Asset Lifecycle Management Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

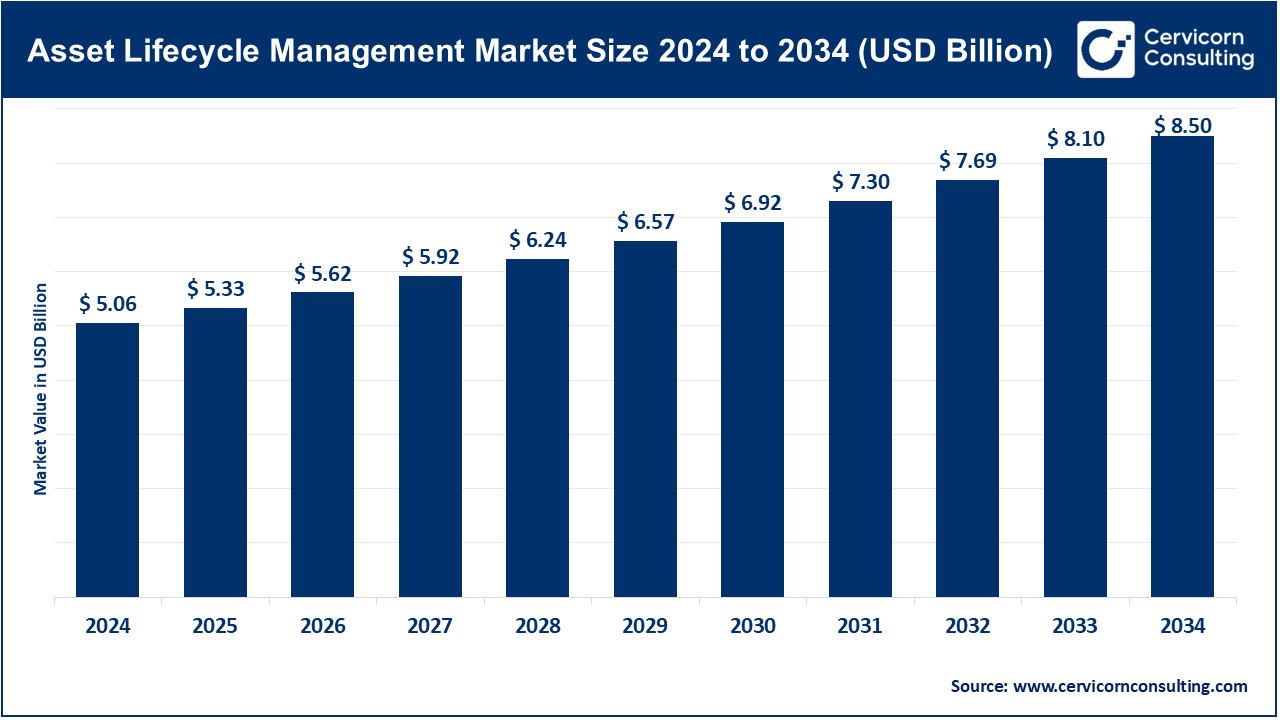

Asset Lifecycle Management Market Size

The global asset lifecycle management market size was worth USD 5.06 billion in 2024 and is anticipated to expand to around USD 8.50 billion by 2034, registering a compound annual growth rate (CAGR) of 5.32% from 2025 to 2034.

What Is the Asset Lifecycle Management Market?

Asset Lifecycle Management (ALM) refers to the combination of software, services, processes, and analytics used to manage the entire lifespan of an organization’s physical assets—from acquisition and installation to operation, maintenance, and eventual retirement or disposal.

The ALM market includes enterprise asset management (EAM) systems, computerized maintenance management systems (CMMS), asset performance management (APM), digital twin technologies, industrial IoT platforms, and lifecycle analytics solutions.

ALM aims to unify engineering data, operational telemetry, maintenance schedules, work orders, spare parts inventories, compliance records, and financial data into a single ecosystem that helps organizations:

- Extend asset life

- Optimize maintenance

- Reduce operational costs

- Improve safety

- Achieve sustainability and regulatory goals

Get a Free Sample: https://www.cervicornconsulting.com/sample/2411

Why Is Asset Lifecycle Management Important?

