AI Smart Glasses Market Revenue, Global Presence, and Strategic Insights by 2034

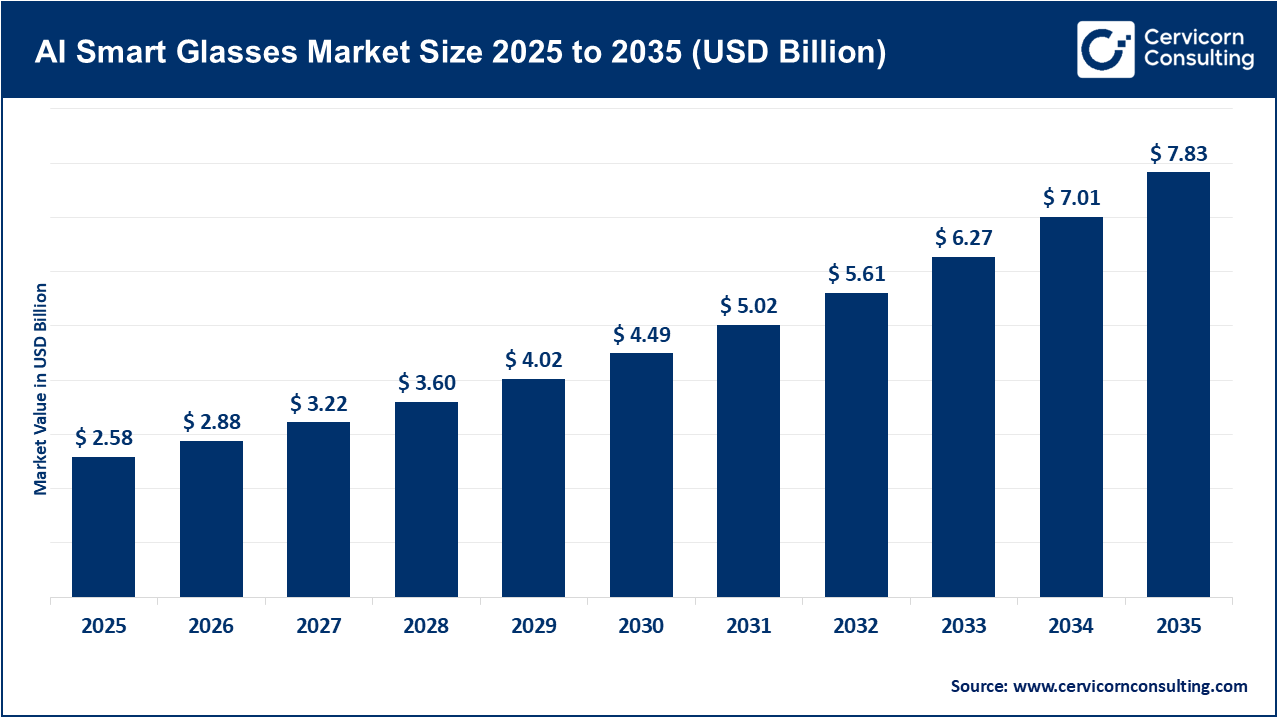

AI Smart Glasses Market Size

The global AI smart glasses market size was worth USD 2.58 billion in 2025 and is anticipated to expand to around USD 7.83 billion by 2035, registering a compound annual growth rate (CAGR) of 11.74% from 2025 to 2034.

AI Smart Glasses Market Growth Factors

The global AI smart glasses market is being propelled by a potent mix of growth factors: expanding demand for remote‑work and telemedicine solutions enabling hands‑free access to information, rising enterprise adoption in sectors such as manufacturing, logistics, healthcare, and retail for inspection, maintenance, and field‑service workflows, increasing consumer interest in wearable computing with voice/vision-enabled assistants, advances in enabling technologies like on‑device artificial intelligence, computer vision, sensors, and edge connectivity (including 5G/6G), the shifting expectation that eyewear can become a computing platform beyond smartphones, and broader ecosystem maturation including component cost reductions, supply‑chain readiness, and software frameworks. Taken together, these factors combine to create a highly fertile environment for AI‑enabled eyewear.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2804

What is the AI Smart Glasses Market?

