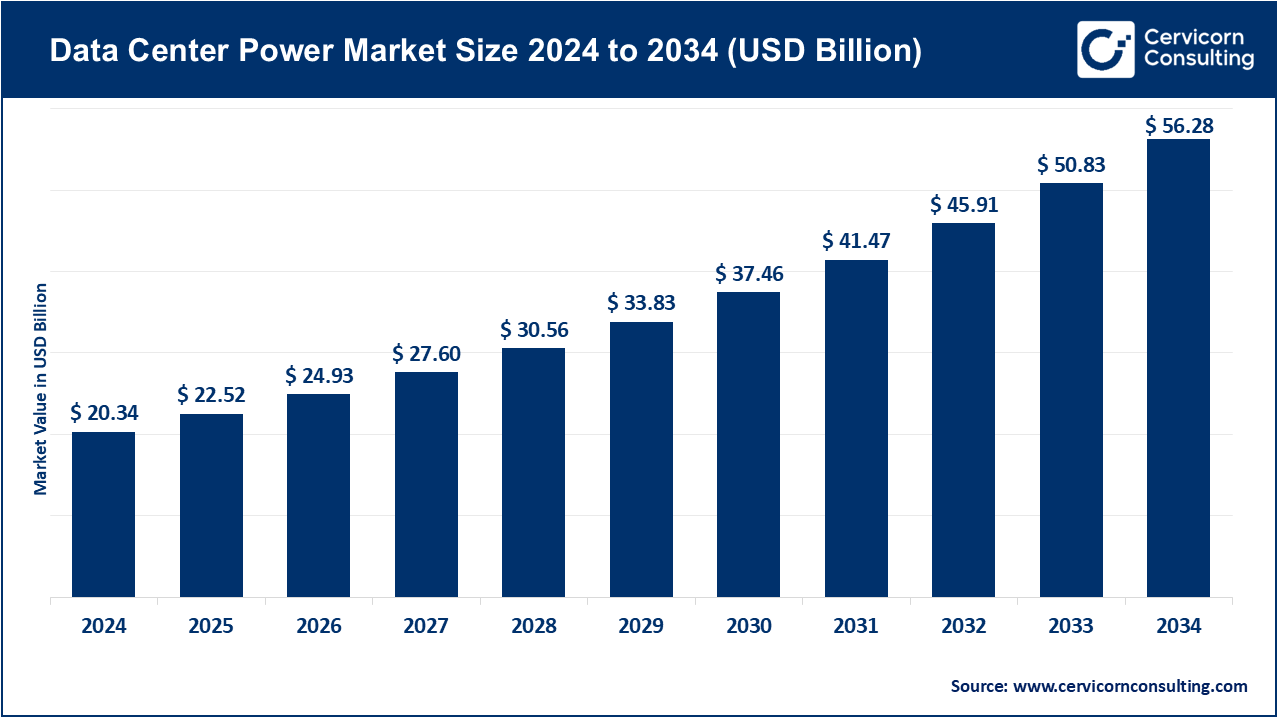

Data center power market Key Players, Trends, and Global Outlook by 2034

Data center power market size

Data center power market — Growth Factors

The data center power market is being driven by accelerating demand for cloud computing, AI/ML workloads, edge computing, and digital services that collectively raise compute density and continuous-availability requirements; rising power densities per rack and a shift toward high-performance GPUs and AI accelerators require more robust, lower-latency power infrastructures; sustainability and decarbonization goals push operators to adopt renewable integration, energy storage, waste-heat reuse and higher-efficiency UPS and cooling systems; stricter regulations and reporting obligations (notably in the EU and parts of APAC) are accelerating retrofits and efficiency upgrades.

Meanwhile, investments in modular/colocation facilities and hyperscale expansions are increasing purchases of prefabricated, rapidly-deployable power solutions and microgrids; finally, supply-chain maturation and innovation in power electronics (silicon carbide, advanced inverter controls), battery technologies, and power management software are lowering total cost of ownership and making modernization commercially attractive—collectively boosting market size, product variety, and aftermarket services.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2734

What is the data center power market?

The data center power market comprises the hardware, software, and services that deliver, condition, back up, distribute, monitor, and manage electrical power inside data centers. It includes: on-grid switchgear and transformers; backup generation (diesel, gas, and increasingly, hybrid/renewable + storage systems); uninterruptible power supplies (UPS) — static and rotary; power distribution units (PDUs) and busways; power monitoring and management software (for PUE, load balancing, battery health); and integrated solutions such as prefabricated electrical rooms, microgrids, and co-located renewable generation/virtual power plant (VPP) integrations. The market spans new-build installations, retrofit/upgrade projects, maintenance services, and third-party managed-power offerings for colocation providers.

