Consumer Healthcare Market Growth Factors, Key Players, and Global Presence by 2034

Consumer Healthcare Market Size

What is the consumer healthcare market?

The consumer healthcare market (also called “self-care” or “OTC & wellness”) is the broad universe of non-prescription products and services people use to prevent illness, manage minor ailments, and optimize everyday health without a clinician’s prescription. It spans over-the-counter (OTC) medicines (allergy, cold & flu, pain, dermatology, digestive), vitamins/minerals/supplements (VMS), nutrition (adult/pediatric), consumer diagnostics (e.g., glucose monitors, pregnancy tests), personal health devices and wearables, and emerging software-enabled self-care solutions. Global spend estimates vary by scope, but the market commonly sits in the hundreds of billions of dollars, with OTC and VMS segments alone reaching well above $140 billion each in 2024. Broader definitions, including devices and services, rise even higher.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2717

Why it is important

- Access & affordability: Self-care widens access to first-line relief (e.g., analgesics, allergy meds) and preventive options (supplements, nutrition) at relatively low cost—especially vital where physician access is limited.

- System sustainability: OTC switching and self-care reduce primary-care burden for minor ailments, freeing clinicians for complex care.

- Prevention & healthy aging: Consumers increasingly use nutrition and monitoring to delay disease onset and manage chronic risks.

- Data-driven self-management: Connected devices (e.g., continuous glucose monitoring) give real-time feedback that changes behavior.

- Resilience in public health: During seasonal surges or disruptions, well-regulated OTC and e-commerce supply chains can keep basic care flowing.

Consumer healthcare market growth factors

Demand is accelerating due to aging populations spending more on joint care, nutrition, and dermatology; chronic disease prevalence fueling nutrition and at-home monitoring; digitalization and data through apps, sensors, and AI that personalize self-care; OTC switches and regulatory modernization; pandemic-reshaped behaviors that normalized stocking of immunity and cough/cold products; e-commerce and social commerce broadening access; emerging middle classes in Asia and Latin America increasing per-capita spend; functional nutrition and premium supplements supported by clinical evidence; and growing recognition from payers and governments that self-care reduces healthcare utilization—together expanding penetration, trading consumers up to trusted brands, and pulling new users into connected monitoring ecosystems.

Top Companies Snapshot

Abbott Laboratories

- Specialization: Consumer diagnostics & nutrition (e.g., FreeStyle Libre CGM, Ensure®, Pedialyte®).

- Key focus areas: Diabetes self-management; adult & pediatric nutrition; hydration; metabolic health.

- Notable features: Global leader in continuous glucose monitoring (FreeStyle Libre) with more than 7 million users; Ensure passed $3 billion in 2024; strong OTC-adjacent digital ecosystem.

- 2024 Revenue: $41.95 billion (company total).

- Market share: Market-leading in glucose monitoring and adult oral nutrition.

- Global presence: Products sold in 160+ countries.

Amway Corporation

- Specialization: Vitamins, minerals, and supplements (VMS) under Nutrilite™, plus personal care and home products.

- Key focus areas: Plant-based supplements, immunity, sports nutrition, personalized nutrition.

- Notable features: Largest direct-selling wellness brand with strong Asia presence.

- 2024 Revenue: $7.4 billion.

- Market share: Leading global VMS brand in direct selling.

- Global presence: Over 100 markets.

BASF SE

- Specialization: Ingredients and solutions for human nutrition & health (vitamins, carotenoids, omega-3s, excipients), personal care, and pharma.

- Key focus areas: Nutrition ingredients, formulation support, and supply reliability.

- Notable features: Global leader in vitamin and carotenoid supply.

- 2024 Revenue: €68.9 billion.

- Market share: Among the largest global suppliers of vitamins and omega-3s.

- Global presence: Manufacturing and application centers worldwide.

Bayer AG (Consumer Health Division)

- Specialization: OTC medicines & self-care (Aspirin®, Bepanthen®, Canesten®, Claritin®, Iberogast®).

