AI in Clinical Trials Market Size and Growth, Trends, Key Players, and Forecast to 2034

AI in Clinical Trials Market Size and Growth Factors

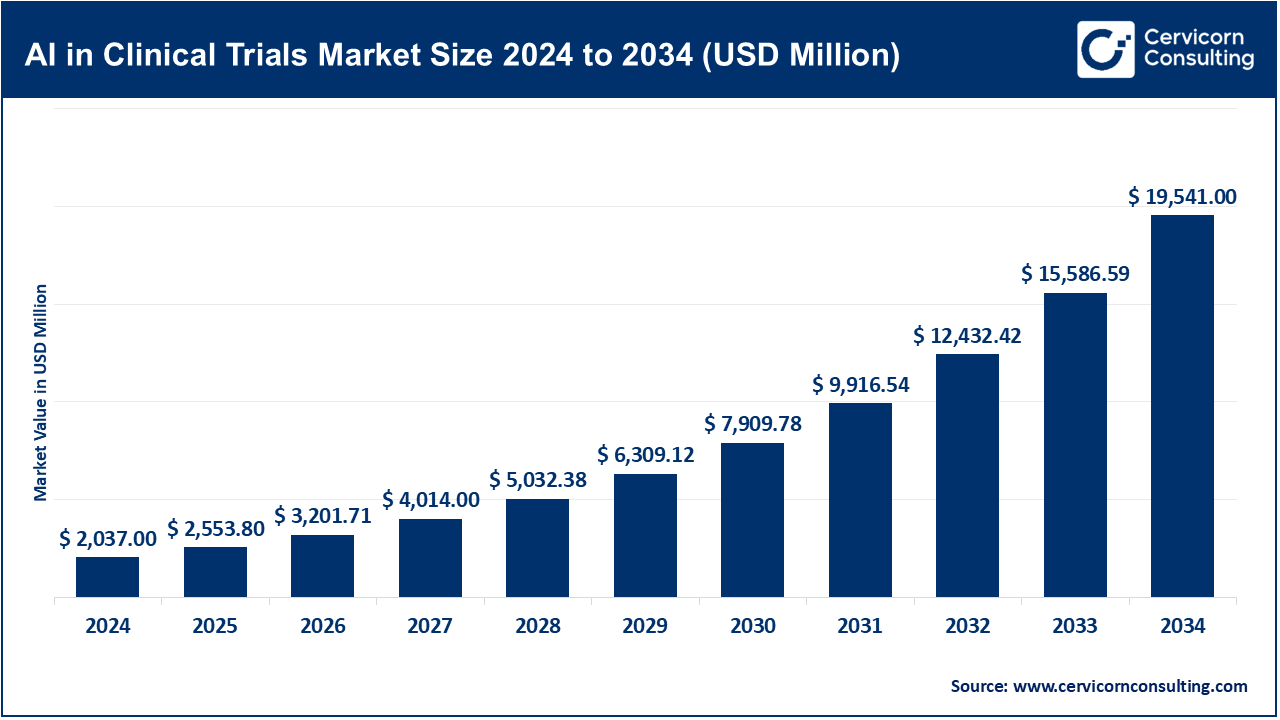

The AI in clinical trials market was valued at USD 2,037 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 25.4% from 2025 to 2034, reaching an estimated USD 19,541 million by 2034.

Soaring R&D spending (PhRMA-member companies alone poured US $276 billion into biopharma research in 2022), record numbers of active studies (≈518,000 global trials logged by December 2024), the push to arrest ballooning development costs (US $1–2 billion per new drug) and time-to-market, a 30 % jump in AI-focused partnerships between 2022-24, plus supportive regulation (FDA, EMA, MHRA, NMPA) collectively create a “perfect demand storm” that is propelling the AI in clinical trials market from and even loftier trajectories in bullish forecasts that factor in generative-AI productivity gains, synthetic control arms and digital-twin analytics.