Why is it important?

Power is the single most mission-critical utility for any data center — compute is meaningless without reliable electricity. Power failures cause downtime, lost revenue, damaged reputation, and potential data loss. As a result, data center power infrastructure is engineered for redundancy (N, N+1, 2N), fast failover, and predictable lifecycle costs. At the same time, power systems heavily influence operating expense (energy bills are often the largest Opex line), sustainability metrics (PUE, Scope 2 emissions), and the ability to scale compute density.

Modern workloads (AI training, inference, high-frequency trading) have tightened performance and latency tolerances, making precise power quality and local resiliency (on-site storage, on-demand generation) more important than ever. Finally, regulatory and stakeholder pressure to reduce carbon footprints is pushing the power-stack to integrate renewables and storage, making the power market central to the data center industry’s future.

Data Center Power Market — Company Profiles (selected companies)

Below are concise company profiles tailored to your requested fields: Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue | Market Share (qualitative) | Global Presence.

ABB

- Specialization: Power and automation technologies, medium- and low-voltage switchgear, grid integration, power conversion and UPS-related systems.

- Key Focus Areas: Electrification for digital infrastructure, modular power solutions, power conversion for high-efficiency data centers, smart-grid integration, digital services for asset management.

- Notable Features: Broad industrial footprint enabling end-to-end electrical systems (from grid connection to PDUs), strong software/controls portfolio for power monitoring and predictive maintenance.

- 2024 Revenue: $32.9 billion

- Market Share: Major global player in power equipment and industrial electrification; significant share in switchgear and medium-voltage infrastructure for large projects.

- Global Presence: Extensive global operations across Europe, North America, APAC, Middle East and Africa; strong EPC and systems-integration footprint.

Black Box

- Specialization: IT infrastructure, data center services, edge solutions, network and power cabling, DC power solutions for telecom and enterprise.

- Key Focus Areas: Turnkey IT and network infrastructure for enterprise and edge facilities; power management for distributed/edge deployments.

- Notable Features: Service-led model combining design, installation, and managed services for smaller-scale and edge data centers; emphasis on integrated systems.

- 2024 Revenue: Around $0.7 billion

- Market Share: Niche / mid-market supplier focused on enterprise & edge; not a hyperscaler supplier.

- Global Presence: North America primary, with international service capabilities.

CyrusOne

- Specialization: Data center REIT — large-scale colo and wholesale data centers with associated critical power infrastructure as part of facility offerings.

- Key Focus Areas: Hyperscale colocation power architecture, high-density racks, resiliency and renewable procurement for customers, campus-level power design.

- Notable Features: Operates and develops multi-tenant, high-power data center campuses; provides turnkey power and resiliency SLAs for enterprise and cloud customers.

- 2024 Revenue: Around $1 billion+

- Market Share: Major colocation operator in North America and selected global markets.

- Global Presence: North America, Europe, and selective APAC/EMEA markets with dozens of operational and in-development sites.

Eaton

- Specialization: Power management solutions — UPS, switchgear, PDUs, power distribution and controls, electrical components.

- Key Focus Areas: High-efficiency UPS systems, modular power for data centers, energy management software, grid-edge solutions and battery-UPS integrations.

- Notable Features: Strong product breadth across low/high-voltage power distribution, recognized in enterprise and industrial verticals; integrated service and spare-parts network.

- 2024 Revenue: $25 billion

- Market Share: Leading global player in UPS and PDUs with substantial share in enterprise and colocation builds.

- Global Presence: Global, with deep penetration in North America, Europe, and APAC.

Equinix, Inc.

- Specialization: Global colocation and interconnection platform; operates data centers with mission-critical power infrastructure and resiliency services.

- Key Focus Areas: Hyperscale and metro colocation, cross-connect ecosystems, green-power procurement, on-site resiliency and power SLAs.

- Notable Features: One of the world’s largest colocation operators by revenue and footprint; strong interconnection fabric (IX) and cloud on-ramps.

- 2024 Revenue: $8.7 billion

- Market Share: Top-tier global colocation leader; significant share of enterprise and carrier-neutral colo market.

- Global Presence: Operates hundreds of data centers across North America, Europe, LATAM, Middle East, and APAC.

GDS Holdings

- Specialization: China-focused wholesale and colocation data center operator, serving cloud providers and enterprises.

- Key Focus Areas: High-density wholesale data centers, integration with local power grids, specialized cooling and energy-efficiency measures for large campuses.

- Notable Features: Local market expertise in China, rapid campus scaling, partnerships with domestic hyperscalers.

- 2024 Revenue: Significant growth reported in annual filings.

