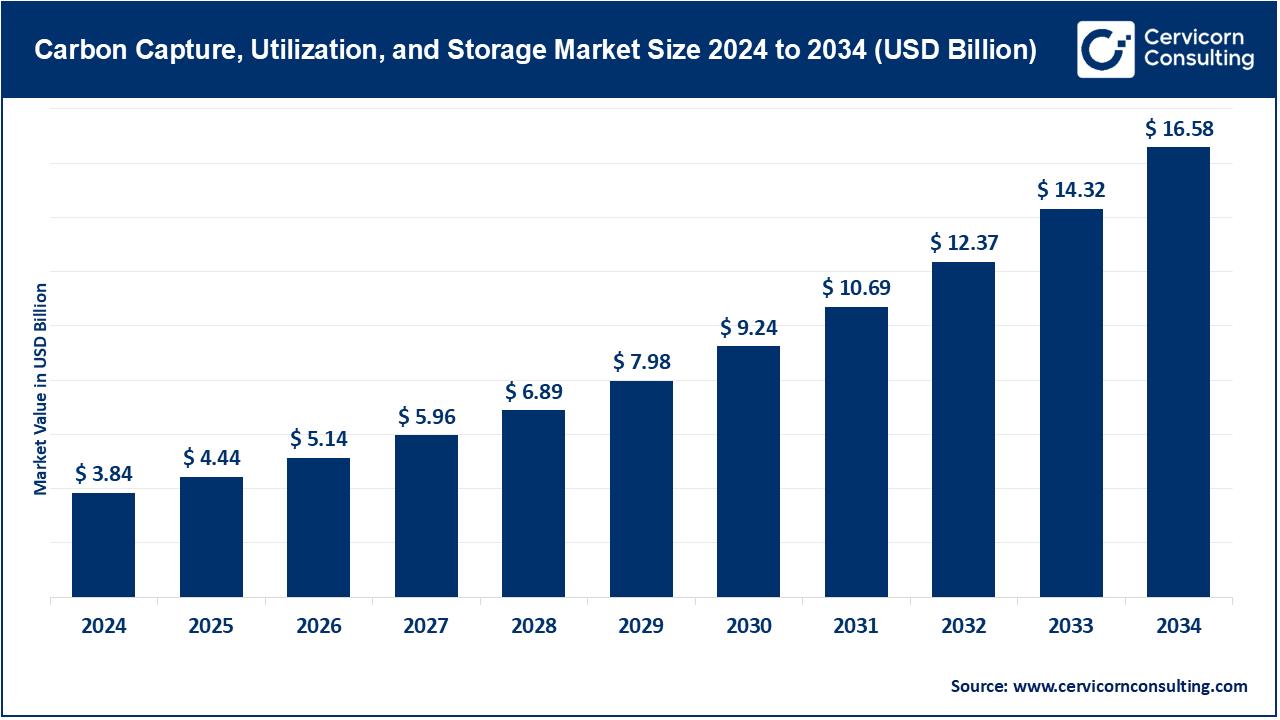

Carbon Capture, Utilization, and Storage Market Trends, Growth Factors, Key Companies & Global Insights by 2034

Carbon Capture, Utilization, and Storage Market Size

What is the Carbon Capture, Utilization, and Storage Market?

The Carbon Capture, Utilization, and Storage (CCUS) market encompasses technologies and processes designed to capture carbon dioxide (CO₂) emissions from industrial sources, transport them to suitable storage sites, and either utilize or permanently store them to mitigate climate change. This market includes various capture technologies, such as post-combustion, pre-combustion, and oxy-fuel combustion, and spans applications across power generation, industrial processes, and enhanced oil recovery.

Why is CCUS Important?

CCUS plays a crucial role in achieving global net-zero emissions targets by addressing emissions from sectors that are challenging to decarbonize, such as cement, steel, and chemical industries. It offers a pathway to reduce atmospheric CO₂ concentrations, thereby mitigating global warming and its associated impacts. Additionally, CCUS can contribute to energy security by enabling the continued use of fossil fuels in a more sustainable manner.

Carbon Capture, Utilization, and Storage Market Growth Factors

The CCUS market is experiencing significant growth due to several key factors: stringent environmental regulations, increasing global awareness of climate change, technological advancements in capture and storage methods, and substantial government incentives. For instance, various countries provide tax credits and financial support for CO₂ storage, encouraging investment in CCUS projects. Moreover, the establishment of CCUS hubs and networks, such as centralized storage projects in Europe and North America, demonstrates the scalability and feasibility of these technologies. The increasing demand for clean energy and the global focus on sustainability are also major drivers, pushing companies and governments to invest heavily in CCUS infrastructure and research.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2713

Leading Companies in the Carbon Capture, Utilization, and Storage Market

1. Equinor

- Specialization: Offshore CO₂ storage and development of CCUS infrastructure.

- Key Focus Areas: Northern Lights project, CO₂ transport and storage solutions.

- Notable Features: Partnerships with Shell and TotalEnergies; first CO₂ injection at Northern Lights completed in 2025.

- 2024 Revenue: Approximately USD 3.68 billion in the CCUS segment.

- Market Share: Dominant player in European offshore CO₂ storage.

- Global Presence: Active in Europe, North America, and Asia.

2. ExxonMobil

- Specialization: CO₂ capture technologies and enhanced oil recovery.

- Key Focus Areas: Deployment of large-scale CCUS projects; development of next-generation capture technologies.

- Notable Features: Extensive experience in CO₂ injection and storage; significant investments in CCUS infrastructure.

- 2024 Revenue: Approximately USD 5.61 billion in the CCUS segment.

