Copper Products Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

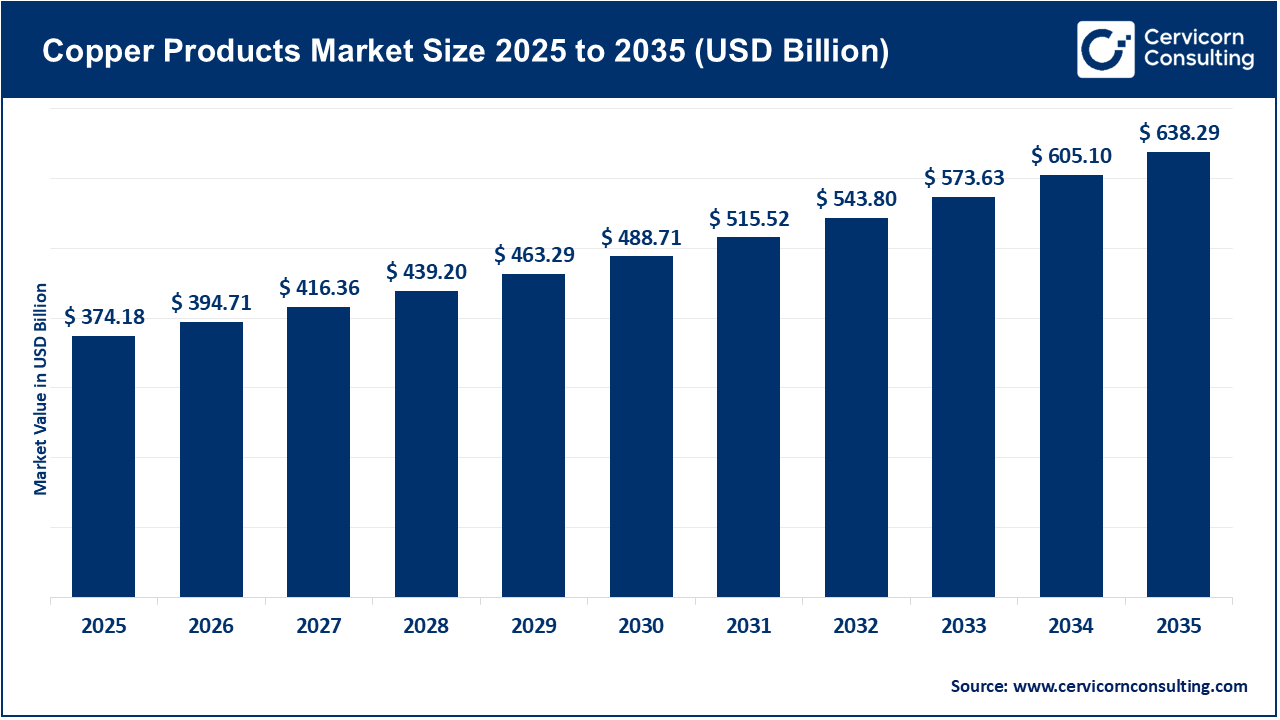

Copper Products Market Size

The global copper products market size was worth USD 374.18 billion in 2025 and is anticipated to expand to around USD 638.29 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% from 2025 to 2034.

Copper Products Market — Growth Factors

Demand for copper products is being driven by the global shift toward clean energy, grid modernization, and electrification across transportation and industry. Electric vehicles use several times more copper than internal combustion vehicles, while renewable energy systems — including solar, wind, and battery storage — rely heavily on copper wiring, busbars, and connectors. Infrastructure upgrades and urbanization continue to boost demand for plumbing, electrical wiring, and HVAC systems. At the same time, limited mine output, declining ore grades, and disruptions in major producing regions tighten supply, encouraging investment in downstream processing and recycling. Government incentives for green manufacturing and local content rules are also prompting countries to strengthen domestic copper processing capabilities, accelerating growth in semi-finished and engineered copper products.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2809

What Is the Copper Products Market?