- Market Share: Major player in China’s wholesale/colocation space.

- Global Presence: Primarily China, with strategic customer ties internationally.

Generac Power Systems, Inc.

- Specialization: On-site backup generation (diesel, gas), critical-power gensets, and integrated power resiliency solutions for commercial and industrial customers (including data centers).

- Key Focus Areas: Standby and continuous-duty generators, hybrid power systems, and solutions for peak shaving and resiliency.

- Notable Features: Strong U.S. market presence for backup gensets and grid-independence solutions for edge and critical facilities.

- 2024 Revenue: $4.30 billion

- Market Share: Leading supplier for commercial standby generation in North America.

- Global Presence: Primarily North America with growing international sales.

General Electric Company (GE / GE Vernova)

- Specialization: Large diversified power and electrification solutions, grid-scale equipment, turbines, and power electronics relevant to utility-to-data center supply.

- Key Focus Areas: Grid equipment for reliable upstream supply, electrification components, and services for large power infrastructure projects feeding data center clusters.

- Notable Features: Deep heritage in power generation & distribution; significant capability in large-scale electrification projects and services.

- 2024 Revenue: GE Vernova reported ~$35 billion revenue in 2024.

- Market Share: Important supplier for grid-scale equipment servicing large data center campuses and regional power infrastructure.

- Global Presence: Global reach across utility and industrial markets.

Leading Trends and Their Impact

Higher Rack Power Densities (AI & GPU workloads)

Drives demand for higher-capacity PDUs, busways, liquid-cooling-ready power delivery, and modular power distribution. Colocation and enterprise sites must upgrade electrical rooms and cooling to handle 30–60+ kW per rack in AI clusters.

Integration of On-Site Energy Storage & Hybrid Generation

Battery Energy Storage Systems paired with renewables reduce fuel use, provide fast ride-through, and support grid services. This shifts spend from pure generators to hybrid genset+BESS architectures and power management software.

Renewables and Green Power Procurement

Power purchase agreements and corporate carbon targets push data centers to adopt behind-the-meter solar, direct PPA procurement, and renewable certificates.

Power Monitoring, AI-driven Power Management & Digital Twins

Predictive battery analytics, automated load shedding, and AI-driven energy optimization reduce downtime risks and operating costs.

Modular & Prefab Power Solutions for Speed-to-Market

Prefab electrical rooms, containerized UPS and genset pods shorten build times and standardize deployments.

Regulatory Pressure and Reporting (Energy Efficiency, Waste Heat Reuse)

Requirements to reuse waste heat, especially in the EU, are prompting investments in higher-efficiency UPS and facility-level energy reuse integrations.

Edge Data Centers and Distributed Power

Smaller facilities need compact, resilient power stacks — often prefabricated and remotely manageable.

Successful examples around the world

- Equinix: Large-scale colocation campuses with robust on-site power design, green energy procurement, and interconnection fabrics.

- CyrusOne: Campus model providing high-availability power architectures and on-site generation capability for hyperscale customers.

- China’s Green Data Center Pilots: New data centers designed for high renewable-use percentages and heavy waste-heat reuse.

- EU Code of Conduct Participants: Operators implementing best practices in PUE reduction, heat reuse, and power monitoring.

- Microgrid + BESS Integrations: Hyperscalers in the U.S. and Europe adopting behind-the-meter microgrids for resilience and carbon reduction.

Global Regional Analysis — Government Initiatives & Policies Shaping the Market

Europe

The EU has tightened energy-efficiency reporting and introduced best-practice guidelines through the Code of Conduct for Data Centre Energy Efficiency. New directives require monitoring of energy performance and encourage heat reuse and efficient PUE targets.

North America

The U.S. provides tax credits and incentives for renewable generation and energy storage that can be applied to data center power solutions. State-level incentives and utility programs add further support for greener power.

Asia-Pacific

- India: State-level data center policies offer fiscal incentives, electricity duty waivers, and expedited approvals to attract investment, often tied to green-energy conditions.

- China: Provincial governments require new data centers in key hubs to meet high renewable-use percentages, driving demand for advanced power systems.

Middle East & Africa

Gulf states and South Africa are investing in data center parks with renewables and grid investments to support hyperscaler growth.

Latin America

Special economic zones and incentives for cloud and data center investment are boosting deployments, though grid reliability challenges shape system designs toward local resiliency.

International Standards

International bodies like EN 50600 and ISO/IEC 22237 series encourage uniform approaches to energy performance monitoring, waste-heat reuse, and power-system resilience, influencing procurement worldwide.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: India Petrochemicals Market Growth Trends, Top Companies, Global Insights and Adoption