The importance of ALM has surged as industries face aging infrastructure, skills shortages, rising maintenance costs, and pressure to deliver more output with fewer resources. ALM systems are important because they enable:

1. Operational Reliability & Uptime

Predictive and condition-based maintenance significantly reduce unplanned downtime, extending Mean Time Between Failure (MTBF) and improving plant efficiency.

2. Cost Optimization

By integrating whole-life asset costing, organizations can make smarter decisions regarding repair, refurbishment, or replacement—reducing total cost of ownership (TCO).

3. Regulatory & Sustainability Compliance

Increasing global regulations require accurate tracking of asset performance, emissions, materials, and disposal. ALM ensures data visibility and auditability.

4. Workforce Productivity

Mobile apps, digital workflows, augmented reality, and integrated asset data improve technician efficiency and reduce errors.

5. Digital Transformation Enablement

ALM is a foundation for digital twins, Industry 4.0, IoT, automation, and AI-driven maintenance strategies, making it central to modern operations management.

Asset Lifecycle Management Market Growth Factors

The ALM market is expanding rapidly due to the rising adoption of Industry 4.0 technologies, increased deployment of IoT and sensor networks that enable real-time telemetry, a strong shift from reactive to predictive and prescriptive maintenance, growing regulatory and sustainability pressures that require better asset documentation, cloud-based ALM platforms that lower implementation costs and improve scalability, aging infrastructure across utilities and public sectors that demands smarter maintenance strategies, and growing investments in digital twins and AI-driven analytics to optimize asset life, reduce downtime, and improve safety. These factors have positioned ALM as a mission-critical element of global operational excellence, fueling substantial market growth across every major industry.

Top Companies in the Asset Lifecycle Management Market

1. IBM Corporation (Maximo) – Global Leader

Specialization

Enterprise Asset Management, Asset Performance Management, predictive maintenance, digital twins, and industry-specific ALM solutions through the IBM Maximo Application Suite.

Key Focus Areas

- AI-driven maintenance using IBM watsonx

- Cloud-based Maximo deployments

- Condition monitoring

- Configurable workflows for asset-intensive industries

- Advanced APM and reliability analytics

Notable Features

- Strong industry templates (utilities, oil & gas, transportation, manufacturing)

- Mobile workforce applications

- Enterprise-scale ALM deployments

2024 Revenue

Approx. USD 62.8 billion

Market Share & Presence

One of the largest ALM/EAM solution providers globally, with deployments across North America, Europe, Middle East, and Asia-Pacific.

2. SAP SE – Intelligent Asset Management

Specialization

SAP integrates ALM within its broader ERP and supply chain ecosystem, enabling end-to-end visibility across finance, procurement, operations, and asset management.

Key Focus Areas

- SAP Intelligent Asset Management

- EAM for S/4HANA

- Predictive maintenance and service

- Cloud-first strategy

Notable Features

- Tight integration with SAP ERP and supply chain systems

- Digital twins for asset operations

- Strong capabilities in large enterprise environments

2024 Revenue

Approx. €34.1 billion

Market Share & Presence

SAP is a dominant ALM provider for large organizations globally, especially where ERP integration is a strategic priority.

3. Oracle Corporation – Cloud Asset & Maintenance

Specialization

Cloud-based maintenance management integrated with Oracle Fusion Cloud ERP and SCM products.

Key Focus Areas

- Cloud-native EAM modules

- Unified financial and operational workflows

- Asset-centric supply chain and maintenance planning

Notable Features

- Powerful analytics through Oracle Cloud

- Integration of maintenance with procurement and inventory

- Strong SaaS ecosystem

2024 Revenue

Approx. USD 53 billion

Market Share & Presence

Oracle holds strong market presence in enterprise cloud deployments across the Americas, Europe, and Asia.

4. Siemens AG – Engineering & Digital Twin Leader

Specialization

Industrial lifecycle management through the Siemens Xcelerator Platform, integrating PLM, EAM, APM, automation systems, and digital twins.

Key Focus Areas

- Industrial digitalization

- IoT-enabled asset intelligence

- Engineering-to-operations lifecycle integration

Notable Features

- Deep digital twin capabilities

- Manufacturing and process industry strength

- Integration between OT and IT systems

2024 Revenue

Approx. €75.9 billion

Market Share & Presence

Siemens is a leading ALM provider for industrial automation, manufacturing, transportation, and infrastructure projects worldwide.

