AI Agents Market Growth, Trends, Top Players, and Global Outlook (2025–2034)

AI Agents Market Size

The global AI robots market was valued at USD 16.75 billion in 2024, projected to reach USD 118.27 billion by 2034, signifying a compound annual growth rate (CAGR) of 21.58%.

What Is the AI Agents Market?

The AI agents market refers to the industry centered on autonomous, intelligent software systems—often powered by machine learning, natural language processing, and computer vision—that perform tasks, make decisions, and interact with users or systems without continuous human oversight. These agents can range from customer service chatbots and virtual assistants to robotic process automation (RPA) bots, autonomous agents in logistics, healthcare diagnostics systems, and beyond. They’re designed to interpret context, learn from feedback, and take actions, operating across industries like finance, healthcare, retail, manufacturing, telecom, and public services.

Why Is It Important?

The AI agents market is increasingly critical because:

- Efficiency Gains: They automate repetitive or complex tasks—customer support, invoicing, data analysis—freeing humans for higher-level work.

- Scalability & Personalization: Agents handle increasing user interactions with tailored responses, boosting engagement.

- Operational Accuracy: Machine learning-driven agents reduce human error in sensitive domains like finance or medicine.

- Cost Savings: Automation leads to reduced labor costs and streamlined processes.

- Innovation Enablement: They power new business models—autonomous services, conversational commerce, intelligent IoT systems.

This combination of efficiency, innovation, and risk reduction makes AI agents a strategic asset across enterprises.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2649

Growth Factors

The AI agents market is being propelled by explosive demand for automation across sectors, rapid advancements in NLP and machine learning, and rising enterprise adoption of personalized AI to improve user experiences. Cloud platforms are enabling scalable deployment, while generative AI breakthroughs (like ChatGPT and Gemini) have enhanced agent capabilities. Businesses are also seeking cost efficiencies and agility, accelerating AI agent integration. Finally, supportive government policies in North America, Europe, and Asia are bolstering R&D, infrastructure, and ethical frameworks—all combining to drive a projected compound annual growth rate (CAGR) between 40–46% through the 2030s.

Market Size: Snapshot & Forecast

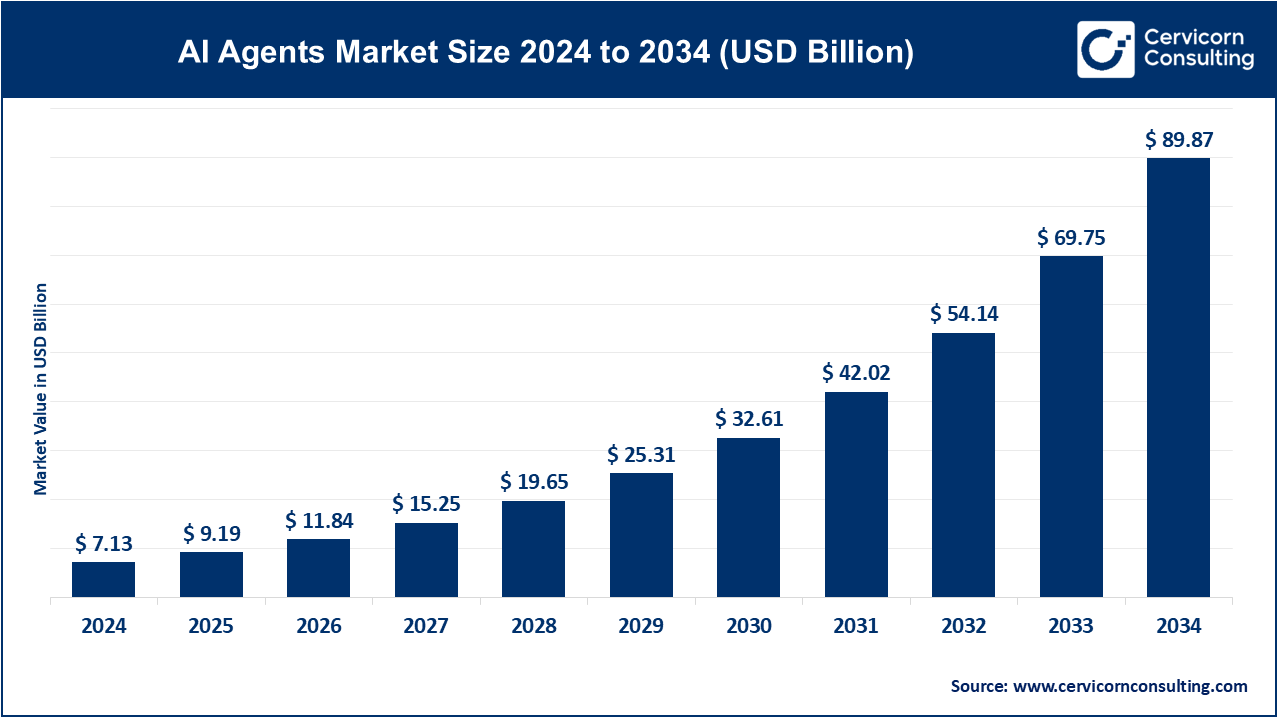

Data sources report:

- $5.40 B in 2024, expected to reach $50.3 B by 2030 (CAGR 45.8%).

- Another forecast shows $7.13 B in 2024, rising to $89.9 B by 2034 (CAGR 43.98%).

- A different study puts $5.43 B in 2024, reaching $236 B by 2034 (CAGR 45.82%).

Even with varying base figures, consensus shows a roaring CAGR of ~44–46%, fueled by enterprise and consumer demand.