What is “AI in Clinical Trials”?

“AI in clinical trials” refers to the use of machine-learning, natural-language processing, computer vision, generative AI and related analytics to design protocols, select sites, recruit and retain participants, monitor data, detect adverse events, create synthetic control arms and generate predictive models or digital twins that emulate trial populations. Solutions span software platforms, cloud-based analytics and purpose-built hardware accelerators that plug into electronic data-capture (EDC), electronic health records (EHRs), imaging systems and real-world-data feeds.

Why It Matters

-

Speed: AI-guided protocol design and eligibility simulation reduce design cycles from months to days and cut first-patient-in timelines by up to 40 %.

-

Cost: Each 1-day delay costs a top-20 pharma ≈US $1–2 million in lost sales; AI platforms that automate data cleaning, risk-based monitoring and recruitment can slice 10–15 % off total trial budgets.

-

Precision & Diversity: Pattern-recognition across multimodal datasets improves cohort stratification (e.g., rare biomarker matching) and supports diversity mandates.

-

Regulatory Confidence: AI-generated audit trails speed queries and support adaptive-trial amendments, which regulators increasingly expect in personalized-medicine pipelines.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2635

AI in Clinical Trials Market Leaders (2024 financials, specializations, and differentiators)

| Company | 2024 Revenue* | Est. 2024 Share | Specialization | Key Focus & Notable Features | Global Footprint |

|---|---|---|---|---|---|

| IBM | US $62.75 bn total; Watson Health/Clinical Development ≈US $0.9 bn† | ~11 % | Hybrid-cloud AI (Watsonx) for protocol simulation, patient-matching & data ops | Watson Clinical Trial Matching boosted oncology recruitment speed +20 % in 2024 pilots; federated-learning tool for GDPR-compliant EU studies | Operates in 175 countries with 60+ life-science datacenters |

| Exscientia (RXRX) | US $22 m (TTM) | ~5 % | Generative-AI drug & trial design platform | Six AI-designed molecules reached clinical stage; DSP-1181 discovered in 12 months (vs. 4-5 yrs) | Labs in UK, Austria, Japan; merged with Recursion to scale US presence |

| Medidata (Dassault Systèmes unit) | US $622 m | ~8 % | End-to-end eClinical cloud with Intelligent Trials analytics | Largest real-time trial-performance dataset (>35k trials, 10 m patients); doubled Tier-1 site identification for a top-10 pharma | 23,000+ trials across 90 countries |

| Insilico Medicine | US $85 m | >10 % | Generative-AI target discovery & virtual screening | Anti-fibrotic asset went start-to-Phase I in 30 months; received US $10 m milestone for USP1 inhibitor XL309 (Phase I, NCT05932862) | R&D hubs in Hong Kong, New York, Abu Dhabi; 30+ global academic partners |

| NVIDIA | US $60.9 bn (FY 2024) | ≥10 % (infrastructure layer) | GPU/accelerated-computing stack & BioNeMo™ generative-AI model zoo | Powers >75 % of AI-enabled trial-analytics firms; Q1 2024 data-center revenue US $22.6 bn; partnerships with Amgen, Recursion, AstraZeneca | Hardware/software in 40+ countries; sovereign-AI deals in MEA, LATAM |

*Corporate revenue shown; AI-clinical-trials segment revenue is a subset (where disclosed). †IBM segment estimate derived from analyst break-outs of Watsonx Health and Clinical Development services.

Leading Trends & Their Impact

- Generative AI & Foundation Models – Platforms such as IBM Watsonx, NVIDIA BioNeMo and Medidata’s Synthetic Control Arm create protocol drafts, simulate control cohorts and auto-generate CSR narratives, cutting authoring time up to 70 %.

- Digital Twins & Synthetic Arms – Regulators now accept external-control data for rare-disease studies; Medidata’s SCA was referenced in five FDA submissions in 2024, reducing control-arm enrollment by 30–50 %.