The copper products market encompasses the entire ecosystem of processing, fabricating, and distributing copper-based materials beyond the stage of raw mining. It includes semi-finished goods such as copper wire rods, cathodes, billets, bars, sheets, foils, and pipes; finished components like tubes, extrusions, and connectors; and specialty alloys such as bronze and brass. This market represents the mid- to downstream segment of the copper value chain — converting refined copper into usable products for industries like electrical engineering, construction, electronics, power generation, and automotive manufacturing. Market valuations typically measure both revenue and tonnage, reflecting not only the value of copper itself but also the added value of fabrication, alloying, and technological enhancement.

Why Is the Copper Products Market Important?

Copper’s unique combination of high electrical and thermal conductivity, ductility, and corrosion resistance makes it irreplaceable in modern industry. It is the backbone of electrical power systems, renewable energy infrastructure, and communication networks. Copper products enable efficient power transmission, reliable plumbing, durable architectural elements, and advanced electronic components. Beyond its performance advantages, copper is also highly recyclable — maintaining its quality indefinitely without degradation — which supports circular-economy goals and lowers environmental impact. The copper products market is therefore not only vital for economic development but also a cornerstone of sustainability, as it contributes to reducing greenhouse-gas emissions through renewable energy systems, electric mobility, and energy-efficient technologies.

Top Companies in the Copper Products Market

Wieland Group

- Specialization: Semi-finished copper and copper-alloy products such as foil, strip, tubes, and profiles, along with engineered system solutions.

- Key Focus Areas: Electromobility, connectivity, electronics, and sustainable materials.

- Notable Features: Founded in 1820, Wieland is among the oldest and most technologically advanced copper processors in the world. It emphasizes circularity and recycled copper use, offering tailored solutions for automotive, energy, and industrial clients.

- 2024 Revenue: Approximately €6.3 billion.

- Market Share & Global Presence: A leading player in semi-finished copper products with manufacturing and service centers across Europe, North America, and Asia.

Mueller Industries

- Specialization: Copper tubing, fittings, brass and copper products, and HVAC components.

- Key Focus Areas: Building products, refrigeration, HVAC, and plumbing systems.

- Notable Features: Headquartered in the U.S., Mueller has a broad distribution network and vertically integrated operations, making it one of North America’s top copper product manufacturers. The company has expanded through strategic acquisitions to diversify its portfolio.

- 2024 Revenue: Around USD 3.8 billion.

- Market Share & Global Presence: Strong market leadership in North America with an expanding global export footprint.

Hailiang Group

- Specialization: Copper pipes and tubes for HVAC, refrigeration, and industrial applications.

- Key Focus Areas: High-precision copper tubing, industrial copper pipes, and large-scale export operations.

- Notable Features: Hailiang is one of the world’s largest copper tube producers, operating modernized facilities in China and multiple international markets. Its advanced manufacturing techniques and strong export capabilities have made it a benchmark for quality and efficiency.

- 2024 Revenue: Approximately ¥87 billion.

- Market Share & Global Presence: Dominant exporter in the copper tube market with distribution across Asia, Europe, and the Americas.

KGHM Polska Miedź

Specialization: Integrated copper mining, smelting, and refining operations.

Key Focus Areas: Upstream production, refining, and supply of high-purity copper cathodes and other non-ferrous metals such as silver.

Notable Features: One of the largest mining and metallurgy companies in Europe, KGHM integrates the entire copper value chain, from ore extraction to finished refined metal. The company is heavily investing in innovation and sustainability to improve efficiency and reduce emissions.

2024 Revenue: Approximately PLN 29.9 billion.

Market Share & Global Presence: Global operations with sales spanning Europe, Asia, and North America, supplying critical feedstock for downstream copper processors.

KME Group S.p.A.

- Specialization: Rolled and extruded copper and copper-alloy products for building, industrial, and automotive uses.

- Key Focus Areas: Construction materials, power transmission systems, and specialized copper alloys.