- Key focus areas: Allergy & cold, pain & cardio, dermatology, digestive health, women’s health, and nutritionals.

- Notable features: Strong OTC brand equity; digitizing self-care; global reach.

- 2024 Revenue: €46.6 billion total, with €5.9 billion from Consumer Health.

- Market share: Top-tier global OTC player with leadership across multiple categories.

- Global presence: More than 100 countries.

Boehringer Ingelheim International GmbH

- Specialization: Pharmaceuticals & animal health; exited consumer health in 2017 via Sanofi asset swap.

- Key focus areas: Cardiometabolic, respiratory, immunology, oncology.

- Notable features: Strong obesity and diabetes pipeline driving self-care adjacencies.

- 2024 Revenue: €25.6 billion.

- Market share: Indirect consumer healthcare impact via therapeutic innovation.

- Global presence: 70+ countries, 50,000+ employees.

Leading Trends and Their Impact

- Real-time self-management: Continuous glucose monitoring is shifting from clinics to everyday self-care. Abbott’s FreeStyle Libre is now used by millions, reinforcing consumer and payer adoption.

- GLP-1 influence: Obesity and diabetes drug breakthroughs are reshaping consumer behaviors, boosting demand for nutrition, diagnostics, and monitoring.

- Premiumization with proof: Consumers increasingly choose clinically validated OTC and nutrition products, fueling growth for brands like Ensure and Bepanthen.

- Regulatory modernization: U.S. OTC Monograph Reform and the EU General Product Safety Regulation have streamlined innovation and raised quality standards.

- Digital-first commerce: E-commerce, direct-to-consumer, and social commerce are redefining market access, particularly in Asia.

- Ingredient reliability: After pandemic disruptions, brands prioritize secure and high-quality supply chains, with BASF playing a crucial role in enabling global brands.

Successful Examples Around the World

- Abbott FreeStyle Libre: Expanded to over 60 countries and adopted by millions, it transformed chronic disease management.

- Bayer dermatology brands: Bepanthen® and Canesten® show consistent global growth across e-commerce and retail channels.

- Abbott Ensure®: Surpassed $3 billion in 2024 as aging populations seek clinical nutrition.

- Amway Nutrilite: Direct-selling and community coaching networks made it one of the largest supplement brands globally.

- BASF Ingredients: Supplies vitamins, omega-3s, and excipients that form the backbone of countless consumer brands.

Global Regional Analysis

North America

- Mature market with strong OTC, VMS, and connected devices adoption.

- Policies like U.S. OTC Monograph Reform and FDA approvals for OTC consumer devices drive faster innovation cycles.

Europe

- High per-capita spend with harmonized safety standards.

- EU General Product Safety Regulation (GPSR) strengthens traceability and quality control for consumer health products.

Asia–Pacific

- Fastest-growing region led by China, India, and Southeast Asia.

- Policies like Healthy China 2030 and India’s Ayushman Bharat Digital Mission formalize and digitize self-care markets.

Latin America

- Growth driven by expanding middle class in Brazil and Mexico.

- Regulators like ANVISA (Brazil) and COFEPRIS (Mexico) enforce supplement and OTC frameworks.

Middle East & Africa

- Rising demand for VMS and dermatology, with rapid pharmacy chain expansion.

- Governments emphasize local manufacturing and traceability, creating opportunities for global brands with compliant supply chains.

How the Featured Leaders Map to Value Pools

- OTC Medicines: Bayer leads globally with trusted brands in multiple therapeutic areas.

- VMS: Amway dominates via Nutrilite and strong Asia presence.

- Nutrition & Hydration: Abbott commands leading positions with Ensure® and Pedialyte®.

- Consumer Diagnostics: Abbott’s Libre CGM ecosystem is the global leader.

- Ingredients Backbone: BASF ensures supply stability and regulatory compliance for thousands of brands.

- Pharma-to-Consumer Influence: Boehringer Ingelheim’s obesity and cardiometabolic pipeline indirectly fuels consumer health demand.