- Federated & Privacy-Preserving Learning – EU GDPR and China’s Interim AI Measures spur on-prem or cross-border encrypted model-training, enabling multi-region data pooling without raw-data transfer.

- Decentralized & Hybrid Trials – AI-powered e-Consent, telemetry and anomaly-detection shrink onsite visits 40 %; patient retention rates improve 15 %.

- Specialized Silicon – NVIDIA’s H100/B100, IBM z-series z17 mainframe and AMD “Kraken” AI accelerators slash model-training costs per protocol by 60 %.

- Explainability & “GxP-Ready” AI – EMA reflection papers and FDA advisory sessions in Nov 2024 codified expectations for model traceability and continuous-validation, pushing vendors to embed audit layers.

AI in Clinical Trials Market Flagship Success Stories

- IBM + Mayo Clinic (US): A 2024 oncology pilot cut median recruitment from 182 to 146 days (-20 %) using Watson-based EHR mining.

- Eli Lilly + Medidata Intelligent Trials (Global): Re-classification of 104 “low-performing” sites unlocked 2.5× more Tier-1 sites, accelerating Phase III enrollment by four months.

- Exscientia + Sumitomo Dainippon (Japan): AI-designed OCD candidate DSP-1181 progressed from discovery to IND in 12 months—four-to-five-times faster than conventional chemistry cycles.

- Insilico + Exelixis (US): AI-generated USP1 inhibitor XL309 reached first-in-human dosing in 24 months; Insilico earned a US $10 m milestone in Dec 2024.

- NVIDIA + Recursion (US): Multi-omic image-analysis pipeline on DGX SuperPOD screened 2.2 million compounds against 3,000 disease phenotypes in <24 hrs, informing five Phase II designs slated for 2026.

These cases collectively demonstrate >30 % faster cycle times, lower screen-failure rates and higher data quality versus matched historical controls.

AI in Clinical Trials Market Global & Regional Landscape

| Region | 2024 Market Size | Growth Catalysts | Policy Environment |

|---|---|---|---|

| North America | US $812 m | Largest R&D spend, 6,000+ active trials, abundant real-world-data networks | FDA 2024–25 AI Action Plan; May 2025 mandate to deploy internal AI tools across all centers (full integration by 30 Jun 2025) |

| Europe | US $532 m | GDPR-aligned federated-learning consortia (IMI, EDCTP-3) | UK MHRA AI Strategy (Apr 2024) emphasises explainability; EMA reflection paper on AI (Feb 2025) |

| Asia-Pacific | US $506 m | Fast-track digital-health sandboxes (Japan’s PMDA, Korea MFDS), China’s 7,100 trials lead world | China Interim Measures for Generative-AI Services (May 2025) and accelerated NMPA device approvals |

| Latin America, Middle East & Africa | US $187 m | Rapid uptake of cloud EDC, sovereign-AI deployments (e.g., Saudi Arabia, UAE) | Brazil’s ANVISA AI guidance draft (2024), South Africa’s AI ethics white-paper |

Governments are not merely observers; they are active enablers. The MHRA’s sandbox lets sponsors test adaptive algorithms pre-submission, while FDA’s “Software as a Medical Device” (SaMD) pilot allows real-time model updates within trials. China’s aggressive timelines (time-to-approval ≈6 months for domestic AI trial software) are attracting Western pharma co-development deals, exemplified by Merck–Antiverse antibody pact and multiple “super-me-too” licensing tie-ups.

Outlook

The convergence of enterprise-grade generative AI, privacy-preserving architectures and a maturing regulatory scaffold is turning AI from a novelty into standard practice for study design and execution. With leaders like IBM, Medidata, Exscientia, Insilico and NVIDIA already capturing double-digit market shares and demonstrating measurable ROI, the technology’s diffusion into mid-size CROs and academia is poised to accelerate dramatically through 2028.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Health Insurance Market Size, Growth, Trends, and Forecast (2024–2034)