- Notable Features: Headquartered in Italy, KME focuses on innovation in copper strip and tube production. The group has undertaken restructuring and acquisitions to strengthen its market position and improve production efficiency.

- 2024 Revenue: Around €1.5 billion.

- Market Share & Global Presence: Major European copper processor with manufacturing bases in Italy, Germany, and other parts of Europe, serving a diverse customer base across industrial sectors.

Leading Trends and Their Impact

- Electrification and EV Adoption:

Electric vehicles require three to five times more copper than conventional vehicles, mainly in motors, batteries, inverters, and wiring systems. This structural shift in automotive manufacturing has dramatically increased copper demand. Producers are developing specialized copper foils and busbars optimized for EV batteries and charging systems, leading to long-term revenue growth for copper component suppliers. - Grid Modernization and Renewable Energy:

Modernizing power grids for renewable integration and electrification involves extensive use of copper conductors and connectors. Large-scale solar and wind projects, combined with distributed power systems, need reliable, low-loss copper components. Utilities worldwide are upgrading networks with high-efficiency copper-based systems, driving steady market expansion. - Data Centers and Artificial Intelligence:

The global boom in data centers — fueled by AI, cloud computing, and edge infrastructure — increases the demand for copper cabling, busbars, and heat-exchanger systems. Copper’s superior conductivity ensures stable power distribution, while its thermal properties support efficient cooling. The rise of AI data centers is therefore creating an additional, rapidly growing demand segment for copper manufacturers. - Supply Constraints and Mining Disruptions:

Many copper mines face declining ore grades and higher operational costs. Occasional disruptions in major mining regions add to market tightness. This has increased prices and incentivized downstream producers to invest in recycling, refining, and alternative sourcing strategies. The result is a more resilient and diversified global copper supply chain, with stronger focus on secondary copper production. - Circular Economy and Recycled Copper:

Recycled copper requires up to 85% less energy to produce than primary copper. As sustainability becomes a key differentiator, many companies are integrating closed-loop recycling systems. For example, producers are partnering with manufacturers to reclaim copper scrap, melt it down, and reintegrate it into new products. This not only mitigates supply risk but also reduces emissions and enhances brand reputation. - Industrial and Trade Policies:

Government policies such as the U.S. Inflation Reduction Act (IRA) and the European Green Deal are reshaping global copper supply chains. Incentives for local manufacturing, tax credits for EV and renewable projects, and sustainability mandates in procurement are encouraging investment in domestic copper processing. In China, industrial policy focuses on strengthening high-value processing and expanding export capacity. These regional dynamics are leading to a more geographically balanced copper product industry.

Overall, these trends are transforming the copper products market into a more technologically sophisticated, sustainability-driven, and regionally diversified sector.

Successful Examples Around the World

- Wieland’s Electromobility Integration (Europe):

Wieland’s partnerships with automotive manufacturers demonstrate how copper producers can move up the value chain. By supplying customized copper systems for EV batteries, connectors, and busbars, the company has become an innovation partner for the European electric-mobility sector. - Hailiang’s Global Expansion (China):

Hailiang has leveraged scale, automation, and vertical integration to dominate the copper tube segment worldwide. Its focus on high-precision manufacturing and exports to HVAC and refrigeration markets has made it one of the most efficient and profitable copper processors globally. - U.S. Onshoring and IRA-Linked Projects (North America):

U.S. companies are expanding domestic copper processing capacity to meet rising EV and renewable energy demand. Government incentives under the Inflation Reduction Act have accelerated projects for copper foil, wire, and anode manufacturing, enhancing supply security and creating local jobs. - KGHM’s Vertical Integration (Europe):

KGHM’s combination of mining, smelting, and refining provides a stable supply of refined copper for Europe and beyond. This integration minimizes supply chain vulnerabilities and ensures consistent product quality for downstream manufacturers.

These examples highlight how different strategies — specialization, scale, policy alignment, and integration — contribute to success in the global copper products industry.

