Artificial Intelligence (AI) Robots Market Growth Factors, Technology, Policy, and Investment Insights

Artificial Intelligence (AI) Robots Market Growth Factors

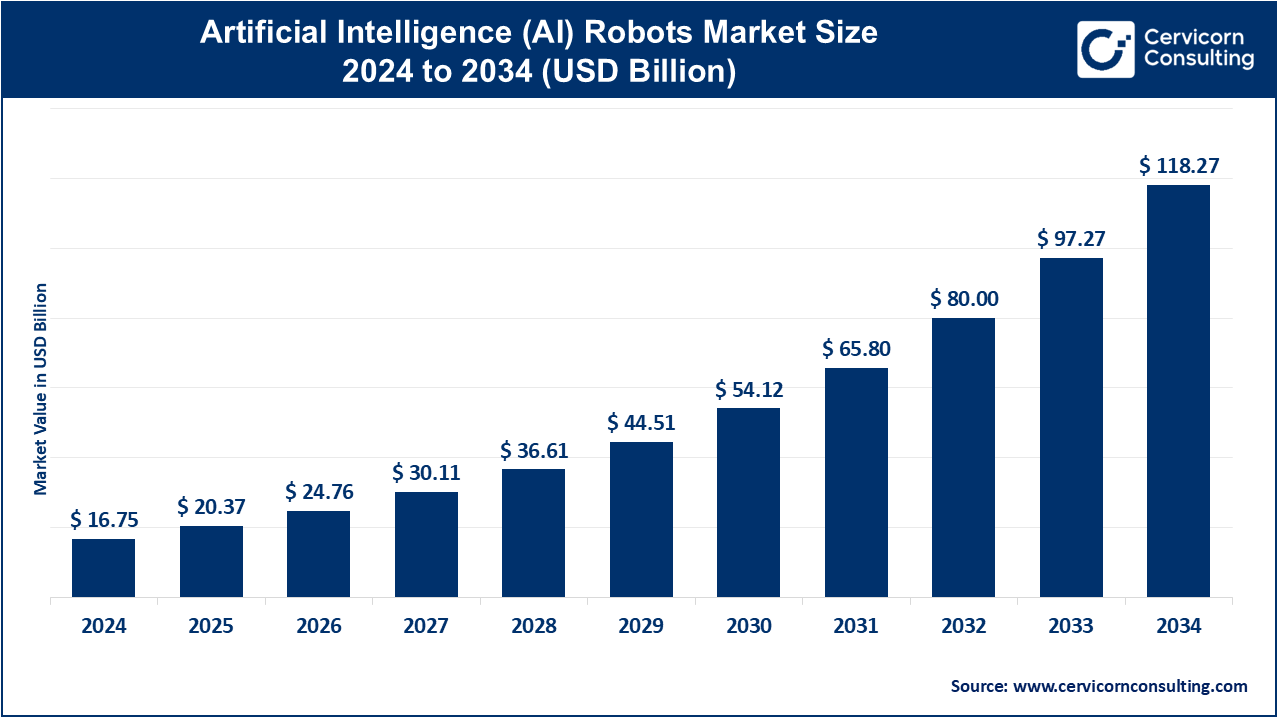

The global artificial intelligence (AI) robots market was valued at USD 16.75 billion in 2024, projected to reach USD 118.27 billion by 2034, signifying a compound annual growth rate (CAGR) of 21.58%.

The AI robots market is being propelled by multiple high-impact drivers: relentless technological progress in machine learning, computer vision, NLP, and autonomous decision-making; widespread adoption of automation in industries—particularly manufacturing, logistics, healthcare, and service sectors—due to rising labor costs and aging demographics; exponential growth in AI-capable chipsets (GPUs/NPUs) from NVIDIA, Intel, and others; massive investments from private equity, AI chip leaders, and governments in robotics infrastructure; emphasis on cobots/embodied AI enhancing human–robot collaboration; standardization, regulatory frameworks, and ethical oversight facilitating safer deployment; and increasing edge computing for low-latency applications. These factors collectively support a robust CAGR, with estimates ranging from ~21% to 27% over the next decade.

What Is the Artificial Intelligence (AI) Robots Market?

The AI robots market comprises autonomous or semi-autonomous robots powered by integrated artificial intelligence technologies—such as ML, computer vision, NLP, and edge analytics—designed to perform tasks across industrial, service, healthcare, logistics, domestic, and public domains. This market includes:

- Industrial AI robots (manufacturing lines, warehouses, automotive plants)

- Service/consumer robots (delivery drones, cleaning, hospitality)

- Humanoids and cobots (collaborative robots in smart factories, elderly care)

- AI hardware/software platforms enabling sensor fusion, perception, decision-making, and real-time control

Get a Free Sample: https://www.cervicornconsulting.com/sample/2646

Why Is It Important?