The “AI smart glasses” market refers to the segment of wearable eyewear devices that integrate artificial intelligence (AI) capabilities — such as computer vision, voice/assistant interaction, context‑aware computing, object recognition, augmented reality overlays, gesture tracking, or interactive features — into a glasses form factor. These devices go beyond basic smart glasses (which might simply include audio, camera, or connectivity) by incorporating on‑device or edge‑assisted AI capabilities, enabling more advanced use-cases such as real-time translation, scene understanding, remote assistance, visual search, hands‑free workflows, and contextual augmented-reality interactions. In short: it’s the wearable-glasses form factor plus smart sensor/AI stack and interactive software/edge services.

Why It Is Important?

The importance of the AI smart glasses market arises from several interconnected dimensions:

- Workforce productivity & enterprise transformation: In industrial, field-service, healthcare, logistics, and retail settings, AI smart glasses offer the promise of hands-free access to data, remote live assistance, workflow guidance, visual overlays, and real-time insight. This can improve safety, reduce error, speed up processes, and reduce training/repair costs.

- Consumer computing transition: As smartphones saturate and users seek more seamless, ambient computing experiences, smart glasses represent a potential next platform for computing — enabling voice/vision interaction, continuous context awareness, and always-on connectivity.

- AI + vision + wearables convergence: The market sits at the intersection of AI, computer vision, wearable technology, connectivity (5G/6G), and augmented reality — all high-growth thematic vectors. The glasses form factor brings a unique human-interface modality that can unlock new use-cases.

- New monetisation and ecosystem potential: Beyond hardware sales, AI smart glasses open opportunities for applications, subscription services, enterprise software, remote assistance platforms, healthcare telepresence, and consumer data insights.

- Differentiation & competitive advantage: For technology leaders and eyewear fashion brands alike, entering this market allows differentiation and extension of ecosystem reach. First-mover advantages and ecosystem alignment can matter significantly.

In short, the AI smart glasses market matters both as a vector of enterprise transformation and as a possible next platform for consumer computing.

AI Smart Glasses Market – Top Companies

Below is a profile of five key companies active in the AI smart glasses market — their specialisation, key focus areas, notable features, recent revenue or market share notes, and global presence.

Meta Platforms (Meta)

- Company: Meta Platforms (formerly Facebook)

- Specialisation: Consumer-oriented smart glasses/AI eyewear under the Ray-Ban Meta brand plus R&D into augmented-reality display glasses.

- Key Focus Areas: Bridging social/AI/vision with fashion eyewear; integrating AI assistant into glasses; enabling hands-free content creation and live streaming; positioning glasses as a next-generation computing platform.

- Notable Features: Two cameras, open-ear audio, livestreaming to social platforms, voice assistant, on-device AI/vision features such as object recognition and translation.

- 2024 Revenue / Market Share: Ray-Ban Meta smart glasses reportedly sold ~1 million units in 2024; Meta captured over 60% of the smart glasses market share in 2024 for the display-less/AI smart glasses category.

- Global Presence: Global footprint across North America, Europe, and other regions.

Vuzix Corporation

- Company: Vuzix Corporation (US)

- Specialisation: Enterprise/industrial smart glasses for enterprise/field-service workflows; waveguide optics; digital eyewear platforms.

- Key Focus Areas: Enterprise smart eyewear with heads-up displays, optical waveguides, enterprise software integration; supplying OEM/ODM components for AR/AI glasses.

- Notable Features: M400 smart glasses series, optical waveguides for AR overlay, SDK/licensing model for developers and industrial clients.

- 2024 Revenue / Market Share: Total revenues of US $5.8 million in 2024.

- Global Presence: Headquartered in the US, serving enterprise clients worldwide.

RealWear Inc.

- Company: RealWear Inc. (US)

- Specialisation: Industrial wearable smart glasses for frontline workers, remote assistance, and rugged head-mounted displays with voice control.

- Key Focus Areas: Hands-free computing in industrial, oil & gas, manufacturing, maintenance; remote expert guidance and voice-driven workflows.

- Notable Features: Rugged design, voice-first interface, secure enterprise connectivity, compatibility with field-service software.

- Global Presence: Devices used globally by enterprise customers.

XREAL

- Company: XREAL (previously Nreal)

- Specialisation: Consumer-oriented AR/AI smart glasses for immersive display, bridging mobile devices and wearable AR glasses.