Global Regional Analysis and Government Initiatives

North America

The United States and Canada are prioritizing domestic copper production and processing as part of their clean-energy and infrastructure agendas. The Inflation Reduction Act and Infrastructure Investment and Jobs Act have spurred billions of dollars in funding for EV supply chains, renewable power, and grid modernization — all heavily copper-intensive industries. New copper wire and foil plants are emerging across the Midwest and Southeast U.S., aimed at reducing dependence on imports and strengthening national supply chains. Canada’s focus on critical minerals strategy also emphasizes copper as a priority material.

Europe

Europe’s copper market is being reshaped by the EU Green Deal, Fit-for-55 targets, and sustainability mandates. These policies encourage recycling, low-emission manufacturing, and resource efficiency. European manufacturers like Wieland and KME are investing in low-carbon production methods and renewable energy sourcing for their facilities. Demand from wind and solar installations, electric heating systems, and grid upgrades ensures steady growth. The EU’s Circular Economy Action Plan further strengthens the role of recycled copper in meeting climate goals.

China and East Asia

China remains the world’s largest copper consumer and processor. Its national plans focus on modernizing the non-ferrous metals industry, expanding EV and renewable capacity, and improving energy efficiency. The government supports domestic copper processing to increase value addition and reduce reliance on imported refined copper. Massive urbanization and ongoing infrastructure investments also keep demand high. Neighboring countries such as Japan and South Korea, with strong electronics and automotive sectors, continue to expand high-purity copper foil and alloy production.

Latin America

Latin America is the global epicenter of copper mining, particularly Chile and Peru. These countries are adopting new policies aimed at balancing foreign investment with environmental protection and domestic value creation. Several governments are promoting the establishment of local smelters and refineries to capture more downstream value. Brazil and Mexico are also growing as copper product markets due to automotive and industrial manufacturing growth. However, policy stability and infrastructure constraints remain key challenges to sustained expansion.

Africa

African nations such as the Democratic Republic of Congo, Zambia, and Namibia are rich in copper resources and are now focusing on downstream development. Governments are introducing incentives to attract investments in smelting and refining rather than exporting raw concentrate. Regional collaboration and international partnerships are crucial to developing processing capacity and infrastructure. Despite logistical challenges, Africa’s potential to become a major copper-processing hub is attracting increasing global attention.

Middle East

The Middle East’s diversification strategies, particularly in the Gulf states, are encouraging investment in copper products for renewable energy and desalination projects. As solar and grid expansion accelerate, demand for copper cables and transformers is rising. Some countries are exploring joint ventures with established copper processors to create regional manufacturing bases.

Policy and Investment Implications

Global governments are realizing that copper is not just a raw material but a strategic asset. Incentives for domestic processing, low-carbon manufacturing, and recycling are now common policy themes.

- Local Content Requirements: Many nations mandate local production or assembly for EVs and renewable components, stimulating copper product manufacturing domestically.

- Recycling Incentives: Tax benefits and subsidies encourage collection and processing of scrap copper, promoting circularity.

- Infrastructure Investment: Power grid expansion, urban development, and industrial modernization continue to underpin steady copper demand.

- Trade and Tariffs: Shifting trade dynamics, such as tariffs on metal imports or export restrictions on concentrates, influence regional market competitiveness.

The overall effect of these policies is to diversify copper product manufacturing across multiple regions, reduce dependence on any single supply source, and accelerate technological innovation in low-emission production processes.

Summary of Regional Outlook

- North America: Driven by policy incentives and EV demand, strong investments in domestic copper product capacity.

- Europe: Sustainability and recycling at the forefront; advanced manufacturing and energy transition ensuring long-term growth.

- Asia-Pacific: China dominates processing and exports, while Japan and Korea focus on high-purity and advanced alloys.

- Latin America: Potential for downstream expansion; balancing mining wealth with industrial development.

- Africa: Emerging producer and future hub for refined and semi-finished copper products.

- Middle East: Growing consumer of copper for renewable energy and infrastructure projects.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Automotive Software Market Growth Drivers, Trends, Key Players and Regional Insights by 2034