- Economic Efficiency & Productivity

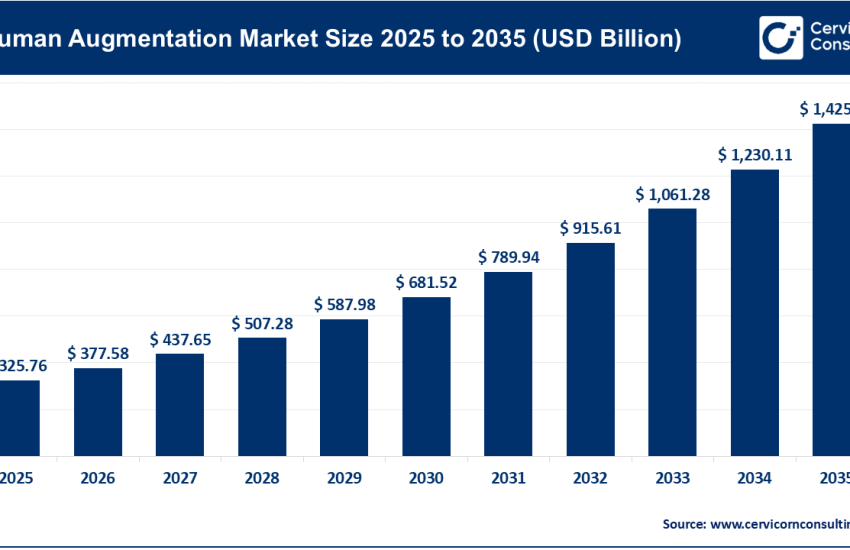

AI robots optimize costs, minimize waste, and improve precision in factory and warehouse systems—e.g., Amazon and Agility Robotics collaboration on warehouse automation. - Demographic & Labor Support

Aging populations in regions like Europe and East Asia drive demand for care robots and robotics to supplement shrinking workforces. - Strategic Leadership & Security

Robotics is central to national technology agendas: U.S. and China race in R&D and sovereign capability; South Korea launched a K‑Humanoid Alliance aiming for commercial humanoids by 2028. - Innovation Spillover

AI robots push boundaries in edge AI, NL processors, sensor integration, and autonomy—positive cross-pollination for AI in sectors like medical diagnostics, autonomous vehicles, and smart infrastructure. - Global Competitiveness

Robotics is a core pillar for Industry 4.0. Countries embracing AI robots diversify industry, enhance manufacturing resilience, and secure supplier networks. For instance, Japan’s “Society 5.0” interlinks robotics in healthcare and manufacturing.

Top Companies in AI Robotics: Profiles & Metrics (2024)

Here’s a breakdown of the leading players you listed:

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue & Market Share | Global Presence |

|---|---|---|---|---|---|

| Alphabet (Google) | AI systems, chips (TensorFlow), robotics projects | Cloud AI, AI chips (A3), humanoid robotics prototypes | Gemini chatbot, A3 Mega processor, TPU-based edge chips | Parent Alphabet ~USD 2 trillion market cap; AI revenue ~ $75 b investment | Global (Americas, Europe, APAC) |

| Microsoft Corporation | Cloud-based AI + robotics software | Azure AI, Copilot, AI-equipped PCs, software platforms for robotic control | Copilot+ PCs, LSD Azure SDKs, ecosystem integration | Revenue ~ $3.19 T market cap, recent 19–33% growth | Worldwide (190 countries) |

| IBM Corporation | AI cognitive systems & enterprise robots | Watson-powered robotics in industry/healthcare, AI software platforms | Legacy strength in automation and consulting | Revenue ~ $60–70 B (total); robotics share growing | 170+ countries |

| Intel Corporation | AI processors (CPUs/NPUs), Edge compute | Neuromorphic chips, embedded AI vision systems | Edge AI processors for robots, automotive platforms | Revenue ~ $79 B (2021) | Global semiconductor footprint |

| NVIDIA Corporation | GPUs/AI chips powering robotics | Robotics AI, foundational AI models (Cosmos), partnerships (Toyota, CES demos) | Blackwell Ultra chip, Vera Rubin platform, AI models for humanoids | Revenue $130.5 B in 2024 | Worldwide R&D & sales |

- Alphabet: So-called “Magnificent 7,” major AI investment; custom chips; Gemini chatbot; R&D in robotics and cloud.

- Microsoft: Heavy investment in OpenAI, Azure AI platforms, and Copilot+ devices; delivering software and cognitive services to integrate robotics.

- IBM: Focused on industrial AI and healthcare robotics powered by Watson; utilizes global consulting network.

- Intel: Chip maker for robots and edge devices; invests in NPU development with Docker vision and inference.

- NVIDIA: Chief AI processor supplier; developing robotics AI models (Cosmos); partners with Toyota for autonomous systems.

These are consistent with lists from Expert Market Research, identifying Google, Microsoft, Intel, IBM, NVIDIA among the top AI companies.

Leading Trends & Their Impact

- Humanoid & Embodied AI

Tesla’s Optimus and startups like Figure AI and Unitree are building humanoid robots (e.g., Figure 02 with vision-language models, 25 kg payload, deployed at BMW).