Top Companies in the AI Agents Market (2024)

Here’s a detailed comparative snapshot of the leaders:

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue / Market Share | Global Presence |

|---|---|---|---|---|---|

| Google LLC | ML, NLP, multi-agent systems | Gemini AI agents, Waymo, Vertex AI | Cutting-edge models (Gemini 2.5), robust cloud infrastructure, genAI expertise | Part of Alphabet’s $300 B+ revenue; AI/cloud share growing double digits | Worldwide (Americas, EMEA, APAC) |

| IBM Corporation | Enterprise AI, automation, ChatOps | Watson, AI for business, RPA | Proven for regulated industries, hybrid cloud, explainable AI | ~$61 B total; AI/software segment significant share | Americas, EMEA, APAC, Latin America |

| Microsoft Corp. | Agentic copilots, cloud-native AI | Copilot suite, Azure OpenAI Service, GitHub Copilot | Deep OpenAI collaboration, vast enterprise integration, security-focus | $210 B revenue in 2024; AI cloud a key driver | Global |

| Salesforce, Inc. | CRM‑embedded AI agents | Agentforce, Einstein, customer support bots | Launched Agentforce in 2024; doubled AI revenue to $1 B; 8,000 AI-agent deals | Q1 ’25 revenue $9.83 B; FY guide $41.0–41.3 B; AI/cloud double-digit growth | Americas, EMEA, APAC |

| SAP SE | Enterprise business AI agents | Billing, HR bots, ERP extensions | Integrating AI into workflow modules, strong enterprise relationships | €32 B revenue; AI business share rising | EMEA, Americas, APAC |

Leading Trends & Their Impact

- Generative AI Surge

Transformer-based models empower agents with better context understanding, conversational depth, and reasoning—even handling tasks autonomously. Salesforce’s Agentforce showcases this trend. - Cloud-First Deployment

Cloud integration is key—North American agent implementation is cloud-native (>40% market share), enabling cost-effective scaling and enterprise-grade security. - Copilot Revolution

Major firms now embed copilots into productivity tools (Microsoft Copilot, GitHub Copilot, Salesforce Einstein), turning agents into daily work partners enhancing efficiency and task execution. - Regulatory & Ethical AI

With global AI regulation evolving (e.g. US AI Safety Institute, EU risk-based rules, India’s BharatGen), companies are focused on compliance, explainability, and data governance. - Cross-Sector Adoption

Agents are proliferating in healthcare (triage bots), finance (fraud detection), manufacturing (maintenance), and public sector (customer service efficiency).

Successful Examples Around the World

- Salesforce Agentforce: Handles 66% of customer inquiries for Fisher & Paykel; resolves 84% of internal queries, saving ~2,000 support roles.

- RSM Atlas (US): Automates tax, audit, and compliance tasks—improving efficiency up to 80%.

- ServiceNow: AI agents cut complex case handling time by 52% via automated workflows.

- Public Sector UK (NHS): 22% of staff actively use generative AI, forecasting a 20% reduction in admin burden.

Global Regional Analysis & Policy Influence

North America

- Market Size: ~$2.9–3 B in 2024 (~40% global share) .

- Drivers: Tech giant-led innovation, cloud adoption, enterprise AI spending.

- Policies: U.S. established the AI Safety Institute; private initiative Stargate ($500 B by 2029). Balanced governance fosters innovation.

Europe

- Market Size: ~$1.4 B in 2024; ~20% share.

- Trends: Push toward AI sovereignty—EU InvestAI (€228 B) and France’s Mistral partnership highlight this.

- Regulation: EU AI Act enforces risk-tiered rules; UK focuses on public sector AI governance.

Asia–Pacific

- Market Size: ~$2.4 B in 2024; ~34% share .

- Growth momentum: China’s LLM approvals, India’s BharatGen & data centers, Japan’s AI adoption indicate aggressive expansion.

- Policy Dynamics: IndiaAI Mission (₹990‑₹110 Cr), data labs, Microsoft and Reliance investments; China’s cautious rollout of generative AI.

Latin America, Middle East & Africa (LAMEA)

- Market Size: ~$360 M in 2024; ~5% share.

- Drivers: Public AI programs in Brazil, UAE’s $10 B+ AI strategy, Saudi’s AI ambitions by 2030.

Government Initiatives & Policies Shaping the Market

- United States

Launched Stargate infrastructure; AI Safety Institute; regulatory frameworks like the EU Act adjusted domestically . - European Union

EU AI Act (risk-based); €228 B InvestAI; France promotes Mistral for sovereignty. - United Kingdom

Innovating public AI use; NHS pilots; ethical oversight calls; part of EU-aligned but separate regulations . - India

IndiaAI mission (₹990 Cr); Centres of Excellence; BharatGen LLMs; voice AI with UIDAI; ₹s by Microsoft and Reliance. - China

Interim generative AI rules; 117 LLM approvals in 2024; state-led but cautious deployment . - Middle East

UAE AI Strategy 2031; Abu Dhabi’s mega data center; Saudi Vision 2030; Africa exploring public AI . - Morocco & Canada

Morocco setting up national AI agency; Canada implementing AI & Data Act, AI Safety Institute, Pan‑Canadian strategy.

Leading Trends: Impact and Interpretation

- Agentic AI Shift

Tools are evolving from co-pilots to agents capable of proactive service. Salesforce expects entire brands to require agentic presence. - Automation in Business Services

RSM invests $1 B in agentic automation, signaling mainstream push in accounting and tax domains. - Enterprise Integration

ServiceNow, SAP and Microsoft are embedding AI agents directly in workflows, significantly boosting productivity. - Ethical & Regulatory Focus

Agencies are enforcing policies—Canada via AIDA, EU Act, IndiaAI—for trustworthy and accountable AI deployment.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Artificial Intelligence (AI) Robots Market Growth Factors, Technology, Policy, and Investment Insights