- Key Focus Areas: Lightweight HDMI/USB-C connected smart glasses, mixed-reality experiences, mobile connectivity, consumer entertainment, and gaming.

- Notable Features: Personal displays for mobile devices; consumer-friendly form factors; aftermarket software ecosystem.

- Global Presence: Based in China, expanding globally in the US, Europe, and Asia.

Lucyd Eyewear

- Company: Lucyd Eyewear (US)

- Specialisation: Consumer smart glasses with audio/AR/AI capabilities.

- Key Focus Areas: Combining fashion-eyewear design with smart audio/voice/AI functionality; accessible lifestyle and consumer segment.

- Notable Features: Smart frames with built-in speakers, microphones, AI voice assistant integration, subscription models for software services.

- Global Presence: US-based, direct-to-consumer online sales worldwide.

Leading Trends and Their Impact

- Miniaturisation & Lightweight Design: Advances in optics, batteries, sensors, and processors enable lighter, more comfortable glasses.

- On-device AI & Vision Processing: Local AI processing allows object recognition, translation, and offline functionality.

- Enterprise Use-Cases & Field-Service Deployments: Industrial applications provide stable business cases and recurring software revenue.

- Consumer Lifestyle & Social Use-Cases: Devices are increasingly lifestyle-oriented for audio, streaming, and AI assistant functions.

- Augmented Reality (AR) and Mixed Reality (MR) Fusion: AR overlays open high-value use-cases like navigation and training.

- Connectivity & Ecosystem Integration (5G/6G, Cloud/Edge): Low latency and edge-cloud integration enable remote assistance and AR overlays.

- Fashion/Brand Collaboration & Consumer Acceptance: Partnerships with eyewear brands increase adoption and acceptability.

- Regulatory, Privacy, and Safety Considerations: Camera/microphone features require regulatory compliance for privacy.

- Multiple Price Tiers & Mass Market Scaling: Expansion into different price segments drives adoption.

- Geographic Expansion & Emerging Market Adoption: Fast growth in Asia-Pacific and emerging markets.

Successful Examples of AI Smart Glasses Around the World

- Ray-Ban Meta Smart Glasses: ~1 million units sold in 2024, combining AI assistant features, camera capture, and fashion frames.

- Enterprise Deployments in Industrial/Field Service: RealWear and Vuzix devices are used globally in oil & gas, manufacturing, and logistics.

- Consumer AR Glasses by XREAL: Provides immersive displays and gaming experiences for mobile users.

- Healthcare / Telemedicine Use-Cases: Smart glasses assist doctors with hands-free data access and teleconsultation.

- Cross-market launches in Asia: Chinese players are preparing AI smart glasses launches, reflecting a dynamic global competitive field.

Global Regional Analysis (Including Government Initiatives & Policies)

North America

North America leads the market in size and innovation. Government policies supporting enterprise digitisation, 5G rollout, AI research funding, and industrial innovation foster adoption. Regulatory clarity on privacy and data protection provides confidence to enterprises.

Europe

Europe is a major market for both consumer and enterprise adoption. Government initiatives supporting Industry 4.0, AR/VR research, and wearable devices shape deployment. Enterprises must navigate privacy regulations and interoperability standards.

Asia-Pacific (APAC)

APAC is the fastest-growing region. National strategies for AI, wearables, smart manufacturing, and Industry 4.0 accelerate adoption. Emerging markets are driving lower-cost models and regional competition is intense.

Rest of World / Latin America / Middle East & Africa

Smaller in current share, these regions are emerging markets with growth potential. Government digital transformation initiatives support wearable adoption, but infrastructure and regulatory gaps may slow expansion.

Regulatory, Standards & Government Initiatives

- Data Privacy & Security: Camera and microphone features require compliance with privacy laws.

- Health & Safety Standards: Industrial smart glasses must meet ruggedness and ergonomic certifications.

- Government Funding & Incentives: Grants and public-private partnerships foster innovation and adoption.

- Infrastructure & Connectivity Support: Investment in 5G/6G and IoT platforms enables advanced use-cases.

- Standards & Interoperability: Emerging standards reduce fragmentation and support ecosystem growth.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Web3 Gaming Market Revenue, Global Presence, and Strategic Insights by 2034