Impact: close to mass deployment, long-term labor shift. - Cobots & Human–Robot Collaboration

Collaborative robots from Universal Robots and integration into service sectors are boosting safe and scalable adoption. - Edge AI & Hardware Advances

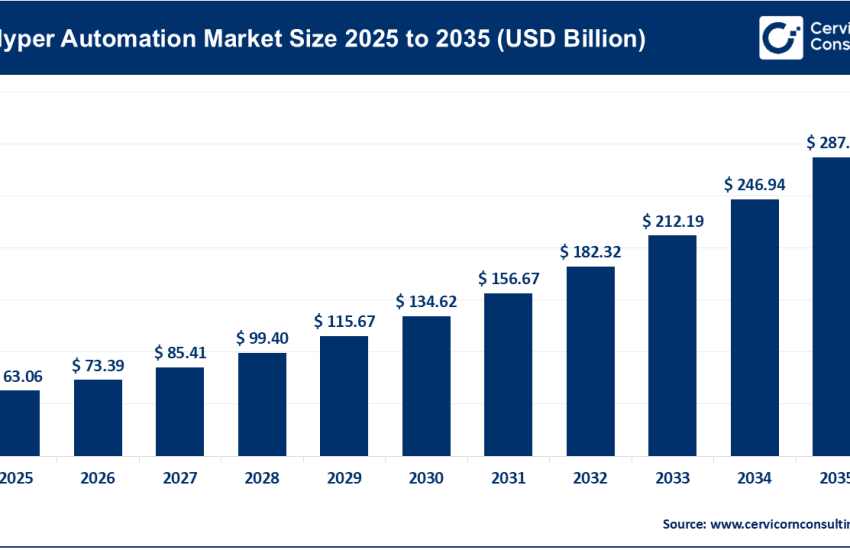

Edge computing chips (from Intel, NVIDIA) reduce latency, enhance processing on-device, enabling autonomy in drones, pickers, healthcare bots. - Software Platforms Surge

Robotic software platforms grew from USD 6.07 B in 2024 to USD 7.30 B in 2025 (CAGR 20.9%), with leaders like Microsoft Azure, AWS RoboMaker, IBM offering end-to-end mappings. - Ethical & Regulatory Alignment

Europe’s Horizon initiative, Society 5.0 in Japan, and labeling transparency mandates in China show increased focus on ethical AI, user safety, and trust. - Government Funding & Alliances

South Korea’s “K‑Humanoid Alliance” for commercial humanoids by 2028.

U.S. robotics coalition calling for a national strategy.

France/EU InvestAI initiative (€200 B), AI Action Summit 2025 in Paris.

Successful Examples of AI Robots in Action

- Tesla Optimus – Vision for general-purpose humanoid; anticipated to mass-produce 1 million by 2030, potentially generating a $70 B market by 2035 .

- Figure AI (USA) – Deploying Figure 02 at BMW demo locations; backed by Microsoft, NVIDIA, Intel, Amazon, OpenAI; next-gen BotQ facility aiming for 12,000 humanoids annually

- Universal Robots (Denmark) – Leading maker of collaborative robot arms (40–50% cobot market share); non-caged automation in plants worldwide.

- Agility Robotics + Amazon (USA) – Early partnership on warehouse mobile humanoids; investor James van Geelen elevates growth visibility.

- Unitree Robotics (China) – Produces AI-guided quadruped and biped robots; widely deployed in public/industrial venues; showcased at Shenzhen events.

- Healthcare/Service bots in China – AI workers delivering supplies and assisting in hospitals; part of the “Year of AI Robotics” and 14th Plan investment of ~730 billion yuan ($100 B).

Global & Regional Analysis: Government Initiatives & Policies

1. North America (USA/Canada)

- Market size US robots installations hit $16.5 B; AI software platforms grew to ~$7.3 B.

- U.S. robotics coalition urging a national office for federal funding, strategy, training to remain competitive with China.

- Investment in infrastructure: Stargate LLC (OpenAI + partners) earmarked $500 B for U.S. AI by 2029.

- Amazon–Agility Robotics warehouse pilots highlight industrial uptake.

2. Europe

- EU’s InvestAI initiative, €200 B for AI data centers and chip factories; France raised €110 B private pledges at AI Summit 2025.

- Germany, France, UK emphasizing ethical frameworks; industries using smart manufacturing & automotive automation.

- Robotics installations hit USD 16.5 B globally; Europe still strong in industrial automation .

3. Asia-Pacific

- China: 730 b yuan (~$100 B) invested; service robots, humanoids in healthcare, logistics; faces U.S. tech sanctions.

- Japan: Society 5.0 integrates robotics in every sector; major government support.

- South Korea: Government-backed K‑Humanoid Alliance launched April 2025; target commercial humanoids by 2028.

- APAC’s robots market: $4.39 B in 2024, projected to $30.99 B by 2034 (CAGR ~22%).

4. LAMEA (Latin America, Middle East, Africa)

- 2024 market at $1.76 B, forecast to $12.42 B by 2034.

- UAE/Saudi Arabia adopting service robots across airports, malls, hospitals; Brazil/Mexico exploring robotics in agriculture/manufacturing.

- Challenges: limited infrastructure, funding, skilled workforce.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generative AI in Packaging Market Size, Share & Forecast 2025–2034