5. Infor – Cloud EAM Specialist

Specialization

Industry-specific cloud ERP and EAM solutions (Infor CloudSuite, Infor EAM) serving manufacturing, healthcare, distribution, and public sector clients.

Key Focus Areas

- Vertical industry templates

- Cloud-first deployments

- Fast implementation for mid-sized and large organizations

Notable Features

- Strong usability and interface

- Configurable workflows

- Broad industry adoption

2024 Revenue

Approx. USD 3.4 billion (estimated)

Market Share & Presence

Infor maintains a strong global footprint with millions of users across over 170 countries.

Leading Trends Shaping the ALM Market

1. IoT and Sensor-Based Monitoring

Remote telemetry enables organizations to monitor asset health continuously, reduce emergency breakdowns, and shift toward condition-based maintenance. This results in lowered maintenance costs and improved asset reliability.

2. Predictive and Prescriptive Maintenance

AI and machine learning predict potential failures and recommend corrective actions. This trend is reducing unplanned downtime and increasing asset availability across sectors like oil & gas, manufacturing, and transportation.

3. Digital Twins

Digital twins simulate asset behavior under various conditions, enabling designers and operators to make data-driven lifecycle decisions. This trend is accelerating across utilities, water management, aviation, and industrial sectors.

4. Cloud Adoption

Cloud-based ALM reduces upfront costs, enhances scalability, accelerates deployment, and enables global teams to collaborate on shared asset data.

5. Mobility and AR-Based Field Service

Technicians using mobile apps and augmented reality can access digital asset histories, step-by-step repair instructions, and remote assistance—reducing repair times and improving workforce productivity.

6. Sustainability and ESG Integration

ALM systems offer essential data to support emissions tracking, circular economy goals, and asset reuse/recycling reporting, helping organizations meet global sustainability mandates.

Global Examples of Successful ALM Implementations

DP World – IBM Maximo

Global terminal operator DP World implemented IBM Maximo across multiple ports to standardize asset data, improve equipment uptime, and optimize maintenance planning. Their unified ALM environment dramatically improved operational reliability.

Utilities and Water Management

Major water utilities such as Thames Water have adopted digital twins and ALM systems to reduce leakages, optimize pipeline integrity management, and improve field response times.

Industrial Manufacturing – Siemens Xcelerator

Manufacturers are integrating engineering (PLM), production (MES), and maintenance (EAM/APM) through Siemens Xcelerator. This integrated lifecycle strategy improves equipment OEE, reduces commissioning time, and enhances production quality.

Large Government Real Estate Projects

Mega infrastructure developments, smart cities, and campus-scale developments use ALM/EAM platforms to optimize building operations, shorten maintenance cycles, and ensure asset compliance across thousands of physical assets.

Global Regional Analysis and Government Initiatives

North America

Market Characteristics

- Mature ALM adoption

- High investments in digital transformation

- Industry 4.0 and predictive maintenance heavily embraced

Government Initiatives

- The U.S. Infrastructure Investment and Jobs Act (IIJA) boosts funding for transportation, water systems, and power infrastructure, driving ALM adoption in public utilities and government agencies.

Europe

Market Characteristics

- Strong regulatory and sustainability requirements

- Advanced manufacturing and industrial automation

Government Initiatives

- The European Green Deal & Circular Economy Action Plan encourage organizations to extend asset life, increase energy efficiency, and document lifecycle sustainability—driving demand for ALM solutions.

Asia-Pacific

Market Characteristics

- Fastest-growing ALM region

- Rapid industrialization and infrastructure expansion

- Massive investments in smart factories and IoT

Government Initiatives (India Example)

- National Infrastructure Pipeline (NIP)

- PM Gati Shakti program

These initiatives drive digital infrastructure planning and large-scale asset investments, boosting ALM adoption in public and private sectors.

Middle East & Africa

Market Characteristics

- Strong demand driven by mega projects, utilities, oil & gas, and real estate

- Digital transformation at the core of national visions (UAE Vision 2030, Saudi Vision 2030)

ALM systems are widely used for large-scale new city developments, transportation networks, and public infrastructure modernization.

Latin America

Market Characteristics

- Growing adoption in mining, energy, and public utilities

- Emphasis on extending the life of aging assets and improving maintenance efficiency

Governments are investing in asset modernization programs and digitizing public infrastructure to improve reliability and lower operating costs.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Sand Battery Market Revenue, Global Presence, and Strategic Insights by 2034