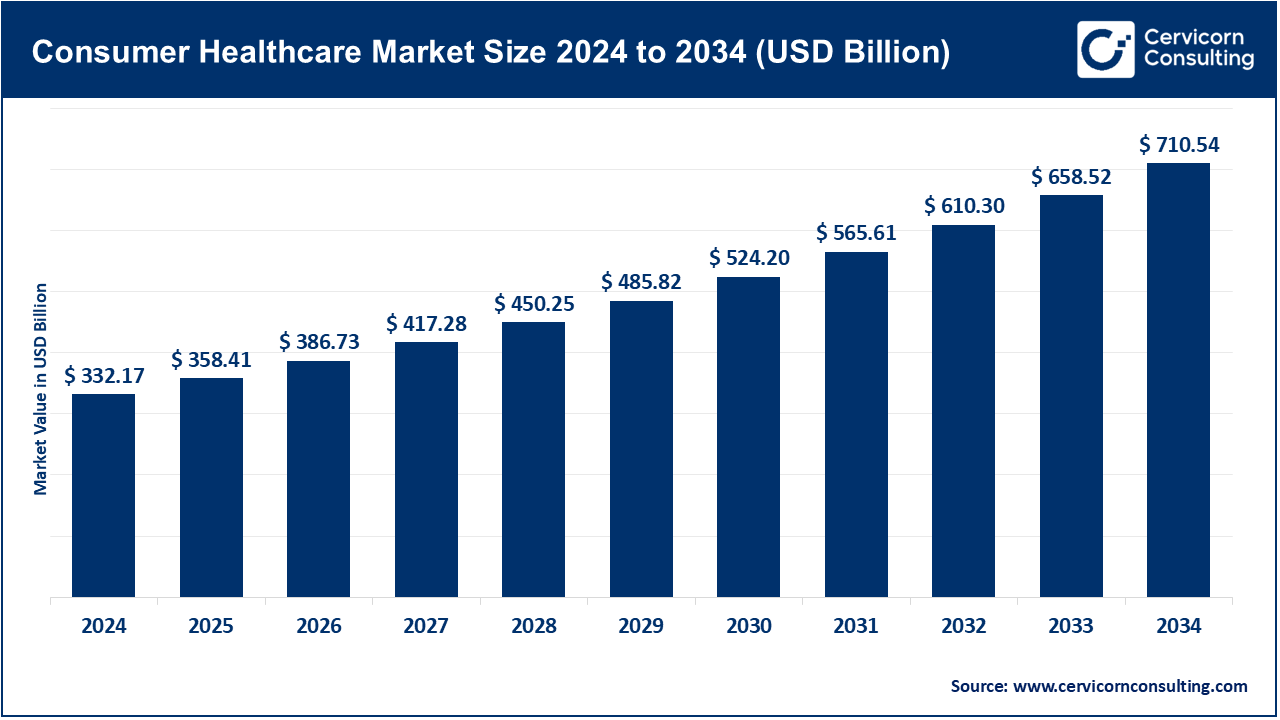

Market Sizing and Shares

- OTC and VMS categories each exceeded $140 billion in 2024.

- Bayer Consumer Health generated €5.9 billion in 2024, holding significant share in branded OTC.

- Abbott leads in continuous glucose monitoring and adult nutrition, with Ensure surpassing $3 billion.

- Amway recorded $7.4 billion in 2024, one of the largest global VMS players.

- BASF dominates as an upstream supplier of vitamins and omega-3s.

- Boehringer Ingelheim’s €25.6 billion pharma sales support long-term consumer health adjacencies.

What to Watch Next

- OTC switches in categories like migraine and contraception could reshape the landscape.

- Premium evidence-backed supplements will outpace commoditized products.

- Hybrid models combining devices, apps, and supplements will become the default in chronic care.

- Stronger e-commerce safety standards will reward compliant multinational brands.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Hyperscale Computing Market Growth Drivers, Key Players, Trends & Regional Insights by 2034