatives aim to unify multimodal infrastructure planning, digitize trade systems, enhance customs portals, and promote logistics parks with IoT and automation infrastructure. Government programs are accelerating TMS/WMS adoption, visibility platforms, and IoT tracking across manufacturing and e-commerce.

Middle East

Countries like UAE and Saudi Arabia are investing heavily in smart ports, logistics hubs, and autonomous vehicle pilots. Government plans such as Saudi Vision 2030 prioritize logistics as a digital-first industry, driving rapid tech adoption.

Latin America & Africa

Digital logistics adoption in these regions is driven by mobile-first applications, low-cost telematics, and last-mile platforms. Governments are modernizing customs and trade processes, enabling opportunities for digital freight management and cross-border visibility solutions.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Brain-Computer Interface Market Revenue, Global Presence, and Strategic Insights by 2034