- Market Share: Significant presence in North America and Asia-Pacific regions.

- Global Presence: Operations in over 50 countries worldwide.

3. BP

- Specialization: Development and implementation of CCUS technologies.

- Key Focus Areas: Net Zero Teesside project; integration of CCUS with renewable energy sources.

- Notable Features: Commitment to achieving net-zero emissions by 2050; collaboration with various stakeholders to advance CCUS technologies.

- 2024 Revenue: Approximately USD 4.5 billion in the CCUS segment.

- Market Share: Strong presence in the UK and North America.

- Global Presence: Active in Europe, North America, and Asia.

4. Global CCS Institute

- Specialization: Advocacy and support for the global deployment of CCUS technologies.

- Key Focus Areas: Policy development; public-private partnerships; knowledge sharing.

- Notable Features: Leading think tank in the CCUS sector; extensive network of stakeholders.

- 2024 Revenue: Approximately USD 150 million in research and advisory services.

- Market Share: Influential in shaping global CCUS policies and strategies.

- Global Presence: Headquartered in Australia with a global network of offices and partners.

5. Aker Solutions

- Specialization: Engineering and technology solutions for CCUS projects.

- Key Focus Areas: Design and construction of CO₂ capture facilities; integration of CCUS with industrial processes.

- Notable Features: Innovative solutions for CO₂ compression and transport; strong track record in offshore engineering.

- 2024 Revenue: Approximately USD 1.2 billion in CCUS-related projects.

- Market Share: Leading provider of engineering services in the CCUS sector.

- Global Presence: Operations in Europe, North America, and Asia.

Leading Trends and Their Impact

- Integration with Renewable Energy: Combining CCUS with renewable energy sources enhances the sustainability of both technologies.

- Development of CCUS Hubs: Establishing centralized facilities for CO₂ capture, transport, and storage increases efficiency and reduces costs.

- Advancements in Capture Technologies: Innovations in direct air capture and bioenergy with carbon capture and storage (BECCS) improve the scalability and economic viability of CCUS.

- Public-Private Partnerships: Collaborations between governments and private companies accelerate the deployment of CCUS projects through shared resources and expertise.

Successful Examples of CCUS Projects Worldwide

- Northern Lights Project (Norway): A pioneering cross-border CCS initiative capturing CO₂ from industrial sources and storing it offshore.

- Petra Nova Project (USA): A retrofit of a coal-fired power plant in Texas, capturing CO₂ for enhanced oil recovery.

- Boundary Dam Project (Canada): The world’s first commercial-scale CCS project integrated into a coal-fired power plant.

- Gorgon Project (Australia): One of the largest CCS projects globally, capturing CO₂ from natural gas processing facilities.

Global Regional Analysis

North America

- Market Size: Approximately USD 2.70 billion in 2024.

- Key Drivers: Government incentives, such as tax credits; significant industrial emissions.

- Challenges: High capital costs; regulatory complexities.

Europe

- Market Size: Estimated at USD 8.6 billion in 2024.

- Key Drivers: EU climate policies; establishment of CCUS hubs.

- Challenges: Funding constraints; public perception.

Asia-Pacific

- Market Size: Growing rapidly, with significant investments in CCUS infrastructure.

- Key Drivers: Industrial emissions; energy demand.

- Challenges: Technological gaps; policy development.

Middle East and Africa

- Market Size: Emerging market with potential for large-scale CCUS projects.

- Key Drivers: Oil and gas industry; carbon management strategies.

- Challenges: Infrastructure development; regulatory frameworks.

Government Initiatives and Policies Shaping the Market

- United States: Tax credits and funding mechanisms incentivize CO₂ storage and project development.

- European Union: The European Green Deal promotes CCUS as a key technology for decarbonization, supporting projects through funding and policy frameworks.

- Norway: National initiatives fund CCUS projects, including large-scale offshore storage.

- China: Policies support the development of CCUS technologies with a focus on industrial emissions reduction.

- India: Strategic initiatives aim to incorporate CCUS into energy-intensive industries, with pilot projects and government support for technology development.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

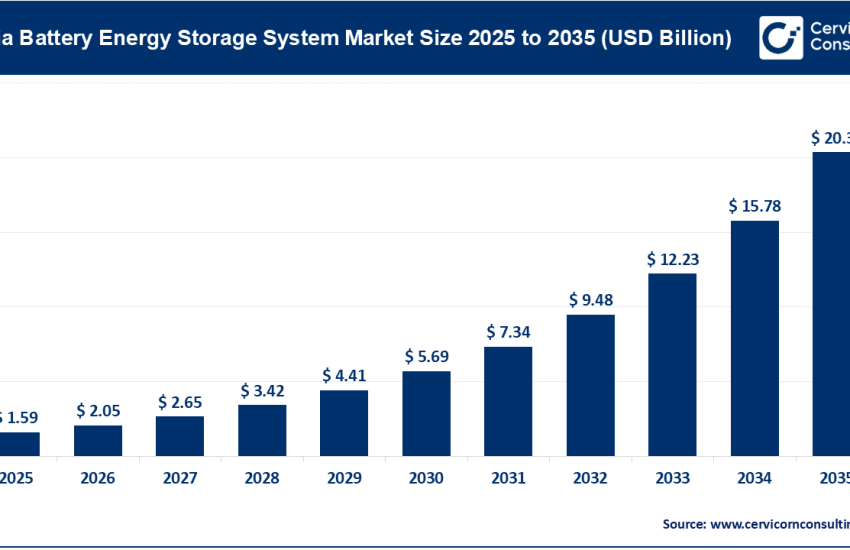

Read Report: Electric Vehicle Battery Market Size, Share & Growth Report 2025-2034